Energy & Commodities

South Korea, the country with the fourth-largest commercial storage capacity in Asia, has just run out of room to store more oil, sources familiar with the matter told Bloomberg on Monday, as available storage capacity everywhere in the world in shrinking fast amid the demand collapse.

South Korea’s total commercial storage capacity on land, at around 38 million barrels, is fully booked, Bloomberg’s sources say, while storage capacity is also depleting fast in India, a key oil consumer in Asia and the world’s third-largest importer of crude oil.

While South Korea’s land storage capacity has been filled up, the Singapore Strait is full of tankers carrying fuel as demand has slumped and as land storage in the region has diminished, analysts and analytics firm tell Bloomberg.

Elsewhere in Asia, in India’s nationwide lockdown to contain the pandemic, demand for oil in the country has plunged while storage capacity fills up. Due to plummeting fuel demand and overflowing storage capacity, at least three oil refiners in India have asked for lower crude oil imports for May from the Middle East, including from the world’s top exporter, Saudi Arabia, officials at the refiners told Reuters last week…CLICK for complete article

One of Canada’s most successful real estate investors shares how he plans to make money in the real estate market during a Pandemic.

Jeff Olin, President, CEO and Portfolio Manager at Vision Capital Corporation will join Michael Campbell tomorrow on Moneytalks:

Saturday April 25th 8:30am – 10:00am Pacific

LISTEN LIVE

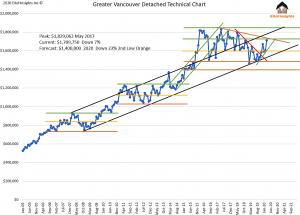

There was Good News economically speaking during the tumultuous month of March 2020. Of course this will be remembered for the major breakout of the Corona Virus. However, for those who sold their detached homes, it will be remembered for achieving the highest sales price since June 2018. Basically receiving similar price points as during the end of the frenzied Real Estate Market.

Notice on the chart, the detached average sales price in March came in at $1,709,750 testing the upper echelon of the current Market Cycle.

The Bad News, this will not be a long lived reality. Prices will be coming off with gusto in the upcoming months. Again notice on the chart in the text box, Eitel Insights anticipates the market to test the 1.4 million pricing threshold during 2020. At that price point the market would have corrected a total of 23% from the peak and down 16% from the latest data point.

For the 1.4 Million average sale price to become a reality the uptrend which began in July 2019 at 1.494 Million would need to be broken (Green uptrend). Additionally a breaking of the prolonged uptrend established in 2008 at $750,686 Black Prolonged Uptrend). The 1.4 Million price point would bring the data to the lowest orange line in the current Market Cycle.

The ugly truth, a 1.4 Million average sales price is our base case (23% correction from peak), the possibility of the market going even lower is tangible. In that case Eitel Insights would look at 1.225 Million (33% correction from peak) as the next major resistance level.

Good News, the buyers who have looked but not touched, will be rewarded with ever lowering price points. Along with increased inventory to choose from.

Bad News, the sellers who chose the two birds in the bush rather than the one in the hand will inevitably chase the market lower, continually searching for those darn birds.

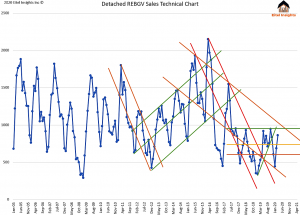

The sales numbers for March 2020 will be shocking until I explain. There were 862 sales in the detached market across Greater Vancouver. Which puts the market technically near the high mark of the current Market Cycle.

The explanation, technically there were not 862 sales in March, there were however 862 completions. The way the REBGV counts the sales data is not on accepted offers in the month but rather on deals that have completed at land titles. Meaning the 862 sales occurred in different months but the key exchange took place in Mach.

Point of interest the price points are taken from the accepted offers in that particular month, while the sales totals are from previous months accepted offers. An odd fact but worth point out from time to time. This also means the upcoming months of sales numbers could continue to be higher than the actual activity transpiring.

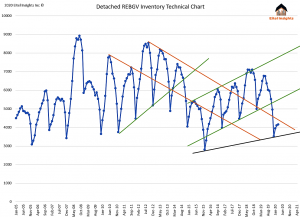

The inventory onslaught is assuredly on the way. As Eitel Insights has been advising for the past quarter or more, is to beat the crowd. Sellers who listened had achieved the highest sales price in the previous 21 months. While prices will not continue the uptrend, the prices now have to be better than what will be offered in the upcoming months and year(s).

We advise home owners to be observant of their current situations, play out our base case of a 18% (correction stops at 1.4 Million) decline to your home’s current value. Add in a possibility of the market correcting an additional an 28% (correction continues to 1.225 Million) from here. If either of those realities put you into foreclosure, sell now get out with your skin, and put the money in the bank. If you see the train coming at you, merely get off the tracks.

Another thought, if the idea in the upcoming years is to downsize. Sell now, achieve the highest price you can, rent for a couple years. Then purchase the Condo when the market is at the lowest price point in 2022. This is the best situation to be in as the market sits right now. Nothing wrong with selling high and buying low.

Not all markets in Greater Vancouver are created equal, some areas are closer to the bottom. While others still have significant percentage losses upcoming. Become an Eitel Insights client to find out which are which. www.eitelinsights.com

Watch Eitel latest video:

The price of Bitcoin (BTC) suffered a tremendous crash on March 12, falling from almost $8,000 to stabilize at around $5,000, a loss of about 40% in the span of less than two days. This happened in the context of a global sell-off in all equity markets, where United States stock market indices such as the Dow Jones Industrial Average and the S&P 500 lost around 10% in a single day — a substantial loss for traditional markets.

Some were quick to decree the end of the narrative that Bitcoin is a safe haven asset, sometimes called a store of value, while others pointed to the fact that even gold fell during the bloodbath….CLICK for complete article

President Donald Trump has ordered Chevron to start “winding down” its oil production in Venezuela in the latest increase in pressure against the Maduro government in Caracas.

The AP reports that Chevron has invested some $2.6 billion in field development and equipment in Venezuela over the last hundred years and is to date the only U.S. oil company that Washington has allowed to continue operating in the country.

Yet this may soon end, as Trump seeks to tighten the noose around the Maduro government’s neck further. The United States government has granted Chevron a series of exemptions from sanctions against Venezuela. With the current state of the oil industry, however, along with the push for maximum pressure on Caracas, these may end soon. If that happens, the company would be obliged to write down its investments in Venezuela…CLICK for complete article