Real Estate

Prices for Greater Vancouver are apparently headed higher in 2020. So says the Real Estate Board, unfortunately their forecasting track record is suspect to say the least. We cannot seem to recall a time when the GVREB had a negative forecast.

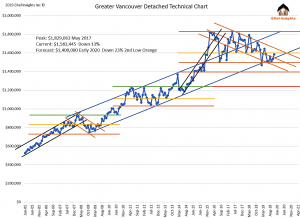

Prices in fact are down 7% from November 2018 or $120,000 dollar lower on an average sales price basis. Other marketing companies have recently come out with their “forecasts”…. maybe, just maybe they have an ulterior motive, rather than being objective market analysts. I remember another analyst saying “if you have a 20 year forecast you can buy now” so that portfolio is down $120,000, good thing for the long term outlook.

Eitel Insights clients and followers have been rewarded with lower prices and more inventory which is exactly what we forecasted, when the market was at the peak. Actionable Intelligence is our motto and those who have taken advantage of our analytical approach have saved time and money. Equally importantly a great night’s sleep. Not all markets in Greater Vancouver are created equal some areas are closer to the bottom while the majority still have significant percentage losses to come.

The time to invest is on the horizon however not at our feet yet. 2020 will experience need based selling as prices dip to 1.4 Million testing the current market cycle’s previously established prices. At the 1.4 Million price point the market will have correct a total of 23% from the peak. Indicated in our chart. Not to mention prices will be back down the 2015 level, indicating all gains over the previous 5 years will have been erased.

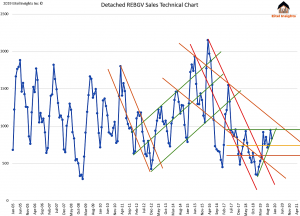

Sales ran like a scared cat from the near term high in sales indicated by the chart. One noticeable trend is there is an uptrend that has been established. We anticipate see the seasonal fall off over the next few months. Of course the buyers are still feeling the relief of the stress test mitigation. However patience is a virtue and those purchasers willing to wait will be rewarded with stiffer competition amongst sellers in 2020 and 2021.

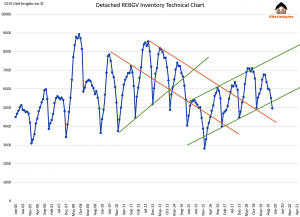

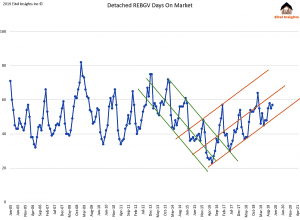

The inventory came in at 4957 active listings which has broken out of the technical uptrend that had propelled the market higher since Feb 2016. The interesting factor with the inventory is, properties that were newly listed in November were 1,070 and the sales were 834. Indicating the newly listed properties that are appropriately priced are likely the ones receiving the acceptable offers. Properties that have been on the market for months are continuing to sit there, this is best exemplified by the chart below which shows the average days on market to before a sale is achieved. The days on market currently sits at 57 which would be lowering in the market was truly bottoming. 2020 will see the inventory tick back up and surpass the 7000 active listings that the market experienced in the summer of 2018. Largely due to the need based selling upcoming.

Money saved is money earned. Since our initial forecast that the Greater Vancouver Market had indeed topped out and prices would begin to trend lower. The market has realized a $360,000 price loss. For an individual report please visit www.eitelinsights.com

Watch Eitel Insights latest video:

Fast-food sandwich chain Subway is set to introduce new deals in January that place additional pressure on already struggling franchisees, according to The New York Post.

Subway’s Promotional CEO

Subway’s advertising agency discussed several discounts the restaurant is set to introduce in a series of private and regional conference calls, The Post’s sources said.

Some of the upcoming promotions include slashing the price of a 6-inch oven-roasted chicken sandwich from $4.25 to $2.99. In total, six sandwiches could be discounted under the leadership of John Chidsey, who was named CEO on Nov. 18.

Chidsey brings fast food experience to the table and previously served as the CEO of Burger King….CLICK for complete article

The Tesla Cybertruck is getting the enthusiasm CEO Elon Musk had hoped for, bragging that 200,000 pre-orders have already been placed for the futuristic electric pickup launched Thursday night. But he’s yet to respond to Nikola Motors CEO Trevor Milton’s offer to share his company’s even cooler fuel cell pickup design to reach a “broader market.”

Nikola Motors is at the center of a surge in support for hydrogen and fuel cell vehicles that had been missing. Musk for years has dismissed and ridiculed hydrogen fuel cell vehicles, but the truck segment is grabbing hold of it — along with cleantech and green power advocates — who had previously always chosen electric vehicles over fuel cell. Consulting firm Cleantech Group calls it a new path to “decarbonize transportation.”

Nikola, Toyota, and Hyundai are being given credit for opening up the “hydrogen highway” through what they’re bringing out in hydrogen-powered commercial trucks. Daimler Trucks, Kenworth, and truck engine maker Cummins are also entering the race. Fuel cell buses are another segment gaining support….CLICK for complete article

Canadians have been on a debt binge, and some cracks are starting to appear. The Office of the Superintendent of Bankruptcy Canada (OSB) saw an increased number of filings in October. Insolvency filings have been moving higher for the past year, especially in the consumer segment.

Canadians Filed Over 139,000 Insolvencies

Canadian insolvencies are rising very quickly from last year’s numbers. There were 13,512 insolvency filings in October, up 11% from a month before. The monthly number is up 13% when compared to the same month last year. In the past 12-months there were 139,194 filings ending in October, which is up 8.8% when compared to the same timeframe a year before. This implies growth could be accelerating even faster….CLICK for complete article

Aurora Cannabis Inc. (ACB.XTSE) shares moved more than 3% lower during Monday’s session after Cronos Group Inc. (CRON) sold its stake in Whistler Medical Marijuana Aurora for C$175 million in stock. While management expects that the strategic acquisition will add significant value, investors are concerned about potential dilution from the all-stock deal.

Melius Research analyst Rob Wertheimer started coverage on Aurora Cannabis stock with an Overweight rating and a price target of C$17 per share, calling it his top pick in the cannabis space. While the analyst firm anticipates overcapacity issues in the future, Wertheimer notes that Aurora has taken measures to capture market share while lowering production costs to preserve margins…CLICK for complete article