Real Estate

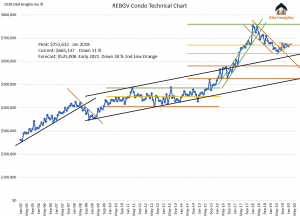

The Condo Market’s average sales price has not moved in the past 5 months. The initial portion of 2019 tested the middle threshold of the Condo market current market cycle. After a successful defense, property values rose in September for the first time in over a year. That resulted in the market average rising to $673,328 in September 2019. January 2020 prices came average came in at $665,190.

Lower highs, and higher lows in pricing since September 2019 have created a divergent trend that needs to be resolved. A market cannot sustain itself inside of a 1% range, expect some volatile movement upcoming to the condo market. The Condo Market has remained 11% off the peak in pricing since the September data point.

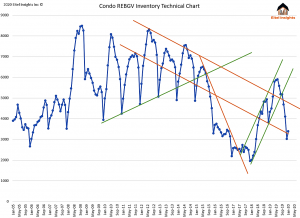

Inventory is inextricably linked to the sale prices. Since the September data point the inventory broke out of the uptrend, which had pushed inventory to 6000. Simultaneously instigated the divergent trend in the price chart. After Septembers break to the uptrend the inventory seemed to be in free fall. The inventory bottom occurred in December with only 3025 active properties while January came in with 3390 active.

Now would be an excellent time to take advantage of the nominal inventory level for sellers. Why wait until the market is again flooded with listings. Just as Eitel Insights guided sellers to take advantage of the stress test mitigation in the detached market. Which resulted in the detached average price increasing by $163,000.

The current opportunity to sell at higher prices will not last, as the completion of many newly built building begins. The market will flood with new units for sale that will debilitate the resale market. Take advantage of the calm before the upcoming storm.

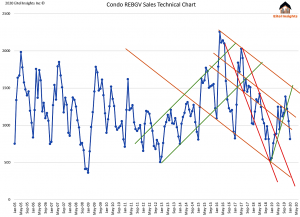

Sales have broken out of the aggressive uptrend that had been prevalent in the latter half of 2019. In January 2020 the total for the Condo market came in at 815 sales. The sales numbers are quite higher on a year over year basis, and likely at the lower third of the newly forming market cycle in the Condo sales chart.

Eitel Insights suggests that buyers hold off until the inventory levels return. Once the inventory returns you will see the competition amongst sellers intensify. Resulting in more negotiating power and an abundance of listings to enjoy perusing during the weekends.

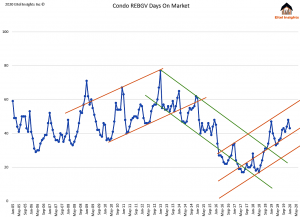

The Days on Market for sales in January was 43 signalling a lower DOM than December, which is to be expected. Eitel Insights believes that that DOM will continue to lower as we head into the spring market. Properly priced listings will be purchased. Again our advice to sellers is to take advantage of the current absence of competition before the wave of listings ensues.

Not all markets are created equal while some fall other rise. Become an Eitel Insights client and receive Actionable Intelligence on Real Estate across Canada, visit our website. www.eitelinsights.com

Watch Eitel’s latest video:

Our friends over at Hawkeye Wealth sent us this fascinating article on the events that lead Vancouver’s real estate market to become the “growth machine” that it is. ~Ed.

For years in British Columbia, the elected powers looked at rising home prices and saw that it was good. It’s “a challenge that virtually every other jurisdiction would like to have,” said former BC Liberal finance minister Mike de Jong in 2016. Such is the gospel of growth.

In 1976, sociologist Harvey Molotch wrote of the alliance between government and the development industry to intensify land use. Molotch called it the “growth machine,” where…click here for full article.

An ongoing challenge to modern society is how best to identify who we are, and who are all those other people out there. We used to be able to carry a card in our wallet or purse that reliably identified who we are. We could carry a birth certificate, a driver’s licence, a passport, or some other government issued identification that included a photo, to assure everyone that we are who we say we are. As technology progressed so did the ability of those with nefarious intent to replicate those card or document based forms of identification. Identity theft is on the rise and it is something we all need to be aware of and take steps to prevent. Even with secret PIN codes and CHIP card readers, bank cards (credit and debit) have been criminally duplicated, and phony automated teller machines (ATM’s) have been set up to capture user info, like account numbers and PIN codes. Today, the costs of identity theft are significant – for individuals and corporations. It is very telling that in the last four months of 2019 the number of users losing secure control of financial accounts was up by…Click for full article.

Air Canada stock is a Canadian success story. The airline almost went bankrupt and traded below $1 per share about 11 years ago.

However, it has miraculously turned around and generated tremendous value for its shareholders. Even if you had bought the stock at $8 per share when it showed signs of turning around, you’d still be sitting on a five-bagger!

In the last 12 months alone, the value stock appreciated 35%, handily beating the TSX index….CLICK for complete article

For the better part of a decade, institutional investors have redeemed capital from active strategies and dumped it into Private Equity (PE). What’s the benefit of PE for allocators? You get to have levered equity returns without the volatility of actually owning public equities. Unlike stocks that often fluctuate wildly, PE is marked-to-model (M-T-M), hence quarterly volatility is minimal. Then, when there’s a liquidity event, you get to see how well you did.

Or at least, that was the theory. However, by the time of the liquidity event, usually someone else is in charge of the position. Meanwhile, you’ve used the nice smooth M-T-M to earn yourself a bunch of bonuses and maybe even a promotion to somewhere else that’s ring-fenced from your allocation decisions at your prior job. In many ways, the funds and the allocators themselves are both incentivized to mark the numbers higher and hope that they’re proven right…..CLICK for complete article