Stocks & Equities

In the first section of this article, we highlighted three key components/charts illustrating why the “rally to the peak” is very likely a result of a continued Capital Shift away from risk and into the US stock market as an attempt to avoid foreign market growth concerns. This method of pouring capital into the US stock market is a process that is driving incredible asset rallies in the US technology sector. Already the US technology sector (FANG and our Custom Technology Index charts) are up almost 15% in 2020. How long will it last and when will it end?

Recently, China has revised the Coronavirus data with a sharp increase in infection cases – now over 40,000. We believe the true number of infections in China are currently well above 250,000 from video content and other data we’ve researched. We believe economic data originating from China for January and February 2020 will show a dramatic 60% to 80%+ decrease in activity for many of the major cities. Satellite technology suggests manufacturing and consumer activity in most major Chinese cities is only a fraction of what would be considered normal – 10% to 20% or normal levels…CLICK for complete article

Warmer winter weather this year has reduced U.S. natural gas demand for heating, and as production growth continues to exceed demand growth, U.S. natural gas prices slumped this month to their lowest February levels in two decades, the Energy Information Administration (EIA) said on Friday.

Natural gas prices at the Henry Hub benchmark closed at $1.77 per million British thermal units (MMBtu) on Monday, February 10. This was the lowest closing price for a day in February since at least 2001, according to Bloomberg and FRED data compiled by the EIA. The $1.77 per MMBtu price was also the lowest price in any month in nearly four years—since early March 2016.

Natural gas prices dipped to below US$2 per MMBtu this January for the first time in almost four years. This winter season, the glut is further aggravated by higher gas production in the Permian, higher than normal inventories, and warmer weather so far this winter.

As natural gas production outpaces demand growth, less gas has been withdrawn from underground storage this winter, the EIA said….CLICK for complete article

Let’s make this clear: these are job openings in December and prior months, before the novel coronavirus had shown up on the business-staffing horizon. Let’s also make clear that the two-month drop was so bad that a statistical flaw might have skewed the data, such as some seasonal adjustments gone berserk. But as we will see, the not-seasonally adjusted data looks even worse. And it’s not just one month. With hindsight we see that the trend started in early 2019 in small uneven drips, and it didn’t really matter until it suddenly did.

The number of job openings in December dropped by 364,000 from November (seasonally adjusted), after having already plunged by 574,000 in November, according to the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS). This two-month plunge of 938,000 job openings came after a series of ups and downs with downward trend starting after the peak in January 2019. It brought the number of job openings in December to 6.42 million (seasonally adjusted), same level as in October 2017. Since the peak in January 2019, over 1.2 million job openings have dissolved into ambient air (November and December in red)….CLICK for complete article

Earlier today, Rabobank’s Michael Every laid out succinctly the dilemma facing Beijing, when he said that “China appears to have perhaps decided that the economic damage being wrought by a demand collapse and supply-chain shutdown is just too much to bear.” As reported overnight, Xi Jinping stated that China will meet its economic goals AND win the battle vs. the virus, and Beijing is urging firms to increase output even as the capital itself is largely locked down – and other cities are physically locking people into their homes. That’s as even the US admits that the Phase One trade deal will be slow off the market due to the virus impact.

Of course, China is no stranger to Double Think: as Every put it, “a freely-floating, controlled currency; market-determined, state-directed interest rates; and free-trade mercantilism. Yet increase economic activity from here and the virus will spread, both internally and globally. Concentrate on just the virus, and the local and global economic impact will be enormous.”

That, in a nutshell, was how Rabobank saw China’s “dialectic that has no comfortable Fichtean synthesis to the thesis and antithesis” and concluded that “things are going to get nasty for economies and markets – especially with official WHO word that a vaccine is 18-months away.”

Today, two days after China officially returned to work, we got the first confirmation of just how catastrophic Beijing’s order to local enterprises and businesses to rush back reboot the economy could be, when Jennifer Zeng reported that a company in Suzhou reopened, and immediately at least one CoVid2019 case found. As a result, the company’s 200+ employees couldn’t go home and were immediately placed under quarantine. At least the workers managed to “organize” quilts for themselves….CLICK for complete article

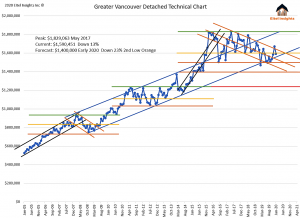

The first data of 2020 is in; the averages sales price for Greater Vancouver is down $80,000 from the previous month, and down $40,000 year over year. No sense for optimism from where we sit.

The price point is in the middle of the current market threshold. After a successful defense during 2019 of 1.5 million, Eitel Insights anticipates the next test of 1.5 million will break through and prices will indeed test he 1.4 million threshold. Previously established in 2015. At that point all equity gained over the previous 5 years will be erased.

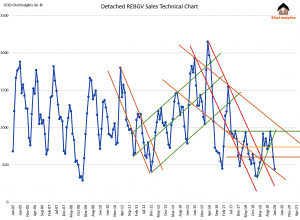

Sales are significantly lower than a quarter ago. Of course, there is a seasonal factor at play and the 444 sales were higher than the previous January when only 344 detached homes sold.

We feel a need to point out what occurred during 2018 and 2019 for the sales activity. In 2018 the stress test was introduced which diminished purchasing ability by 20%. That forced a major segment of buyers to the sidelines. In 2019 prices had indeed dropped to 1.5 million which is 18% from the peak in prices. Basically nullifying the stress test for the first time. It took the market dropping 18% for purchasing to begin. The 2 year backlog of buyers meant pent up demand that was finally able to release in 2019.

The current prospective purchasers are in a wait and see mode. We anticipate the sales numbers to again jump once the market reaches stress test mitigation. The Market sentiment will also begin to turn further negative as the introduction of the need based seller becomes prevalent in 2020.

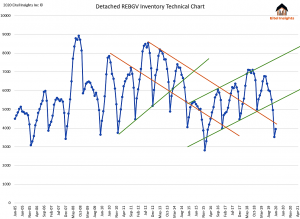

The Inventory numbers have hit their lows and will begin to rebound during the upcoming spring and summer markets. Eitel Insights forecasts the detached inventory will again return above the 6000+ active listings by the beginning of the 2020 school year. Current inventory levels in January were 3947 the lowest amount since February 2016.

The notion that the demand has eroded the inventory is a fallacy. The inventory had dried up due to seller’s fatigue. Much of the inventory had a listing that was at expiration and rather than relist they took the 4th quarter off. After that time off, still with a need to sell, propelled on by the hyped sales numbers reported by the board the inventory will be loaded soon enough.

We advise to the sellers who will be in that need based situation begin to sell now before onslaught of similar stories hit the market. Need based selling will become necessary in 2020, propelling the market lower in price. Simultaneously the buyer’s trepidation will skyrocket. The only way to mitigate their pessimism will be time. Which is not something every seller will be able to afford in the upcoming market.

Not all markets are created equal while some fall other rise. Become an Eitel Insights client and receive Actionable Intelligence on Real Estate across Canada, visit our website. www.eitelinsights.com

Watch Eitel Insights latest blog: