Asset protection

The last few weeks marked a turning point in the global economy. It’s more than the trade war. A sense of vulnerability is replacing the previous confidence—and with good reason. We are vulnerable, and we’ll be lucky to get through the 2020s without major damage. Let’s talk about the risks facing us in the next year or so and the economic environment in which we will face those risks.

Supply Shocks Ahead

In a recent Project Syndicate piece, NYU professor and economist Nouriel Roubini outlined three potential shocks, any one of which could trigger a recession:

- A slower-brewing US-China technology cold war (which could have much larger long-term implications)

- Tension with Iran that could threaten Middle East oil exports

The first of those seems to be getting worse. The second is getting no better. I consider the third one unlikely. In any case, unlike 2008, which was primarily a demand shock, these threaten the supply of various goods. They would reduce output and thus raise prices for raw materials, intermediate goods, and/or finished consumer products. Roubini thinks the effect would be stagflationary, similar to the 1970s….CLICK for complete article

Canadian seniors are slowing down on the equity binge, but they’re still tapping quite a bit. Office of the Superintendent of Financial Institutions (OSFI) filings show reverse mortgage debt reached a new high in June. Canadian reverse mortgage debt is decelerating in growth, but is still one of the fastest growing segments of debt.

A reverse mortgage is an increasingly popular way for seniors to tap their home equity. Lenders will give you a lump sum or regular payments, secured by the equity in your home. They’re similar to a home equity line of credit (HELOC), but no regular payments are not required. Instead, the balance is only generally due in the event of death, sale, or default.

For this privilege, they generally charge a higher fee than a HELOC. Combining no payments and a higher interest rate is a great way to see your home equity vaporize. So it’s always best to thoroughly think a move like this through. Got it? On to the data….CLICK for complete article

It’s not just you who’s aging. Our world is getting old. By next year, 55-year-olds will outnumber 5-year-olds. By 2050, the number of people aged 50 and older will rise to 3.2 billion–a twofold increase since 2015.

Baby Boomers, born between 1944 and 1964, are now desperately searching for the “fountain of youth”, and the market is finally responding.

This conference is a must-see for anyone with oil and gas in their portfolio or thinking about it for the first time. General admission tickets are sold out but VIP tickets are still available and are offered to MoneyTalks listeners at early bird prices. Click here to learn more or click here to buy tickets.

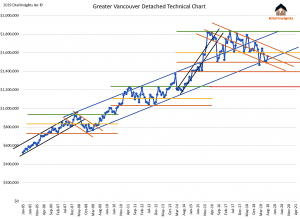

Eitel Insights forecast of the stress test mitigation has come to fruition. June and July 2019 Average Sales Price for Greater Vancouver Detached properties realized a loss of 17% & 18% respectively. That signaled a stress test mitigation.

The stress test was introduced in 2018 and basically cut any potential buyers purchasing power by 20%. Buyers needed to qualify at higher rates and terms than were ever required before. That sent a significant segment of the market to the sidelines.

Now that the market has dropped off, there is a portion of those sidelined buyers that are off the bench and in the purchasing game. During August prices rose back to $1.560 Million, which is perfectly in the middle of the market downtrend that has been established. Equally important the market has jumped back above the ten year uptrend after two months of threatening to break the important technical indicator.

We at Eitel Insights believe sellers should take advantage of this temporary market. We have been stating for the last quarter that this stress test mitigation would come, now that it is in play, we feel obligated to warn that this is a blip in the markets evolution lower. Before you know it the average sales prices will officially break the ten year uptrend and the market will be sent lower with a significant test of $1.400 million likely in 2020.

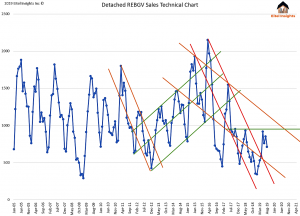

The Detached sales figures which had broken out of the falling knife trend. Is now, seemingly in a triple top scenario with sales not being able to climb above 920 sales with any sustainability. This will be a short term problem as sales can indeed increase from their very low levels and still be in the overall downtrend. We do anticipate seeing higher lows in the sales numbers and it is not hard to imagine higher lows being put in place considering all the market needs to realize is more than 344 sales to achieve the goal in place. However as we say the market needs to have a heartbeat. Just because there are sales does not give you the whole story of supply versus demand.

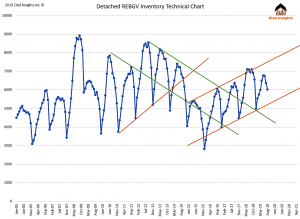

The inventory growth has curtailed as of late, with properties staying on the market longer and some sellers giving up hope and taking properties off the market. The new activity brought on by the stress test mitigation will cause another increase in inventory over the next couple of months. As old sellers hop back on the bandwagon believing the market has turned. This will again cause a further imbalance between buyers and sellers. Once the sidelined buyers have purchased there is no pent up demand following them and prices will indeed head lower while inventory grows.

Money save is money earned. Since our initial forecast that the Greater Vancouver Market had indeed topped out and prices would begin to trend lower. The market has realized a $360,000 price loss. For an individual report please visit www.eitelinsights.com.