Stocks & Equities

Short selling a stock has become an increasingly popular way for traders to profit off of negative market action. But sometimes short selling comes at a steep price.

In addition to the risk of making a losing trade, short sellers often must pay extremely high fees to borrow the stocks they need to complete a short sale. Those fees can eat into profits quickly and create tremendous pressure on short sellers to close out their positions.

The daily borrow fee is calculated as the borrow rate times the market value of the security divided by 365 days in the year.

- Private portfolios of wealthy individuals continued to move away from investing in bonds and equities, preferring cash, investment property and private equity instead.

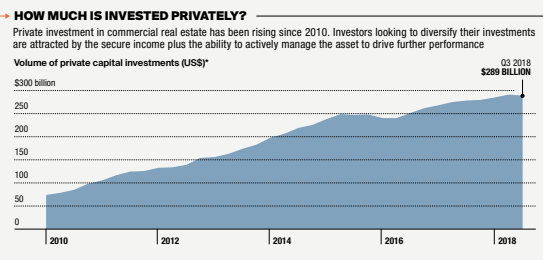

- There’s a continued shift towards private commercial real estate investment. While $385 billion was invested institutionally, $289 billion was comprised of private investments in 2018, up from $75 billion in 2010.

- Amidst global economic uncertainty, the Wealth X Billionaire Census showed a continued pull to cash as cash holdings hit a five-year high, making up more than one-quarter of billionaire portfolios.

A year has past since I first wrote about the asset allocation of the global wealthy in an effort to understand current financial trends. The outlook then, like today, presented many uncertainties that continue to challenge our paradigms of how the financial markets function. Whether you are asking yourself what is going to happen because trade tensions have continued or because we are still going through a long rally in the stock market, you are not alone.

After all, one apparent axiom of history is that a recession occurs every ten years, and we have been warned of its imminence as the United States economy recently entered its tenth year of economic recovery. Lending to the doom and gloom, the global billionaire population declined by 7% in 2018 according to Wealth X’s 2019 Billionaire Census. But predicting the economy’s trajectory isn’t always as straightforward as pointing at a cycle and even if a recession is looming, individuals with ultra high net worth aren’t yet crying that the sky is falling.

In Knight Frank’s most recent Wealth Report, 69% of ultra high net worth individuals (UHNWIs) felt the governments and central banks around the world were more prepared for a financial crisis compared to ten years ago.

Talk of a recession is nothing new, and so are concerns on the ongoing trade wars, political landscapes, governments’ changing policies, and increasingly now, climate change. So if it’s all about to go awry, what to do with your capital? Let us take another look at the globe’s ultra high net worth individuals (UHNWIs) to see where they’re allocating their capital.

Confidence among United States’ wealthy

According to the 2019 Knight Frank Wealth Report, in spite of the economic unrest, existing UHNWIs expect their wealth to increase over the next year. Those polled in the United States expressed the most confidence as 80% expect to be better off financially in the coming year and their confidence seems warranted. In the 2019 Wealth X Billionaire Census, there was a decline for just the second time in a decade in the billionaire population globally but North America was the only region to see growth among its billionaire population. This is on the backs of the United States as Canada and South America saw losses. What many view as President Trump’s isolationist policies may be paying off for American investors now but its sustainability is questionable, especially with a looming election cycle. The crystal ball may be fuzzy but looking back at the past year can shed some light on how the globe’s wealthy are striving to preserve and grow their capital.

Where capital is being placed globally

Private portfolios of wealthy individuals continued to move away from investing in bonds and equities, focusing on cash, investment property and private equity, in that order.

In 2018, 45% more UHNWIs allocated their capital to cash to comprise 17% of their overall portfolio. Trailing not far behind was a 21% change in asset class to owning real estate as an investment. The Wealth X Billionaire Census showed similar findings as cash holdings hit a five-year high, making up more than one-quarter of billionaire portfolios. More and more billionaires also moved away from public holdings and increased their share of private assets.

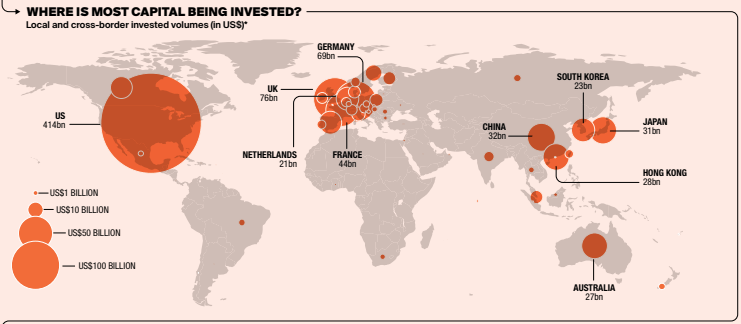

One of the sectors seeing the most growth (according to the Knight Frank Wealth Report) was the Commercial Real Estate industry in North America. A number of factors contributed to growth in this sector. For one, real estate valuation can increase through asset management. There’s a level of control for investors that doesn’t necessarily translate to other allocations.

Also driving the shift towards commercial real estate were low interest rates, the promise of long-term returns and a strong track record. The office sector led the way in this niche with $302 billion (in US dollars) invested followed by apartments with $202 billion global capital invested.

Another trend we’re seeing in this sector is a move towards private investment. While $385 billion was invested institutionally, $289 billion was comprised of private investments in 2018. Since 2010 (when private investment hovered around $75 billion), there’s been a steady incline in private investment with 35% of those private investors looking to buy into apartments.

Multifamily housing also remains strong but there’s a changing tide in real estate investment. The Knight Frank report showed investors intend to increase their exposure to education facilities, student housing and “last mile” logistics property, as well as targeting office investment in key tech and innovation markets. Luxury residential markets continue to come back down to earth and that settling will favour buyers for a change.

Government’s hand in real estate investment

Governments have been taking one of two positions in real estate investment: either create legislative barriers for foreign investors or embrace the influx and make foreign investors more inclined to buy-in to their markets. Canada falls into the former group, creating more and more hurdles for foreign investors to purchase Canadian real estate. In spite of or because of these approaches, global real estate investments continue to grow. The Knight Frank report showed 24% of respondents intended to invest in real estate in their home country in the following year whereas 27% shared their intention of investing in another country’s real estate. Taking it a step farther, a record 26% of UHNWIs shared their intentions of emigrating to another country. There are more options for the world’s wealthy to find a haven that has more friendly laws and policies to protect their nest eggs.

The overall globalisation of investment has fared well for North America in particular as the United States continues to be a global leader in commercial real estate as well as being a big draw for residential property. These highly competitive sectors have led investors to seek secondary or suburban markets. Investors are now being forced to branch out from gateway cities to even less established markets that show markings of growth potential.

Where to go from here?

As the global uncertainty rises amidst government reform, trade wars and stock volatility among other factors, UHNWIs are shifting towards a play-it-safe model. In the Knight Frank attitudes survey, 42% of respondents indicated they were more risk averse over the past 12 months. That cautious approach may bode well for all levels of investors. The 2019 Capgemini Wealth Report findings showed that the high net worth individuals making $1-5 million a year were much more conservative with their investments compared to their wealthier counterparts. That conservative approach shielded them from the volatility of the market and they experienced much less loss (<.5%) than the upper tiers of wealthy individuals.

So if the proverbial storm is coming, there’s still time to batten down the hatches by looking to historically more protected investment options. Don’t abandon ship just yet.

References:

Knight Frank, The Wealth Report 2019: The Global Perspective on Prime Property & Investment

The Wealth Report Attitudes Survey 2019, Knight Frank

Wealth-X, The Wealth-X Billionaire Census 2019

Capgemini, World Wealth Report 2019

Sign up for Hawkeye’s newsletter for market updates, upcoming events and private offerings by clicking here.

This past week was built for the “bulls” as just about every item on their “wish list.” was fulfilled. From a “trade deal” to more “QE,” what more could you want?

Trade Deal Near?

Concerning the ongoing “trade war,” our prediction that Trump would begin to back peddle on negotiations to get a “deal done” before the election came to pass.

Trump has once again delayed tariffs to allow the Chinese more time to position. China, smartly, is using the opportunity to buy soy and pork products (which they desperately need due to a virus which wiped out 30% of their pig population) to restock before the next meeting.

This is a not so insignificant point.

China is out for “China’s” best interest and will not acquiesce to any deal which derails their long-term plans. In the short-term, they may “play the game” to get what they need as a country, but in the long-run, they will protect their own interests….CLICK for complete article

Drone strikes on crucial Saudi Arabian oil facilities have disrupted about half of the kingdom’s oil capacity, or 5% of the daily global oil supply, people with knowledge of Saudi’s oil operations told CNN Business.

Yemen’s Houthi rebels on Saturday took responsibility for the attacks, saying 10 drones targeted state-owned Saudi Aramco oil facilities in Abqaiq and Khurais, according to the Houthi-run Al-Masirah news agency.

Five million barrels per day of crude production have been impacted after fires raged at the sites, one of them the world’s largest oil production facility, people with knowledge of the kingdom’s operations said. The latest OPEC figures from August 2019 put the total Saudi production at 9.8 million barrels per day.A source told CNN Business that Aramco “hopes to have that capacity restored within days.”

The Saudi interior ministry confirmed the drone attacks caused fires at the two facilities. In a statement posted on Twitter, the ministry said the fires were under control and that authorities were investigating. “Abqaiq is perhaps the most critical facility in the world for oil supply. Oil prices will jump on this attack,” Jason Bordoff, founding director of the Center on Global Energy Policy at Columbia University, said in a statement.

The development comes as Saudi Aramco takes steps to go public in what could be the world’s biggest IPO. Aramco attracted huge interest with its debut international bond sale in April. It commissioned an independent audit of the kingdom’s oil reserves and has started publishing earnings. Over the past two weeks, the kingdom has replaced its energy minister and the chairman of Aramco.

Saudi Arabia, the world’s largest oil exporter, has cut back on production of crude and other energy products as part of an OPEC effort to boost prices. Saudi Arabia produces approximately 10% of the total global supply of 100 million barrels per day.

The International Energy Agency said on Saturday it was monitoring the situation in Saudi Arabia. “We are in contact with Saudi authorities as well as major producer and consumer nations. For now, markets are well supplied with ample commercial stocks,” it said on Twitter.

If the disruption in Saudi Arabia is prolonged, “sanctioned Iran supplies are another source of potential additional oil,” Bordoff said. “But [US President Donald]Trump has already shown he is willing to pursue a maximum pressure campaign even when oil prices spike. If anything, the risk of tit-for-tat regional escalation that pushes oil prices even higher has gone up significantly.”