Timing & trends

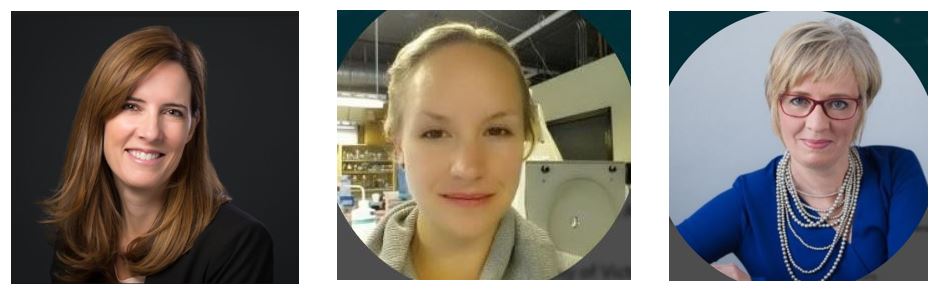

ImmunoPrecise Antibodies (TSX:V – IPA) was a quiet, private Victoria-based company that had established itself as a successful, albeit small, contributor to the Canadian biotech scene. That is all changing with a vengeance under the leadership of it’s new President & CEO Dr. Jennifer Bath. And perhaps more tellingly, with the assistance of her Chief Scientific Officer Dr. Deanna Dryhurst and Director of Global Project Management Kari Graber, this team has helped make the now publicly traded ImmunoPrecise arguably the industry’s first full-service antibody discovery provider. And they are exciting shareholders with significant worldwide growth and revenue up over 400% this year alone.

A lot of conversation and ink has been used in the media decrying the lack of role models in science for girls and young women. And perhaps that is a function of where we are looking. There is no doubt our education system and academia is too often the focus, and found to be wanting. Dr. Bath and the team at ImmunoPrecise remind us that it is worth exploring the private sector for success stories. It is certainly a story that the shareholders at IPA are enjoying and has them looking for better things ahead.

Dr. Bath began her career as an academic, becoming the founder and executive director of the Concordia College Global Vaccine Institute. She then moved to the private sector where she spent 15 years with Aldevron LLC, serving as its Global Director. Dr. Dryhurst has a PhD in Biochemistry and Molecular Biology from UVic. Her work in developing ImmunoPrecise’s proprietary single B cell technology has been critical to the company’s growth and profit margins. Kari Grabner has more than 20 years experience in biotech manufacturing quality assurance, and has been critical to the success of IPA’s customer service model.

Most importantly, Dr. Bath and her team have given ImmunoPrecise a view of the future that is international is scope and scale. Her ambitious business plan is to be the partner-of-choice for the world’s biggest pharmaceutical companies seeking treatments for major diseases. And perhaps not surprisingly, IPA’s recent acquisition of ModiQuest Research in the Netherlands brought another female STEM leader into the fold. Dr. Debby Krusijsen is the head of research at the lab which recently announced the expansion of its human therapeutic discovery platform in Europe and the US, partnering with Ligand Pharmaceuticals.

The competitive world of bioscience – and the public markets – rewards skill, experience, commitment and boldness. Canada can take pride in a company whose female leadership team exhibits all of these characteristics.

Here is a great article that I felt MoneyTalks subscribers would like to read to prove the point that the federal government is on another tax grab of your hard earned money. They have increased the “collection plate” to add an additional $20 billion over their projected forecast and guess where it comes from… $10 billion surplus from income tax.

If your frustrated in paying more than your fair share of taxes, we have a couple strategies to significantly reduce your tax contributions for 2018. We will be conducting seminars in Vancouver, Victoria and Calgary November 12, 13, 14 & 15. – Craig Burrows CEO, TriView Capital Ltd.

The Economist this week warns policy makers to “start preparing for the next recession” while they still can. The release of the government of Canada’s annual financial report for the 2017-18 fiscal year, however suggests the Trudeau Liberals have no notion of foregoing that most enjoyable of all entitlements: spending other people’s money.

The annual budget is an aspirational document, revealing what the government would like to do. But the annual report is a look…Click here for full article

As the cryptocurrency market continues to struggle to break free from bear territory, opportunists are looking at the slump as their chance to catch a deal. Blockchain and crypto M&A deals have surged this year, climbing from 47 in October 2017 to 115 currently. And according to JMP, it could reach as high as 145 by the end of 2018…. CLICK for complete article

How is Investment Real Estate doing in Canada?

Every quarter, Altus Group surveys over 200 investors, owners, lenders, analysts and other market stakeholders and real estate professionals for their perspective on Canadian real estate investments.

As recent news (including one of our latest articles) already pointed out, the large availability of private capital is driving up prices in a number of assets across the investment spectrum. Real estate is no different, with some sectors seeing cap rates compressing more than others.

According to the report, overall capitalization rates compressed slightly to 5.03%, compared to 5.13% from a year ago. Cap rate compression is usually attributed to increased prices due to higher competition for properties. As more capital seeks investment real estate, prices are bid up even though properties haven’t necessarily increased their Net Operating Income (NOI).

Consider the High-Grade, Class “AA” Office Sector for example. Altus reports that cap rates for Toronto and Halifax moderately increased, with most other markets marginally decreasing. Given strong demand for investment real estate, the high-quality office product in core markets becomes a more highly-competitive, scarce commodity driving investors to look for yields in other more attractive markets.

A similar effect happens in the multi-family sector. Higher prices for residential product amid the housing affordability crisis we are facing in major Canadian markets is driving cap rates down, forcing investors to seek opportunities in secondary and tertiary markets, while also forcing home buyers to postpone their decision to buy. The only markets not experiencing cap rate compression are Ottawa (which saw a marginal increase) and Halifax (which remained flat).

Thus, it comes as no surprise that the top three product/market combinations advanced by Altus’ survey are all multi-tenant industrial in Ottawa, Edmonton, and Calgary. Having the highest average cap rate across markets from all asset classes (at 5.58% for single tenant industrial), increasing rents across Canada due to demand outpacing supply, and advances in e-commerce should make for a great case for the sector.

What about the impact of interest rate increases? For the short to medium term, Altus notes that commercial real estate in Canada has not caught up entirely to the impact of the recent increases, so cap rates are expected to hold steady with moderate increases in certain markets.

Strong demand outpacing supply and large availability of capital is great economic news for the country overall. Despite the cautious approach from investors in such a high-priced market, there is good reason for the large investment volumes seen in the recent quarters.

To access Altus Group’s Investment Trends Snapshot, click here.

There are times that investments look odd on the surface but make a lot more sense once you perform due diligence. With debate circulating over the production of oil and pipelines in Canada, pencil lead might just be what we need to help move Canada to a ‘green economy’.

Graphite pencil lead is only one form of a very common substance – carbon. Coal, another form of carbon shaped our modern Industrial Revolution and the coal-bearing areas of Ozark mountains made America an Industrial giant in the early 20th century. Another form of carbon creates diamonds, one of the hardest and most beautiful gemstones in the world. The picture below does not show diamonds, but its cousin flake graphite, taken as samples from Lomiko’s La Loutre property in Quebec.

Graphite is best known as pencil lead, but it has an incredible array of new uses that make it a miracle material. A primary use for graphite is to create refractories, which are heat-resistant materials used in manufacturing steel, molds and as insulating bricks in steel foundries. In addition, graphite is useful as a dry lubricant in area liquids can’t be used, heat sinks in outdoor and stadium lighting, vehicle brakes, and as an additive in manufacturing.

However, graphite’s primary use and the reason it is considered a critical element by both the European Union and America is its crucial role in the green economy. Demand for graphite is shown in the chart below as compared to other ‘green materials’.

It exceeds copper in the ability to handle electrical current, and to conduct and contain heat. Further, it is much easier to combine into 3d printing materials – a bright future in additive manufacturing. However, the most exciting use is as an anode in a Lithium-ion battery, the most prevalent power system for Electric Vehicles.

Electric vehicles will be 50% of the cars on the road by 2040. The current EV technology depends on the Lithium-ion battery. There is 15 times more graphite than lithium in these batteries. Lithium has increased 4-fold in price due to demand. The demand for graphite is now increasing as the price for battery grade graphite materials has doubled in the last 3 years and is slated to move higher.

In 2012, China supplied 90% of the world’s graphite but that percentage has been dropping every year until. In 2018 the number was 70%. More graphite is being consumed by the Chinese lithium-ion battery manufacturing boom led by e-bikes, EVs and cellular phones and tablets. Both the European Union and the United States have declared graphite a critical mineral which indicates there is no economic alternative. This is good news for graphite companies in Canada. Canada has a good reputation as a country which is able to supplant Chinese supply of graphite and provide secure supplies. Quebec is especially important due to the proximity to Eastern American industrial centers and Quebec’s long-term and stable approach to mining industry.

Graphite prices have increased 100% in the last 3 years to over $2,000/tonne. If this were the gold markets, investors would be dancing in the streets. However, in the battery materials space, we must see a multi-year, sustainable run to call it a bull market. This will likely occur, as it did in the lithium market, as demand outstrips supply. Speculative interest in the graphite market is already beginning to take off and this should help attract major customers or partners to Lomiko’s La Loutre Project.

From the Editor

A. Paul Gill is the CEO of Lomiko Metals Inc. a Canada-based, exploration-stage company. The Company is engaged in the acquisition, exploration and development of resource properties that contain minerals for the new green economy.

Lomiko’s La Loutre is situated in the heart of Quebec’s graphite area with neighbours like Northern Graphite TSXV: NGC, Nouveau Monde TSXV: NOU and Imerys Carbon and Graphite, which has the only operating mine in North America. Infrastructure is excellent as the project is 1.5 hours from the International Seaport of Montreal along a paved highway. They are ready to drill their second resource in a high grade (10%+ Cg). At present, the project is one of the most promising in the world. The La Loutre Flake Graphite Property of 18.4 million Tonnes of 3.19% in the indicated category and 16.7 million tonnes at 3.75% Flake Graphite Inferred with a cut-off of 1.5% at the Graphene-Battery Zone.

In 2018, Lomiko signed a deal to increase the ownership of the La Loutre Property to 100%. Further, it was able to raise $ 1.5 million for development of the project and, in addition, launched several technology initiatives which will be going to the public markets in 2019.

Lomiko plan’s to complete drilling at the Refractory Zone of the La Loutre Property concentrating on an area that produced 135 m of 7.74 metres and 110 metres of 14.56% to create a second resource, complete metallurgy and a 3D model of the property and by the end of the year 2019, a Pre-Economic Assessment (PEA) which will establish a book value for the project.