Op/Ed

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

EIA Weekly Oil Data: The EIA data of Wednesday November 24th was mixed. US Commercial Crude Stocks rose 1.0Mb (forecast a decline of 481K) as Net Imports rose 1.26Mb/d. The key was a decline in Exports of 1.02Mb/d. Refinery Utilization Rose by 0.7 points to 88.6% from 87.9% in the prior week. Total Motor Gasoline inventories fell 0.6Mb while Distillate volumes fell 2.0Mb. US Crude Production rose by 100Kb/d to 11.5Mb/d back to the year high so far. Total Demand rose by 123Kb/d to 21.75Mb/d. Gasoline consumption rose before the US Thanksgiving long weekend by 92Kb/d to 9.33Mb/d which is just above the 9.20Mb/d consumed in 2019 at this time. Jet Fuel Consumption rose 125Kb/d to 1.51Mb/d versus 1.88Mb/d consumed in 2019 during that holiday season travel time. Cushing Inventories rose 800Kb to 27.4Mb/d.

EIA Weekly Natural Gas Data: Weekly injections continue as we get close to the winter withdrawal season. Last week there was an injection of 26 Bcf, lifting storage to 3.644Tcf. The five year average for last week was a withdrawal of 26 Bcf. Storage on a five-year basis was 3.735Tcf so storage is only 2.2% below the five-year average. Injections for the last nine weeks have been above 2020 levels so NYMEX prices have retreated 22% from their robust levels of US$6.47/mcf in early October when there was fear of too low storage levels for the upcoming winter. NYMEX today is US$5.03/mcf and AECO spot is at $3.77/mcf down over $2/mcf from recent highs. As to be expected, natural gas stocks have retreated from their 2021 highs.

Baker Hughes Rig Data: The data for the week ending November 19th showed the US rig count rose by seven rigs (up by six rigs in the prior week). Of the total of 563 rigs working last week, 461 were drilling for oil and the rest were focused on natural gas activity. This overall US rig count is up 82% from 310 rigs working a year ago. The US oil rig count is up 100% from 231 rigs last year at this time. The natural gas rig count is up a more modest 34% from last year’s 76 rigs, now at 102 rigs. Texas saw an increase of seven rigs last week to 271 rigs and was up 88% from 144 rigs last year. The Permian saw an increase of six rigs to 278 working and was up 78% from 156 rigs working last year.

Canada had a decline of one rig (versus a rise of eight rigs in the prior week) to 167 rigs. Canadian activity is now up 65% from 101 rigs last year. There was one more oil rig working last week and the count is now 102 oil rigs working, up from 42 last year. There are 65 rigs working on natural gas projects now, up from 59 last year.

The material increase in rig activity over a year ago in both the US and Canada should continue to translate into rising liquids over the coming months, especially with the DUC count (drilled but uncompleted well count) at very low levels. The data from many companies on their plans for Q4/21 and forecasts for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d before the end of 2021. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs and crews as staffing issues are getting tougher for the sector.

Conclusion:

Bearish pressure on crude prices:

- A coordinated effort by consuming nations to lower rising gasoline prices by opening their strategic reserves (SPR’s) appears to include China, India, Japan, South Korea, the UK and the US. Total releases may be in the range of 100-120Mb (US 50Mb) or just over one day of world demand. This may not be enough to lower prices immediately but should open up a Pandora’s box for OPEC as consuming nations balk at their current pricing and production policies. OPEC holds its next meeting on December 2nd. They increased production by 486Kb/d in September (exceeding nicely the 400Kb/d approved level) but in October they increased volumes by only 217Kb/d. What level they approve at that meeting may force consumers to lift SPR sales even more (US has 604 Mb).

- The US may increase pressure on top of SPR sales by cutting off all imports from OPEC countries. Last week the US imported a total of 496Kb/d from only three OPEC countries (mostly from Saudi Arabia – 453Kb/d – the rest from Iraq and Nigeria) and could easily cut them off from sales access to the biggest consuming nation. The US imports the largest amount of needed crude from Canada at 3.43Mb/d (61% of the total). To replace OPEC crude the US could import more from Canada or from Mexico, Colombia, Ecuador, Brazil and Trinidad which also supplied the US last week. The US is also considering a new ban on crude exports which was allowed to start in 2015 after a 40-year ban.

- Covid caseloads are growing around the world. In the US, the death rate is over 772K deaths (up 8,000 during the last week). Worldwide, the death count is now 5.16M. Deaths are rising in Europe particularly in Austria (imposing lockdowns on the unvaccinated with fines of $30K, Bulgaria, Czech Republic, Croatia, Germany (now over 51K new daily cases plans to tighten restriction next week), Netherlands (21,615 new daily cases), Romania, Russia, Slovakia, Slovenia, and Ukraine. South Korea is now facing record caseloads and is planning to tighten up their economy. If they and Germany tighten up, that will add to world supply chain problems and slow economic growth.

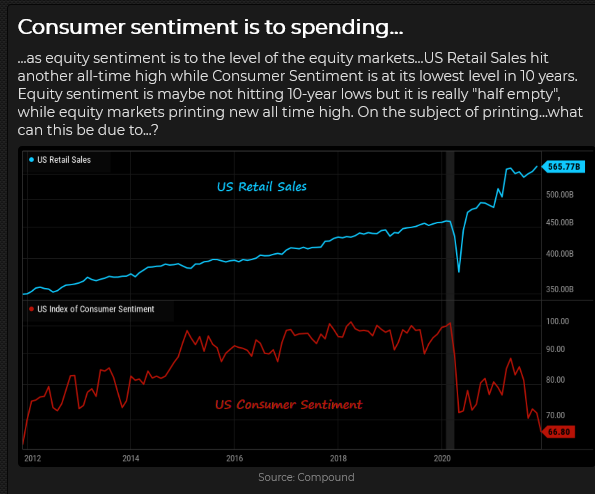

- Energy demand is under pressure as high prices for most food, rent, taxes, child care, health expenses, auto costs and other daily necessities make spending decisions tougher for consumers. This gouge in prices will surely impact consumers’ buying behaviour in the coming months. The spending pie of consumers is shrinking and some spending habits of the past will have to be dropped. Demand destruction is on the way. Recent US economic releases indicate that we may already be in the early stages of a recession.

- China has seen a rising wave of new infections in 19 of its 31 provinces. Many industrial plants in China have been closed due to the high cost of fuel and the Government’s plan to lower emissions in the Beijing area for the upcoming 2022 winter Olympics from February 4th to the 20th. Clean air is needed for the event and China wants to show it is making progress on its climate initiatives.

Bullish pressure on crude prices:

- OPEC may be considering lower crude exports to offset sales from SPR’s of the consuming countries planning such sales to keep world inventories tight. The December 2nd meeting in Vienna will be closely watched for the next phase of this tussle.

- Speculative long investors (options traders, hedge and commodity funds) and a short squeeze on bearish positions in the futures and options markets on crude, have spiked up prices. Energy bulls like Bank of America see US$120/b by June 2022.

- The Iran deal may not see much progress in the coming months so the concern about 1-2Mb/d of new Iranian oil is abating.

- JP Morgan and other US investment banks see world demand exceeding pre-pandemic levels in Q2/22.

CONCLUSION:

WTI is at US$78.46/b unchanged from last week despite the SPR sales and the retaliatory comments by OPEC members. Crude has retreated over 8% from the high in late October. We see prices as still having US$20-25/b of speculative value which should disappear as demand weakens in the US and China as they both appear to be headed into recessions. If repeated economic data comes out supporting recessionary conditions, the oil price slide could be quick and painful. Leveraged speculative longs in crude oil futures are vulnerable to nasty margin calls in the future.

Energy Stock Market: The S&P/TSX Energy Index currently trades at 169, up four points from last week as investors jump on OPEC’s talk of restricting future supplies. We think that the supply side bullish view will be trounced by the weakened demand side as the two biggest economies face slower growth and move towards recession. Add in problems in Germany, Japan and South Korea and the world’s economic juggernauts will offset any supply moves by OPEC. Remember regular recessions can lower world demand by 2-5Mb/d rising to over 8Mb/d of lower demand as was seen during Covid-impacted 2020.

Josef will be away next week. Our next ‘Eye on Energy’ issue will come out on Wednesday December 8th.

Our November Schachter Energy Report Monthly comes out tomorrow Thursday November 25th with detailed updates on 25 companies that have released their Q3/21 report since our Interim Report.

Become a subscriber if you would like to access the archive of the webinar and all our previous SER reports. Go to https://bit.ly/34iKcRt to subscribe.

If you enjoy reading our weekly ‘Eye on Energy’ feel free to forward it off to friends and colleagues. We always welcome new subscribers to our complimentary macro energy newsletter.

Rare Earths Elements: Where in the World Are They?

Rare earth elements are a group of metals that are critical ingredients for a greener economy, and the location of the reserves for mining are increasingly important and valuable.

This infographic features data from the United States Geological Society (USGS) which reveals the countries with the largest known reserves of rare earth elements (REEs).

What are Rare Earth Metals?

REEs, also called rare earth metals or rare earth oxides, or lanthanides, are a set of 17 silvery-white soft heavy metals.

The 17 rare earth elements are: lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), scandium (Sc), and yttrium (Y).

Scandium and yttrium are not part of the lanthanide family, but end users include them because they occur in the same mineral deposits as the lanthanides and have similar chemical properties.

The term “rare earth” is a misnomer as rare earth metals are actually abundant in the Earth’s crust. However, they are rarely found in large, concentrated deposits on their own, but rather among other elements instead.

Rare Earth Elements, How Do They Work?

Most rare earth elements find their uses as catalysts and magnets in traditional and low-carbon technologies. Other important uses of rare earth elements are in the production of special metal alloys, glass, and high-performance electronics.

Alloys of neodymium (Nd) and samarium (Sm) can be used to create strong magnets that withstand high temperatures, making them ideal for a wide variety of mission critical electronics and defense applications…read more.

Canada prides itself on being an ideal environment for entrepreneurs but stats disagree. Statistics Canada (Stat Can) employment data shows self-employment is shrinking. These individuals now represent the smallest share of employment since the early 1980s. At the same time, the public sector has been hiring roughly two people per self-employed job lost. Employment might be recovering but it’s a totally different labor market.

Self-Employment Drops To The Smallest Share Of Workers Since The Early 80s

Canadian entrepreneurship has taken a hit and not just because of the recession. The number of Canadians that identify as self-employed fell to 2.92 million in October, down 3.8% from last year. It’s now 12.1% lower than the peak reached in September 2019. The public health restrictions definitely accelerated this trend but it started before 2020. The environment was weakening before the recession, meaning bigger issues are present.

Self-employed Canadians have shrunk to their smallest share of employment since the 1980s. They represent 15.7% of total employment, down from 17.2% a year ago. The share hasn’t been this small since June 1982. That was also right around the last inflation crisis Canada faced.

Public Sector Employment Hits The Largest Share Of Employment Since 1992

Canada has been leaning on public employees to help pad its employment numbers. There were 4.15 million public sector employees in October, up 5.7% from last year. Annual growth advanced a point faster than general employment. This helped the sector to hit a new record high.

Public sector employment has captured its largest share of employment in three decades. It now makes up 21.8% of all people employed in the country as of October, the highest share since 1992. Canada’s public sector essentially hired two people for every self-employed person lost…read more.

Canadian Share Of Employment

The share of self-employed and public sector employees, as a percentage of total employment in Canada.

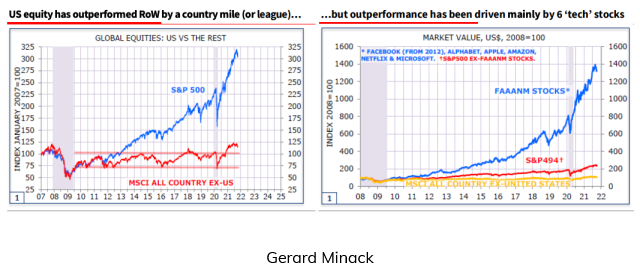

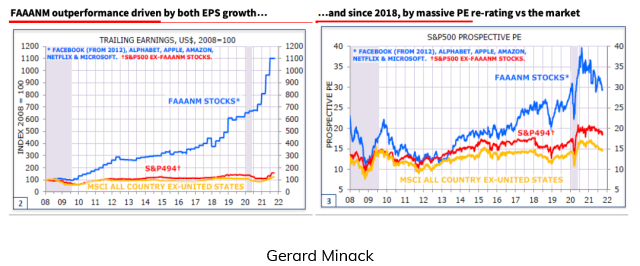

A handful of BIG cap tech stocks make all the difference

The DJIA and the small-cap indices closed lower for two consecutive weeks (the DJIA fell as much as 1,000 points from last week’s high to this week’s low) – but the Nasdaq and the S+P 500 indices hit new All-Time Highs this week.

The American stock market has massively outperformed the Rest Of the World – largely thanks to the same handful of BIG cap tech stocks.

The S+P and Nasdaq keep tracking the seasonal trends – momentum trumps valuations.

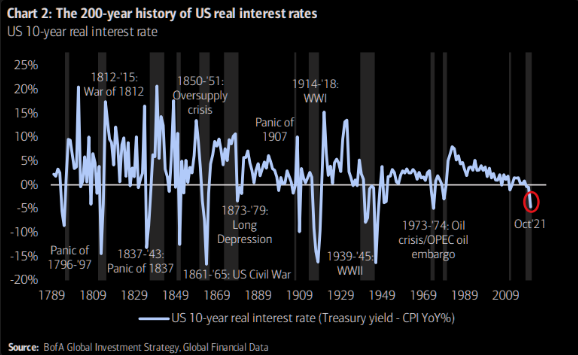

American real interest rates hit the deepest negative level of our lifetime

The recent inflation surge means the difference between nominal rates and after-inflation rates has dropped more deeply negative. A critical aspect of deeply negative real interest rates is that they add to the “pressure” of capital flowing into risk assets. Deeply negative real rates mean that people who should be “savers” become “traders” – reaching for yield in risky markets.

The purchasing power of the US Dollar is falling – except when it comes to buying other currencies

The USD hit (what I called) a cathartic inflection point on Wednesday, January 6, 2021, when the mob stormed the Capitol Building in Washington, DC. It was a 34-month low for the US Dollar Index, and since then, it has rallied ~ 8%.

The Japanese Yen has tumbled ~10% since January, hitting a 56-month low this week.

The Euro currency has fallen ~8% against the USD since early June. Against the Swiss Franc, the Euro is down 6% (near All-Time record lows) during that same period. I look at the Euro falling against the Franc as a sign that European citizens are moving money to “safety” because they are unhappy with or fearful of the political/economic climate in Europe.

The Canadian dollar hit a 4-year low at ~68 cents during the Covid Crisis of March 2020 but rallied to 83 cents (22%) at this year’s high as 1) the USD trended lower and 2) commodity and stock markets trended higher.

The CAD peaked at ~83 cents in June as the USD started to trend strongly higher and rolled over from a lower peak in October as the commodity indices (and crude oil especially) dropped away from 7-year highs.

With the USD making solid gains against virtually all currencies this month, it is hard to tell if the CAD is suffering from the effects of the extensive flooding on the West Coast, which has crippled vital transportation links.

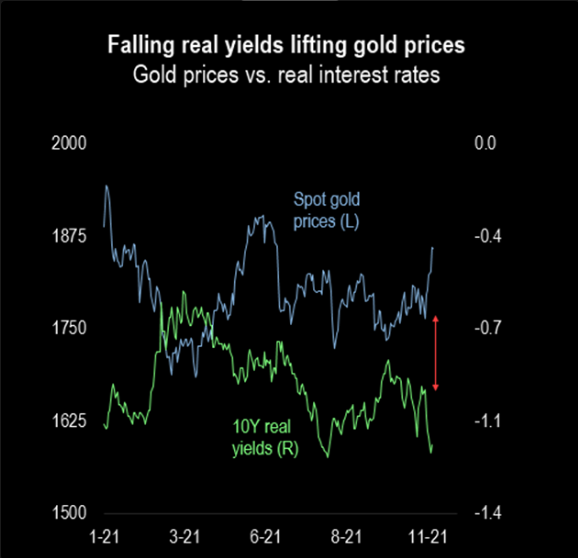

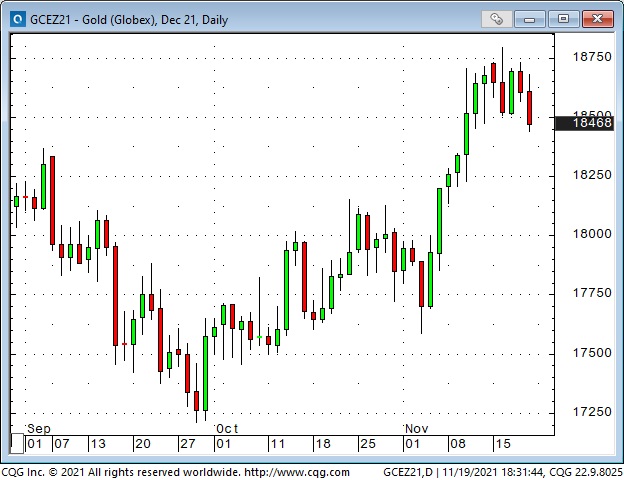

Gold surged over $100 the past two weeks – but fell back this week

Gold rallied the last two weeks even as the USD rallied – and that’s unusual outside of “haven buying” on a geopolitical event. The rally broke through several key technical levels and was accompanied by a 20% surge in open interest. Net speculator long positioning in the futures market soared.

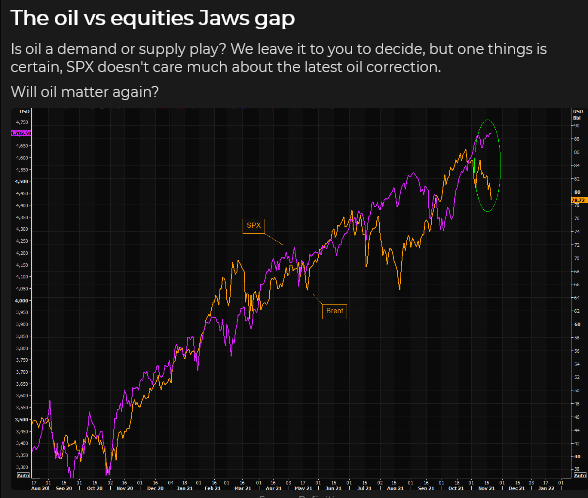

Crude oil and commodity indices fell away from multi-year highs in September

WTI rallied from ~$62 to ~$85 (37%) from August to October as “re-opening” demand surged and OPEC+ made only modest production increases. The need for crude “right now” caused a very sharp increase in the price of nearby futures over deferred futures during October, but a lot of that has faded away as front-month prices have dropped from ~$85 to ~$75.

This chart shows that the Dec 2021 contract was a $1 premium over the Mar 2022 contract in early September. Soaring “demand” for WTI crude drove the premium to nearly $5.50 by November 1st. It has now dropped back to ~$2 as crude prices have fallen.

Speculators may also have “backed away” from bullish positioning on concerns of a coordinated global release of government crude oil reserves and worries about rising covid cases.

My short term trading

I started this week with no positions, but after doing my homework last weekend, I developed a “bias” that the “runaway inflation narrative” had gone too far too fast. I decided to look for opportunities (price action setups) to fade that narrative.

I shorted gold, crude, the S+P and the CAD on Monday. I was quickly stopped for a slight loss on the S+P. I was stopped on gold Tuesday, also for a small loss, but I re-shorted the market as it fell back below Monday’s lows (gold had a daily key reversal down on Tuesday.)

I was also stopped on my short WTI position Tuesday, and I regret not finding a spot to re-short that market as it dropped $5 by Friday’s lows.

I took profits on the short CAD ahead of the weekend. I was puzzled that the CAD wasn’t weaker, given the USD’s strength and the economic disaster unfolding on Canada’s West Coast.

Going into the weekend (ahead of the US Thanksgiving week), the only position I hold is short gold. My realized P+L for the week is flat; I have decent unrealized gains on the gold position, which ended the week right on its lows.

On my radar

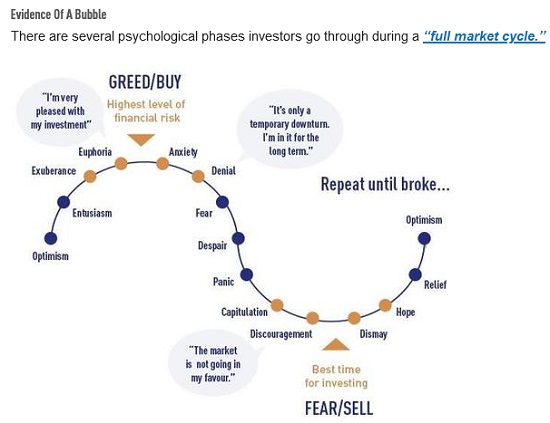

I continue to think that the stock market is at the “Euphoria” stage of the “full market cycle,” so I will keep looking for price action setups to probe with short positions.

I think the “central banks are WAY behind and will have to tighten” narrative is overdone (or at least, fully priced in), as is the “runaway inflation” narrative, so I will look for price action setups to fade those sentiments.

President Biden has said he will announce his decision about the Fed Chair before Thanksgiving. Betting sites see Powell being re-appointed – if Biden wants to replace him the markets won’t like that.

Thoughts on trading

I recorded a 30-minute interview on November 19 with Howestreet radio. I talk about what I’m seeing in several different markets, and some of the trades I’m making. Access is free.

Last week I invited readers to tell me what they would like to see in the TD Notes. Several people asked for more detail on how I trade. Here is an edited version of my reply to one of those readers:

First, I form an “opinion” about a market. For instance, the stock market has HUGE upside momentum for several reasons, but my s/t opinion is that retail FOMO has “taken it too far, too quickly.” I think it could experience a quick, nasty correction – which could morph into a more significant downside move (for instance, if it takes out the Sept lows.)

My “opinion” gets me looking for an opportunity – a setup – to get short. This trade would be an initial position. If the market fell, I would look for a setup to increase my short position.

My “opinion” is not a timing tool – price action is the timing tool. I can’t sell a market without regard to price action simply because I think there is a “good chance” that it will be lower in the future.

The S+P made a new ATH within the first hour of the “day session” on Friday, November 5 – but then started to fall back. I got short an hour later with a stop just below the ATH. The market took a swift 35 point drop from the ATH and closed the day below the mid-point of the day’s range. I felt OK staying short over the weekend. If the trade had been in the red by Friday’s close, I would have exited the trade (and cancelled the stop – the stop was intended to protect me if the market had a swift rally while I wasn’t looking.) I would not want to carry a money-losing short position into the weekend with the market in a powerful uptrend. (The Friday closing price is often the most valuable price of the week.)

The market rallied during the Sunday “overnight” session and the opening range of the Monday “day session” – and nearly hit my stop – but it then drifted lower for the next couple of days. By the Wednesday lows, I was ~75 points ahead on the trade. That was “decision time.”

Wednesday’s lows (4625) had been a resistance level in early November. If the market could break below 4625, I could see it falling another 75 points. I decided to stay with the trade – to give it the chance to become a BIG winner. But for risk management purposes, to protect my P+L, I lowered my stop to lock in at least a small gain.

The market turned higher from Wednesday’s lows, and I was stopped for a small profit (~20 points) on Friday, one week after entering the trade.

To wrap up: My process is to form an opinion about a market (I follow dozens of markets, and most of the time, I have no motivating view on many of them.) When I have a “strong” opinion, I look for confirmation from the price action. I look for a price action setup. For example, I might get short if I’m bearish and the market has just made a lower high. Maybe the market will fall, but, at least on some time horizon, I’m not trying to top-pick a rising market. I also need to have a potentially good risk/reward ratio for the trade given where I would place my stop – a point where I know I’m wrong to be short.

Best wishes,

Victor

Two weeks ago, I included a link to a video done by Goehring & Rozencwajg. As I watched their video, I was thinking, “If their ideas are correct, then a TON of capital is mal-invested in the energy markets – where’s the trade?”

Here’s a link to another (5-minute) video that also makes the case that a TON of capital is mal-invested in the energy markets – and if that’s true, it will create many great trading opportunities.

Another reader sent a link to a beautiful little piece (a 4-minute read) that makes the point that amateurs will win more by avoiding stupid mistakes – rather than trying to be brilliant. This message applies to trading/investing BIG TIME.

Raoul Pal and Keith McCullough

I watched a fabulous 1-hour video interview between Raoul Pal (founder of RealVisionTV) and Keith McCullough (founder of Hedgeye.) The video is about Crypto – Macro – Regime Change – and how Millennials are HUGELY different than Boomers (and how that changes everything in markets now that the Mills out-number the Boomers.) Both men are deep thinkers and very successful traders.

This video is one of the best explanations of crypto and what it is likely to become that I have ever seen. I loved Raoul’s perception (near the end of the video) of the Regime Change underway as Millennials view RISK much differently than Boomers!

Quotes from the Notebook

Trying to predict a trend is hard. Trying to predict the end of a trend is even harder. (Therefore) picking stocks to buy is a better use of your time than trying to pick stocks to short. Jared Dillian 2021

My comment: I agree with Jared, but it’s in my nature to look for opportunities to fade irrational exuberance or to call “Bullshit!“

My fundamental premise in trading is that “When” is much more important than “Why.” Raoul Pal in the video noted above. 2021

My comment: I agree. I remember taking a phone call from a client many years ago when I was a commodity broker. He wanted to discuss some ideas he had about a market. After our chat, he asked me to buy some contracts for him – at the market. I wondered, “why now? Just because we’re on the phone doesn’t mean that this is the best time to enter the market.”

You can have your ideas about “why” a market should be doing something (I call it having an “opinion,” but instead of trying to be brilliant, reduce the chances of doing something stupid by concentrating on “When” you enter the market.

A small request

If you like reading the Trading Desk Notes, please do me a favour and forward a copy or a link to a friend. Also, I genuinely welcome your comments. Would you please let me know if there is something you’d like to see included in the TD Notes? Thanks, Victor

Barney getting set to hit the “irrational exuberance” bid

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

El Salvador will build a Bitcoin City powered by geothermal energy from a nearby volcano, President Nayib Bukele said (not on SNL) this weekend.

The city will be circular in shape to resemble a bitcoin, and residents will encounter tributes to the crypto in the city’s museums, shops, restaurants, and even the local soccer team, the Bitcoin City Shiba Inus.

Here’s where it gets interesting. The government will help finance Bitcoin City by issuing $1 billion in sovereign bonds backed by bitcoin, with half of the proceeds going to infrastructure and the other half going toward (what else?) buying more bitcoin.

Blockstream, the crypto company that developed the bond, predicts the price of bitcoin will go to $1 million within five years, giving the bond an annual yield of 146% in a decade.

Bitcoin City would be another high-profile move into the crypto space by El Salvador. The Central American country already became the first to make bitcoin legal tender in September…read more.