Gold & Precious Metals

- Manufacturing sales in Canada contract in April.

- NY Fed Manufacturing Index beats expectations.

- USD/CAD rises to its highest level in nearly year above 1.31.

The USD/CAD pair, which closed the previous day with a 150 pips gain, built on it recent gains at the beginning of the NA session and touched its highest level since late June of 2017 at 1.3170. As of writing, the pair was trading at 1.3165, adding 0.5%, or 65 pips, on the day.

Today’s data from Canada showed that the manufacturing sales contracted by 1.3% in April following March’s 1.4% expansion and fell short of the market expectation of 0.6%. With the loonie facing a fresh selling wave amid the disappointing figures, the pair gained nearly 50 pips in the last hour.

On the other hand, the monthly report released by the Federal Reserve Bank of New York showed that the general headline index of the Manufacturing Survey improved to 25 in May to beat the experts’ estimate of 19. Despite the positive reading, the US Dollar Index remained in its recent range below the 95 mark and was last seen at 94.80, where it was down 0.15% on the day.

Meanwhile, the weak performance of crude oil prices weighs on the commodity-sensitive CAD as well. After closing the first four days of the week with modest gains, the barrel of WTI is looking to end the week on a negative note as it loses 0.5% at the moment.

Technical outlook

The pair could face the first technical resistance at 1.3200 (psychological level). A decisive rise above that level could open the door for further gains toward 1.3260 (Jun. 27, 2017, high) and 1.3340 (Jun. 21, 2017, high). On the downside, supports are located at 1.3115 (daily low), 1.3000 (psychological level) and 1.2950 (Jun. 14 low).

One of the superb Market Analysts of the last 100 years, Richard Russell, who died in 2015 at 91 years old was a proponent of the Dow Theory. A system whose goal was to “get you out at the top and in at the bottom of major, long-term market moves.” Presently this analyst points out the Dow Theory is setting up for another change in market trend. – R Zurrer for Money Talks

New technologies

Investors like new ideas. New technologies bring rapid growth. And growth leads to big gains in stock prices.

But old ideas also have value. As things change, it can help to look at how they also stay the same.

In the 21st century, the blockchain helps shipping companies identify where everything is. That’s important. But the industry really is a lot like it was in the 1880s.

Shipping means getting something from point A to point B. Ideally, it gets there on time. This hasn’t changed in hundreds of years.

Railroads worked to deliver things on time in the 1880s. They do the same today.

In the 1880s, the amount of stuff shipped depended on economic growth. When growth was strong, the shipping industry was strong. A slowing economy caused weakness in the railroad industry.Charles Dow, founder of The Wall Street Journal, recognized that link. He also recognized that stock market trends mirrored economic trends. To profit from that, he developed the Dow Jones Transportation Average (DJTA) to track the economy in 1884.

Dow also developed a theory to spot trend reversals in stock prices. He combined the DJTA with the Dow Jones Industrial Average to identify reversals.

Dow’s Theory

Dow realized both transportation and industrial companies do well in an expanding economy. Railroads deliver raw materials to factories. Factories, which are industrial companies, manufacture finished goods, and then the rails transport those goods to markets.

If industrials are doing well but railroads aren’t, the economy is slowing. That’s because the industrial companies don’t have new orders, so railroads don’t deliver new raw materials.

When railroads do well but manufacturers struggle, it means the economy is breaking out of a recession. Factories see new orders in that scenario, and raw materials flow to factories. In a few months, the economy should be expanding as finished goods stream out of factories.

Even in 2018, this theory is still true. Railroads remain important to the modern economy. But so are trucks. So investors must track both.

And the trucking industry is growing at a record pace.

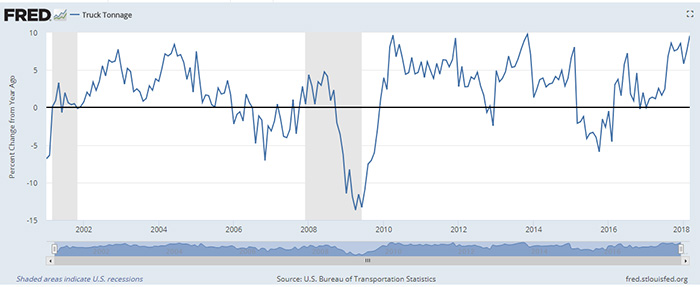

(Source: Federal Reserve)

The chart above shows the annual change in truck shipments. Right now, it’s at the highest level since 2013. It was also this high in 2010.

Growth in trucking shows the industry is transporting raw materials to factories and finished goods to markets. This is good news.

Under Dow’s theory, when the news is good, stocks rise rapidly. This is the final, speculative phase of a bull market. It’s a chance to make big gains. But it also signals a reversal is near.

This is both the most rewarding and most dangerous times to own stocks.

Regards,

Michael Carr, CMT

The Federal Reserve’s decision today to hike its policy rate by 25 basis points (bps) to a range of 1.75% to 2.0% was widely expected. The Federal Open Market Committee (FOMC) also signaled growing consensus that the robust pace of economic activity warrants two more rate hikes this year, for a total of four in 2018. But the elimination of forward guidance in the Fed’s statement,coupled with today’s announcement that it will hold a press conference after every meeting starting next January, is perhaps the most interesting aspect of today’s meeting: It underscores the Fed’s medium-term dilemma of how to set policy that sustains the expansion by balancing the risk of overtightening with the risk of overheating the economy.

The Federal Reserve’s decision today to hike its policy rate by 25 basis points (bps) to a range of 1.75% to 2.0% was widely expected. The Federal Open Market Committee (FOMC) also signaled growing consensus that the robust pace of economic activity warrants two more rate hikes this year, for a total of four in 2018. But the elimination of forward guidance in the Fed’s statement,coupled with today’s announcement that it will hold a press conference after every meeting starting next January, is perhaps the most interesting aspect of today’s meeting: It underscores the Fed’s medium-term dilemma of how to set policy that sustains the expansion by balancing the risk of overtightening with the risk of overheating the economy.

Finding neutral

Late-cycle fiscal stimulus, a flat Phillips curve and the high degree of uncertainty around the neutral interest rate – the rate at which the Fed is no longer accommodative and starts restricting the economy’s growth – complicate the Fed’s medium-term risk management task.

On the one hand, uncertainty over the neutral rate, coupled with the long lags needed for monetary policy to affect the real economy, argues for hiking gradually – or even pausing to assess the cumulative effects of the seven hikes, including today’s, since late 2015. The flattening Treasury yield curve could indicate that monetary policy is close to becoming restrictive, which could choke off growth more than the Fed intends.

On the other hand, late-cycle fiscal stimulus and still-easy financial conditions with unemployment at historically low levels raise the risk that inflation accelerates. If inflation expectations start to rise, the Fed could find itself in a nasty inflation spiral. As in the late 1970s and early 1980s, this could require a recession to restrain.

Focusing on overtightening could steepen curves and boost inflation-risk premiums

On its own, the elimination of forward guidance points to wider possibilities and more divergent views of the future path of the fed funds rate, as rates approach neutral. Today’s Statement of Economic Projections maintains the path of interest rate hikes will remain gradual (it showed an additional hike in 2018, but this was balanced by one less hike in 2020) and foresees only a small inflation overshoot. Taken together, this suggests that policymakers may still be slightly more focused on managing the risk of overtightening (while not ignoring overheating risks). Little evidence of U.S. financial market imbalances and well-behaved inflation also support this focus.

We continue to expect The New Neutral framework of low equilibrium policy rates will anchor Fed policy and U.S. fixed income markets. However, it’s important to keep the risks in mind. At a minimum, the Fed’s continued focus on managing the risks of overtightening and its stated commitment to a “symmetric” inflation target still argue for steeper interest rate curves, and higher inflation-risk premiums, as outlined in “Key Takeaways From PIMCO’s Secular Outlook: Rude Awakenings.”

Tiffany Wilding is a PIMCO economist focusing on the U.S. and is a regular contributor to the PIMCOBLOG.

Classic and collectible cars have been the best-performing asset for the last two-, five- and 10-year periods (see “Return on investment,” below). This proves that they are no longer simply a novelty for the wealthy collector, but a genuine alternative investment strategy. WMG recently launched its Collectable Car Fund to exploit that fact.

The last decade for classic cars has been lucrative. Certain marques have risen four-fold in value — the rising tide has lifted almost every boat. A Ferrari 250 GTO built for Sir Stirling Moss was sold for $8.5 million in 2002; a decade later the same car was sold for a staggering $35 million. In 2014 a 250 GTO sold for just over $38 million — a record for a car sold publicly. However, in 2016 Simon Kidston, founder of the K500, sold a Ferrari 250 GTO for an undisclosed sum that reportedly exceeded that record. Talk on the street is the car sold for more than $60 million.

In 2013, RM Auctions sold a Ferrari F50 with 10,000 kilometers on the clock for €560,000 ($783,044). In early 2017, RM Auctions sold an F50 with 2,000 kilometers on the clock for €2.64 million ($3.18 million).

Historically speaking, classic cars have been a buoyant, liquid market, but one that requires discipline and deep knowledge of the underlying asset class. The pitfalls of sloppiness are deep and costly. However, it does offer resilience to wider traditional market trends. During the financial crisis of 2008 to 2011, smart money flowed into the asset class as a safe haven. The K500 Classic Car Index outperformed all investment benchmarks during the 2008 crash (see “Port in a storm,” page below).

The Trend is Your Friend

Alternatives grew to over $3.6 trillion in 2016, up 3% on 2015 according to a Financial Times report citing a major U.S. bank released in early 2017. This was a significant increase, as investors steer away from traditional long-only, value-driven investment classes. It doesn’t come as much of a surprise that the modern ultra-high net worth individuals (people with investable assets of at least $30 million, excluding personal assets) are ensuring investment portfolios include an exposure to much higher yielding alternative asset classes, including classic and collectible cars.

Until now there hasn’t been a regulated investment fund to get exposure to collectible cars, which as an asset class is up more than 400% in the last decade (see “Return on investment”). If you’re a high-net worth investor, family office or wealth manager, portfolio exposure to wine or stamps is a common investment. So, why not cars? Well, unless you have a large storage facility, a team of mechanics, detailers, insurers, transporters, security guards and a concierge to rotate the tires, investing in collectible cars can be complex and expensive.

Pedigree

Compare a 1982 Chateau Lafite and a Series 1 Ferrari 250 GTO; both investable assets, both valuable and likely will come with a magnificently documented history. While both are investments of passion, only one of them can truly be enjoyed without value erosion. In reality, a 50-kilometer journey in the 250 GTO isn’t going to materially change the car’s value. Enter it into a classic race or Concours event and it could even enhance it, but the ‘82 Lafite should you dare remove the cork after paying 20% tax on delivery, becomes worthless. Investments in classic cars are also free from capital gains tax.

Ferrari 250 GTO

So why have several attempts at starting a classic/collectible car fund in the UK failed? Because regulation has made it cumbersome. WMG Advisors LLP, as the appointed Fund Manager, is regulated by the Financial Conduct Authority (FCA) for investment business. Serious investors rarely commit capital to funds that are not regulated or where a team has little or no investment experience, regardless of their knowledge of the underlying asset. As an investment professional/collector of classic cars myself, the only risk to my investment should be the performance of the underlying asset. The UK’s FCA is one of the toughest regulators in the world, so it makes perfect sense for WMG to operate the car fund under its scrutiny. Second, investors will always look closely at the pedigree of the fund management team, which is where WMG’s USP becomes apparent – the team.

WMG’s Chairman Mehmet Dalman has a long career in investment banking/asset management, including managing director of Deutsch Morgan Grenfell and the only non-German Vorstand Member of Germany’s second-largest bank Commerzbank, where he founded the Securities division. It was on Commerzbank’s trading floor where Dalman and I met in the late 1990s and connected through a mutual life-long passion for exotic automobiles.

Dalman would often wander the London trading floor – then home to more than 300 trading professionals – engaging in conversation to get a feel for the mood in the market. We would spend two minutes discussing stock prices, but much longer on the market prices of the latest and greatest Ferraris, of which Dalman had already amassed an eye-watering collection, many of which he still owns today.

As a petrol-head with a 30-year track record of motorsport competing at both club and professional levels and a 20-year career as an investment banker, I would often assist Mehmet on new car specifications, helping choose color, wheel types and bespoke options. At the time I was driving a BMW, flirting with some of the most exotic car manufacturers in the world — on behalf of my boss, of course. I have built a huge automotive network in doing so, which lives on today — enter part 2 of WMG’s USP, the network.

With an aptitude for Capital Goods stocks, Automotive and Aerospace in particular, and after a 20-year career on some of London’s busiest trading floors, I quit the brokerage world due to an increasingly punitive environment ahead MiFID 2.

A meeting with Dalman at WMG’s Mayfair office in early 2016 revealed a joint aspiration to build and launch a car fund. Knowing he was a reputable collector, I went to see Mehmet to discuss a business idea — an ultra-high net worth individuals-based car concierge service that I had recently launched. It wasn’t long before my attention switched to the prospect of launching a proper investment grade car fund. I’d seen a few attempts previously, but knew what we could offer under WMG would be different; it would work.

As with any investment portfolio, diversity is key. A single car is not an investment, it’s a bet, same as a single-stock portfolio. WMG can offer the financial rewards of owning a McLaren F1 (up 1,000% since new) with none of the expenses or hassle. Classic car ownership costs can be considerable, but WMG has them comfortably controlled, thanks largely to efficiencies from the network.