Two big themes last week at Inside ETFs, the Comic-Con of exchange-traded funds attended by more than 2,300 advisors and investors, were innovation and disruption. Like all other industries, the investing world has seen its fair share of disruption in the past quarter-century—think indexing, passive investing, the rise of robo-allocation and now blockchain and cryptocurrencies. This year marks the 25th anniversary of the first ever ETF, and today total ETF assets top $3 trillion. That’s a far cry from the estimated $40 trillion sitting in mutual funds worldwide, but exchange-traded funds are rapidly catching up as investors seek cheaper, more innovative and tax-efficient instruments.

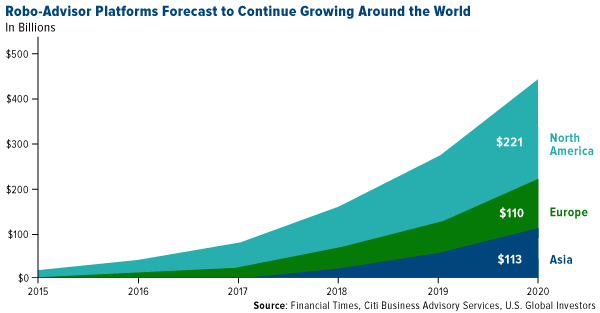

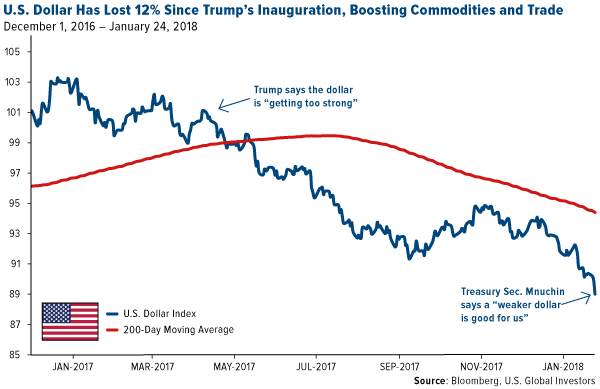

Consider robo-advisors, which emerged only 10 years ago. Who would have thought in the mid-2000s that so many investors would be comfortable enough with the idea of a machine managing their money? And yet here we are. By 2020, Citi analysts predict, assets controlled by robo-advisors could reach close to $450 billion globally.

click to enlarge

click to enlarge

Disruption was definitely top of mind during many of the presentations and interviews at Inside ETFs, including that of producer and composer Quincy Jones, who was at the conference to promote a new stock index that tracks music and entertainment companies. “Q” is the very definition of a legend, having been at the center of some of the most influential musicians, actors, and artists over the course of his long career. With a record 79 Grammy Award nominations to his name, he’s made an indelible impression on the music, television, and film we all consume and enjoy, whether we’re aware of it or not.

When CNBC’s Bob Pisani asked Jones if he was ready for the day when robots write and perform music, the 84-year-old Jones said, “You can’t stop the technology,” adding that he was among the earliest experimenters of synthesizers. (Anyone remember the synthy theme song to the old 1960s-1970s detective show, Ironside? That was composed by Quincy Jones.)

“You got to always stay curious. You got to be willing to take a chance,” he said.

A similar forward-thinking attitude was expressed by Serena Williams, who was also in attendance. The tennis virtuoso and four-time Olympic gold medal winner, who bagged her 23rd Grand Slam last year while pregnant, is a savvy businesswoman in her own right, sitting on the board of online survey firm SurveyMonkey and Oath, a subsidiary of Verizon that controls a number of media outlets such as HuffPost, Yahoo and Tumblr.

When asked why she was drawn to tech firms in particular—her husband Alexis Ohanian co-founded Reddit—Williams said, “This is a new time, and I don’t want to be left behind.”

I couldn’t agree more with Jones and Williams.

Embracing Disruption with HIVE Blockchain Technologies

Curiosity and a willingness to embrace change and innovation are what led me to invest in HIVE Blockchain Technologies and agree to become its chairman last year. As many of you know, HIVE is the first publicly-traded company engaged in the mining of virgin digital currencies, including bitcoin, Ethereum, Litecoin, Dash, Monero and many more.

I’m thrilled to be at the forefront of this new technology that’s already disrupting our industry and reshaping how transactions are made and companies raise funds across the globe. The year 2017 was the real catalyst, bringing cryptocurrencies into mainstream conversations as bitcoin hit an all-time high of nearly $20,000 apiece in mid-December.

Total crypto market cap briefly cracked $830 billion earlier this month yet has since receded to around $540 billion, with strong pressure being exerted by the global equities bull market. A record $33.2 billion flowed into stocks in the week ended January 24, according to investments data provider EPFR Global. U.S. stocks alone attracted $7 billion, while emerging markets saw inflows reach $8.1 billion, the second-highest amount recorded in a week.

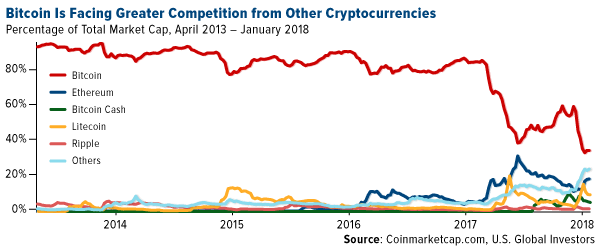

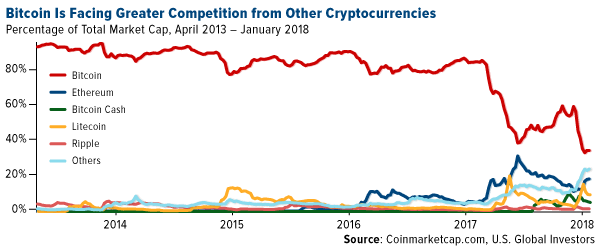

Competition among digital currencies is also heating up. Although bitcoin remains the top dog, it faces tough competition from the likes of Ethereum, Litecoin, Ripple and the other nearly-1,500 coins on the market today. It now accounts for about 40 percent of the entire market, down from almost 100 percent just a few years ago.

click to enlarge

What’s important to remember is that digital currencies are, at the moment, highly volatile and speculative. Unlike gold and other hard assets, they haven’t been tested in all economic backdrops. Bitcoin was created only in 2009, after the worst months of the financial crisis, and it’s existed mainly in an environment of rising equity prices and gradually improving economic conditions. How investors might use it in the next recession or major market correction is unknown at this point.

Coinbase Generated $1 Billion in Sales Last Year

Having said that, the crypto space is rapidly maturing in a number of different ways. Every day, more and more businesses accept the currency as a form of payment. Investors can now buy bitcoin futures. Fidelity and USAA both allow account holders to monitor their cryptocurrency holdings. Blockchain ETFs are appearing on the market—though a couple of proposed bitcoin ETFs have hit roadblocks getting approval from the Securities and Exchange Commission (SEC). And I overheard at the Canaccord Genuity Blockchain Conference in Toronto last week that as many as 10,000 millionaires have been created from Ethereum.

Last year, the cryptocurrency trading platform Coinbase booked $1 billion in revenue, almost double what company executives had expected for 2017. Founded only six years ago and boasting more than 13.5 million accounts, Coinbase has recently closed the door on any additional venture capital, leaving investors to hope for an initial public offering (IPO) sometime in the near future.

Coinbase is about to face some serious competition, though, as smartphone-only trading app Robinhood will begin allowing customers to trade bitcoin and Ethereum next month—all commission-free.

World Gold Council: Cryptocurrencies Are No Substitute for Gold

Several attendees at Inside ETFs and the blockchain conference raised concerns that cryptocurrencies are on a path to replace gold as a safe haven investment. I’ve mentioned multiple times before that I do not see this to be the case, for a number of reasons. Unlike bitcoin, gold has thousands of years’ worth of history to justify its role as a currency and store of value. Central banks own gold, as do institutional and retail investors. It’s widely used not just as money but also as jewelry and in dentistry and electronics. The metal, in fact, can be found in the very computer hardware used to mine bitcoin.

Now, in a new report, the World Gold Council (WGC) takes the position that, while cryptocurrencies and blockchain technology are attractive, they simply don’t and can’t usurp gold’s place in investors’ portfolios.

What’s more, “there isn’t any quantifiable evidence that gold holdings are directly suffering from competition from cryptocurrencies,” the WGC writes.

Need proof? According to the group, bitcoin currently trades around $2 billion a day on average. That’s less than 1 percent of the $250 billion in gold bullion that’s traded every day. Remember, gold is one of the most liquid currencies in the world, with a highly developed and accepted market structure.

There are several other important differences between the two asset classes, and I highly recommend you read the full report. You can do so by clicking here.

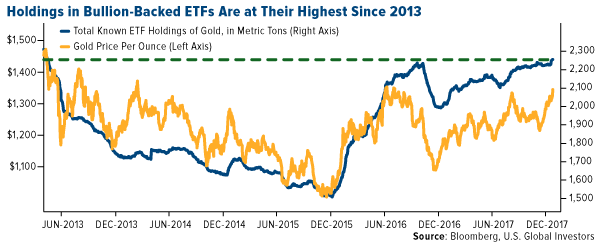

Investors Pile into Gold-Backed ETFs Ahead of Potential Jump in Inflation

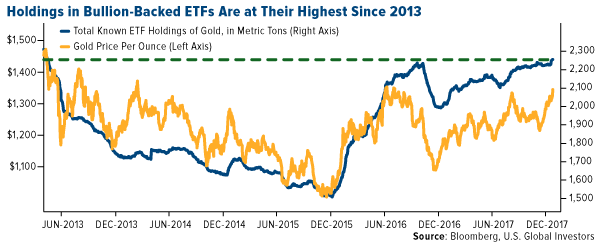

Coming back full circle to ETFs, Bloomberg reported last week that holdings in gold bullion-backed funds rose to their highest level since 2013 on a weaker U.S. dollar, rising geopolitical risk and growing expectations that inflation could finally heat up in 2018.

Holdings climbed to 2,250 metric tons earlier last week, the highest amount since May 2013, when gold prices were still in the $1,400 to $1,500-an-ounce range.

click to enlarge

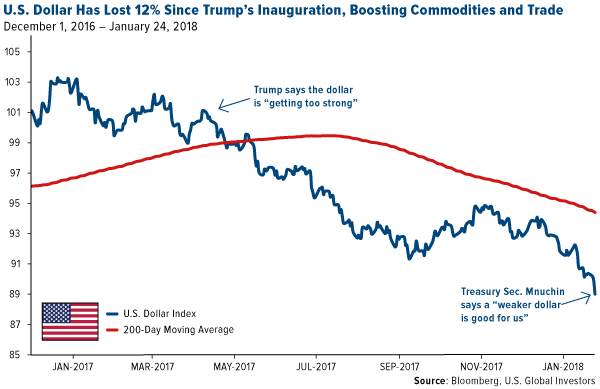

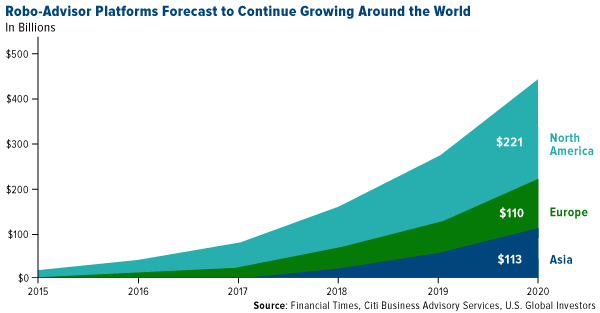

The U.S. dollar has plunged in value for the past several weeks, dipping more than 1 percent last Wednesday alone—the biggest one-day pullback in 10 months—following Treasury Secretary Steven Mnuchin’s comment at the World Economic Forum in Davos, Switzerland, that a weaker buck “is good for us as it’s related to trade and opportunities.” The greenback similarly tanked back in April 2017 when President Donald Trump said the dollar is “getting too strong.” Soon after, it fell below its 200-day moving average.

click to enlarge

Last Thursday, however, Trump walked back Mnuchin’s (and his own) comment, telling CNBC that the dollar “is going to get stronger and stronger, and ultimately I want to see a strong dollar.”

In any case, this has all been constructive for the price of gold, which Thomson Reuters GFMS now sees hitting $1,500 an ounce this year. If you remember, $1,500 was approximately my estimate after analyzing gold’s performance in the months following the December rate hikes in 2015 and 2016.

According to Thomson Reuters, the price appreciation could be driven by “concerns that the United States may pull out of NAFTA.”

Doing so, of course, would be highly inflationary—and inflation, as I point out in last week’s episode of Frank Talk Live, has historically been a tailwind for gold. The tax overhaul is already helping to boost wages at Walmart, Starbucks and elsewhere, and the U.S. recently slapped fresh tariffs on imported washing machines and solar cells. In response, South Korea opened two cases against the U.S. at the World Trade Organization (WTO).

And let’s not discount geopolitical noise. Last week, the “Doomsday Clock” was moved 30 seconds closer to midnight and now stands only two minutes away. That’s the closest to midnight the symbolic barometer has come since 1953, when both the U.S. and Russia first began testing thermonuclear weapons—among the most disruptive advancements of the past 100 years.

Curious to learn more about what’s driving gold? Click here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly.

The U.S. Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2017.

The world’s two largest silver mines have seen their productivity decline substantially due to falling ore grades and rising costs. Gone are the days when silver mines could produce silver at 15-20 ounces per ton. Today, the Primary Silver Mining Industry is likely producing silver at an average yield of 4-5 ounces per ton.

The world’s two largest silver mines have seen their productivity decline substantially due to falling ore grades and rising costs. Gone are the days when silver mines could produce silver at 15-20 ounces per ton. Today, the Primary Silver Mining Industry is likely producing silver at an average yield of 4-5 ounces per ton.

click to enlarge

click to enlarge