Currency

Bank of England governor Andrew Bailey has expressed concerns over El Salvador’s adoption of Bitcoin (BTC) as legal tender after President Nayib Bukele announced the launch of Bitcoin City.

Bailey argued that El Salvador’s decision to adopt Bitcoin as a currency was alarming because consumers are likely to suffer from the cryptocurrency’s extreme volatility.

Trading around $43,000 on the first day of El Salvador’s Bitcoin adoption as legal tender, Bitcoin surged to a new historical high above $68,000 on Nov. 9. BTC’s price has significantly tumbled since then, with Bitcoin trading at $54,626 at the time of writing.

“It concerns me that a country would choose it as its national currency,” Bailey said at the Cambridge University student union appearance, Bloomberg reported on Thursday.

The governor also questioned whether Salvadorans understand the nature and the volatility of Bitcoin at all, which causes his biggest concern…read more.

As we close out 2021, I want to provide you with an honest understanding of our current economic environment, the real risks we face, and the opportunities we may have. Grab some popcorn and cross your fingers.

Bigger Government

The most recent edition of The Economist proudly proclaims, “The Triumph of Big Government.” They are right.

The most disturbing thing about what will happen over the next 18 months, just like what has already transpired over the past 18 months, is that market and economic events will be driven almost entirely by Government; their decisions, and their rules. It will not be driven by the market economy or any participants in it. This is unusual, troubling and the inverse of how free-market capitalism, or market-based democracy is designed to function. Clearly, market- based democracy has been unbelievably successful over the past 250 years, raising millions out of poverty. This current environment is much more akin to state-controlled capitalism, such as practiced in communist China, Russia and Venezuela.

This fact needs consideration. Throughout history there are few, if any, examples of Governments which, entirely by their own accord and without coercion, choose to cede control and power, and which choose to become smaller and less important.

While you may feel this is a good thing, or a bad thing, the reality of it forces us to focus our analysis almost entirely on the actions and activities of Governments, primarily in the U.S..

As I have stated many times, hard and financial assets will continue to inflate in this environment . This because cash itself devalues on a relative basis. We, of course, knew this. This is exactly why, since the Spring of 2020, we have encouraged clients to add capital to your portfolio, or alternatively to buy any hard asset such as real estate, art, or physical gold.

Taxes

Over the past 18 months, almost uniformly, but disproportionately so in the U.S., G7 and G20 Governments have borrowed vast amounts money and expanded dramatically in both size and scope – to a scale greater than any point in history. Unlike what many politicians and finance ministers have been saying (who quite frankly, either should know better, or whom are being intentionally disingenuous), this expansion and resulting borrowing will indeed have a cost.

The most immediate direct cost will likely be increasing taxation. Indeed, the most recent American spending bill includes the provision for 80,000 more IRS auditors. Taxes create a significant economic drag which in turn damage economic opportunity, innovation, entrepreneurship, and growth.

This is to say nothing of the annual structural deficits (annual deficits, caused by expanded Government program spending which then must be built into a budget each year, but which cannot be covered by current tax revenues) a new much larger Government will impose upon those who are expected to pay for it. This would imply perpetual deficits and the perpetual servitude of taxpayers, be they individuals or corporations.

Please keep in mind that prior to the covid calamity, the U.S. already had a structural annual deficit of $984 Billion and Canada was similarly spending $14 Billion more than it could afford annually.

They Are Not Going To Print More Cash Are They?

Over the past 18 months, Governments have now printed more cash than at any time in history – adjusted for inflation! Government has printed this cash in order to provide both monetary (institutional) and fiscal (individual) stimulus to buffer the economy from the severe impact of the self-imposed lockdown.

An important point here, which I hope everyone understands, is that Governments are mechanically incapable of actually creating capital or wealth. They simply cannot do either.

But if you are an adherent to Modern Monetary Theory (MMT), a trendy academic theory/ideology which now dominates the hushed dark corners of most Central Banks globally, this inability to create capital or wealth is not a problem. Their theory speculates that if every G7 or G20 Government simply prints more cash, then people will just have more money, and everything is fine. Right?

Please keep in mind that, for the most part, these young Central Bank civil servants have never actually created capital or wealth or participated in a market economy to any degree. They have never started a business, never owned one, and most importantly they have never had to make payroll. Most disturbingly, they really have just one tool – the cash printer.

If you are a hammer, everything looks like a nail.

If you have yet to hear about Modern Monetary Theory (MMT), like it or not, you will hear much more about it in the months and years ahead. MMT is the baseline academic rationalization which Central Bankers will point to, in order justify a very transformative economic policy. One that you had no opportunity to vote for.

Inflation

We at McIver Capital Management have been saying over the past 18 months that the risk we faced when Government began these expansive programs (the massive fiscal and monetary stimulus programs designed to push cash into the economy), was inflation. It would begin with hard asset (real estate, gold, art, classic cars etc.) and financial asset inflation, then move into food inflation which then creates a cost-push inflationary cycle as virtually everything begins to rise in price. The most impactful would be the cost of labour.

The MMT crowd will tell you that this dangerous upward inflationary cycle is just “transitory” and will end soon as the excess cash washes through the system. However, in truth, inflation is just “transitory” until it isn’t. Then, suddenly, it is endemic, entrenched, locked into expectations, and it goes about its business insidiously damaging the economy.

Please keep in sharp focus, that one of the two U.S. Federal Reserve mandates is to keep core inflation at 2%, which is considered optimal. Over the last 30 years they have largely been able to achieve this goal.

Let’s review what takes place when Government prints money:

Every time they print $100 dollars, the dollar in your back pocket is worth less. That’s just the math. And when cash devalues, we all experience inflation. The more they print, the less your dollar is worth.

Since January, a simple trip to the grocery store has dramatically changed. Sugar has risen 33%, Corn up 30%, Coffee has risen 86%, Rice 7.5%, Poultry 29%. While Beef has been flat over the past year, it is up 28% since the printing presses started in the spring of 2020.

Again, we expected this and increased your positions in agricultural and commodities in general starting in May of 2020. Most of those are up some 40%. Unsurprisingly the CRB Commodity index (which McIver Capital clients largely own) is up 40.43% just since January 1.

The Producers Price Index (PPI), which measures the cost increases manufacturers face when producing products is now annualizing at 8.7%. Because these costs are passed on to the rest of the economy and of course consumers, this is a relatively reliable leading indicator of where future inflation is headed. But even this stunning inflation number may be muted. Recently Costco estimated that its suppliers are experiencing 2-4% monthly inflation (which equates to 20–40% annualized inflation).

An Extraordinarily Bad Idea

One of the two largest inputs into the cost of living and inflation itself is energy. Higher energy prices increase the costs of everything in the economy because virtually all goods are transported using energy.

By ensuring a plentiful and cheap supply, the Government can ensure that goods can be delivered, and labour can travel to where it is needed in the economy, as efficiently and inexpensively as possible. In many respects, it is the most effective way to protect consumers and counteract the damaging forces of inflation.

Additionally, as a country, the best way to be able to have this ability, is to be able to produce all the energy needed domestically and not be dependent on an international market. International markets are inherently unstable, with potentially large price spikes, and force a nation to do business with potentially unsavory energy sellers.

In 2019 the U.S. achieved energy independence for the first time in almost 60 years. This was a historic and important milestone. A milestone which, after 30 years of being involved in almost continual conflict in the middle east, was long overdue. Energy independence allowed the U.S. to finally sever the umbilical cord between themselves and the middle east.

Importantly, the U.S. was also able to build significant strategic oil reserves to help buffer any supply shortages. This was the perfect position to be in given the storm clouds of inflation clearly forming on the horizon.

In what one could only describe as an extraordinarily bad idea on many levels, for seemingly purely ideological reasons, the new American administration cancelled the Keystone XL Pipeline project, among a large number of other existing and proposed projects to generate energy.

Without these sources of energy coming online, the U.S quickly burned through its strategic reserves and is now, once again, dependent on foreign energy. This is exactly why you have seen the new administration, just months after cancelling domestic energy projects, pleading with OPEC to increase its energy production. They will not, by the way.

Accordingly, specifically at the moment when the benefit of a fully domestic energy supply was to become critical to counteract inflation, it was eliminated. Without the protection of a domestic supply, energy prices have indeed spiked, making the impact of inflation that much worse.

Gasoline prices are now up a whopping 65% since January with energy prices in general, across all forms, up more than 30% since January.

Inflation is catchy, and while we in Canada may not be able to export our energy to the U.S. in the volume needed, we most assuredly will import the inflation that the lack of energy will create to our south.

Napalm Anyone?

As discussed above, Government is now the arbitrator of all things economic in the U.S., and by extension, Canada. Since the beginning of the covid calamity, and including the recently passed Infrastructure Bill, the U.S. has borrowed/printed and pushed more than $6 Trillion dollars into the economy, which has caused the massive distortion and the inflation discussed above.

American legislators are now considering the Build Back Better bill, which will spend and push into the economy additional Trillions. Credible third-party auditors have estimated the actual cost of this bill to be up to an amazing $4.3 Trillion dollars.

For context, in today’s dollars (meaning in today’s value), the United States spent a total of $4.7 Trillion fighting and winning WW2 over 4 years. The $4.7 Trillion in today’s dollars includes the rebuilding of both Europe and Japan for many years after that, under the Marshall Plan.

If this indeed does pass in the current form, the economic distortion (and damage) will be well beyond anyone’s ability to forecast. Crippling structural deficits would be almost a guarantee.

All of this is evidently due to covid.

Does anyone else remember 2 weeks to flatten the curve?

What Else Are We Worried About?

We have number of concerns beyond what I have discussed in detail above. Of those, as the second largest economy in the world, China remains near the top of our list.

We are watching carefully as Chinese domestic real estate companies run into significant liquidity problems. This was inevitable based upon an environment in which borrowing heavily to speculate is common. This is combined with a propensity for shadow banking (unregistered private loans). At this point, although liquidity problems can be catchy, we do not see an immediate threat.

Most of our concern with China is geopolitical. Since Chairman Mao, the Chinese Communists have run the country largely by committee. President Xi, however, was appointed for life, which changes the equation to a great degree. Over the last few years, he has been conducting himself, and the affairs of China, much more as a dictator, or an Emperor would.

Xi will act against anyone and any entity, either internally or externally, which threatens his power. We have seen this with Alibaba CEO Jack Ma going into hiding for a time. Perhaps sensing American weakness, we have more ominously seen this with China’s growing aggression and belligerence toward Taiwan. The chance that China, under the CCP and Xi, becomes more of a concern moving forward, is extremely high.

We have been very much underweight China in your portfolios for some time and we will be decreasing exposure further in the coming weeks.

Are There Some Positive Signs?

Yes, from a portfolio and financial market perspective over the medium term, there are a fair number, in fact. Firstly, the asset party will continue. Much of your performance over the past year has been driven by asset inflation due to the stimulus spending as discussed above, and you have done very well. That event is far from over, and there is still a fair amount of stimulus dollars that has not yet been spent.

Secondly, there is a natural, and real economic recovery taking place from the covid calamity and that will continue over the next year. Corporate earnings remain very good, and interest rates, for the time being, remain low. These are all very positive key inputs for both the financial and real estate markets.

Lastly, assuming the Build Back Better Bill is not passed, there is a possibility that some of the inflation is indeed transitory and exits the economy over the next 18 months. Our estimation is that much of it will not, but it remains an open question.

We believe the markets will indeed remain buoyant into the spring of next year and potentially beyond. That said, there will parts of the market which we will wish to own, and parts of the market which we will be taking profits on and exiting.

In the Future

Over the past 18 months we have been continually adjusting and updating portfolios to ensure they are properly structured for both our current and future economic environments. This is where our performance has come from. The results have been clear.

Because of the clear economic and financial market distortion we are now experiencing, managing risk exposure will be paramount over the next two years. There will be both great opportunity, and great volatility along the way.

For more information on McIver Capital Management, and to see the net after fee performance of their portfolios CLICK HERE. Neil and his team are currently accepting new clients. ~Ed

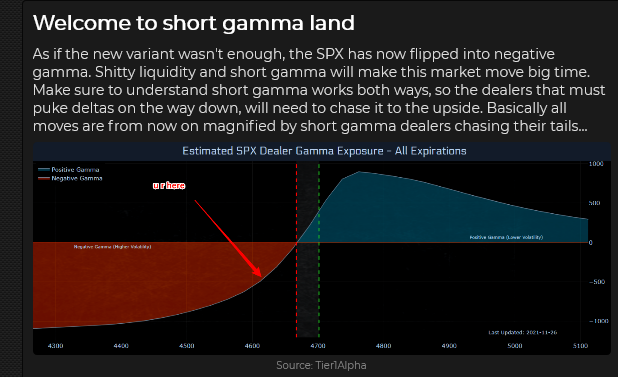

Risk Happens Fast

The S+P 500 hit All-Time Highs on Monday’s opening – but closed 165 points (3.5%) lower by Friday’s close. The daily S+P futures volume on Friday was the highest since early October – and was probably the highest EVER for a Thanksgiving Friday.

The DJIA closed at a 7-week low, down ~1,800 points (5%) from the All-Time High reached three weeks ago.

The Acid Test

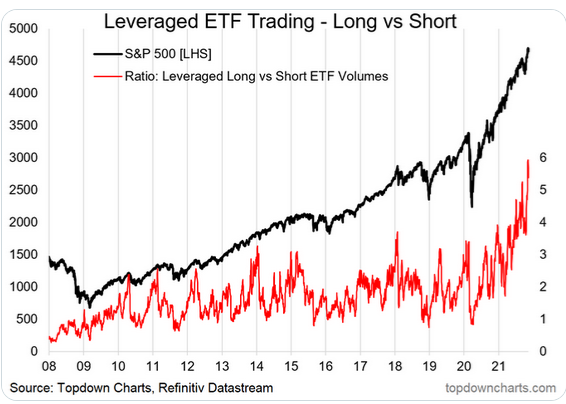

My recent thinking has been that market complacency would likely continue – unless the September/October lows are taken out. I think people who have put money into “passive” investment strategies have been told to expect minor corrections and short-term spikes in volatility – but to stay the course because, inevitably, stocks will keep rising.

I think those folks also “feel” as though the unrealized gains in their investment accounts are as “good as cash” when it comes to calculating their net worth, and that, while the market could have a dip now and then, it will NEVER AGAIN drop like it did in March 2020.

When Complacency Turns To Panic, Volatility Soars

There was complacency with “risk-on” sentiment across asset classes early this week, but as sentiment turned “risk-off” Thursday afternoon and prices began to slide, “liquidity risk” accelerated the panic, and volatility soared.

Position Unwinding Added To Volatility

For the past few weeks, traders (especially in the interest rate and currency markets) have been building positions around the idea that the Fed would be “forced” to raise interest rates much more, and much faster, than previously expected – because of “inflation.” There was severe unwinding of some of those positions in illiquid market conditions during the last 24 hours of the trading week.

Interest rates: As stock indices tumbled on Thursday/Friday, bonds rallied hard, and short-term interest rate futures “un-priced” at least one Fed rate increase next year.

Currencies: The US Dollar Index surged to a new 16-month high early this week on expectations that the Fed would be much more hawkish next year than previously expected. The USD reversed those gains on Friday to close unchanged for the week.

The Japanese Yen plunged to a new 5-year low against the US Dollar early this week but reversed HUGE on Friday. Speculators have amassed a HUGE net short Yen position over the past few months.

The Swiss Franc caught a “haven” bid Friday after tumbling the past two weeks on expectations of Fed tightening next year.

The Canadian Dollar hit a 6-year high against the USD at 83 cents in June but fell back as the USD began to rally against all currencies.

The CAD rallied to a lower high (81 cents) in October as commodity indices (especially crude oil) surged to 7-year highs. When the commodity indices (especially crude oil) began to roll over and slide lower, the CAD also began to trend lower.

WTI rallied from ~$62 to ~$85 (37%) in two months, from mid-August to mid-October. The strong demand for near-term delivery over deferred delivery caused a severe steepening of the forward curve. Front-month WTI fell from ~$85 three weeks ago to a low of ~$68 Friday, with more than half that decline happening in illiquid conditions on Friday. Implied volatility in WTI options spiked sharply.

Gold rallied ~$110 the first two weeks of November and fell ~$100 the next two weeks. Gold’s initial rally phase happened in sync with a USD rally (an unusual occurrence) as both markets reacted to the “soaring inflation” narrative. Gold’s tumble happened as the USD continued to rally (the more typical gold/dollar relationship), and as real interest rates reversed from record negative levels.

Open interest in the gold futures market (circled above) increased sharply as gold rallied in early November as speculators “chased” it higher. As gold fell, some of those speculators “bailed out,” exacerbating the decline.

My Short Term Trading

The only position I held as this week began was short gold, and I covered that for a good profit on Monday. Gold had tumbled ~$75 in three days – I was only short because I was looking for some “give-back” after the early November rally – so I covered the position.

I shorted the NAZ about an hour after the Monday floor session opened. The market had surged to an All-Time High on the opening but then dropped below the opening range. I had been looking to sell “irrational exuberance,” so I saw a nice setup and got short with tight stops. The market fell during the day, and I lowered my stops – and was stopped for a small gain later in the day.

The falling bond market on Monday increased my confidence to short NAZ as that index is heavily weighted with “long duration” stocks.

I shorted NAZ again on Tuesday but I was also watching the Dow futures and noticed they were not falling. I covered the short NAZ for a small gain and bought Dow futures. I was stopped for a small loss.

I bought the S+P on Wednesday, was stopped for a small loss, but then I bought it again. The market closed right on its highs so I decided to stay with the trade into the Thanksgiving holiday. (This was a decision to give the trade an opportunity to run. The market had been trending strongly higher, had dipped Monday and Tuesday, and was now closing right on the highs. Staying with the trade was the right thing to do.)

The market continued to rally in the Wednesday overnight session. I raised my stops. The market drifted sideways during the Thursday holiday session, but then began to tumble as soon as the Thursday overnight session began and I was stopped for a small gain.

I made the right decision to stay with the trade when it closed on its highs. At its best levels, I was ahead nearly 40 points but was stopped for a gain of only four points. I have no regrets about that. Given what happened next, I’m thankful that I use stops.

I bought the CAD and gold on Wednesday. I was stopped for a small loss on the CAD in the Thursday overnight session and covered the gold for a small gain Friday morning.

I did not establish any new positions Friday and was flat going into this weekend. My P+L was up just short of 1% on the week.

On My Radar

I don’t know if Friday’s market action was the start of something BIG or a one-day flash-in-the-pan. I’m willing to go either way, although I’m leaning towards the start of something.

My bias has been that too much money has been flooding into risk assets without appreciating just how risky those assets can be. The risk in those assets has increased “because” of the money flooding in.

Thoughts On Trading

For years I had a small yellow sticky note on my screens saying, “Anything Can Happen.” I put it there to remind myself that I had no idea what was going to happen next.

A few weeks back, in the Quotes From The Notebook section, I featured the Godfather saying, “I spent my entire life trying not to be careless.”

If I wanted to briefly explain the essence of my trading style, I would say that I never want to take a big loss. I never “fall in love” with a trade.

Several years ago, I started working with another broker that I didn’t know very well. We were opening a new office for a Chicago commodity firm in Vancouver. One day I overheard him talking to his best client. He was telling his client why they had to stay with a trade that was relentlessly going against them. I couldn’t believe what I was hearing.

A few days later, I had an epiphany while taking a shower before I headed to work (I get a lot of good ideas in the shower or in the pool – there’s something about water that does that – and, of course, you can’t make a note to yourself when you’re in the water!) My epiphany was that the broker was, first and foremost, a stockbroker – who also happened to be a commodity broker – and that stockbrokers believe and tell stories – good commodity brokers don’t do that.

Here’s a 90-second video of Jack Schwager (author of the Market Wizards series) explaining that one of the things the 70 Wizards he interviewed for his books had in common was their ability to have no loyalty to a position. (This is a fantastic insight – and great trading advice!)

Quotes From The Notebook

“Don’t count your chickens before they hatch.” My Grandmother kept telling me that from the time I was a little boy until she died.

My comment: My friend Peter Brandt likes to say that he never counts unrealized gains as “his money” it’s not his until he closes the trade. I can’t tell you how many times I’ve assumed that a trade would be a big winner – only to have it go sour on me.

Peter also likes to ask this question, “Let’s say you hold a position with an unrealized gain of $10,000. The market moves against you and you liquidate the trade to realize a $5,000 gain. Do you feel like you made $5,000 or lost $5,000 ?”

My guess is that if you feel like you lost $5,000 (because you didn’t get out at the top) you’re going to have an unhappy life as a trader. Have I mentioned before that trading is not a game of perfect?

“WHEN you make a trade is WAY more important than WHY you make a trade.” Raoul Pal, Founder of Real Vision TV, 2021

My comment: I agree 100%. Focusing on “why” you are making a trade may cause you to be too “loyal” to the trade. (Refer to Jack Schwager’s interview above.) Focusing on “when” you make a trade means you realize that there is a time to make the trade, and a time to NOT make the trade.

A Small Request

If you like reading the Trading Desk Notes, please do me a favour and forward a copy or a link to a friend. Also, I genuinely welcome your comments. Please let me know if there is something you would like to see included in the TD Notes. Thanks, Victor

Barney (now 12 weeks old) “Papa, leave your computers alone and play with me!”

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

This is an English translation of a letter by Guus Berkhout of CLINTEL that was published in De Telegraaf, the largest newspaper in The Netherlands earlier this week.

In recent years we have seen the strangest things happening to our universities. Professors must be extremely careful about what they teach. If they present scientific results that do not fit the ideology of activist movements, their lives are made difficult and they even run the risk of being excommunicated. Joining the consensus is by far the safest. The Boards of Governors do not protect their professors; on the contrary, they are solidly behind the activists.

The University of Amsterdam believes that every student should become ‘woke’. It is no longer about developing talents, but about making white, heterosexual, serious students feel guilty. After all, their ancestors have blood on their hands and they are the new generation of oppressors. Radboud University in Nijmegen has bowed to climate activism and has just decided that all students must be taught the sustainability narrative. The climate crisis is central to this, whether that is scientifically correct or not, that does not matter in Nijmegen.

My own university, TU Delft, has recently adopted the fashionable label ‘climate university’. This university also indoctrinates its students by telling them that there is a man-made climate crisis that must be solved with solar panels, windmills and biomass plants. Criticism is not tolerated. But I say to the Board of Governors, surely the university must be a sanctuary for the unbiased exchange of knowledge? How free is the discussion at TU Delft if everyone is pushed into an ideological straightjacket? Do you still want to send your child to such a university?…read more.

Join Plurilock CEO Ian Paterson on Monday Nov 29th at noon pacific time, 1pm MT, for an update on the cybersecurity sector, an overview of PLUR’s string of acquisitions and record earnings in Q3, plus Q & A for investors considering adding cybersecurity to their portfolios. CLICK HERE to register.