Timing & trends

1. It’s a Hideous Money Grab, Pure & Simple

1. It’s a Hideous Money Grab, Pure & Simple

by Michael Campbell

Mike is hot under the collar about a new tax about to be levied on anyone who who owns a cottage, ski condo or family vacation home. The tax will have to be paid every year! They’re calling it a speculation tax.

2. Bundesbank Warns German Banks Rates are Moving Higher

Martin Armstrong reports the latest movements on the interest rate front as well as the remarkable move by Germany which will convince the world the European project is authoritarian (Germany arrested a Catalonian politician enforcing Spain’s dictatorship)

3. Ozzie Jurock’s Latest Real Estate Recommendations

Ozzie’s track record has been remarkable, Surrey BC up 60% last year, Seattle, Phoenix, Coquitlam, Burnaby….the list goes on but what he wants you to know is where to go now

We have chronicled the on-going efforts by government to target Canadian small businesses and professionals. We are pleased to be able to recommend an opportunity to learn several key ways Private Corporation Shareholders dramatically cut their income tax.

Andrew Ruhland and the team at Integrated Wealth Management are putting on a series of LIVE workshops across Western Canada. Seating is extremely limited so we suggest you reserve a space today.

Calgary – April 3rd, 5th, 9th & 14th

Edmonton – April 4th

Victoria – April 10th

Vancouver – April 11th & 12th

Langley – April 12th

Each member of the younger generation set to inherit a minimum of $113,000 in Federal, Provincial and Pension debt, so it’s no wonder they are going to have a problem finding money to buy a home. Where is our Politicians angst about that?

….also from Michael: Beware the Informed Voter

Exploiting inefficiencies using two recent examples, Facebook and Nvidia (the artificial intelligence/self driving stock). In the one case selling is justified, in the other buying the panic makes more sense – R. Zurrer for Money Talks

The Efficient Market Hypothesis is a mainstay of academic thinking about financial markets. It is rejected by many traders and money managers. Warren Buffett, for example, famously said that he would be on a corner, selling pencils from a tin cup if markets were efficient.

I do not expect to settle this decades-long debate in a single blog post. Instead, I will share how my own personal thinking changed along with my career – from college professor, to financial analyst, and to investment manager. I hope to stimulate and to provoke; we can all benefit from some wise comments. I will also suggest a few ideas we might consider to exploit inefficiency.

Provocative Examples

It is often useful to have a specific example in mind. Let’s start with Facebook (FB), a company familiar to all. Here is a chart of recent stock action:

As the Dow reeled from its biggest one-day drop in six weeks Gold spiked higher by more than $20 last Friday morning on the news that President Trump picked a new national security adviser, John Bolton who believes strongly in regime change through war. So with the U.S. apparently gearing up for war on multiple fronts: the trade front and actual, physical conflict, investors appear to be piliing into that anchor in uncertain times, Gold! – R. Zurrer for Money Talks

In Saturday’s column, we talked about why President Trump’s decisions on trade tariffs and security are good for gold. You can read it here: “Cry Havoc! And Grab Gold.”

Last week, we saw gold post its biggest weekly gain since 2016. That’s what made me so bullish. My fear was I might be too early. That sometimes happens. I notice a trend develop and hop on it before the rest of the market wakes up and smells the coffee. We generally don’t want to hop on too soon. That can be just as painful as too late.

But gold surged to a five-week high on Monday. Sure, it will zig and zag. But I believe it’s likely heading higher.

Last week, we looked at the psychological reasons. To that, you can add the fundamental reasons of supply and demand. Indeed, here are two charts that show ETF investors are going long in a big way.

First, here is a chart of holdings in physical silver ETFs (white line) and physical gold ETFs (blue line).

You can see that investors are piling into both. Zeroing in on gold, the latest numbers from Thursday show that gold ETF holdings of the metal stood at 72.9 million ounces. That’s the highest since May 2013.

Second, we can see that gold holdings in ETFs went up right as hedge fund managers’ holdings of gold went down.

Here, gold holdings are the white line, and hedge funds are the blue line. Hedge funds are famous for doing the wrong thing at just the wrong time. So, kudos to Mom and Pop investors on that one.

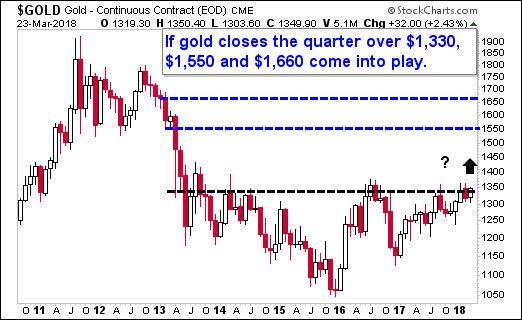

That’s all short-term. So, for my third chart, well … you know me, and my long-term cycles and charts. I’m going to dust off a monthly chart of gold here …

|

This week ends the quarter. And if gold closes this quarter above $1,330, that would be the first time we’ve had a quarterly close above that level since 2013. For technical traders, that would be like throwing red meat in a shark tank!

Now, will gold close the quarter above this level? I might be jumping the gun here. But:

• For all the trade and war reasons I laid out in my article …

• For the reasons of tightening supply and demand …

• For the reasons of investor psychology, which we can see in the ETFs …

… I think it’s a great time to buy the strongest miners.

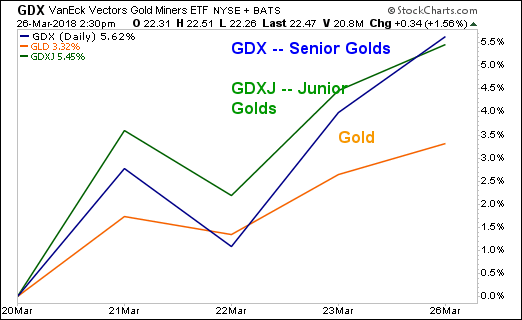

Those miners are tracked by the two biggest gold miner funds, the VanEck Vectors Gold Miners ETF (NYSE: GDX) and the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ). For a long time, these two funds underperformed gold. But on March 20, that all changed.

March 20 was when the miners started leaving the metal in the dust.

|

That’s the kind of action you expect to see in bull markets.

You can buy either of these ETFs and do well. OR, you can drill down, do your research, and buy individual names for even more potential outperformance.

Here’s what I did — I gave my Wealth Supercycle subscribers five gold miners that are on the launch pad. They are poised for outperformance. That’s on top of the three picks I gave them previously.

Do whatever suits you best. This profit ship is setting sail. Be onboard.

Best wishes,

Sean