Bonds & Interest Rates

I have previously reported that about 50% of German municipalities are insolvent. This is a global trend and we are witnessing it in the United States as well. The North Rhine-Westphalian Association of Cities has called for help from the future German federal government as the building crisis among financially weak municipalities continue to escalate. This includes the fourth largest by area in Germany with the capital situated in Düsseldorf. The main cities include Cologne, Düsseldorf, Dortmund, and Essen. They are pleading for a grand coalition between the CDU and SPD to save the municipal governments. With the end of the historic low-interest phase, interest rates are poised to rise dramatically in Europe and they begin to see that the appetite for new debt from the government is sharply declining.

Politicians have been hiding this municipal crisis in Germany until after the elections when it was assumed Merkel would win as always. Now the cat is coming out of the bag and we will begin to see the real impact of nearly 10-years of subsidizing governments by the ECB rather than actually stimulating the economy that never bounced. This is a fundamental background issue behind the rise in interest rates between 2018 and 2021.

….also from Martin: At What Point do we reach Euphoria in the Equity Markets?

Ed Note: Eventually, after the Federal Reserve has done everything in its power to keep interest rates low, a giant bear market in Bonds is looming. The Fed Fund rates hit a high in May 1981 of 20%. and a low of .25% in Dec 2008. Since then Janet Yellen kept the Fed Funds rate between .05% & .75% before creeping a bit higher to 1.5%. The 30 year bond high was 176.94 on July 8, 2016, and has since fallen to the 150 area. It is a relief that this analyst Rambus has clearly laid out a technical case that that huge 36 year bull market in Bonds appears to finally be ready to roll over into a significant bear market. For anyone with exposure to interest rates, be it through mortgages, loans of investments, this analysis could be absolutely critical to navigating the next decade or more successfully. – Rob Zurrer Money Talks Editor

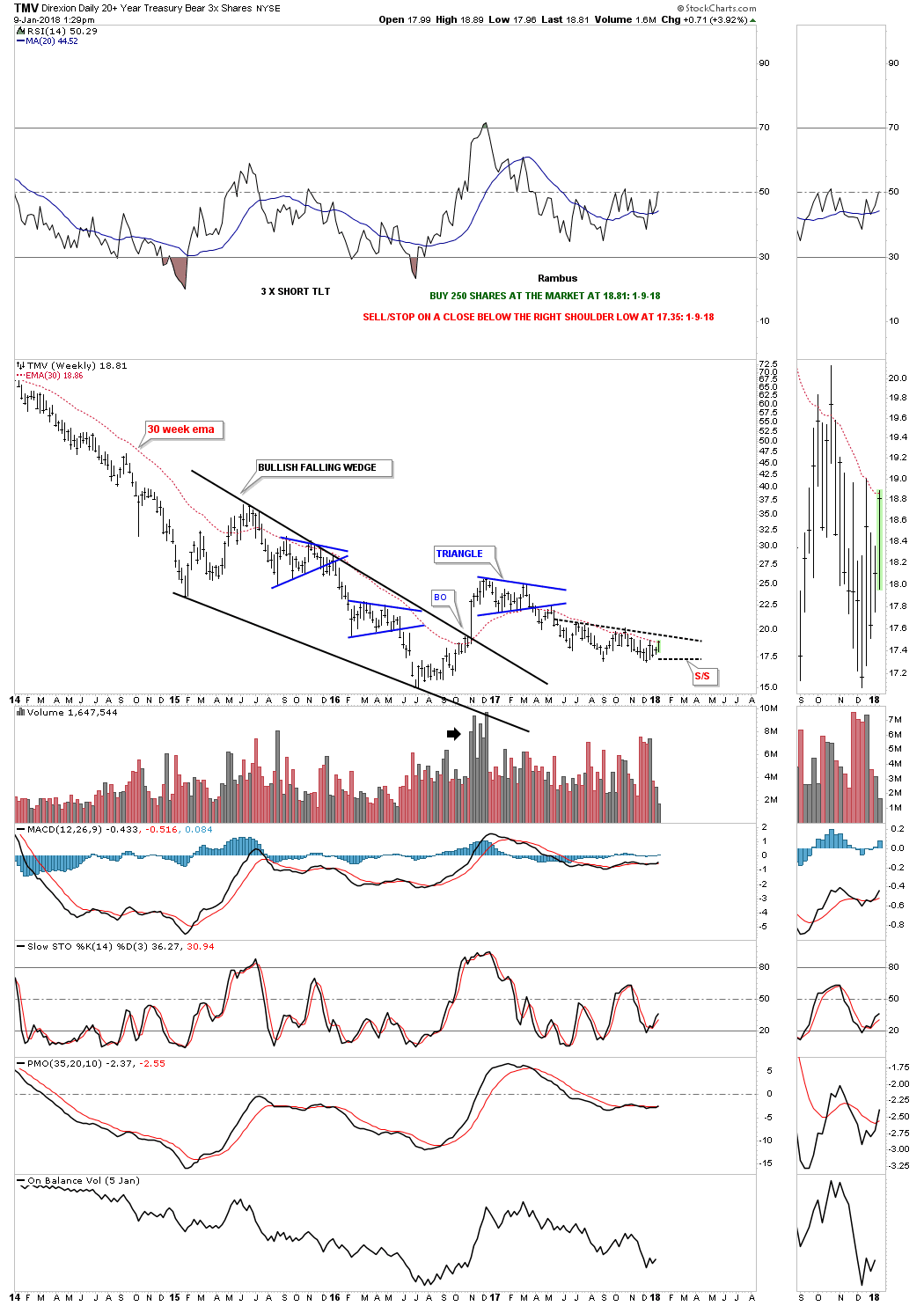

TMV : 3X Leveraged Short on Treasury Bonds

TMV is a 3 X short the TLT 20 year treasure bond etf. This trade is based on the TLT. For well over three years now the TLT has been building out what looks like a massive H&S top with the top of the right shoulder now in play. I’m going to take an initial position and buy 250 shares of TMV, 3 X short the TLT, and buy 250 shares at the market at 18.83 with the sell/stop on a daily close below the right shoulder low on the daily chart for the TMV at 17.35. I’m anticipating the the right shoulder high on the TLT will be the ultimate high. There will be several more entry points if this trades starts to workout.

A second buy point would be on the breakout above the neckline on the daily chart for the TMV. A third buy point would be on a breakout above the double bottom trendline.

Below is the weekly chart for the TMV. The more conservative members may want to wait for the breakout above the double bottom trendline and the 30 week ema.

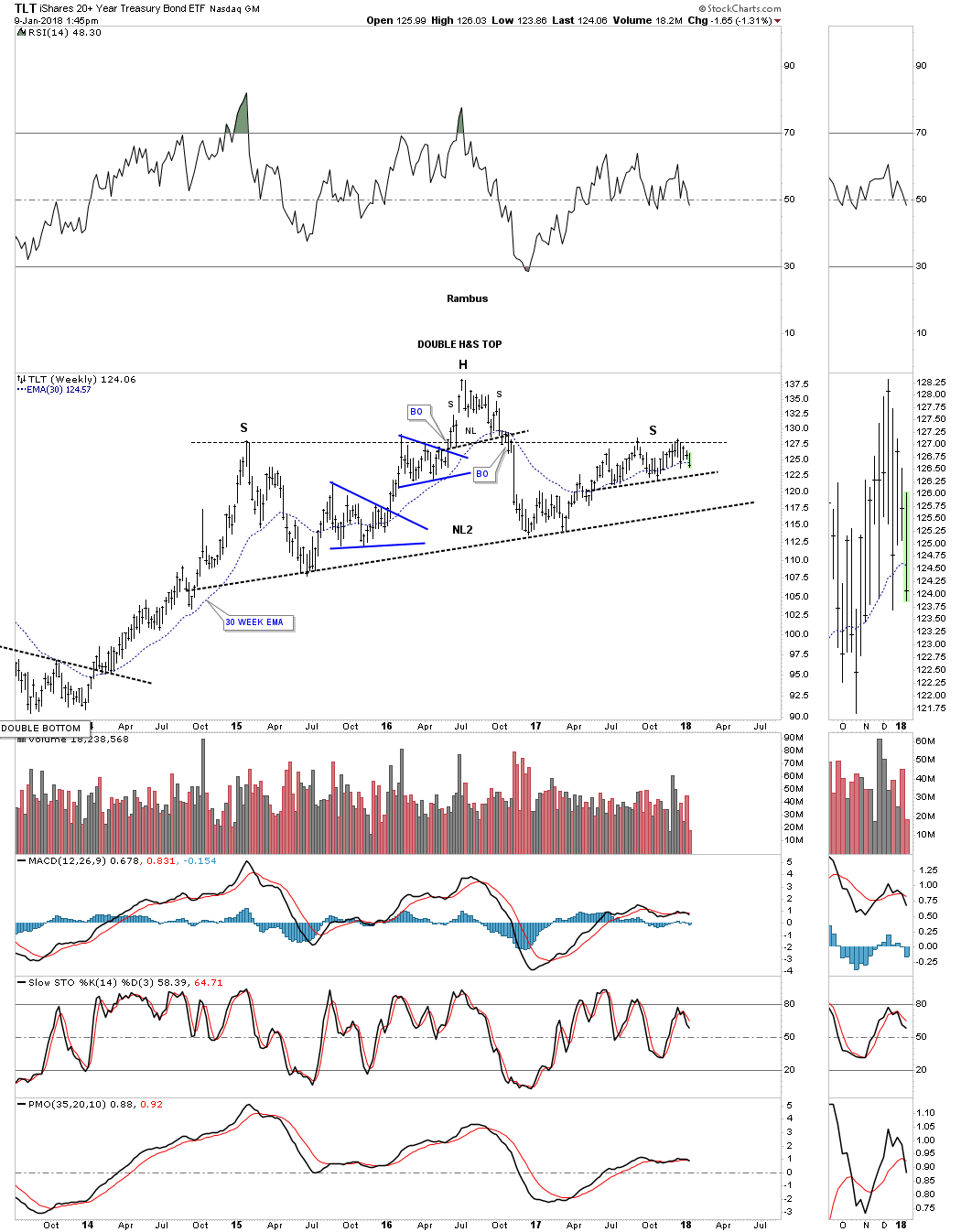

Below is a one year daily chart for the TLT which shows the possible double top right shoulder high that we’ll looked at on the weekly chart. Reverse symmetry may suggest we could see a small bounce off of the neckline as the 200 day ma is also intersecting the neckline.

This next chart is a weekly look at the TLT which puts everything in perspective. There is some nice symmetry forming on this 3 plus year H&S top where both the left and right shoulder highs formed at the same high. This chart also shows you why I’m willing to take an initial position up here toward the possible right shoulder high.

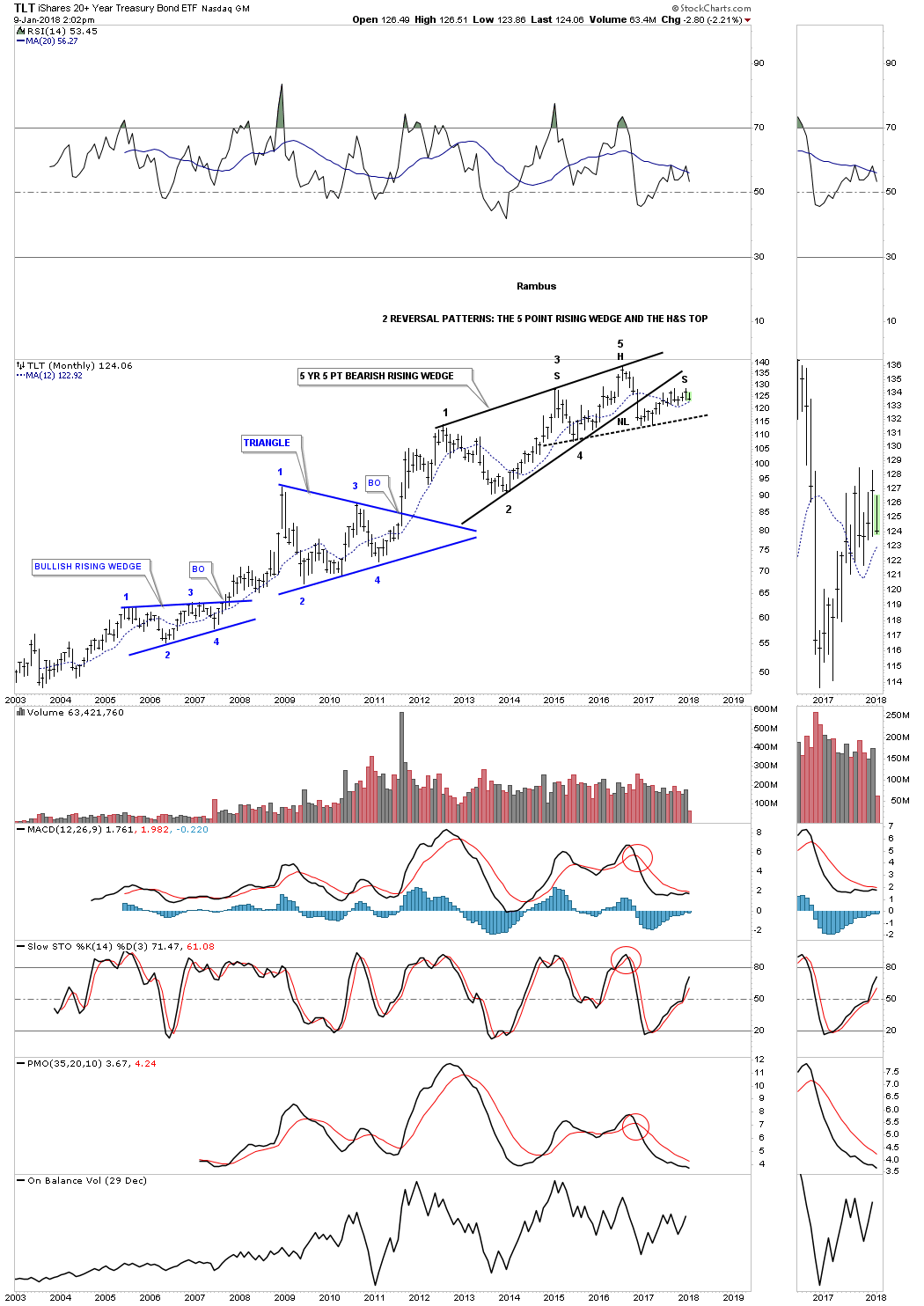

The long term monthly chart for the TLT is showing a possible classic H&S top building out. I’ve shown you many cases that a H&S pattern can buildout with the left shoulder and head forming inside of a wedge pattern, in this case the 5 year 5 point bearish rising wedge with the right shoulder forming on the backtest to the underside of the bottom rail. TLT has fallen just shy of a complete backtest to the bottom rail, but in this case it looks close enough. As you can see my entry point is very early if this very large H&S top plays out. There will be several more good entry points if things start playing as these charts are suggesting. We basically have two separate reversal patterns forming in the same location.

Join me in a look at the long term trends that are currently reversing in gold, silver, dollar, euro and the yen.

https://blog.smartmoneytrackerpremium.com/

2018 will be a year of major volatility in many markets. Stocks are now in a melt-up phase, and before the major bear markets start in virtually all countries around the world, we are likely to see the final exhaustion moves which could be substantial. T

he year will also be marked by inflation increasing a lot faster than expected. This will include higher interest rates, much higher commodity prices, such as food, oil and a falling dollar. And many base metals will strengthen. Precious metals finished the 2-3 year correction (depending on the base Currency) in 2015 and are now resuming the move to new highs and eventually a lot higher.

…also from King World:

ALERT: This Is What Will Trigger The Big Surge In Gold And The Mining Shares