Featured Article

Four blockchain-based metaverse projects generated more than $100 million worth of virtual land nonfungible token (NFT) sales last week, according to data from DappRadar.

A Tuesday post from the decentralized application analytics firm reported that between Nov. 22 and Nov. 28, activity was “booming” on The Sandbox, Decentraland, CryptoVoxels and Somnium Space with a combined $105.8 million worth of trading volume among them from more than 6,000 traders:

“Undoubtedly, Metaverse land is the next big hit in the NFT space. Outputting record sales numbers and constantly increasing NFT prices, virtual worlds are the new top commodity in the crypto space.”

The Sandbox represented the lion’s share of volume for the week with $86.56 million, Decentraland accounted for $15.53 million, while CryptoVoxels and Somnium Space generated $2.68 million and $1.1 million, respectively. All four of these metaverse projects are built on the Ethereum blockchain, although projects on other chains such as Solana are beginning to gather pace, too.

DappRadar noted that “the wave of attention towards virtual worlds like The Sandbox and Decentraland started with Facebook’s rebranding to Meta.”…read more.

Canadian real estate prices are rising, but investors are quietly pulling back. In fact, they’re withdrawing their capital at one of the fastest rates in history. Statistics Canada (Stat Can) data shows residential investment dropped sharply in Q3 2021. This is the component of GDP that covers real estate’s most direct economic output. The GDP component recently printed a record, but falling home sales and delayed projects have it spiraling lower.

Canada Spends More Than A Third Of Its Investment Capital On New Housing

Canada’s investment in residential structures showed one of the sharpest declines in history. Seasonally adjusted investment fell to $231.2 billion in Q3 2021, down 7.1% ($17.7 billion) from the previous quarter. That second quarter had been the record high for investment in dollar terms.

The (sorta) good news is fixed capital formation, a measure of total GDP investment, didn’t fall as fast. Residential investment is 39.8% of gross fixed capital formation in Q3 2021. This is a decline of 2.4 points from the previous quarter, underperforming the economy. It peaked in Q1 2021, and the share is now 2.9 points lower from that peak. Canada’s dependence on real estate is starting to loosen, though it’s still very high.

Residential Investment Has 3 Major Subcomponents

Let’s go over where this weakness is coming from by looking at the three big subcomponents. Renovation, the biggest of the subcomponents, is the capital spent on major home renos. New construction is the second biggest and shows the amount of capital sunk into new housing. Ownership transfer costs are the smallest and represent costs associated with trading homes. This is primarily realtor commissions, known as broker revenues. All three segments showed weakness in the most recent data.

Investment For New Housing Made The Sharpest Drop Since 2009

New housing investment is the largest share of residential investment, and it slipped. The segment fell to a seasonally adjusted $102.7 billion in Q3 2021, down 2.6% ($2.8 billion) from the previous quarter. This would be the most significant drop since the beginning of public health measures.

Stat Can made a special note about this segment in regards to the size of its drop. When adjusted for inflation, investment in new housing construction fell 5.7% in Q3. Their analysis shows this is the largest drop for the segment since 2009 — the Great Recession. It really emphasizes the enormous role inflation is playing in this environment…read more.

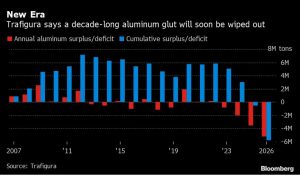

On an industrial park about an hour’s drive toward the South China Sea coast from Ho Chi Minh City sit giant mounds of raw metal shrouded in black tarpaulin. Stretching a kilometer in length, the much-coveted hoard could be worth about $5 billion at current prices.

In the esoteric world of aluminum, those in the know say the stockpile in Vietnam is the biggest they have ever seen — and that’s in an industry that spends a lot of time building stockpiles while analysts spend a lot of time trying to locate them. But as far as the increasingly under-supplied market is concerned, it’s one that may never be seen again.

Why it’s unlikely to move anytime soon involves Vietnam’s customs authorities. How its existence has become so significant, meanwhile, opens a window on a ubiquitous, yet erratic commodity at a time when makers of everything from car parts to beer cans are competing for more of it as they emerge from the coronavirus pandemic and China throttles supply.

While there used to be millions of tons of aluminum at ports from Detroit and New Orleans in the U.S. to Rotterdam in Europe and Malaysia’s Port Klang, market watchers say the stockpile 50 kilometers (31 miles) from Vietnam’s biggest city is likely the only notable one left.

To put it in perspective, it’s equivalent to the entire annual consumption of India, the world’s second-most populous country, said Duncan Hobbs, a London-based analyst at commodities trader Concord Resources who has been covering metals markets for 25 years.

“We’re seeing the deepest deficit in the world market in at least 20 years, and this stockpile would not only fill that deficit, but it would leave you with something leftover as well,” he said…read more.

In March, Beeple sold a digital collection of his art as an NFT for a record $69 million. Now, the buyer wants everyone to have a free copy.

The buyer, Vignesh Sundaresan, who’s also known as MetaKovan, told Bloomberg he’d be happy if everyone downloaded a copy of the multi-million dollar non-fungible token, “Everydays: The First 5,000 Days.” That’s because Sundaresan, a crypto investor who cofounded bitcoin ATM company BitAccess, told Bloomberg “information wants to be free,” and keeping things on the internet inside walled gardens like paywalls doesn’t work well.

To him, everyone should be able to enjoy an NFT, a digital piece of art tied to the blockchain, without having to pay for it. For those who pay for the production, they get the credit for it, Bloomberg wrote.

“Instead of giving the importance to that copy of the file, it kind of gives importance to something else big. The idea that some person supported an artist at some time and this was the memorabilia,” he told Bloomberg.

NFTs have ballooned to a massive market this year, reaching more than $10 billion in trading volume in the third quarter alone, a more than 700% jump from the prior three months.

Even as the mania around them continues, NFT enthusiasts and critics are sparring over the digital asset’s actual worth. Enthusiasts say NFTs are the key to unlocking the future internet, known as the metaverse; critics say they’re nothing more than a file that can be right clicked and downloaded. One critic even downloaded all of them to make a point…read more.

Deutsche Bank expects crude oil prices to drop considerably next year, dipping below $60 per barrel in New York, the bank said in a note.

“It would be misguided to think of an OPEC pause on Thursday as bullish, since we have assumed that in our model and still end up with a surplus in Q1,” the Deutsche analysts said, as quoted by Bloomberg. “We would be sellers of a rally in crude on the back of an OPEC pause,” they also said.

Most other banks are forecasting higher prices for crude oil: JP Morgan analysts recently forecast Brent crude reaching $125 per barrel in 2022 and rising further to $150 in 2023.

“OPEC+ is not immune to the impacts of underinvestment…. We estimate ‘true’ OPEC spare capacity in 2022 will be about 2 million barrels per day (43%) below consensus estimates of 4.8 million,” the team, led by Christyan Malek, wrote in a note.

The JP Morgan analysts don’t appear to be expecting a surplus in global oil supply even in the first quarter of next year. Instead, they are noting that OPEC+ might need to add a few more installments of 400,000 bpd monthly to bring the market closer to balance.

Morgan Stanley, on the other hand, earlier this week slashed its oil price forecast on the latest Covid-19 scare caused by the emergence of the highly mutated omicron variant. The bank previously forecasted that Brent will trade at an average of $95 per barrel in the first quarter of 2022—but now this has been revised down to $82.50 per barrel…read more.