Asset protection

The media is full of articles about the financial situation of Millennials in today’s economy. According to numerous surveys, they are saddled with too much debt, can’t secure higher wage-paying jobs, and are financially distressed on many fronts. Moreover, this is occurring during the longest financial and economic boom in the history of the United States.

Of course, the media is always there to help by chastising boot-strapped Millennials to dump their savings into the financial markets to chase overvalued, extended, and financially questionable stocks.

To wit:

“Only about half of American families are participating in some way in the stock market, according to research from the St. Louis Fed. When it comes to millennials (ages 23 to 38), about 60% have no direct or indirect exposure to the stock market.

Of course, you don’t definitely don’t have to invest, Erin Lowry, author of ‘Broke Millennial Takes on Investing,’ tells CNBC Make It. It’s not a life requirement. But you should understand what you’re losing out on if you avoid the markets. It’s a shocking amount, Lowry says. ‘You’re going to have to save so much more money to achieve the same goals because the market is helping do some of the work.’”

Great, you have a person with NO financial experience advising Millennials to put their “savings” into the single most difficult game on the planet….CLICK for complete article

Privately owned Plurilock Systems in Victoria BC is quietly becoming a key player in the ever-growing anti-cyber attack security space. Recent contracts with the US Department of Homeland Security and Canada’s Department of National Defense will see the company at the forefront of machine-to-machine anomaly detection technologies. Plurilock in the only Canadian company to receive funding from DHS’s Silicon Valley Innovation Program.

“Our behavioral, anomaly detection, and AI capabilities, give us a head start in developing machine-to-machine authentication tools,” says Plurilock CEO Ian Paterson. “We think this technology will become more and more critical as the ‘internet of things’ era matures, so we’re excited to continue to collaborate with the Silicon Valley Innovation Program. Obviously, DHS and SVIP are world-class partners to work with.”

The Canadian DND contract tasks Plurilock with advancing state-of-the art, real-time cyber-attack detection and advanced persistent threat (APT) prevention.

“It’s hard to overstate the need for real-time threat detection and response in today’s critical systems,” says Paterson. “Plurilock will significantly enhance this capability, and we’re excited to be able to demonstrate our leadership across multiple kinds of security-driven anomaly detection in our work for DND.”

Plurilock began in the research labs of the University of Victoria with breakthroughs in biometric identity verification. This early “behavioral-biometric” science was applied to the movements involved in computer use—mouse and keyboard activity to start—and a new, advanced form authentication for computing systems was born.

Economists debate whether the decline in productivity is real. It is real, let’s investigate 10 reasons why…

Facebook a Productivity Killer

Google searches are indeed a time-saver. But what the hell is “produced” by them. And where do the searches and Facebook playing take place?

At work perhaps. After discussing the above Brookings did come to this conclusion: “In large part, the productivity slowdown—and the associated productivity paradox—are real.”

It never explained why. Rather Brookings remains puzzled: “While recent research suggests that mismeasurement, although sizable, does not explain most of the observed decline in productivity, it must be noted that there remain unknowns and gaps in data.”

Real or Imagined

The National Bureau of Economic Research (NBER) asks Is the U.S. Productivity Slowdown a Mirage?

Labor productivity in the United States—defined as total output divided by total hours of labor—has been increasing for over a century and continues to increase today. However, its growth rate has fallen. One explanation for this phenomenon focuses on measurement difficulties, in particular the possibility that current tools for measuring economic growth do not fully capture recent advances in the goods and services associated with digital communications technology.

One reason some analysts believe that labor productivity is understated is that price inflation may be overstated for digital goods and services.

As with Brookings, the NBER concludes there is some mismeasurement but fails to figure out why.

As an aside, the NBER group is the official arbiter of recession dates in the US….CLICK for complete article

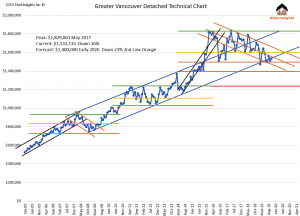

The October data has come in and has been touted as a signal of strength from the Real Estate Board and optimistic analysts. The truth in the matter is prices are down almost 100 Thousand from October 2018. Over 300 Thousand from the peak. In addition the detached market produced an average sales price of $1,533,135, signaling no pricing momentum over the past quarter. Simultaneously falling behind the 10 year uptrend. What this means to us is the market is holding on for dear life. Eitel Insights anticipates seeing another drop in prices for the first quarter of 2020, likely testing the 1.4 million prices point on an average sales basis.

If you go back and look at the Real Estate Board of Greater Vancouver outlooks over the past few years while the market has been falling. Each outlook is anticipated for the upcoming year to be in recovery mode. Not to mention they never caught any market top. Eventually this forecast will be correct just not in 2020. The board has never once anticipated anywhere near a 20% correction, Eitel Insights on the other hand absolutely predicted this outcome.

As we have always advised not all markets are created equal, some markets inside of Greater Vancouver have dropped 30%+ and are close to their technical bottom. While other markets still have much further to go and will bottom in 2021. The markets that are nearing their bottoms will hover at the low end of the market cycle. The lagging markets will continue their evolution lower. With no increase to the leading markets, the Greater Vancouver Average sales price will be forced lower as well.

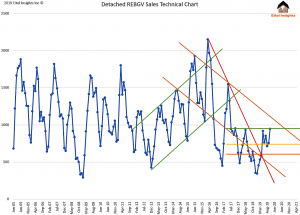

The sales numbers have rebounded from paltry levels however no where near recovery territory. The market is experiencing is need based buying. What the analysts are missing out on is the purchasing activity is largely tied to the mortgage stress test mitigation that is occurring in many markets across Greater Vancouver. Prices have hovered around 16% – 18% correction over the past quarter.

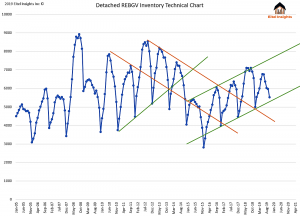

Unfortunately there hasn’t been too much newly listed inventory over the past quarter causing purchaser to battle over the newly listed properties that are in line with the actual market trajectory, lower. In 2020 listings will pile back onto the market, unfortunately the buyers that had a need, will have already purchased. The purchasers who have held back will be rewarded. Investable markets are still rare but there are a few gems out there that Eitel Insights can guide you to.

Noticeable is the lack of growth in the inventory market, expect that to change again in the early part of 2020. When prices decrease back to the 1.4 million price threshold that will have eroded any equity gains over the previous 5 years. Signalling a tough time during mortgage renewal conversations. Not only this factor will start to become prevalent but the market has been holding off with the optimistic hope that 2020 will be better. Now that there has been a blip of buyer activity, you will see a rush of new listings come to the market in 2020.

Sellers are advised to take advantage of the fall market before the spring market is yet another disappointment. It is very difficult for any market to go up or even base when there is a market upcoming with need based sellers. Just wait you’ll see what we mean.

Money saved is money earned. Since our initial forecast that the Greater Vancouver Market had indeed topped out and prices would begin to trend lower. The market has realized a $360,000 price loss. For an individual report please visit www.eitelinsights.com

Capital One has replaced its cybersecurity chief, four months after the company disclosed a massive data breach involving the theft of sensitive data on more than 100 million customers.

A spokesperson for Capital One confirmed the news in an email to TechCrunch.

“Michael Johnson is moving from his role as chief information security officer to serve as senior vice president and special advisor dedicated to cyber security,” said the spokesperson.

Mike Eason, who served as chief information officer for the company’s commercial banking division, has replaced Johnson as interim cybersecurity chief while a permanent replacement is found….CLICK for complete article