Asset protection

For the last several months, we have been issuing repeated warnings about the market. While such comments are often mistaken for “being bearish,” we have often stated it is our process of managing “risk” which is most important.

Beginning in mid-January, we began taking profits out of our portfolios and reducing risk. To wit:

“On Friday, we began the orderly process of reducing exposure in our portfolios to take in profits, reduce portfolio risk, and raise cash levels.”

Importantly, we did not “sell everything” and go to cash.

Since then, we took profits and rebalanced risk again in late January and early February as well.

Our clients, their families, their financial and emotional “well being,” rest in our hands. We take that responsibility very seriously, and work closely with our clients to ensure that not only are they financially successful, but they are emotionally stable in the process….CLICK for complete article

The month of March has been brutal so far for investors, but short sellers are making a killing off on the volatility caused by the COVID-19 coronavirus outbreak.

There is currently $154 billion in aggregate ETF short interest, 90% of which is in U.S. domestic ETFs, according to S3 Partners. S3 analyst Ihor Dusaniwsky said Tuesday there are 216 U.S. ETFs with short interest of at least $25 million.

Most Shorted ETFs

By far the most heavily shorted ETF is the SPDR S&P 500 ETF Trust. The SPY ETF tracks the S&P 500 and represents a simple bet against the U.S. stock market and/or a hedge against long positions in U.S. stocks. Here are the top four most shorted U.S. ETFs, according to S3: CLICK for complete article

Eitel Insights continues to outperform the competition. Not a single time have we suggested purchasing a detached home or condo property. On the contrary, we have been suggesting selling into this short lived reality of optimism. Most every other analysts said 2019 was the bottom. 2 months into 2020 they are running scared. Eitel Insights has never wavered from saying the market is going lower for longer.

Eitel Insights uses Technical Analytics to provide actionable intelligence to the market. Fundamental analysts will never catch a “Black Swan” because they need the event to occur before they see the ramifications. Technical Analysts use metrics to show that the market is at too lofty of a position and a correction is upcoming. Just like we did during 2017.

The latest Black Swan no one saw coming is the Stock Market recession and the Corona Virus. Now Eitel Insights did not have a name for these events, however we did state that the technical showed further losses upcoming.

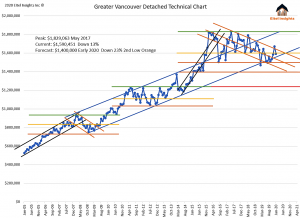

The detached market currently sits at 1.6 Million on an average sales basis. Down 13% from the peak in 2017 or -$230,000. As we have advised our clients this current market cycle will test 1.4 Million in 2020 which would be a total correction of 23% or -$430,000 from the peak. If that does not hold firm the next echelon tested will likely be 1.225 Million.

Here is a quote from the Eitel Insights update last month “We advise to the sellers who will be in that need based situation begin to sell now before onslaught of similar stories hit the market. Need based selling will become necessary in 2020, propelling the market lower in price. Simultaneously the buyer’s trepidation will skyrocket. The only way to mitigate their pessimism will be time. Which is not something every seller will be able to afford in the upcoming market. ”

We certainly hope you took our advice in the last installment. If you disregarded it and purchased based on the recommendations of the “usual advisors”, looking at the chart notice the whipsaw effect you are in now.

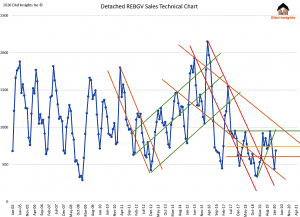

The sales totals from February for the detached market were 686 in Greater Vancouver. We have projected a sales threshold which has an artificial top around 950. Given our new reality, we believe the artificial top will hold firmly in place until the market correction is over.

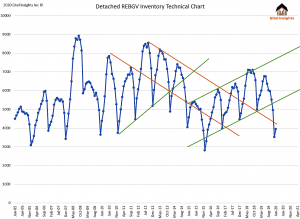

While inventory still came in on the light side with only 4100 active listings. The numbers are continuing to climb from previous months. Now with the stock market crashing and over 400 Billion dollars lost in the TSX. Expect to see hard assets begin to be sold off. The housing market will definitely feel this impact. We have been stating 2020 would begin the onslaught of foreclosures and to date there are 49 foreclosures. Expect that number to rapidly rise by the end of the year, as we predicted

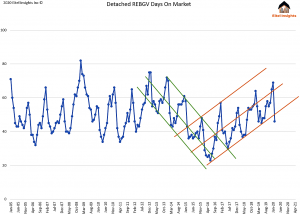

The one shining light of this dreary market is that the properties that are selling, are selling in quicker time. Properly priced listings have been getting sold. We had said list before the onslaught. While the onslaught appears to be on us; listing sooner rather than later offers a chance to receive a higher priced sale. As the time continues to pass and the inventory builds up, prices will decline further. For some it could be list now or have the bank list it for you in the upcoming future.

Not all markets are created equal while some fall other rise. Become an Eitel Insights client and receive Actionable Intelligence on Real Estate across Canada, visit us at eitelinsights.com .

Watch Eitel’s latest video:

Nearly all economic data as reported on a monthly or quarterly basis have so far reflected the era in the US before the economy reacted to the coronavirus. These reactions – from panic-buying of toilet paper to airlines shutting down much of their international and now even domestic routes – were phased into the economy beginning in later February and have now risen to a crescendo. But they’re slow in making their way into the economic data.

We get company by company warnings, and we get the government’s and the Fed’s reaction to the events, but we haven’t seen the impact in the official data yet. The first data to seriously reflect this are the surveys of company executives such as the Purchasing Manager’s Indices for March, out later this month, or the New York Fed’s Empire State Manufacturing index, which was released this morning,

And it’s ugly: The Empire State Manufacturing index of General Business Conditions plunged by 34.4 points, the largest point-drop on record, from a still relatively sanguine level of 12.9 in February, to the level in March of negative -21.5, the lowest since 2009, and right at where it had been in October 2008, following the Lehman bankruptcy in September. And this was just the first reaction related to the impact of Covid-19 mitigation measures…CLICK for complete article

After multiple sessions of panic selling, the markets caught an up-draft after US President Trump declared a national emergency over the coronavirus, thus freeing up $50 billion in federal aid to help contain the rapid spread of the pandemic.

As stocks accelerated gains in the final hours of trading, posting the biggest one-day lift since the financial crisis, USA Today reported traders and analysts saying that Trump’s remarks removed some of the uncertainty hanging over financial markets.

“The change in tone shows that the Trump administration is taking this more seriously now,” said a senior portfolio manager at Atlanta-based GLOBALT Investments. “This still isn’t over by any stretch, but it’s a better sign.”

Too right. Even with Friday’s rally, the S&P was down 8.8% for the week and all the gains US stocks accrued in 2019 have been wiped out. All three indices are now in a bear market, defined as a drop of at least 20% from all-time highs…CLICK for complete article