Economic Outlook

Anglo American Platinum (Amplats) announced the temporary shutdown of the Anglo Converter Plant and declares “force majeur” following an explosion at its plant in South Africa.

- Anglo American is the world’s third largest producer of platinum (“Pt”) and palladium (“Pd”)

- Significant production curtailed due to shutdown, i.e. possible annualized cuts of 500K oz Pt and 300K oz Pd now forecasted for 2020

- Platinum market expected to swing to deficit of 400K oz from surplus of 100K in 2020

- Palladium deficit in 2020 now forecasted to increase from ~500K oz to ~800K oz (300K increase to forecasted deficit) Click here for full article.

TORONTO – North American stock markets were on edge again Thursday, plunging amid new concerns about the spreading of novel coronavirus and uncertainty over the upcoming U.S. presidential election.

“There’s clearly still a lot of uneasiness happening in the broader marketplace,” said Mike Archibald, vice-president and portfolio manager with AGF Investments Inc.

California declared a state of emergency after a COVID-19 related death and the number of infections doubled overnight in New York. And then Sen. Elizabeth Warren dropped out of the race to become Democratic presidential nominee in an expected boost to rival Sen. Bernie Sanders.

The U.S. 10-year treasury yield dropped to a new low under the one per cent psychological level for investors.

“Until we can get back above one sustainably I think you’re going to see a lot of…click for full article.

Our friends over at Green Mortgage Team sent us this Op-Ed on how the recent BoC rate drop will affect you and mortgage rates in general. ~Ed

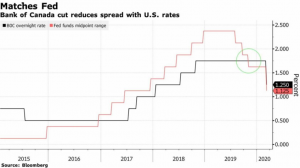

Today, the Bank of Canada dropped the overnight lending rate by a whopping 0.5%.

This is the first rate cut the Bank of Canada has had since 2015, when falling oil prices caused the Bank of Canada to take precautionary measures. This move comes one day after the US, Canada’s largest trading partner, called for an “emergency” meeting and reduced their overnight lending rate by 0.5%.

Why did this happen?

There are a number of reasons, although it seems like many of these events have been fueled by the Coronavirus scare.

- Oil prices are $10/barrel less than expectations set only two months ago in January. Canada is very export-dependant and dropping oil prices will negatively affect Canada.

- With Canada being so export heavy, maintaining a low dollar is important. When the US fed decreases rates by 0.5%, it weakens the US dollar to the Canadian loonie. This makes it more expensive to import our goods, which could have a negative impact on exports. By following the US, we are weakening our dollar to stay on par and not letting our exports get more expensive relative to other countries around the world.

- Coronavirus is having an impact on manufacturing in China, which has lowered both their exports and imports. China is buying less raw materials to manufacture goods, and is also buying less high-end goods (sorry Gucci, but now is not a good time to be selling $2,000 handbags to China).

- Stock markets have been in a bit of a free-fall (this is why we invest in real estate, right!?), and it was interesting to see that some of the reasoning behind the US Feds’ decision was definitely stock market-driven. While I don’t agree with this (the role of the Fed is to use interest rates and other means to support macro-economic factors like economic growth, jobs, inflation, currency, among others), lowering interest rates should at least lessen the blow a bit.

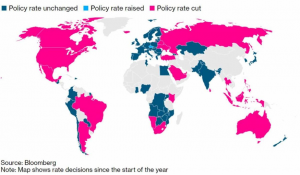

Canada is one of many countries who have already dropped rates this year, and we are only two months in.

How does this affect you?

It’s important to note that a drop in the overnight lending rate does not automatically mean that the banks will follow suit and drop by the same amount. Banks set their Prime rates on their own (TD Prime for instance is 4.15% and others are 3.95%), and there has been precedent for the banks to not follow suit with a full drop. Here is the takeaway from this information:

- The banks probably will not drop a full 0.5%. Expect something closer to 0.25% of a drop.

- Remember that this drop will only affect those who are in variable rate mortgages. Fixed rate contracts are unaffected.

- Fixed rates are 98% correlated with bond yields, which have also been falling. Just in the past two weeks approximately, bonds have fallen 0.5%. A lot of the past drops were built into the current rates being offered, but there is currently downward pressure on fixed rates; therefore, expect some drops in the next week or so.

Hedging is a useful practice that every investor should know about.

It’s a way to protect your portfolio, and protection is often just as important as portfolio appreciation. Even if you are a beginner, you can learn what hedging is and put it to work for you.

The best way to understand hedging is to think of it as a form of insurance. When people decide to hedge, they are insuring themselves against a negative event to their finances. This doesn’t prevent all negative events from happening, but when something does happen and you’re properly hedged, the impact of the event is reduced.

In practice, hedging occurs almost everywhere, and we see it every day. For example, if you buy homeowner’s insurance, you are hedging yourself against fires, break-ins, or other unforeseen disasters.

Risk is an inherent part of investing. Regardless of what kind of investor one aims to be, having a basic knowledge of hedging strategies will lead to better awareness of how investors can protect themselves.

While typically the goal of hedging is to protect from losses rather than to make money, with Trend Technical Trader (TTT) we take it one step further. Cycles will always occur, and we seek to profit greatly from those cycles.

TTT is a hedging service that is designed to profit during stock market declines, and the bigger the decline, the bigger the gains TTT trades can generate. Our objective is to help serious investors avoid losing a significant portion of their wealth in the next downturn and position them for the next big buying opportunity.

It is also possible to make a lot of money during a market downturn, not just mitigate losing money. It’s even possible to have typical long positions that stay flat or go higher when markets collapse, if they’re properly and prudently chosen.

Trend Technical Trader is not just for hedging, or seeking to profit when markets plunge. We’ve made phenomenal gains when it was prudent to be bullish – in stocks, gold, oil, currencies… whatever is compelling at the time. In fact, our proprietary Gold Timing Indicator (GTI) has a record better than any other we’ve seen.

Why is timing so important? Those who rely on “fundamentals” are ignoring history, unaware of how creative corporate accounting often is, and at best basing their valuations on quarterly-reported numbers and metrics that are already months old. We believe a timing element is essential to successful speculating and investing over time, so while we consider fundamentals, we also heavily factor technical and sentiment measures.

Our ideas can also be an effective tax strategy. Clearly it was prudent to sell stocks or hedge a few weeks ago, and we said so to our subscribers in no uncertain terms. Is it right from a tax perspective to sell all or part of perhaps dozens of holdings? What about dividends? It may be best to adopt only a single position to protect that broad portfolio, triggering just one or two taxable events when that position is closed, and in the meantime dividends will still accrue.

Our timing measures are also of great use to those who have their own investment ideas, or get their stock picks from other advisories. We have up-to-date timing indicators that help investors to decide when is the most opportune time to buy or sell.

Please view a free recent copy of our publication. It may be exactly what you need going forward, because market turmoil will not end when the virus scare passes. It’s been decades since there was a legitimate bear market – one that didn’t skyrocket to new all-time highs and far beyond within a couple of years. Some may wish to believe that it can’t happen again, but as last week has irrefutably shown; history repeats.

To view a free sample of Trend Technical Trader click here.

Because “the coronavirus poses evolving risks to economic activity,” despite the “strong” fundamentals of the US economy, and despite stocks being off just 7.8% from all-time highs, the Fed’s FOMC announced during trading hours this morning, following the G-7 conference call, that it had voted unanimously to cut the target for the federal funds rate by half a percentage point to a range between 1% and 1.25%: Click for full article.