Gold & Precious Metals

02:50 – 19:24 Featured Guest: A word to the wise – big name analyst, Greg Weldon issues a major warning for investors. Hint: the game’s changed.

….also from Michael: Dr. Michael Berry Ph.D: Prepare Yourself For Higher Rates

Critics of “New Age” monetary policy have been predicting that central banks would eventually run out of ways to trick people into borrowing money. There are at least three reasons to wonder if that time has finally come:

Wage inflation is accelerating

Normally, towards the end of a cycle companies have trouble finding enough workers to keep up with their rising sales. So they start paying new hires more generously. This ignites “wage inflation,” which is one of the signals central banks use to decide when to start raising interest rates. The following chart shows a big jump in wages in the second half of 2017. And that’s before all those $1,000 bonuses that companies have lately been handing out in response to lower corporate taxes. So it’s a safe bet that wage inflation will accelerate during the first half of 2018.

The conclusion: It’s time for higher interest rates.

The financial markets are flaking out The past week was one for the record books, as bonds (both junk and sovereign) and stocks tanked pretty much everywhere while exotic volatility-based funds imploded. It was bad in the US but worse in Asia, where major Chinese markets fell by nearly 10% — an absolutely epic decline for a single week.

Normally (i.e., since the 1990s) this kind of sharp market break would lead the world’s central banks to cut interest rates and buy financial assets with newly-created currency. Why? Because after engineering the greatest debt binge in human history, the monetary authorities suspect that even a garden-variety 20% drop in equity prices might destabilize the whole system, and so can’t allow that to happen.

The conclusion: Central banks have to cut rates and ramp up asset purchases, and quickly, before things spin out of control.

So – as their critics predicted – central banks are in a box of their own making. If they don’t raise rates inflation will start to run wild, but if they don’t cut rates the financial markets might collapse, threatening the world as we know it.

There’s not enough ammo in any event

Another reason why central banks raise rates is to gain the ability to turn around and cut rates to counter the next downturn.

But in this cycle central banks were so traumatized by the near-death experience of the Great Recession that they hesitated to raise rates even as the recovery stretched into its eighth year and inflation started to revive. The Fed, in fact, is among the small handful of central banks that have raised rates at all. And as the next chart illustrates, it’s only done a little. Note that in the previous two cycles, the Fed Funds rate rose to more than 5%, giving the Fed the ability to cut rates aggressively to stimulate new borrowing. But – if the recent stock and bond market turmoil signals an end to this cycle – today’s Fed can only cut a couple of percentage points before hitting zero, which won’t make much of a dent in the angst that normally dominates the markets’ psyche in downturns.

Most other central banks, meanwhile, are still at or below zero. In a global downturn they’ll have to go sharply negative.

So here’s a scenario for the next few years: Central banks focus on the “real” economy of wages and raw material prices and (soaring) government deficits for a little while longer and either maintain current rates or raise them slightly. This reassures no one, bond yields continue to rise, stock markets grow increasingly volatile, and something – another week like the last one, for instance – happens to force central banks to choose a side.

They of course choose to let inflation run in order to prevent a stock market crash. They cut rates into negative territory around the world and restart or ramp up QE programs.

And it occurs to everyone all at once that negative-yielding paper is a terrible deal compared to real assets that generate positive cash flow (like resource stocks and a handful of other favored sectors like defense) – or sound forms of money like gold and silver that can’t be inflated away.

The private sector sells its bonds to the only entities willing to buy them – central banks – forcing the latter to create a tsunami of new currency, which sends fiat currencies on a one-way ride towards their intrinsic value. Gold and silver (and maybe bitcoin) soar as everyone falls in sudden love with safe havens.

And the experiment ends, as it always had to, in chaos.

Let’s not go into great detail about sentiment and internals indicators trying to ascertain something already fully in play. The stock market has finally cracked, making an A-B-C correction in micro time per a 30 minute chart. Sentiment is in play from the negative side, volatility is now intense and while we will gauge the macro regularly going forward, we also are in the realm of straight TA. So #486 is going to be a breeze for us this weekend as we get down mainly to more TA and less theory across various markets.

Table of Contents

Wrap Up (a basic summary based on conclusions from work done in this week’s report)

-

US Stock Market: So we had anticipated a bottom and a bounce. Last week the US market bottomed, bounced, dropped, bottomed and bounced again. SPX reversed on Friday from a logical point and this could get over bearish participants thinking “rut roh, why did I puke?” and starting to chase. I think this is the type of market where you buy a logical low and hope that a rally ensues or else don’t blindly chase the reactions.

-

There could well be another shoe to drop after a bounce plays out. Let’s watch sentiment and macro indicators to gauge the proceedings.

-

Market Internals: The few divergences we had, like those noted in the Semi sector manifested in a hum dinger of a correction. Now the market is finally in motion with herds running every which way. You can’t ask for better if you are like me. A market in a robo trend or melting up day after day is not fun. A market that is running on emotion and becoming volatile in both directions… is. When things smooth out we’ll again gauge internals.

-

3 Amigos: Stocks vs. Gold got whacked from a point lower than the ultimate target allowed for by the monthly chart. Let’s keep open minds both ways here and go week to week. 10yr yields are essentially at target and 30yr dwells below target, all with Gross & Dalio plastered across the media as poster boyz of the new bond bear (that isn’t quite yet). The yield curve unsurprisingly steepened with the market disturbance but remains in a long-term flattening trend.

-

Amigos bottom line: no confirmations of trend changes yet.

-

Global Stock Markets: In some cases egregiously overbought and correcting, like

the US. Also subject to bounce potentials like the US.

-

Commodities: USD-centric ‘Inflation trade’ still alive because USD is still bearish on its larger trends, despite bounce.

-

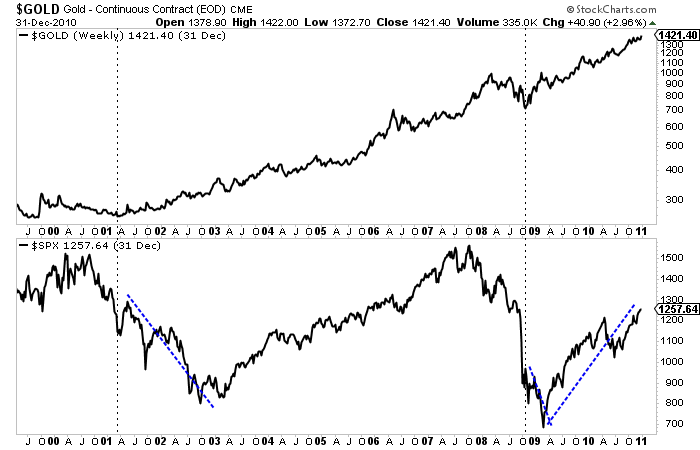

Precious Metals: Sector’s best ‘epic buy’ (ala Q4 2008) would be if the ‘inflation trade’ ends in global liquidation and the sector gets wiped out. But if stock markets are taking the 1st of more hits to come, this would be very supportive and if gold at least holds its own vs. commodities and silver leads gold, so much the better. Constructive here even if an inflationary phase grinds along.

-

Currencies: USD bearish but bouncing.

-

Sentiment: Sentiment got cleaned very well last week, to the point where a solid bounce across asset markets is not only possible, but likely. Friday’s reversal may have been the start. Let’s see how the pig comes out of the gate early this week.

US Stock Market

SPX and its fellows made an A-B-C correction (i.e. short-term down-up-down whipsaw) in micro time last week. The SMA 200, per the SPX chart is generally the line in the sand that sparked Friday’s bullish reversal. SPX has 2 significant gaps, one as noted above in the mid-2800s and the other as noted in an update in the mid-2400s.

Double Click For Larger Image