Bonds & Interest Rates

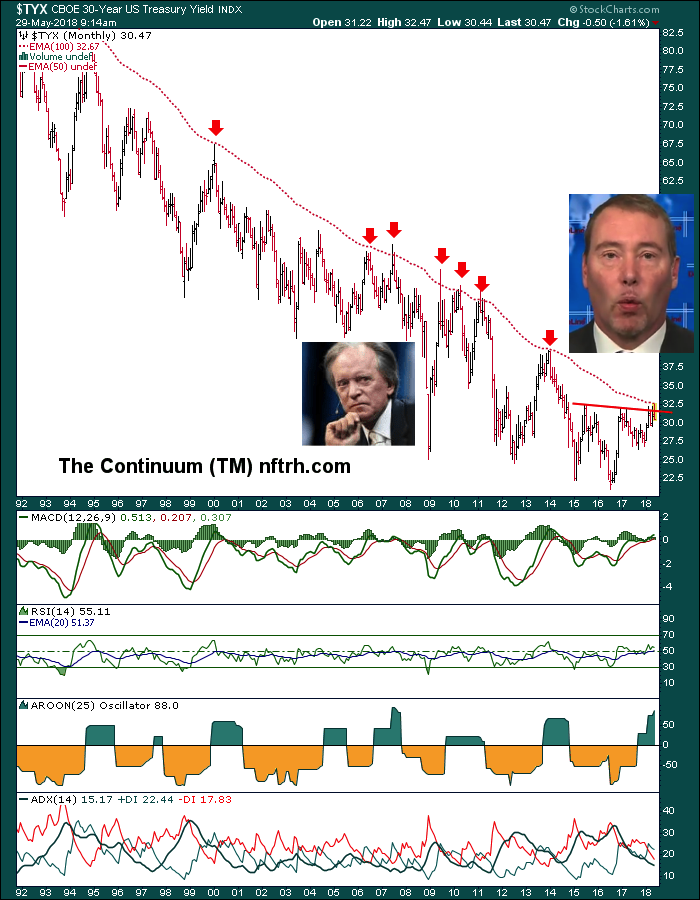

After nailing the recent peak in rising yields, Gary Tanashian takes a look at where we are likely going intermediate term from here – R Zurrer for Money Talks

It was just a little over a week ago (May 20) that NFTRH 500 presented a case for caution on the rising bond yields tout that was vigorously in play across the financial media. Here is an excerpt from the Bond Market Sentiment segment presented at the time.

From this public post:

I want to make clear that I am not trying to predict anything. I am simply trying not to have people (myself included) running like stupid lemmings (do lemmings run, waddle or put themselves in motion in some other way?) over a media-obscured cliff.

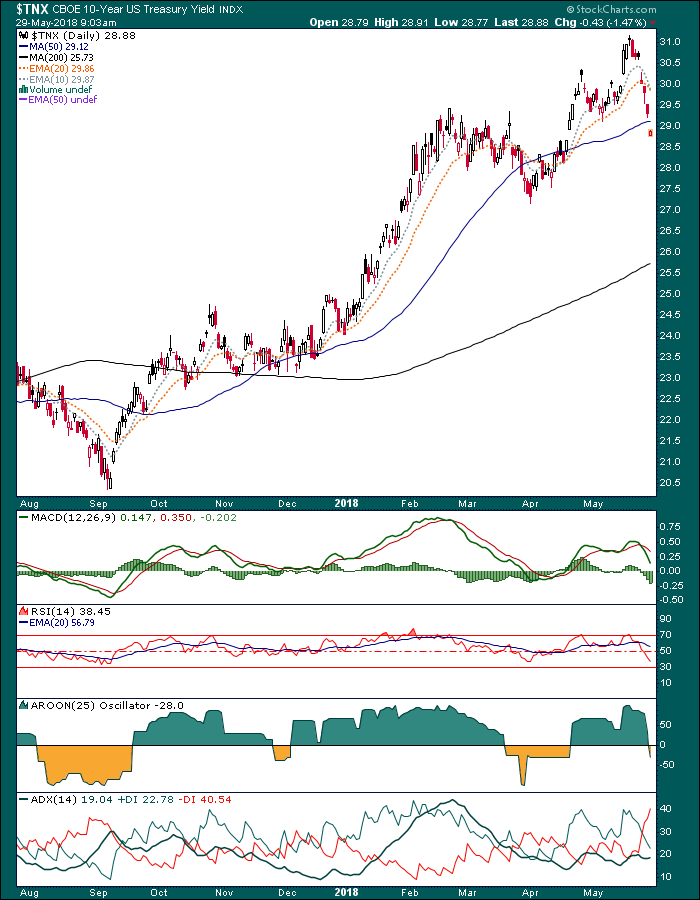

So today here we are, with the 10 year yield having dropped from the cacophony-inducing 3.1% level and I wish to announce that I am not making fun of the bond gurus anymore because the froth has been skimmed off and the intermediate trend in yields is bullish, not bearish.

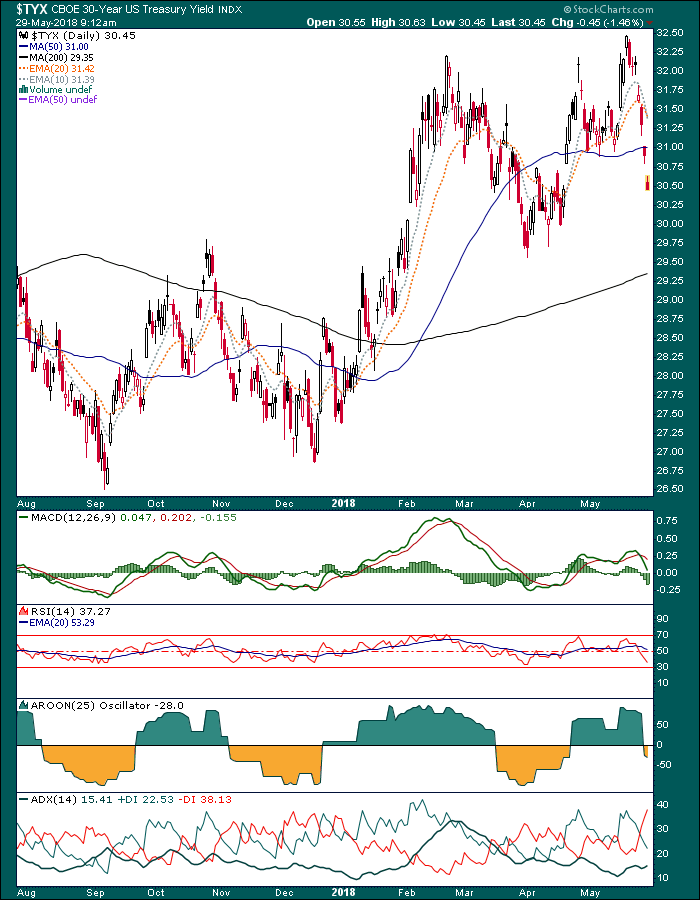

The 30 year is even more soundly corrected.

also from Gary:

GOLD, US STOCKS AND BONDS

With the US dollar gaining strength across the currency market and Treasury yields coming off significantly, it’s easy to conclude the underlining the investor mood of risk aversion is pushing those looking for safety into the US Dollar – R Zurrer for Money Talks

The dollar collapse thesis – which ends with all fiat currencies achieving their intrinsic value of zero — doesn’t preclude some thrills and chills along the way, in which some currencies fall faster than others and wreak havoc on various parts of the global economy.

This might be one of those times, as instability in the Middle East, Europe, and parts of Latin America sends worried capital pouring into the US, pushing the dollar up from its recent lows:

This may not look like much of a spike in the historical scheme of things, but it actually is, because a handful of developing countries have, for reasons that defy both history and common sense, decided to borrow trillions of US dollars. Now, with the dollar appreciating versus their local currencies, they’re having trouble making the suddenly-much-more-expensive interest payments.

Why would a country whose money is the peso or the real conclude that it’s a good idea to bet that their currency will appreciate versus those of other countries for decades to come? Who knows? But they’ve done it, and big banks around the world have enabled them.

Here’s a chart from Bloomberg showing that the foreign currency debt of emerging market countries has nearly tripled since 2008, to more than $8 trillion (most of which is denominated in dollars, with some euros tossed in for diversification), which they now have to pay back regardless of where the dollar goes relative to the currency in which their governments collect taxes or their corporations make sales.

And here’s an excerpt from the Bloomberg article that included the above chart:

Emerging-Market Stress Just Begun as Record Debt Wall Looms

Emerging-market companies and governments straining to deal with the rising cost of borrowing in dollars face increasing pressure as a record slew of bonds come due.

Some $249 billion needs to be repaid or refinanced through next year, according to data compiled by Bloomberg. That’s a legacy of a decade-long debt binge during which emerging markets more than doubled their borrowing in dollars, ignoring the many lessons of history from the 1980s Latin American debt crisis, the 1990s Asian financial crisis and the 2000s Argentine default.

Even since the 2013 taper tantrum, the group’s dollar debt has climbed in excess of $1 trillion — more than the combined size of the Mexican and Thai economies, Institute of International Finance data show.

“We look to be in for a pretty rough patch near term,” says Sonja Gibbs, senior director for capital markets in Washington at the IIF, an association of the world’s biggest banks. “The sharper the rise in the dollar and rates, the greater the near-term contagion risk.” Rising U.S. rates will have a knock-on effect even in local debt markets, she said.

China has far and away the most dollar debt coming due through next year among emerging markets. Though much of the debt is also owned by Chinese investors, strains have become clear in recent weeks, with some companies unable to issue at their preferred amounts and maturities, and others, unusually, marketing floating-rate notes.

Despite having defaulted in the early 2000s, Argentina has issued so much dollar debt that it ranks No. 4 on the list — a testament in part to the impact that unprecedented U.S., European and Japanese monetary stimulus had in spurring a global hunt for yield since the 2007-09 financial crisis.

Turkey has the largest foreign debt load relative to gross domestic product, and perhaps not coincidentally has one of the worst-performing currencies against the dollar this year, down about 21 percent. Only Argentina’s peso has done worse among 24 emerging nations tracked by Bloomberg — another country that ranks high on the debt metric.

The rapid build-up in debt over the past decade has alarmed some — including Harvard economist Carmen Reinhart, who made headlines saying emerging markets are worse off today than during the 2008 crisis and 2013 taper tantrum.

“This is not gloom-and-doom, but there are a lot of internal and external vulnerabilities now that were not there during the taper tantrum,” Gibbs said last week.

Why should Americans care if Turkey or Argentina defaults on their bonds? Because institutions all over the world bought those bonds in more innocent times (see Here’s When Everyone Should Have Known That Argentina Would Implode), and have built share prices, pension payouts and arbitrage strategies around them. If the bonds blow up, so do a lot of banks, hedge funds and pension funds.

And if the resulting global anxiety sends even more flight capital into the dollar – pushing its exchange rate up even further and making emerging market debts even harder to manage – we might be looking at a negative feedback look with systemic implications.

New meddling by Governments mandating stricter regulation on the fuels used by the shipping industry could send middle distillates such as diesel and marine gasoil soaring. Tsvetana Paraskova explains the reasons for the soaring crude oil market – R. Zurrer for Money Talks

New meddling by Governments mandating stricter regulation on the fuels used by the shipping industry could send middle distillates such as diesel and marine gasoil soaring. Tsvetana Paraskova explains the reasons for the soaring crude oil market – R. Zurrer for Money Talks

Iran and Venezuela have dominated the oil market discourse for a while and will continue to do so in the coming months. Fears of supply shortages amid a tighter market have stoked an oil price rally that saw Brent Crude hitting $80 a barrel last week.

But an upcoming regulation that analysts have called “the biggest change in oil market history” and the “the most disruptive change in the refining industry” is lurking just around the corner, and experts say that it will drive oil prices higher as it will fundamentally shift the demand pattern for fuels.

The regulation concerns significantly limiting the sulfur content in the fuel that ships use, in a bid to curb emissions from the shipping industry.

The International Maritime Organization (IMO) has set January 1, 2020, as the starting date from which only low-sulfur fuel oil will be allowed to be used for ships. The global sulfur limit on fuel oil will be set at 0.50 percent m/m (mass/mass) in 2020, a significant cut from the 3.5 percent m/m global limit currently in place.

The regulation will send demand for middle distillates such as diesel and marine gasoil soaring, and refiners will have to shift some of the products they will be processing from crude oil, analysts concur.

Middle Eastern crude oil producers could be one the biggest losers from the new regulation, because they pump high-sulfur crude, Amrita Sen, chief oil analyst at Energy Aspects, told CNBC this week, discussing the outlook for oil prices. Related: Oil Prices Fall Despite Iran, Venezuela, Libyan Supply Outages

“That is very important because Middle Eastern producers lose out heavily from that because their crude tends to be very high sulfur,” Sen said, noting that the shipping fuels regulation is the “biggest change in the history of the market.”

The stricter regulation on the fuels used by the shipping industry will result in booming demand for middle distillates that would boost crude oil demand by additional 1.5 million bpd, potentially sending oil prices to as high as $90 a barrel in 2020, Morgan Stanley said last week.

In fuel oil prices, the forward curve has not yet fully priced in the regulation, according to research from S&P Global Platts Analytics last month.

According to Rick Joswick, managing director for downstream oil analytics at Platts, the forward curve for middle distillates currently shows little change between 2019 and 2020—underestimating the impact of the new rules.

“The market has not appreciated yet the degree and scope of these changes,” Joswick said.

The timing of the new regulation will coincide with the effect on supply from the underinvestment during the oil price crash and the strength in demand, suggesting that the “era of ‘lower for longer’ oil prices is dead”, Energy Aspects’ Sen and Yasser Elguindi wrote in a commentary in the Financial Times this week. Related: OPEC Sends Oil Prices Crashing

Over the past month, the five-year forward oil prices that generally trade in a much narrower band than front-month futures have rallied more than the prompt prices.

“While there has been breathless attention paid to prompt Brent prices climbing to $80 a barrel for the first time since 2014, what has received less attention is that the entire Brent forward curve is now trading above $60, including contracts for delivery as far out as December 2024. This development is an important psychological milestone for the oil market. The market is, in effect, saying that ‘lower for longer’ is dead,” Sen and Elguindi wrote.

Looming shortages of supply and strong demand will combine with the marine fuel regulation in 2020 to put additional pressure on the physical oil market. Demand for diesel and ultra-low sulfur fuel is expected to jump by 2 million bpd-3 million bpd, Energy Aspects analysts noted.

“Nothing ever moves in a straight line, but the broader oil market is perhaps not prepared for what will happen to oil prices over the next couple of years,” they concluded.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Shell Makes Large Deepwater Discovery In Gulf Of Mexico

- Oil Prices Fall Despite Iran, Venezuela, Libyan Supply Outages

- Is $70 Oil Enough For Shale Drillers?

Oil prices have fallen $3 per barrel this Friday as Saudi Arabia and Russia discussed easing supply curbs that have helped push crude prices to their highest since 2014. Below a graphon Russia vs Saudi vs U.S. oil production – R. Zurrer for Money Talks

Rally Unwinds As Russia, Saudis Aim To Increase Oil Output

U.S. West Texas Intermediate crude and internationally-favored Brent crude oil are trading sharply lower on Friday, putting the market in a position to finish the week lower for the first time since the week-ending April 27. The market is being pressured by the possibility of increased production from OPEC for the first time since 2016. This news is offsetting potentially bullish supply disruptions from both Venezuela and Iran.

Also worrying bullish crude oil traders was a sustained rise in gasoline inventories just ahead of the Memorial Day holiday in the United States, which typically marks the start of the summer driving season.

Russia Factor

Crude oil sellers are reacting to the news that Russia hinted it may gradually increase output after withholding supplies since 2017 together with producer cartel OPEC.

Russia has been floating the idea of ending the production for several weeks, with energy minister Alexander Novak saying on Thursday that restrictions on oil production could be eased “softly” if OPEC and non-OPEC countries see the oil market balancing in June.

Surprise Build in U.S. Inventories

An unexpected build in U.S. crude oil inventories also weighed on prices, driving the spread between Brent crude and U.S. West Texas Intermediate (WTI) close to its widest in three years.

On Wednesday, the U.S. Energy Information Administration (EIA) said commercial crude inventories rose by 5.8 million barrels in the week to May 18. This surprised traders who were looking for a draw of 1.6 million barrels.

Additionally, U.S. crude oil exports dropped by more than 800.000 barrels a day last week to about 1.75 million barrels a day. Meanwhile, crude imports were up by 558,000 barrels and refiners produced less distillate fuel, which includes diesel and heating oil.

Gasoline stockpile levels also surprised the market by jumping 1.9 million barrels a day, while distillate inventories fell slightly less than expected.

Hedge Fund Activity Indicator

One key indicator that is impacting the price action is hedge fund and commodity fund activity. According to government trading data, they have cut their holdings of crude futures and options by more than 10 percent in the last seven weeks to the lowest level this year. The markets are not likely to rally much from current price levels until the professional money managers start buying again.

July West Texas Intermediate Crude Oil Technical Analysis

Current prices @ 11:15am May 25th shows drop $3.00 from thursday’s close:

The main trend is up according to the weekly swing chart, however, the higher-high, lower-close chart pattern has put the market in a position to form a potentially bearish closing price reversal top. This chart pattern doesn’t indicate a change in trend, but it often indicates that the selling is greater than the buying at current price levels. This is likely to lead to a 2 to 3 week correction and possibly a 50% correction of the last rally.

The short-term range is $55.45 to $72.90. If the closing price reversal top chart pattern is confirmed next week then look for the start of a possible correction into the 50% to 61.8% zone at $63.77 to $61.81.

This week’s weakness has also put the market inside the contract’s 50% to 61.8% zone at $64.77 to $70.60. This makes $70.60 new resistance and $64.77 a new downside target.

Combing the short-term retracement zone and the contract retracement zone creates a potential support cluster at $64.77 to $63.77. This area is my primary downside target.

Weekly Forecast

Based on this week’s price action, the direction of the Weekly July WTI crude oil contract over the near-term will be determined by trader reaction to the long-term uptrending Gann angle at $68.98 this week and $69.48 the week-ending June 1.

A close under $69.98 the week-ending May 25 will put the market in a weak position even before the start of next week’s trading. The inability to overcome $69.48 next week will also be a sign of weakness. This could trigger the start of a prolonged sell-off with $64.77 to $63.77 the next likely downside target.

The main trend is up on the monthly chart, but the market is coming dangerously close to forming a potentially bearish monthly closing price reversal top.

A close below $68.48 on May 31 will form a closing price reversal top. This will be a very serious development because a reversal on a monthly chart often triggers the start of a 2 to 3 month correction.

A pair of Gann angles come in on the monthly chart at $66.98 and $66.51. Crossing to the weak side of these angles will indicate the selling pressure is increasing. This could trigger a move into the major 50% level at $64.77.

Crude oil has formed a closing price reversal top on the daily chart and is in a position to form one on the weekly chart. A close below $68.48 on May 31 will form a reversal on the monthly chart. This rare triple closing price chart pattern will be a strong sign that a major top has formed.

“A curious” event that took place about a month ago, aggravated by other “Big Changes” like the US considering tariffs on German, Japanese, North Korea cancelling the summit then virtually begging to reinstate, home prices “skyrocketing” while home sales fall, Bitcoin tumbling on news of DOJ probe into price manipulation there’s more Big Change coming – R. Zurrer for Money Talks

Something curious took place one month ago when the PBOC announced on April 17 that it would cut the reserve requirement ratio (RRR) by 1% to ease financial conditions: it broke what until then had been a rangebound market for both the US Dollar and the US 10Y Treasury, sending both the dollar index and 10Y yields soaring…

… which led to an immediate tightening in financial conditions both domestically and around the globe, and which has – at least initially – manifested itself in a sharp repricing of emerging market risk, resulting in a plunge EM currencies, bonds and stocks.

Adding to the market response, this violent move took place at the same time as geopolitical fears about Iran oil exports amid concerns about a new war in the middle east and Trump’s nuclear deal pullout, sent oil soaring – with Brent rising above $80 this week for the first time since 2014 – a move which…