Stocks & Equities

Tyler has run a scan that looks for stocks making abnormal price and volume moves on the daily chart. Below are three charts that really stand out: – Robert Zurrer for Money Talks

In this week’s issue:

![]()

In This Week’s Issue:

- Stockscores’ Market Minutes Video – Be Patient for Proof

- Stockscores Trader Training – Effective Strategy Testing

- Stock Features of the Week – Abnormal Breaks

Stockscores Market Minutes – Be Patient for Proof

Traders often get out of trades too early because they don’t see the proof that they are right. Take time and stick with the trade until there is proof that you are wrong. That plus my weekly market analysis and the trade of the week on SRRA. Click here to watch on Youtube

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – Effective Strategy Testing

We have all heard the story about the King who asks a group of blind men to feel an elephant and report back on what an elephant is. Each feels a different part and as a result, each has a very different perception of what the elephant is. They fail to accurately understand the Elephant because each does not touch the entire animal.

Many traders fall in to a similar mistake when evaluating their approach to the market. It is very easy to misjudge the effectiveness of trading rules by looking at the result of the last trade. If you buy a stock because it is breaking to new highs and the trade ends up failing, it is easy to say that buying stocks breaking to new highs is not an effective strategy.

This concept is referred to by some as being fooled by randomness. By drawing conclusions from a small sample of data, the trader makes an incorrect assessment of cause and effect.

To really judge the effectiveness of strategy rules requires they be tested over a large sample size, at least 30 trades but more is better. Only then can you start to see patterns and correlations. Only then can you assess cause and effect.

Suppose you are sitting in front of your computer and you decide that you will buy shares in Herbalife (HLF) if the next car that drives past your window is blue. The next car that drives by is blue so you buy HLF and the trade ends up making you a $1000 profit.

Encouraged by your result, you take a look at Pfizer (PFE) and again determine that you will buy the stock if the next car that drives past your window is blue. The next car surprises you by being blue so you buy and again, you make a profit. Trading seems easy!

What do you think would happen if you carried out this rule for your next 30 trades? Since most will realize that there can be no cause and effect between a blue car and a winning trade, most will say that the overall result should not be positive. Intuitively, you know what there can be no correlation between the color of the car that drives past your window and the performance of your trades.

However, what if your test actually finds that 25 out of the 30 trades you do end up being winners? Is there now reason to believe that blue cars predict strong stocks?

The problem is that even when there seems to be a correlation between one factor and a result, it could simply be that there is another cause at work. The reason that there was 25 winners out of 30 could simply be due to a strong trending market that makes most stocks rise.

This example highlights two important considerations when assessing the effectiveness of strategy rules.

First, make sure you test a rule over a large sample to get data that is reliable.

Second, test your strategy rules over varying market conditions so you can remove bias.

When testing the rules of a strategy, do not stop at the entry rules. Evaluate the exit strategy and how you size positions and do risk management. Small changes in any of these areas can have dramatic effect on your profitability. I recently completed a two week test of one of my day trading strategies and found that a couple of minor changes to the exit strategy more than doubled the profitability of the strategy during the test period.

If you want to truly understand how well your trading strategy works, take the time to compile data on a large number of trades across varying market conditions. Avoid looking at just one factor or the results of your last trade.

This week, I ran the Stockscores Abnormal Breaks Market Scan. This looks for stocks making abnormal price and volume moves on the daily chart. Here are three charts that stand out:

1. T.NEPT

T.NEPT (NEPT) is breaking a pull back with abnormal price and volume action today and looks like it will resume the long term upward trend. Support at $3.20.

2. BLPH

BLPH is breaking from an ascending triangle pattern, a good sign of building optimism. Support at $2.60.

3. CLSN

CLSN has been trading sideways for 7 months and is breaking higher with abnormal price and volume activity today. Support at $2.75.

Follow on Twitter | View Youtube Channel

If you wish to unsubscribe from the Stockscores Foundation newsletter or change the format of email you are receiving please login to your Stockscores account. Copyright Stockscores Analytics Corp.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Foundation is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of this newsletter may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

Stewart Thomson’s 25 point summary of what is happening in the US Dollar, the US Stock market, Central Banks & Interest Rates, Treasury Bonds, Gold Stocks Gold.

Most importantly if Piyush Goyal should take charge of the Indian finance ministry on a permanent basis “he will likely be the catalyst that launches a massive and sustained rise in Indian gold demand. Demand that should be enough to drive gold in an Elliott C wave advance to at least $1650, and probably $2000!” – R. Zurrer for Money Talks

June 18, 2018

1. The dollar and the US stock market may be starting their next major legs down today. Please click here now. Double-click to enlarge this ominous US dollar versus Japanese yen chart.

2. Central banks around the world are ramping up their tightening. Back in 2013-2014 when I predicted quantitative tightening and relentless rate hikes were imminent, almost nobody believed me.

3. I promised that this tightening cycle would be like no other because of the enormous size of the QE money balls in Japan, Europe, and America. The tightening action is moving the money balls out of the deflationary government bonds asset class and into the inflationary fractional reserve banking system.

4. Powell just raised rates again and is poised to launch another increase in quantitative tightening. He’s also beginning to change the spread between the Fed funds rate and the excess reserves rate that banks get paid to keep money at the Fed. Going forward, I expect him to put much more pressure on banks to move money out of the Fed. This is highly inflationary action.

5. Please click here now. Double-click to enlarge. The US stock market looks like a technical train wreck.

6. For the stock market, one mainstream money manager just referred to the global tightening cycle in play as akin to a sports team losing their goalie!

7. It’s obvious that the stock market is doomed. Powell appears determined to push through another rate hike in either August or September. Maybe the market staggers sideways or slightly higher until then, but the US stock market train is headed towards a global central bank tightening cliff. It’s going to go right over that cliff and implode, and tariffs are just icing on the cake.

8. Please click here now. Double-click to enlarge this interesting T-bond chart. Stock market money managers usually buy bonds when they panic, and that’s starting to happen now.

9. This time they are jumping from the fire to the fry pan. They believe the Fed will blink and stop hiking. In contrast, I predict the hiking will be accelerated, with a possible half point hike coming in December as inflation continues to rise.

10. Because of the widening spread between the Fed funds and excess reserve rates, banks will become more aggressive about moving money out of the Fed. Ultimately, the money managers will panic-sell bonds and buy gold as they see the stock market melting but inflation getting even stronger.

11. The bottom line is that Powell’s tightening actions to date have not done enough damage to the bond market to kill it as a safe haven for stock market investors. That will change fairly soon.

12. Please click here now. Double-click to enlarge this GDX chart. Gold stocks continue to meander sideways in my important $23 to $21 accumulation zone.

13. Many individual miners have started to trade independently of the ETFs and mine stock indexes, and are staging fabulous rallies. There are always some outperformers in a sideways market, but the large number of them staging these rallies now is quite impressive.

14. Note the strong volume bar that occurred on Friday. Gold stocks are in very strong hands now at a time where some possible “game changing” news is coming for bullion.

15. On that note, please click here now. India and China are the biggest markets for physical gold, and price discovery on the COMEX and LBMA ultimately relates to changes in demand there versus mine and scrap supply.

16. When Narendra Modi got elected as India’s prime minister, he put Arun Jaitley in charge of the finance department. This was disappointing, because Jaitley’s actions and words have been very negative for gold, and the finance ministry has the power to set the gold import duty.

17. Jaitley has a long history of health issues, and he just had a kidney transplant. Piyush Goyal has been appointed as “interim” finance minister. He’s pro-gold and fought against the import duty. There are rumours that his appointment may become permanent.

18. If that happens, I think gold investors around the world are going to watch the import duty tapered to zero just like American QE was tapered to zero.

19. Please click here now. Double-click to enlarge this spectacular long-term gold price chart. The Indian finance ministry is the main driver of the global gold price doldrums that have been in play for the past seven years.

20. It’s unknown if Goyal takes charge of the finance ministry on a permanent basis, but if he does, that is likely the catalyst that launches a massive and sustained rise in Indian gold demand. That demand will be enough to drive gold in an Elliott C wave advance to at least $1650, and probably $2000!

21. If “Royal Goyal” has charge of India’s finance ministry at the same time as Powell is joined by the ECB and then Japan in a giant effort to roll the QE money balls into the fractional reserve banking system, gold will likely surge to $3000 – $5000 very quickly.

22. When gold began its “eight-bagger” advance from the $250 area in 1999, few people anticipated the upside potential. The highest price targets coming from mainstream analysts were in the $400 area. Most of them thought gold was going to stay in the doldrums for decades, while the stock market would never decline in a material way. They had no clue what was coming!

23. Please click here now. Double-click to enlarge. I believe the potential for another eight-bagger is much stronger now than it was in 1998. This quarterly bar chart shows gold making an epic bull wedge breakout.

24. All that’s technically in play right now is a pullback from the breakout zone and that’s very healthy. Note the rise in volume from 1998-2002. That came ahead of the runaway action in the price. The exact same thing is happening now. Gold and silver investors should have absolute confidence in their holdings… and look to eagerly accumulate more!

Thanks

Cheers

St

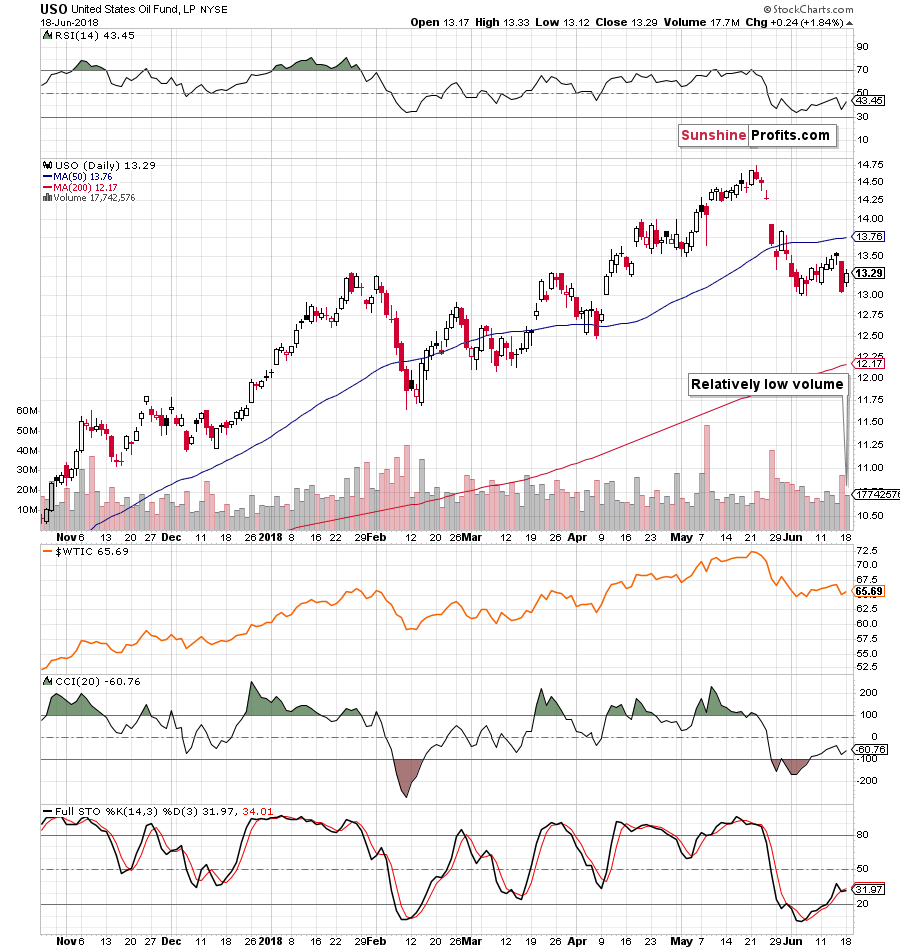

Crude oil’s Friday’s huge daily decline was not followed by yet another daily slide, but by a profound reversal. The price has surely turned by 180 degrees, but can we say the same thing about the outlook for the following days?

No. The volume doesn’t support this outcome and as you’ve seen in the previous several days, indications and confirmations from volume are very important. In fact, the low volume was one of the key reasons that made us open the short position at $66.78 on Wednesday.

We wrote it many times before and we’re going to write it again – a reversal without significant volume does not indicate what it should. It doesn’t show a fierce battle that was won by one side on a decisive manner. It shows that there was a pause that looks like a reversal, but really isn’t one and definitely doesn’t have one’s implications.

Let’s take a look at yesterday’s price move and the corresponding volume level.

The volume was higher than what we saw during Friday’s decline, but it’s still low compared to what we saw previously this month. Compared to the last few days, the volume was average and compared to the past month, the volume was low. It was definitely not high. Therefore, there are no bullish implications of yesterday’s session, and even if they are, they are very insignificant.

The above chart features the USO ETF, which is a proxy for the price of crude oil. It’s also a proxy for its volume readings and the latter is the reason that we are featuring it today. The volume that we saw in USO yesterday was nothing to call home about and thus, there are no bullish implications of the upswing. It seems to be a breather within a decline, not the end thereof.

Moreover, please note that we don’t see such signal in case of crude oil, as far as the USO is concerned, we have a sell signal from the Stochastic indicator. This divergence has bearishimplications.

Summing up, no market moves up or down in a straight line and periodic corrections are inevitable in all markets and it seems that we have just seen an example of this rule in case of crude oil. At the first sight, yesterday’s move may appear to be bullish as it looks like a bullish reversal. However, looking closely at the volume levels reveals that it was actually a pause that only looked like a real reversal and thus implications are not bullish. Consequently, the outlook remains bearish.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Martin Armstrong answers a question on what the timing and nature of the oncoming “Crash & Burn” looks like – R Zurrer for Money Talks

QUESTION: Martin, as all members do, I really do thank you and appreciate you for your knowledge and insight. I am a business owner – Real Water and do approximately $10 million in annual sales right now. As a concerned citizen, I have also run for political office and was elected to the Nevada State Assembly in 2015. With Republican control, our legislature pushed through the largest tax increase in our State’s history in the name of more money for education (I led the opposition against the tax, but failed in preventing it). Of course, our latest school ratings came out and we are still ranked at the bottom – 50th. More government is NOT the solution!

I completely understand we are headed for a financial crash and burn. You have frequently stated that the only reason you are doing what you are doing is for your posterity. Other than personal preparation, extra food, don’t be in bonds, etc., what do you believe is the most beneficial thing we can do to help our country come out of the crash and burn with more freedom and limited government (like our Founders so emphatically intended) as opposed to the other potential of totalitarianism that you frequently warn us about? What is the most effective way to rally the troops so to say to help push our civilization in the proper direction?

To an elevated lifestyle,

ANSWER: The Government always thinks that throwing more money at something make it better. I have NEVER seen where that has EVER corrected any such trend. The problem lies in the total mismanagement. Governments are simply incapable of operating even a bubblegum machine. They completely fail to understand the economy, human nature, or society as a whole. The only way to actually correct such a problem is to privatize. That installs actual management and employees must actually perform. Government unions demand benefits and they negotiate with themselves. This is why the entire socialist agenda is collapsing.

I had a friend who was a postmaster. He had to tell an employee he would be checking on them a day before to ensure they were doing their job. The union made them provide notice so the employee would not actually be caught doing anything. This is how government unions have destroyed themselves and society. This is what we are headed into a crash and burn because governments do not respect the people and assume we are an endless supply of revenue.

All government agencies should be privatized and then the services they provide would actually work. Going to the New Jersey Division of Motor Vehicles was a case study in how not to run a government. The people were nasty, you would wait in line and they would be having a conversation with the next employee about what they would do after work and actually make you wait even 5 minutes while they did this right in front of your face. The attitude was WTF do you want now. Just absolutely nasty and hostile. No supervision and nobody even forces them to actually work. Always a horrible experience – not just one time. Ask a question and you NEVER got a straight or correct answer.

It is a structural management problem. There is no accountability and you can look at any government agency and you will see the same pattern. Increase the budget and there is NEVER any actually change. They cannot improve because there is a lack of management ability.

What does the Crash & Burn look like? It all depends upon how long we have to wait to achieve it. If we get the start of a Crash & Burn in 2021, then there is real hope of a soft-landing. If we are looking at stalling and refusing to change as taxes continue to rise, we will see that last wave of totalitarianism and then what comes AFTER 2032 is a very hard landing. That type of decline historically results in civil war and/or revolution.

All I can offer is what has happened before historically. My personal opinion would be just a guess and that is not what clients want to hear. So the sooner the better and the longer this is stalled the worse it gets.

This hostile attack against Trump is symbolic of the bureaucracy fighting to keep its power. They think if they can get Trump out of office, they will return it back to normal with a career politician. They are seriously wrong for the people voted for Trump because they are fed up with the system as is. This was not a personal popularity contest that Trump won. It is the rising tension of the people. There is not going back. This can only lead to a confrontation between the left and right. Choose where you want to like based upon the political orientation of that area. The area I live in was conservative which voted overwhelmingly for Trump. That is a bit safer than a left area for then they ultimate come after you and see you are the problem why things are not going their way.