Currency

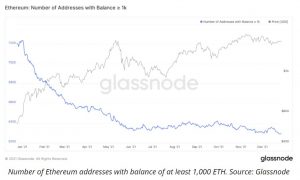

The number of Ethereum addresses holding at least 1,000 ETH dropped to a four-year low this week.

Ethereum is having difficulty keeping its richest investors in line as its native token, Ether (ETH), hints at logging more losses in the near term.

Blockchain data analytics service Glassnode revealed that the number of Ethereum addresses holding at least 1,000 ETH dropped to 6,292 this Monday, the lowest reading since April 2017. At its year-to-date peak, the numbers were 7,239 in January.

On-chain analysts typically observe ETH distributions among addresses to realize retail and institutional sentiments. They consider wallets that hold above 1,000 ETH (around $3.92 million at currency exchange rates) as “whales,” primarily for their ability to influence interim market trends via large sell and/or buy orders.

But as the numbers of these so-called whales drop, it reflects an ongoing selling trend among the richest Ethereum wallet owners. For instance, the number of Ethereum addresses that hold at least 10,000 ETH (or around $39.20 million) has also plunged, from 1,208 in June to 1,156 at the time of this writing, marking an almost 4.5% decline…read more.

Canada’s budget watchdog says the deficit forecast laid out by the federal government in its Economic and Fiscal Update will likely be higher than expected because roughly $50 billion in key spending promises from the Liberal Party’s election campaign were omitted.

“Looking at the update, we can be reassured that the deficit is going to be lower – significantly lower over the next several years – however, that misses some of the landmark elements of the Liberal electoral campaign proposals,” Yves Giroux, parliamentary budget officer, said in an interview Thursday.

“It suggests that the deficits will be slightly higher than what [Finance Minister Chrystia Freeland] laid out, when she tabled the Economic and Fiscal Update last week.”

The federal government is now forecasting a $144.5 billion deficit for the 2021-22 fiscal year, about $10 billion less than in the spring budget, thanks to higher than expected revenues.

It’s also forecasting its debt-to-GDP ratio – the feds’ relatively newly-preferred way to measure its financial health – to peak this year at 48.0 per cent before eventually declining to 44.0 per cent by fiscal year 2026.

Several key spending promises including the Liberals’ proposed Tax-Free First Home Savings Account, an increase to the Guaranteed Income Supplement, modernization of CBC/Radio-Canada and reducing mortgage insurance premiums for homebuyers that have a down payment of less than 20 per cent were not included in the fiscal update, according to Giroux.

“So even though the update shows the deficit going down to between $20 [billion] and $30 billion in five years, that still does not include about $50 billion in spending that the Liberals had promised during the electoral campaign,” he said…read more.

Towns across eastern Germany saw the largest turnouts in protests against a planned vaccine mandate and new restrictions. At least 10 police officers have reportedly been injured in riots in Saxony.

Thousands of people demonstrated on Monday against coronavirus restrictions in Germany.

The protests came in response to new restrictions on private gatherings and a ban on spectators at public events ahead of New Year celebrations. The German parliament also approved a vaccine mandate for medical staff earlier this month.

In recent weeks, demonstrations against COVID measures have flared up across Germany — and often turned violent, with police officers injured and protesters arrested.

Eastern states see most protests

Police in the northeastern state of Mecklenburg-Western Pomerania reported that a total of 15,000 protesters took to the streets in various towns.

According to police in Mecklenburg-Western Pomerania, around nine criminal charges involving resisting arrest, inflicting bodily harm, damage to property and the use of symbols of unconstitutional and terrorist organizations were handed out to protesters…read more.

Last summer, the BC NDP government retained Mariana Mazzucato, a celebrity academic who is a professor at University College London (UCL), “to advise on the future of the economy as B.C. develops a long-term … plan that will steer the province through the post-pandemic era.”

The government asked Mazzucato to develop ideas for aligning public-sector capabilities, financing mechanisms and citizen engagement with a new innovation strategy aimed at creating a more inclusive and sustainable economy.

This stream of pleasing buzz words doesn’t provide much insight into the substance of the economic plan the NDP government intends to finalize, with input from the professor and her team, in the coming months. A solid plan to boost prosperity and foster innovation that embraces some fresh thinking would be welcome. But if, as the government’s briefing material indicated, the economic plan will “build on B.C.’s long-standing advantages and reflect people’s values,” several fundamental realities will need to inform the strategy…read more.

- Criminals have stolen close to $100 billion in pandemic relief funds, the U.S. Secret Service said Tuesday.

- The stolen funds were diverted by fraudsters from the Small Business Administration’s Paycheck Protection Program, the Economic Injury Disaster Loan program and a another program.

- Recovered funds include more than $400 million from PayPal and Green Dot Corporation. The government has shelled out about $3.5 trillion in Covid relief money since early 2020, when the pandemic began.

Criminals have stolen close to $100 billion in pandemic relief funds, the U.S. Secret Service said Tuesday.

The stolen funds were diverted by fraudsters from the Small Business Administration’s Paycheck Protection Program, the Economic Injury Disaster Loan program and a another program set up to dole out unemployment assistance funds nationwide.

More than $2.3 billion in stolen funds have been recovered so far, resulting in the arrest of more than 100 suspects who span the spectrum from individuals to organized groups, according to the agency. The government has shelled out about $3.5 trillion in Covid relief money since early 2020, when the pandemic began.

The Secret Service, which specializes in financial fraud in addition to its better-known role in presidential protection, also announced the appointment of a new national pandemic fraud recovery coordinator to oversee its sprawling investigations into the enormous number of fraud cases resulting from all that theft…read more.