Stocks & Equities

What goes up, must come down. And it was finally the stock market’s turn to take some profits aside. Friday’s 2.13% decline in the S&P 500 was the bookend to a week’s drop of 3.86% – all while the majority of companies this week produced positive earnings and sales surprises. The correction this week served as a bearish engulfing pattern on the weekly chart, a reversal pattern of some renown.

No news event, no central bank catalyst, and no bubble bursting caused investors to sell this week. Merely, selling begot selling. Post the election in 2016, we haven’t had a 3% drawdown in the S&P 500. Looking at the counter, it has been essentially 311 trading days from the last 3% drawdown. So reversion to the mean is the name of the game.

The news this week could have fueled the advance further but it did not. Of the 251 companies that have reported their fourth quarter 2017 earnings, 80% have beaten sales estimates and 75% have beat on earnings estimates. The number of companies reporting sales surprises is record-setting with the 5-year average at 56%. The materials sector has had the largest upside surprise from estimates, at around 11%, while energy has had the largest downside difference between actual and estimated earnings, at -12%. The last report I read from FACTSET showed the earnings growth rate for Q4 stands at 13.4%, up from the estimated rate of 11% on Dec 31. Analysts are projecting S&P 500 earnings growth of 16.8% for the full 2018 year; that’s up from 12% at the beginning of the year as more companies have increased their guidance as a result of the reduction in corporate taxes.

So earnings are strong to very strong just as Seth Davis described his portfolio in the movie Boiler Room (2000): “Investors are selling stocks because earnings were better than expected.” Would make zero sense this week but that’s essentially what happened. Stock valuations are high, and it was time that a pause takes place in an otherwise uninterrupted advance in stocks.

The US stock market is mean reverting. The trend accelerated higher in January and the release valve was needed. It’s here now. With the kind of momentum we’ve seen, it’s very difficult to say that the bullish trend from November 2016 can end this immediately. A bearish reversal is formed when the bulls fail to rally prices to a higher high in the month to come. Calling a top here would be premature. In the article, Records Were Made to Be Broken, Chris Puplava showed in a study he did that the average returns for the S&P 500 from 1928 to today after the weekly relative strength indicator hit 80 were 4.23%, 8.46%, and 13.63% looking at forward returns 3, 6, and 12-months after the event. Momentum like we’ve had, without the parabolic move, usually paints a positive outlook for returns in the near future. So as we revert, don’t hit the red alert.

That said, certain stocks are trading in parabolic moves, many standard deviations away from their 200-day moving average. In such cases, it would be hard-pressed to say such moves could be prolonged so take precautions to set stop losses. Setting stop losses is just good unemotional risk management. As Steve Nison, a valued technician who formalized Japanese Candlesticks in the US through his books says, “all long-term trends begin as short-term moves”. The crystal ball is cloudy. Though the economy is strong, and Treasury yields have been rising on those terms, nobody knows at which point the top will show up.

For more information about Financial Sense® Wealth Management, our investment models, or investment services, click here to visit our website.

Solar Minimum Continues

January’s Sunspot count came in at 6.7, which was down from December’s 8.2. The following chart includes the latest post and covers Solar Cycle 24.

The high was 145 in February 2014, which compares to the high of 238 in September 2003.

With the decline in solar activity, the number of Spotless days continues to grow. It’s the way it works. So far, this year there has been 17 days, or 52% for the year. In all of 2017, the number was 104 days or 28% and the year before it was 32 days or 9%. For 2015 the count was zero, as it essentially was back to 2010.

On the weather front (pun not intended), there has been a brief warming in the El Nino region, which shows in the next chart.

The main thing is that on the longer-term, the El Nino and its warming influence is waning.

Cosmic Stuff

As solar activity diminishes the Earth’s magnetic field also diminishes. This lets more cosmic rays through, which prompts more clouds. This not only increases the probability of precipitation. By reflecting more of the sun’s energy to outer space it forces cooling.

This influence is beyond weather, it is climate and it is changing. The current part of the decline has yet to bring the average temperatures down. It will.

The chart below shows the steady rise in cosmic radiation as the sun’s activity declined. It begins in 2015 and the feature is the decrease in cosmic radiation with a strong, but brief solar outburst. So the concept works on the nearer-term.

The theory about cosmic ray influences is gaining widespread acceptance.

The next chart is from the Danish Met and it shows the brief surge in the mean temperature. The current number is not down to the mean for this week. Thank heaven for small mercies. However, the restoration of the mean is now probable.

Danish Met: Arctic Mean Temp

Source: Ice Age Today

Unusual Weather Reports

From the Northern Hemisphere:

“First Snow in 50 Years Paralyses Southern Morocco” – January 30.

Then from the Southern Hemisphere:

“Summer Blizzard in Tasmania” – January 31.

Wherever it occurs snow needs clouds and cool.

Northern Hemisphere Snow Content

Part of the season was at the high-side of normal. Lately it is in the middle of normal.

This, of course, depends upon cold and precipitation. The following link to the Great Lakes Ice Cover shows a material increase for this season.

Readers are invited to contemplate the establishment’s insistence that expanding ice and snow cover is caused by Global Warming.

Have a Happy Groundhog Day.

Great Lakes Ice

Global Temps: Satellite

Source: Dr. Roy Spencer

• Highlights Are the El Ninos of 1998 and 2016

Link to January 26, 2018 Bob Hoye interview on TalkDigitalNetwork.com: https://www.howestreet.com/2018/01/26/equity-markets-have-taken-on-a-life-of-their-own/

Listen to the Bob Hoye Podcast every Friday afternoon at TalkDigitalNetwork.com

In this past weekend’s missive, I discussed the recent market sell-off:

“Well, this past week, the market tripped ‘over its own feet’ after prices had created a massive extension above the 50-dma as shown below. As I have previously warned, since that extension was so large, a correction just back to the moving average at this point will require nearly a -6% decline.”

Chart updated through Monday

Before turning to the action I would like to put where we are in the “everything” bubble into perspective, as I had an insight this weekend, which everyone else may already have thought of, but it was new to me so I thought I would share it…

Before turning to the action I would like to put where we are in the “everything” bubble into perspective, as I had an insight this weekend, which everyone else may already have thought of, but it was new to me so I thought I would share it…

The Weakest Links…

When the stock bubble burst in March 2000, it was the most speculative elements with the highest imagination potential — i.e., the dot-com stocks — that signaled the end of the mania when they broke. Similarly, in the real estate bubble,

…also from King World:

James Turk – Phase 2 Will Pave The Way For $11,000 Gold

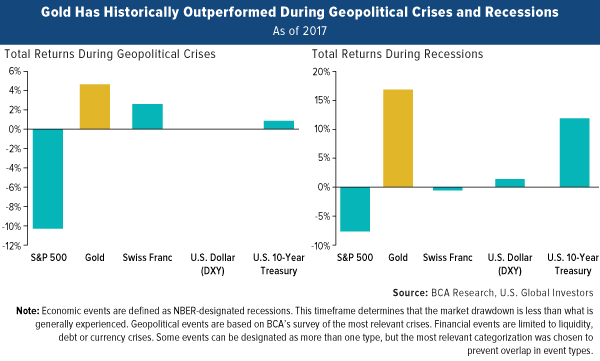

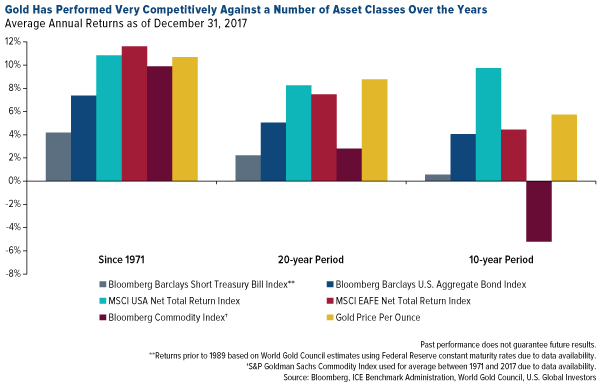

Monday’s monster stock selloff is exhibit A for why I frequently recommend a 10 percent weighting in gold, with 5 percent in bullion and jewelry, the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

Monday’s monster stock selloff is exhibit A for why I frequently recommend a 10 percent weighting in gold, with 5 percent in bullion and jewelry, the other 5 percent in high-quality gold stocks, mutual funds and ETFs.