Gold & Precious Metals

Crude Oil is currently scratching at recent highs, but this analysis makes a strong case we will see an immediate drop back $5 to $6 in the next 5-10 days. Click on all chart for larger versions – R. Zurrer for Money Talks

Crude Oil – Hello Elliott, My Old Friend…

The test of the resistance line, the triangle apex reversal, the a-b-c waves in the zigzag pattern… What connects them? Give us 28 paragraphs and 974 words and you will see that these seemingly mismatched concepts will form a meaningful and promising scenario

Technical Analysis of Crude Oil

Let’s start with the well-known daily chart (charts courtesy of http://stockcharts.com).

In our Monday’s Oil Trading Alert, we wrote that oil bulls took control shortly after the opening of the Friday session (…) and climbed to the major resistance zone, which stopped light crude’s rally at the end of January, triggering declines in the following weeks.

Will history repeat itself once again and we see similar price action in the coming days?

As you see on the daily chart, the red resistance zone created by the previous 2018 peaks is currently reinforced by the upper border of the green rising trend channel, which suggests that reversal may be just around the corner – especially when we factor in the fact that the daily indicators increased to their overbought areas, which could translate into sell signals in the very near future.

From today’s point of view, we see that the situation developed in tune with our assumptions and crude oil reversed and pulled back after the test of the upper border of the green rising trend channel, which suggests further deterioration in the coming days.

But will we really see the next downward move in near future? After all, oil bears disappointed us many times during the last month, so why should it be different now and why we should trust them?

The Reasons

First, the bears have on their side the above-mentioned strong resistance zone, which successfully stopped their opponents two times earlier this year.

Second, the Stochastic Oscillator generated the sell signal.

Third, Elliott wave theory…

What do we mean by that? Let’s examine the chart below.

Looking at the daily chart once again (but this time from a wider and different perspective), you can see that we divided the entire upward move, which started in June 2017 for individual waves in accordance with Elliott wave theory.

The potential first wave ended on August 1, 2017, the second wave ended on August 31. The third wave stretched until January 25. After this peak the price of crude oil corrected the previous upward move, which created the first wave (marked with a) in a potential zigzag pattern. As you see, the green support zone triggered a rebound, which created a potential wave b of a zigzag, which includes another zigzag at the moment of writing these words.

What does it mean for crude oil and how oil bears can use this pattern?

The most important feature of wave b is that it cannot retrace 100% of wave a. In other words, if the above sequence of waves is well-written, we’ll see another downward move in the coming days. In this way, black gold will create wave c in the above-mentioned big zigzag.

How Low Could Crude Oil Go?

If crude oil goes to the south from current levels, we’ll see (at least) a decline to the lower border of the medium-term blue rising trend channel seen on the above chart (currently around the February low of $58.10).

This is the Time, This is the Place

Once we already know where (potentially) the next wave of declines will head, it’s time to find out when we can expect another bigger reversal that will end the move to the downside. What can help us with this issue?

If you do not know yet, don’t worry about that, because we will describe everything in the following paragraphs (after all, you have us to analyze the charts carefully and share our insights).

So, coming back to the earlier question… what can help us determine the date of the next reversal? Triangle apex reversal pattern. What does it mean in practice?

Looking at the above chart, you can see the yellow triangle created by the resistance line based on the late February and early March highs and the support line based on the mid-February and mid-March lows. The intersection of his arms took place yesterday, which resulted in a reversal.

On the above chart, however, we can notice one more tringle (marked with the black dashed lines). As you see, it is created by the resistance line based on the February peaks and the support line based on the December and February lows. When will these lines intersect? Around April 10. What’s interesting, this date is also confirmed by the blue triangle (we marked it with dashed lines on the first daily chart in today’s alert) and two medium-term triangles seen on the weekly chat below.

From this perspective, we see that the blue triangle is created by the resistance line based on the June 2016 and January 2017 peaks and the support line based on the April 2016 low and mid-November 2016 low. The green triangle is created by the resistance line based on the February and April 2017 highs and the support line based on the August 2016 and June 2017 lows.

Additionally, analyzing the above chart, we noticed that April 4, 2016 and April 10, 2017 brought reversals, which increases the probability that we’ll likely similar price action in the coming month.

Will April 9/10, 2018 show the bottom of the fourth wave in the five-wave sequence? Taking all the above into account and combining it with the fact that in the same “time zone” the duration of the wave c will be equal to the duration of the wave a (we marked them with black rectangles on the last daily chart) we believe that oil bears will do their best and realize this scenario, making our short positions profitable.

Finishing today’s Oil Trading Alert, please keep in mind that the above waves’ structure may break only if the price of light crude increases above the major red resistance zone. Nevertheless, at the moment of writing these words, all available technical and fundamental factors favor the pro-bearish scenario in the following weeks.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits – Tools for Effective Gold & Silver Investments

Get 7 days of free access to our premium daily Oil Trading Alerts as well as Gold & Silver Trading Alerts. Sign up now.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Game theory postulates that rising oil prices increases the payoff for OPEC members to cheat on their deal. Game Theory is “the study of mathematical models of conflict and cooperation between intelligent rational decision-makers” and is mainly used in economics – R. Zurrer for Money Talks

- OPEC members have a deal to cap production levels until December.

- Oil prices are rising.

- When prices are higher, there is less incentive to cooperate with production caps.

With oil prices rising, Organization of Petroleum Exporting Countries members are facing a dilemma.

Extending output caps means making more room in the market for non-member competitors, and coordinating a higher amount of output means lowering prices. So they might not do either, and game theory could help explain why.

“Game theory suggests that higher oil prices increase the pay-off from cheating on the deal, which means that compliance could fall in 2018,” Thomas Pugh and Liam Peach, economists at Capital Economics, wrote in a note to clients this week.

West Texas Intermediate crude oil has stayed above $60 a barrel most of this year, only falling during a major market selloff in February. And as prices rise, non-OPEC production is increasing. In November, US shale producers hit a record high for production, pumping more than 10 billion barrels a day.

For an individual country focused on maximizing revenue, producing as much oil as possible is usually the dominant strategy — what players should do regardless of the actions of other players.

But when everyone amps up production, it puts downward pressure on prices. In game theory, this is an example of the prisoner’s dilemma. Because everyone acts out of self-interest, players end up in a worse scenario than if they collaborated.

This is where OPEC collusion comes in. Member countries — Algeria, Angola, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia and the United Arab Emirates — act as a single supplier.

But as prices rise, it creates more incentive for members to cheat and produce more. Because marginal revenue is higher than at lower prices, there is greater payoff from raising output — even in the face of production caps.

At the same time, the opportunity cost of complying also becomes greater.

“Cutting output to counter the effect of rising non-OPEC production would require giving up increasing amounts of market share and revenue,” Pugh and Peach added.

….also from Business Insider: Trump wants to go after Amazon

Mr. Todd is preparing to buy the plunging Stock Market short term unless it breaks an important level. Today he has also switched from bullish Gold & Silver to Bearish – R. Zurrer for Money Talks

Published @ 3:00pm PST Tuesday March 27, 2018

DOW – 345 on -1031net declines

NASDAQ COMP – 211 on 1564 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bearish

STOCKS: Here are the factors in today’s selling. Nvidia backed away from driverless cars and this caused a drop of 7% in the stock and that infected other high techs. Then interest rates dropped sharply and this caused trouble for the banks which like higher rates.

And of course, there is the old reliable Facebook which was down over 5% for the session and is now 22% below its high.

Another point. The end of the quarter comes on Thursday and we’ll probably see a lot of choppy action as institutions rearrange their portfolios for the quarterly reports. Of course, computer driven algorithms are a factor and are probably the reason for the extreme point action.

I’m sticking with a short term bullish posture. We’re very oversold and sentiment is extremely negative. However it’s important that we hold the closing lows of Friday.

GOLD: Gold dropped $11. The dollar was higher and the yellow metal was overbought.

CHART: The S&P 500 is doing a retest of the early February lows. This is a support zone since it arrested the last big decline. Most technical measures are oversold and we have a very high put call ratio. It should resolve to the upside unless we have entered a bear market. I’m not of that opinion, but it does require close attention.

BOTTOM LINE: (Trading)

Our intermediate term system is on a sell.

System 7 We are in cash. Stay there for now.

System 9 We’re on a buy for system 9 from Friday March 16 to March 30.

NEWS AND FUNDAMENTALS: Consumer confidence came in at 127.7, lower than last month’s 130.0. The Case Shiller home price index rose 0.8% more than the estimated 0.7%. On Wednesday we get oil inventories, the trade deficit and pending home sales.

INTERESTING STUFF: Shallow men believe in luck. Strong men believe in cause and effect. ——–Ralph Waldo Emerson

TORONTO EXCHANGE: Toronto lost 82.

BONDS: Bonds surged.

THE REST: The dollar rebounded. Crude oil was lower.

Bonds –Change to bullish as of March 27.

U.S. dollar – Bearish as of March 26.

Euro — Bullish as of March 26.

Gold —-Change to bearish as of March 27.

Silver—- Change to bearish as of March 27.

Crude oil —-Change to bearish as of March 27.

Toronto Stock Exchange—-Bullish as of Feb. 12.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

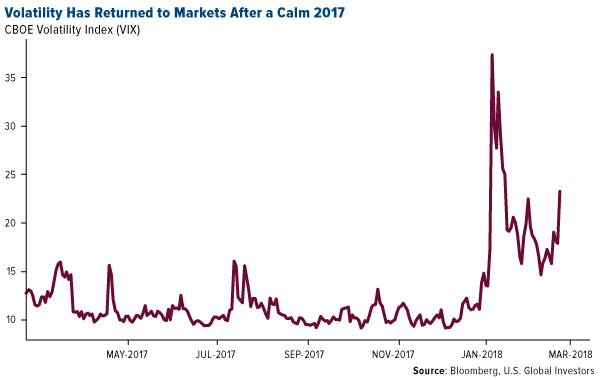

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 12.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

Martin Armstrong reports the latest movements on the interest rate front as well as the remarkable move by Germany which will convince the world the European project is authoritarian (Germany arrested a Catalonian politician enforcing Spain’s dictatorship) – R. Zurrer for Money Talks

QUESTION: Mr. Armstrong; It appears that now the Bundesbank has adopted your view of rising interest rates. How fast do you see rates rising?

ANSWER: Yes, the Bundesbank President Jens Weidmann has come out and warned that banks should start to make provisions for interest rate risks associated with rising interest rates. The normalization of the interest rates is essential and as always, it is now too little too late. The economic environment is changing much more rapidly than most suspect. It is true that the German banks have increased their equity significantly since the financial crisis. While the central banks are warning that rates are rising, they misjudge the fact that banks are by no means as resilient as they were before the 2007-2009 crisis.

German 10-year rates will start to rise rapidly following a monthly closing above 0.79%. The next stop will be 2% and thereafter, we will see a test of the 4% level. Once we exceed the 2007 high of 4.67%, we will see a rapid rise to the 5.6% area and an annual closing above that will warn of a test of the 8.5%-11% zone and that can be easily by 2020.

….related from Martin: The Fed is Raising Rates Because of the Pension Crisis

…also breaking: Germany Arrests Former Head of Catalonia for Spain Confirm the Spanish Constitution Violates Human Rights