Timing & trends

The World Outlook Financial Conference is just 3 days away and I can hardly wait. The track record has been amazing, from predicting the 2014 peak in oil and subsequent fall, to recommending the nascent marijuana industry at the same time. We called the massive move in real estate in Vancouver in February, 2010 – the bottom on the stock market in March, 2009 – we even recommended Bitcoin Trust last January.

Obviously great money making forecasts, but there is one prediction made in the fall of 2012 and repeated at every subsequent conference that is more important than all the others. I’m talking about forecasting the huge up-move in the US dollar and the accompanying weakness in the loonie. I say more important not just because you could have exchanged the Canadian dollar for the greenback, put it under the mattress and made 30%, but for three other significant reasons.

- A strong US dollar means money is coming into the US from all over the world, which is a significant factor in propelling the stock market to record highs.

- Any sustained recovery in the devastated commodity market, especially gold, is next to impossible with a strong US dollar.

- Trillions in US dollar denominated debt issued by foreign governments would be much closer to default with the increased strength in the greenback.

There are other reasons because the US dollar is the world’s reserve currency but let me get to what’s going on today.

My Big Question

Is the current weakness in the US dollar indicating the major trend has changed, bringing the greenback inexorably lower over time? Because if the major trend has changed all of us have to act because it reverses the major investment moves of the last six years.

A weaker dollar would mean higher commodity prices. It would probably result in lower bond prices as money leaves the US. Stocks would go down on the short term as money leaves the States. It would mean the price of all US real estate holdings would drop in Canadian dollar terms, which may be of big interest to investors with properties in Palm Springs, Phoenix and Florida.

I’ve always said – if there is only one thing to get right in investing – it is the direction of the US dollar. So not a big surprise that I want to know if the major trend has changed and the US dollar is about to go down OR if this is simply a correction and a chance to exchange more money into US dollar while the loonie’s up.

The good news is that we’ve got some of the top analysts in the world at the conference to help with the answer. Jack Crooks, well known currency expert will join James Thorne, billionaire money manager and Martin Armstrong, who’s been called the top forecast in the world.

Great people to have in your corner, and as I said, the answer is essential for your financial well being.

Of course, there are lots of other reasons to attend the conference. Josef Schachter is hosting a special program on oil and gas. Josef correctly predicted the recent rise in oil and gas stocks and we’ll get a chance to find out what he thinks now. Should we take profits or take bigger positions?

Ryan Irvine will give his World Outlook Small Cap Portfolio, which has returned double digits every year – although that’s no guarantee of future success – but I like our odds. I’m really looking forward to getting the latest from Mark Leibovit on the marijuana sector, given he was the first one to recommend it nearly 4 years ago. And for the first time, BT Global’s Paul Beatty is coming and I guarantee that when he recommends a stock I’ll be taking notes.

I appreciate that spending Friday and Saturday at the World Outlook Conference is not everyone’s cup of tea – maybe you have shopping to do or TV to watch – but I guarantee you’ll be missing out. Big things are happening that we can’t afford to ignore – at least if our financial future is important.

We have only 61 seats left – so don’t hesitate. Your financial future is worth it. And please come up and say hi at the conference.

Sincerely,

Mike

PS To get tickets or a subscription to the archive video click on the link below.

Ed Note: Since Martin Armstrong wrote a post in his blog January 29th predicting a January correction the Dow has dropped 646 points from is January 29th opening tick. Martin writes a followup and clarifies his correction thinking in the blog posting Jan 31st below: MoneyTalks Editor

COMMENT: OK Mr. Armstrong. Looks like the government was right. You come out and said the Dow reached a turning point and it crashes. You posted: “In the US Share Market, this is now a turning point we have reached. I have warned for months that exceeding the November high would lead to a January high.” You are too influential.

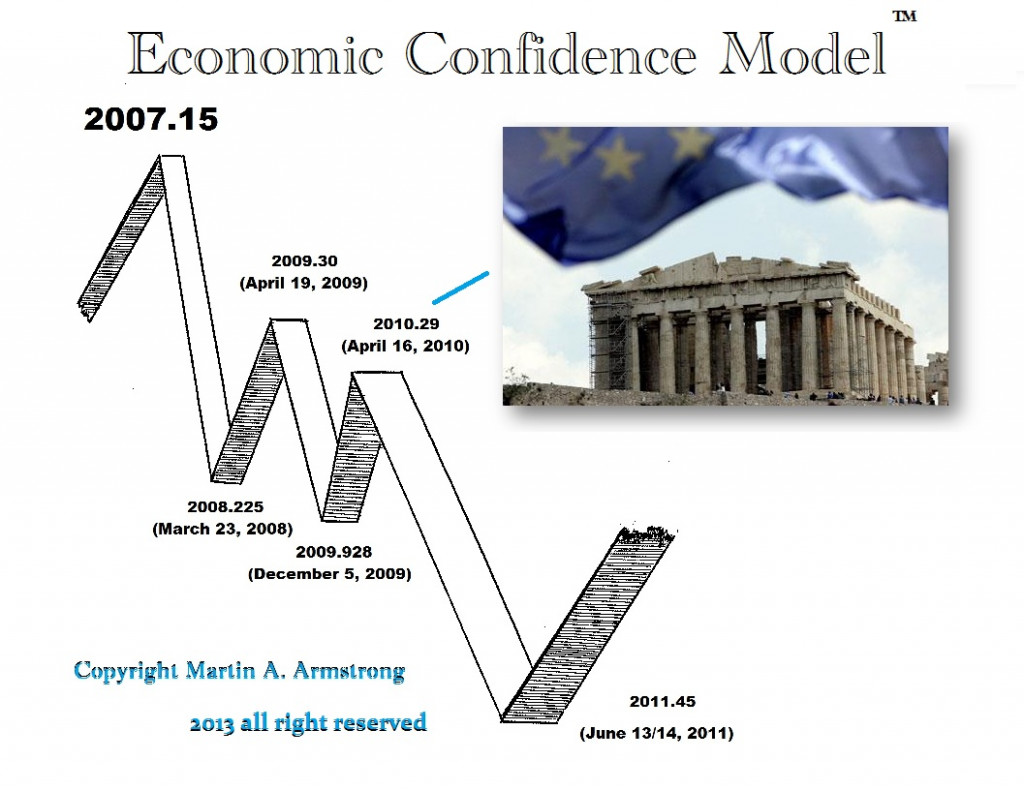

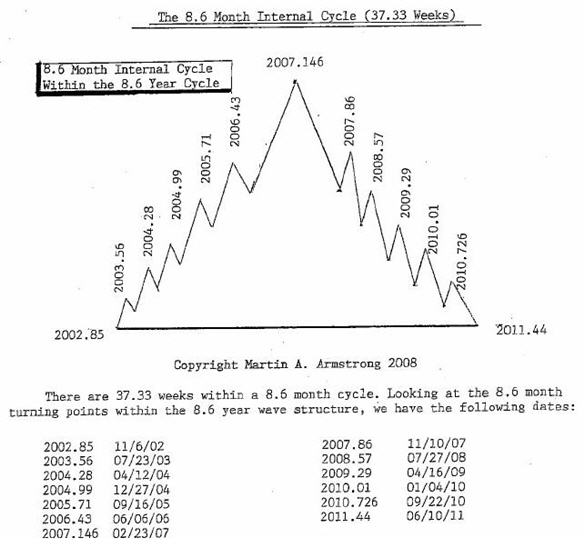

REPLY: Or perhaps our models are correct. This nonsense that people can move the market is absurd. Governments have spent trillions and failed. Why is it I am the only person who can move the world? Does a tree make a sound when it falls in a forest even when nobody is there to listen? They tried to silence me yet it still did not matter. Here is the internal 37.33-week cycle within the Economic Confidence Model. The target date 2007.86 was November 9th/10th. It was November 9th, 2007 that all four Daily Bearish Reversals were elected from the major high. Why do things take place precisely to the day even when I do not announce them?

So far, we have elected the first Daily Bearish Reversal. There are three more to go before we can say we are headed into a March low. Time will tell. It should be choppy for the next couple of weeks. When you gap lower like this, you normally will bounce and eventually fill that gap. So caution is always advisable.

The first high was the precise day that the Real Estate market peaked in 2007. They called that Armstrong’s Revenge on the trading floor that day since it was again to the day. That was precisely to the day of which the same calculation produced the very day of the low during the 1987 Crash. Markets peak and bottom in sync with our models around the world even when I do not mention them. Even Greece petitioned the IMF for help precisely on the turning point. Then on the very day, Russia entered Syria on 2015.75. These events are all the same model and the calculations are cast in stone.

Sorry – there is just something beyond the surface that warrants our attention. These dates are not random. They cannot be fudged. You can blame me, but they have existed before my time and will continue beyond my lifetime.

Many are the metaphors used to describe the agent that initiates a major crisis. Light the fuse, or pull the trigger, pull the rug out from under the room, or pull on the string for unraveling the sweater, these are commonly heard. What comes soon is the Bonfire of the Vanities, a term the Jackass prefers since irony is thick. Hardly the burning of objects deemed as tempting toward occasions of sin as in the 15th Century. In the present-day case, the burning would be of the massive piles of paper assets the US Federal Reserve has been illicitly supporting for the past several years. The bonfire would be of falsely valued heaps of paper. If truth be known, the Quantitative Easing was put in place in 2012 when the big US banks were all in danger of failures. They required amplified liquidity infusions in order to prevent these giant silos of insolvency from entering financial failure. Their huge bond holdings were supported. Generally, when insolvency meets illiquidity, big failures occur. The USGovt and USFed colluded to prevent the entire set of Wall Street banks from failing like Lehman Brothers did. They all had the same ugly insolvent traits. Few tell the story correctly, but Goldman Sachs and JPMorgan suffocated Lehman to death. Lehman did not fail without help. Like Chief Justice Scalia, Lehman was suffocated in a bed of unpaid bond sales. What comes next is a nasty corrosive dangerous sequence of financial market crises, where pumped paper assets suffer notable declines. It will include the stock, bond, and currency markets. The last times all three suffered simultaneous declines was 1979 and 1987. Add soon 2018.

GLOBAL SYSTEMIC LEHMAN EVENT

What comes next is what the Jackass has come to call the Global Systemic Lehman Event. For ten years, the Powers that Be, namely the banker cabal, have been supporting the entire global bond market in almost exactly the same manner as they supported the mortgage finance market in 2005 through 2007 before it erupted. The subprime bond market crisis of 2008 will be repeated, but on a global scale which includes major sovereign bonds. Recall that Greenspan justified the off-loading of risk, and Bernanke justified the asset backed bond market as sound. They were both wrong, both heathen heretics. It can accurately be said that these top-rated sovereign bonds are all subprime, with horrendous fundamentals led by grand deficits and economic recessions.

The entire Western world bond market and stock market has subprime traits. The worst offender is the United States, with its $550 billion annual trade deficit, expected to go over $600 billion this year. The USGovt deficits have been running regularly at over $1.0 trillion each of the last three years, despite fanciful adjustments and clever line items in perverse one-off attempts to conceal reality. New military budget additions and tax reforms will ensure a larger federal deficit this year, unless and until the nation enjoys a renaissance of re-industrialization with 100 thousand new businesses formed and several $trillion invested. Not likely.

WARNING SIGNALS

Warning signs are numerous. Consider the Money Velocity index, the flattened Treasury Yield Curve, the junk bond index, the pension fund shortfalls, the business defaults, the high leverage in big bank bond portfolios, and the growing automobile bond market travesty that features a full repeat episode of the subprime mortgage market. The USFed is more guilty of heretical monetary policy with each passing year. In the last several months, they have seen fit in their dim vision to support (rig) the actual measures that give warnings and alerts, like the VIX volatility index. For the last two years, the central bank has been buying US stocks with both hands using their Wall Street partners in collusion. For the last four years, the central bank has been supporting (rigging) the Treasury Inflation Protected Securities (TIPS) bonds, in order to silence the price inflation warnings. Of course, the USFed justifies their actions in silly ways, but they are trying desperately to conceal the vicious chronic economic recession by putting fingers in the dike holes. As partner in crime, the Euro Central Bank has been supporting corporate bonds, like in a division across the Atlantic Ocean of criminal labor initiatives. All the while, the standard economic statistics for economic growth, price inflation, and unemployment continue to be grossly falsified. The Fascist Business Model has not only gone haywire, gone totally mad, but broadened its reach. Next comes a reality check.

However, the two biggest warning signals are the flat yield curve and the rising long-term bond yield for USTreasurys. To begin with, imagine a supported (controlled, rigged) bond market for the 10-year USTreasury Bond Yield with the full power of the QE bond purchase program. It is failing to stop a widely recognized recession warning signal. This time it is from a rising short-term bond yield, combined with a rising long-term bond yield simultaneously. The USFed rate hikes are responsible for the short end, while global USDollar rejection is responsible for the long end of maturities. The Jackass has been adamant, and mostly (not completely) alone in heralding that the QE might be financial stimulus but it causes capital destruction in an unavoidable deadly manner. QE is wrecking the USEconomy on Main Street while providing a party-like atmosphere on Wall Street.

FUSE, TRIGGER, STRING

The fuse to light the financial market bonfire is the USTreasury Bond market, in particular the long-term maturity. Much of the various market run-ups over the course of the last two to three years have been predicated upon the ultra-low interest rates. They are kept down by USFed pressure, using QE with strong support by the Exchange Stabilization Fund (ESF). That is the multi-$trillion fund managed by the USDept Treasury, for the purpose of controlling several very important financial markets in the West. There are no free markets anymore, not since 9/11 and the installation of the fascist bankers at the helm. They committed the terrorist crime, sacked the World Trade Center giant bank, installed the Patriot Act, captured the $700 billion TARP Fund, and have controlled the USGovt ever since. It is all a crime scene, a coup d’etat, with cover provided by the lapdog corrupted press networks. Former actor, wrestler, and governor Jessie Ventura tried to run a cable show to reveal the 9/11 crimes, but his life was threatened and he quit the program.

The ESFund is the control center for fabricated USTBond demand, using the nifty Interest Rate Swap contract. It balances short-term versus long-term securities, and coupon versus cash types, to create mythical bond demand. The USGovt steps in to declare wondrous bond rallies, like in 2011 for that historic rally which was built upon $8.5 trillion in IRSwaps clearly evident by Morgan Stanley on the OCC Reports. The Office of the Comptroller to the Currency reports are rarely read by market mavens, but it shows the rigging very effectively. Lastly, the rise in the stock market usually indicates an imminent economic revitalization and growth period. But QE distorts it all. The typical Fed Valuation Model calls for higher stock indexes as a result of low interest rates. In past cycles, the model was effective, but that was before QE and the multi-$billion bond monetization program that has been firmly in place for six years. The entire set of big Wall Street banks join the bandwagon, and rely upon the faulty valuation model. We were told QE would be temporary, like for six months. The Jackass instantly declared in 2011 that it would be permanent, just like the Zero Rate Interest Rate policy. Third World fundamentals and absent bond buyers dictated desperate measures. It should be noted that the QE bond program is unsterilized hyper monetary inflation. No bond removal is done as compensatory drainage. It is pure inflation of the worst kind, deemed good by the heretics behind the curtain.

LIT FUSE IN PROGRESS

The USTreasury 10-year yield is on the verge of a breakout. Interest rates are rising, and could cause tremendous damage, starting with the stock market. The USFed balance sheet is loaded for massive losses, from USTBonds bought at low rates. If and when TNX goes above 3.0% on the all-important bond yield, the S&P500 and Dow Jones Index will turn down hard and scream of a major stock market decline. For yet another rare moment in US history, the US-based stocks, bonds, and USDollar will all go down in unison. No counter-balancing will be seen this time, not in this correction from historical abuse. Maybe not all in unison at first, but later soon for certain. The great QE unwind is upon us, within view. It has even been given a name in the financial press recently, Quantitative Tightening. The policy of tightening after such pervasive monetization of financial assets is lunatic and certain to cause a crisis.

Look for Gold & Silver to be the object of safe havens as the financial crisis elevates in pitch. Both precious metals already have begun to respond very favorably, with Gold comfortably over the $1300 level and Silver comfortably over the $17 level. Both precious metals have endured a long basing process, amidst unspeakable corruption in paper gold and paper silver games framed within a grand charade. Neither can be held back any longer. The Global Financial RESET will be urgently put into motion, jumping up a gear in activity and intensity. Ironically, expect in several months that the East will be invited to help stabilize matters. They will comply, but on condition the Gold Standard is re-instated.

DIRE CHART PATTERN

The Jackass adds a few points, first on the technical chart and then on the pessimistic viewpoint toward the vile banker sector. Notice a severely dangerous looking chart, with a Head & Shoulders reversal pattern evident, and a slight upward bias in addition. A secondary H&S reversal has reached completion over the last several months, adding propulsion for completing the major H&S reversal. The secondary pattern hit its 2.7% yield target. It is a highly reliable pattern in general. The recent move above the 2.60% key resistance level with gusto could continue to provide impetus in pushing the USTreasury 10-year yield (TNX) above the 3.0% level. That would cause severe problems, and issue loud dire signals. It would pop and pinprick the S&P500 stock index and the Dow Jones Industrial Average. They are an accident waiting to happen.

The Head & Shoulders reversal target calls for an upward move in the neighborhood of 3.4% to 4.0% incredibly, as the great unwind is near, for both stocks and bonds. The more conservative 3.4% target pertains to the basic H&S pattern without considering its upward bias tilt. The more aggressive 4.0% target pertains to the more liberal interpretation when taking into account the positive upward bias evident in the entire chart for four full years. Refer to the two long parallel lines at the neck and shoulder levels, each with upward slope. Either way, the move toward the 3.5% area will cause tremendous grief and lead to significant publicity. Expect a major stock market decline, together with a major bond market decline, the worst of both worlds. Two declines simultaneously under the King Dollar banner will signal ignominious light.

The fundamentals ride directly beside the dire technicals. 1) The USGovt deficits are rising fast, better described as exploding higher. The trade gap is rising also to truly dangerous levels. 2) The USGovt stands at risk of shutdown over the debt ceiling issue. Foreign governments are moving away from the USDollar in bank reserves AND in trade payments. The USGovt continues in its sanctions, enforced via SWIFT channels. 3) The Eurasian Trade Zone is seeing major coalitions forming, with a united front toward the return to the Gold Standard. 4) As the Petro-Dollar continues is fracture and demise, the broken pieces like Saudi Arabia will take up alliance with China. Sales of Saudi crude oil in RMB terms will be a major event, coinciding with a USDollar index decline and a TNX yield sudden rise.

WALL STREET SCUM CENTER

The Wall Street controllers will lose control in a magnificent QE unwind. They built a gigantic monster, using the QE largesse at the USFed. They have produced multi-year unsterilized hyper monetary inflation, whose bitter consequences are soon to arrive. In no way can they clear up six years of QE with tons of hidden actions, in the biggest QE extravaganza of monetary abuse in modern history. The USFed balance sheet is poised for magnificent wreckage, possibly leading to its bankruptcy and final end of debt slavery rule.For them to add stocks and crude oil to their list was insane, deadly, and reckless, with huge consequences eventually. The time is like right now!

TREASURY SPREAD SIGNAL AS FOOTNOTE

The last time the USTreasury Yield Spread went almost totally flat was immediately before the 2007-2008 subprime mortgage crisis. It served as the key signal, and accurately so, for what was to come in the following several months. The same warning signal is now flashing red, but it is not being given much attention. The record setting stock market, and quick advances by 1000 points, and new era are catching the headlines. Market internals defy the ballyhooed story. This too will end badly. In the busy chart below, the purple series is the Fed Funds target rate. The black series is the spread between 2-year yield versus 10-year yield. The blue series is the spread between 5-year yield versus 30-year yield. Both are heading toward zero, where the red alarm will flash with sirens for all to hear.

Get back to me in a year’s time to see how effective this entire collection of warning signals is in forecasting a crisis, dead ahead. They were very accurate and effective in the year 2007. The Jackass expects the same here and now. China and the Eurasian Trade Zone will take great advantage of the unfolding financial crisis to usher in the Gold Standard. It will become their standard for trade payment and infra-structure project payment. In response, they will revise their banking reserves system to reflect this change. They will shed USTreasury Bonds, add Chinese Govt RMB-based bonds, and add Gold bullion. The Gold Standard will first arrive in trade payment, then in banking reserves management, and last in currencies. It is finally happening after a long wait and much preparatory work in the East.

HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

home: Golden Jackass website

subscribe: Hat Trick Letter

Jim Willie CB, editor of the “HAT TRICK LETTER”

Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. The historically unprecedented ongoing collapse has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the

Towards the end of financial bubbles, people who previously paid little attention to things like “quality” start trying to figure out what they actually own. The result is either funny or terrifying, depending on the point of view.

This time around bonds are (finally) getting a closer look. From today’s Wall Street Journal:

Decade of Easy Cash Turns Bond Market Upside Down

Debt deals set records from Tajikistan to East Rutherford, N.J., as investors keep hunting yield.

Last fall, a hydroelectric dam in Tajikistan, the government of Portugal and a cruise-ship operator all issued debt at unusually low interest rates. The seemingly unconnected deals are part of a proliferation of aggressive bond sales influenced by a decade of loose monetary policy and a demographic shift in global investing.

Historical limits on who can borrow, and at what cost, have broken down as fund managers agree to previously unpalatable terms.

Central bankers in the U.S., Europe and Japan helped shape the new breed of deals by simultaneously purchasing over $1 trillion in high-quality bonds since 2009 and lowering benchmark interest rates to jump-start their faltering economies. Modest economic growth came, but the strategy crowded private investors out of safe debt, prompting them to buy riskier bonds to boost returns.

Retiring baby boomers amplified the trend by moving their investments away from stocks into bonds, boosting assets in U.S. bond mutual funds to $4.6 trillion in November from $1.5 trillion a decade earlier, according to the Investment Company Institute, a trade group for investment firms.

The article goes on to present some examples of bonds that might not exist in less bubbly times. Here are three:

- Tajikistan borrowed $500 million to finish construction of a hydroelectric dam that was started under the Soviet Union. This is one of the world’s most corrupt countries – a fact noted in the offering prospectus — and the dam’s electricity will be sold to Afghanistan, which, as most Americans know, is in the middle of a civil war that the “good guys” might easily lose (also mentioned in the prospectus). The deal’s investment bank, Citigroup, initially marketed the bonds to yield 8% but received such a warm welcome that it cut the rate to 7.1%. Buyers included big U.S. firms like Fidelity, which bought $14 million of the bonds, presumably to boost the yield of funds sold to retirees.

- The American Dream Mall in East Rutherford, N.J. broke ground in 2003 but ran out of money to finish construction. In 2017 the mall’s current owner—its third—employed Goldman Sachs to sell $1.1 billion of 6.9% muni bonds, fully half of which were bought by the Nuveen fund family. “Unlike most malls, American Dream will derive most of its revenue from experiential attractions that can’t be replicated online, rather than depending on retailers,” said a Noveen executive.

- On Nov. 8, Portugal sold €1.25 billion ($1.55 billion) of 10-year bonds that yielded 1.94%—the lowest rate ever for the country. Portugal needed an international bailout in 2011 and still has a junk credit rating. It’s one of the most heavily indebted countries in Europe, but the auction set its borrowing cost below that of the U.S. government, which sold 10-year bonds in November to yield 2.31% [those bonds now yield 2.7%].

What does all this mean? In a nutshell, crazy stuff has been happening under the placid surface of the fixed income market. None of the three bonds profiled here are especially good bets, and retiree and pension fund portfolios are full of similarly toxic paper.

When a few such deals blow up – as bubble assets always eventually do – investors will start wondering what’s going to blow up next. And they’ll find not just a few but many, many bad ideas lurking in their “low risk” accounts. The resulting stampede for the exits will look familiar to anyone who lived through the tech stock and housing busts of previous decades.

With one big difference. This time around crappy, crazy paper is not just in tech stock and ABS portfolios. It’s everywhere. Trillions of dollars of sovereign debt will tank along with the sketchy shopping mall and emerging market infrastructure bonds. The resulting bust will be more broad-based and therefore way more interesting than anything that’s come before.

–

–