Real Estate

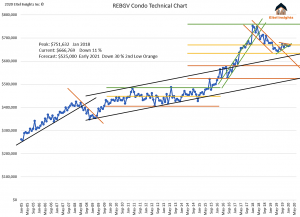

Prices in February had an average sales price of $666,769. Signalling a 6th month in a row of a 1% price range. Prices have held in correction territory with prices down 11% from the peak which occurred January 2018 with prices at $751,632. We still expect volatility to impact the condo market in the upcoming months. Up first will be a retest of the lower middle threshold of $635,000, which would bring the market down a further 5% from current levels. Once that level fails the next price level test would be $600,000. Ultimately we forecast the bottom of the Condo market to occur in the early part of 2021 with around $525,000 a 30% correction from the peak.

Eitel Insights has heard that some condos have been receiving multiple offers. We are not surprised by this short lived reality. We have been stating that there is a great opportunity to sell. With low inventory in the market, there is a lineup of potential purchasers that are eagerly awaiting property priced listings. When one such listing has come to the market those buyers have entered into minor bidding wars. A warning though, as each listing is purchase that has the forced effect of lessening the potential buyer’s pool.

After this imbalance between supply demand is corrected prices will again decline to previously established prices. In other words continue lower in the current market cycle.

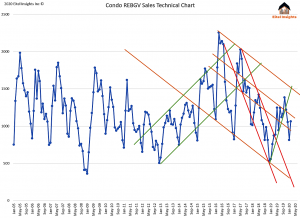

There were 1064 sold properties in Feb mirroring the number from December just a few months ago. A large portion of purchasing occurred in the 3rd and 4th quarter of 2019 that is in large part due to popular areas around Greater Vancouver had dropped 20% – 30%, which in turn brought the sidelined buyers back into the purchasing game.

The trend is your friend, there are powerful downtrends in play with the sales totals. While the sharp rebound uptrend has been nullified. Eitel Insights does believe a higher low has been put in place, however, the market also seems to have found an artificial top that the sales cannot overcome.

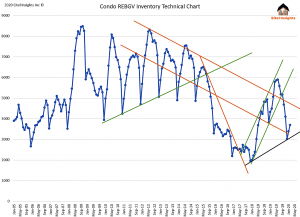

The Inventory increased roughly 700 listings from January. Totalling 3700 Active listings in Greater Vancouver in February. With spring rapidly approaching we anticipate a rather substantial jump in listings over the next few months.

Throughout spring and summer the inventory regain the 5000 active listing level, we are confident. A repeat test of 6000 is a likely possibility as well.

The frenzied presale market of 2016 is beginning to rear its ugly head. Those pre sold properties are just beginning to hit the market. Some buildings are seeing 25% of the building for sale while an additional 25% of the building is for rent. Meaning 50% of the building is available in one way or another. This does not bode well for the overall market as this is just one early example.

Major losses in the Real Estate portfolio could have been mitigated by all-time high levels stock markets. The Dow Jones (DJIA) recent decrease from 29,500 to under 24,000 which has a major impact to the bank account.

Add it all up and you shouldn’t be surprised to see prices decrease a few levels lower than they are currently selling for in the not too distant future.

We have stated the past few months have been a great opportunity to sell. Here is some proof we were correct again. The Days on Market of sold properties dramatically decreased month over month from 43 days in Jan to only 31 in February. We anticipate this trend will continue for the next few months until the inventory levels surpass 5000 active listings. This opportunity to sell with less competition is rapidly closing. Eitel Insights urges those thinking of selling to act now before you become another casualty of this upcoming chaos.

Click here for more info on Eitel Insights.

Watch Eitel Insight’s latest video:

After oil prices collapsed in the worst drop in nearly three decades—courtesy of the renewed Saudi-Russia rivalry on the oil market – Russia’s Finance Ministry said on Monday that Moscow had enough resources to cover budget shortfalls amid oil prices at $25-30 a barrel for six to ten years.

The price of the Russian export grade Urals dropped to below $42.40 a barrel on Monday as oil prices tumbled by 30 percent…Click here for full article.

OTTAWA (Reuters) – Canada gained a higher-than-expected 30,300 net jobs in February while the unemployment rate rose to 5.6%, official data showed on Friday, but analysts said the data was unlikely to trigger a rethink at the Bank of Canada as it tries to shield the economy from the effects of a coronavirus outbreak.

Analysts in a Reuters poll had forecast a gain of 10,000 jobs in February and an unemployment rate of 5.6%. Wages for permanent employees – a metric watched closely by the Bank of Canada – rose by…Click for full article.

Dr. James Thorne, a regular on MoneyTalks was kind enough to send us this report on the seriousness of the COVID 19 crisis and its emotional affects on the market. ~Ed. Over the past week, global stock markets experienced the most severe 5-day market correction in history. As news of the global spread of Covid-19 intensified, fears of a global pandemic increased. The three major US market indices, the Dow Jones Industrial Average, The NASDAQ composite, and the S&P 500 fell more than 10% from the record peaks achieved a few weeks ago. In 5 short days, the markets went from the euphoria of record highs to extreme fear. In our 2020 market outlook presentation we examine the most recent work by Dr. Robert F. Shiller, “Narrative Economics: How Stories go Viral and Drive Major Economic Events”. Click here for full article