Economic Outlook

Trans Mountain Corp. last week said it hoped to have the pipeline that provides most of the oil, gasoline and diesel for southern B.C., as well as refineries in Washington state with crude oil, back in operation by now.

And Canadian National Railway (TSX:CNR), which can move oil or refined fuels by rail, had resumed some services as of last week.

But it could take a week or two before the Parkland Corp. (TSX:PKI) refinery in Burnaby is back in full production, one petroleum analyst predicted.

Oddly, though some gasoline stations in B.C. ran out of gas, gasoline prices did not spike in Metro Vancouver the way one might have expected.

Gas prices in Vancouver were averaging $1.60 per litre on November 15, when the three-day rainstorm that cut highways, rail lines and shut down the Trans Mountain pipeline ended.

On November 22, the day Parkland announced it was ceasing its refining operations because it was out of oil, gas prices in Vancouver fell by about $0.02 per litre, according to GasBuddy…read more.

On Black Friday, SpaceX CEO Elon Musk sent an anxious email to his company’s employees, urging them to work over the weekend on SpaceX’s Raptor engine line and describing the production situation as a “crisis.” In the email, a copy of which was obtained by The Verge, Musk argued that the company faces a “genuine risk of bankruptcy” if production doesn’t increase to support a high flight rate of the company’s new Starship rocket next year.

The Raptor is SpaceX’s massive methane engine that will be used to propel the company’s next-generation launch system, called Starship. SpaceX plans to use Starship to take people to deep space, and in April, NASA awarded SpaceX a $2.9 billion contract to develop Starship as a lunar lander to transport astronauts to the Moon’s surface as early as 2025. SpaceX has been hard at work developing and testing Starship prototypes at the company’s test site in Boca Chica, Texas, though the company has yet to launch the vehicle to orbit.

SpaceX is currently hoping to conduct Starship’s first orbital launch in either January or February of 2022, according to a presentation given by Musk to the National Academies of Sciences on November 17th. However, according to Musk’s email, SpaceX needs to launch Starship at least once every two weeks next year to keep the company afloat. And apparently, Raptor engine development isn’t on track at the moment…read more.

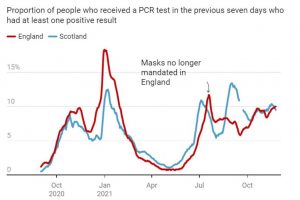

University of Oxford Professor Jim Naismith asserts that despite England dropping its mask mandate in July and Scotland keeping its rules in force, official data shows this “has made no meaningful difference” to infection rates.

Naismith goes on to argue that new face mask mandates imposed in England today are “unlikely to have much of an impact” in fighting off the spread of the Omicron variant.

Despite flatlining case numbers and declining deaths, partly achieved because England chose to lift lockdown restrictions in the summer unlike many European countries, mask mandates are once again back in force.

Face coverings are compulsory in shops, on public transport and numerous other venues arbitrarily chosen by the government.

Highlighting the absurdity of the rules, face masks are mandatory in takeaways but not restaurants, meaning you have to wear one if picking up a takeaway but not if you stay inside the restaurant for a sit down meal…read more.

Shortly after President Biden sat down with top executives from Wal-Mart, a handful of regional grocers and others to hold a “round table” to discuss “supply chain” issues, the FTC announced Monday afternoon that it would launch an investigation into the factors contributing to these types of disruptions, which have been blamed for contributing to inflation by helping to drive up prices.

Just as reports claimed the supply chain crunch appears to finally be waning, President Biden sicced the FTC on the issue. Once again, it’s bureaucracy to the rescue; and anybody who doesn’t go along with the Biden Administration’s preferred narrative (ie that this is part of a global phenomenon, and that the US isn’t unique) better hope the administration doesn’t accidentally make things worse.

At any rate, it’s bureaucracy to the rescue.

And we don’t say that because we think America’s ports need assistance (they clearly do). The problem is that the supply chain crunch goes far beyond the ships and the ports and the truckers. It’s what an economist might call a “complex”” issue.

While President Biden met with a senior Wal-Mart executive in person, and in front of the cameras, as part of Monday’s “supply chain round table” at the White House, Bloomberg says it is ordering large retailers, wholesalers and consumer good suppliers including Amazon and Walmart to provide the White House with “detailed information” that might aid in a newly launched inquiry into the ongoing supply chain disruptions that are contributing to President Biden’s inflation (or should we say, reflation?) fears…read more.