Gold & Precious Metals

|

|

|

|

|

1. Todd Market Forecast: Complex Bottoming Process

1. Todd Market Forecast: Complex Bottoming Process

Stephen’s monthly newsletter covers all major markets, Stocks, Bonds, Gold Canadian Markets and current market sentiment. Everything seems to be lining up for multi week uptrend, but there is one caveat…..

2. Federal Liberals Blackmail Canadians

The Liberal’s have gone a step to fare when they made it clear a citizen doesn’t have right to Federal money if they disagree with the Prime Minister’s point of view.

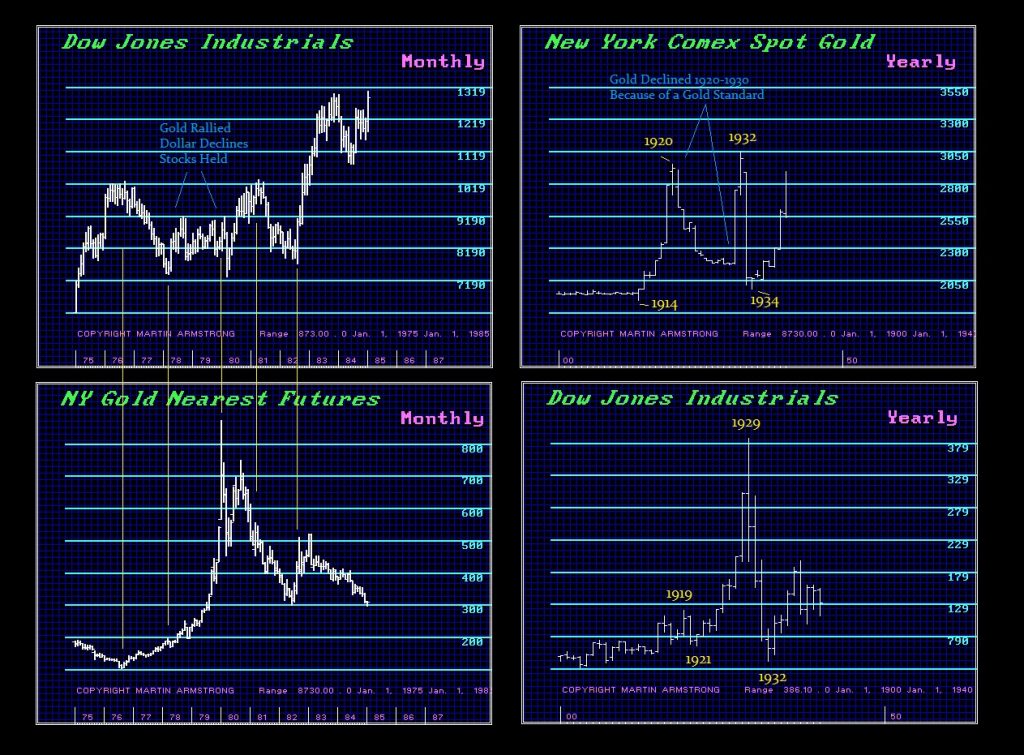

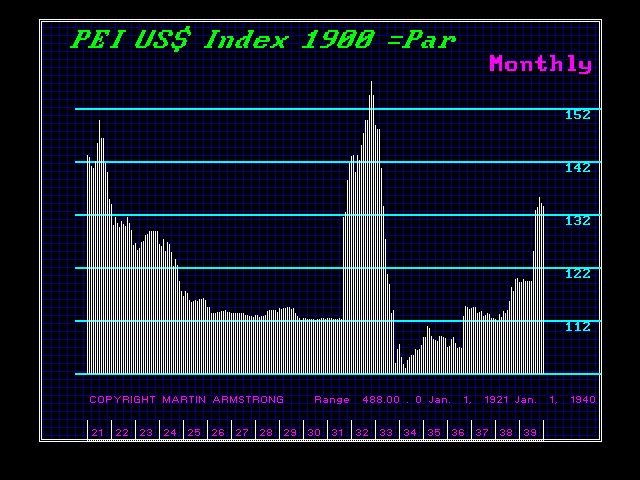

3. It’s Not Yet Time for Gold….

This analysis as well as Martin Armstrong’s Quarterly Closing Post clearly state that it is just not Gold’s time to explode upwards. There are factors that will have to fall into place before Gold can begin a long term bull swing upwards

How to Protect Yourself & Profit from a Market Crash

Because there is never enough time on the radio, immediately following today’s show (Saturday April 7th at 10:00am Pacific) Chief Derivative Market Strategist Patrick Ceresna is hosting a live FREE webinar exclusively for MoneyTalks to go into more detail on investments and strategies to use during a bear market and market crashes. In it he will discuss:

- Which asset classes perform the best during economic contractions

- Understanding the differences in cyclical high beta stocks vs. defensive stocks

- Learning how to remove tail risk using option overlay strategies on stocks you already own

- Positioning yourself to profit during declining markets

Only 500 spaces are available so register today!

After rallying last Friday, the Dow tanked over 450 points this Monday, rallied more than 1,000 points Tues/Wed/Thurs then tanked another 572 points today. That’s volatility and this analyst has some advice on how to survive in this violent action – R. Zurrer for Money Talks

Have you been experiencing a sickening feeling? The kind you get when a plane hits some unexpected turbulence, or when the roller coaster you’re on takes that high drop?

That’s volatility.

Some people like that feeling – if they’ve chosen to be on a roller coaster. Of course, they’ll come out just fine on the other end of the ride with big smiles on their faces. They might even run to get back on line for another trip.

But if you’re investing in the market, volatility is nothing to enjoy. And definitely not something to wish for.

This column is less an energy update than something far broader in scope. But I can’t ignore the bigger picture surrounding oil and oil stocks and still have any chance of getting the smaller picture right, and volatility is currently swamping out everything else in the energy markets.

Volatility isn’t a disease, it’s a symptom. It’s a symptom with a number of possible diagnoses, like a chronic cough is for a person. You might have a cold – or it could be something much worse. But one thing for sure, a chronic cough is not something to wish for, nor is it something you’d be smart to ignore.

Since the market highs in late February, we’ve had a very violent correction from some understandable sources: The big and long-awaited corporate tax cut was passed. A changeover in the Fed chairman signaled a slow but steady rise in interest rates. The dollar began to gain strength from its lows.

But we’ve also seen some added pressures that have been unexpected: A retreat from global trade agreements in Asia and North America. An unending turnover in White House staff. Saber-rattling in North Korea and Iran. A 1950’s-style energy advocacy towards coal. And, most recently, an unprovoked threat of a full-on trade war with China.

My job isn’t to measure the politics of these pressures – although most of them seem entirely unnecessary – it is to measure how they are likely to impact our investments in oil and gas stocks.

Volatility is a sign of insecurity – and it’s almost always a negative sign. So, whether the markets happen to be up today, you shouldn’t feel all that much better about your oil and gas investments – not while we’re in the midst of such turmoil.

So, how do we handle this roller coaster ride? Well, in two ways – by limiting our exposure to higher-beta stocks and increasing it towards more blue chip dividend producing shares. In the end, we want to be increasing our cash position as well.

This has been my mantra for the past several columns and, if anything, gains even more volume after the action of the previous week. Despite the very strong fundamentals that I see in high-beta, Permian focused shale players, now is not the time to be adding to positions – in fact, most rallies in these shares should be seen as opportunities to lighten up on them. They SHOULD NOT BE ABANDONED – only shaved. Concurrently, downdrafts in the market should be used to add to positions of a few key dividend-safe majors. I have particularly favored the Euro-majors like Total (TOT) and Shell (RDS.A) for the better part of a year, and they have performed far better than their U.S. counterparts.

In this way we will be minimizing the effects that this new trend of huge volatility has been having, and likely will continue to have on our oil and gas stocks.

And maybe come out smiling on the other end of this roller coaster ride.

By Dan Dicker Oilprice.com

“Tesla, without any doubt, is on the verge of bankruptcy.”

“Tesla, without any doubt, is on the verge of bankruptcy.”