Mike's Content

In Live from the trading desk, Michael Campbell gets Victor Adair’s core expectation for 2018. Also Victor delinates areas where danger lies.

…also from Michael: They Chose Rape, Beheadings and Murder

2018 has so far brought in the highest price of crude oil since late 2014 (chart 1), but we shouldn’t be surprised by the price action. Indeed, ignoring geopolitics for a moment, the fundamental picture for the crude markets haven’t been this favorable in years. As we will see, from inventory levels, to the US dollar, to economic growth, to the setup in the futures markets, most signs are pointing to higher oil prices ahead.

One of the main drivers of oil prices is the relationship between production, consumption and inventory levels. As chart 2 shows, crude production in the US has recovered to mid-2016 highs, which in and of itself would be bearish for crude prices. But, the total inventory of crude has been falling over that period and now stands at the lowest level in 2.5 years. Chart three depicts total crude inventories (ex the strategic petroleum reserve) plotted with the blue line on the left, inverted axis, overlaid on the price of oil on the right axis (red line). Furthermore, oil consumption has remained strong too. The combination of lower stocks and growing demand has caused the days supply of oil to drop from 34 a year ago to just 25 now. Chart four shows the price of crude on the left axis (blue line) overlaid on the days supply of oil on the right, inverted axis (red line). These two series are highly inversely correlated, so a contracting days supply should result in higher prices. As we will see later, a continuation of this trend is likely.

This might seem a frivolous question, while the dollar still retains its might, and is universally accepted in preference to other, less stable fiat currencies. However, it is becoming clear, at least to independent monetary observers, that in 2018 the dollar’s primacy will be challenged by the yuan as the pricing medium for energy and other key industrial commodities. After all, the dollar’s role as the legacy trade medium is no longer appropriate, given that China’s trade is now driving the global economy, not America’s.

This might seem a frivolous question, while the dollar still retains its might, and is universally accepted in preference to other, less stable fiat currencies. However, it is becoming clear, at least to independent monetary observers, that in 2018 the dollar’s primacy will be challenged by the yuan as the pricing medium for energy and other key industrial commodities. After all, the dollar’s role as the legacy trade medium is no longer appropriate, given that China’s trade is now driving the global economy, not America’s.

At the very least, if the dollar’s future role diminishes, then there will be surplus dollars, which unless they are withdrawn from circulation entirely, will result in a lower dollar on the foreign exchanges. While it is possible for the Fed to contract the quantity of base money (indeed this is the implication of its desire to reduce its balance sheet anyway), it would also have to discourage and even reverse the expansion of bank credit, which would be judged by central bankers to be economic suicide. For that to occur, the US Government itself would also have to move firmly and rapidly towards eliminating its budget deficit. But that is being deliberately increased by the Trump administration instead.

Explaining the consequences of these monetary dynamics was the purpose of an essay written by Ludwig von Mises almost a century ago.[i] At that time, the German hyperinflation was entering its final phase ahead of the mark’s eventual collapse in November 1923. Von Mises had already helped to stabilise the Austrian crown, whose own collapse was stabilised at about the time he wrote his essay, so he wrote with both practical knowledge and authority.

The dollar, of course, is nowhere near the circumstances faced by the German mark at that time. However, the conditions that led to the mark’s collapse are beginning to resonate with a familiarity that should serve as an early warning. The situation, was of course, different. Germany had lost the First World War and financed herself by printing money. In fact, she started down that route before the war, seizing upon the new Chartalist doctrine that money should rightfully be issued by the state, in preference to the established knowledge that money’s validity was determined by markets. Without abandoning gold for her own state-issued currency, Germany would never have managed to build and finance her war machine, which she did by printing currency. The ultimate collapse of the mark was not mainly due to the Allies’ reparations set at the treaty of Versailles, as commonly thought today, because the inflation had started long before.

The dollar has enjoyed a considerably longer life as an unbacked state-issued currency than the mark did, but do not think the monetary factors have been much different. The Bretton Woods agreement, designed to make the dollar appear “as good as gold”, was cover for the US Government to fund Korea, Vietnam and other foreign ventures by monetary inflation, which it did without restraint. That deceit ended in 1971, and today the ratio of an ounce of gold to the dollar has moved to about 1:1310 from the post-war rate of 1:35, giving a loss of the dollar’s purchasing power, measured in the money of the market, of 97.3%.

True, this is not on the hyperinflationary scale of the mark – yet. Since the Nixon shock in 1971, the Americans have been adept at perpetuating the myth of King Dollar, insisting gold now has no monetary role at all. By cutting a deal with the Saudis in 1974, Nixon and Kissinger ensured that all energy, and in consequence all other commodities, would continue to be priced in dollars. Global demand for dollars was assured, and the banking system of correspondent nostro accounts meant that all the world’s trade was settled in New York through the mighty American banks. And having printed dollars to ensure higher energy prices would be paid, they would then be recycled as loan capital to America and her friends. The world had been bought, and anyone not prepared to accept US monetary and military domination would pay the price.

That was until now. The dollar’s hegemony is being directly challenged by China, which is not shy about promoting her own currency as her preferred settlement medium. Later this month an oil futures contract priced in yuan is expected to start trading in Shanghai.[ii] Only last week, the Governor of China’s central bank met the Saudi finance minister, presumably to agree, amongst other topics, the date when Saudi Arabia will start to accept yuan for oil sales to China. The proximity of these two developments certainly suggest they are closely related, and that the end of the Nixon/Saudi deal of 1974, which created the petrodollar, is in sight.

Do not underestimate the importance of this development, because it marks the beginning of a new monetary era, which will be increasingly understood to be post-dollar. The commencement of the new yuan for oil futures contract may seem a small crack in the dollar’s edifice, but it is almost certainly the beginning of its shattering.

America’s response to China’s monetary manoeuvring has always been that of a nation on the back foot. For the last year, the yuan has been rising against the dollar, following President Trump’s inauguration. Instead of responding to China’s hegemonic threat by increasing America’s role in foreign trade, President Trump has threatened all and sundry with trade restrictions and punitive tariffs. It is a policy which could not be more designed to undermine America’s global economic status, and with it the role of the dollar.

In monetary terms, this leads us to a further important parallel with Germany nearly a century ago, and that is the contraction of the territory and population over which the mark was legal tender then, and the acceptance of the dollar today. The loss of Germany’s colonies in Asia and Africa, Alsace-Lorraine to France, and large parts of Prussia to Poland, reduced the population that used the mark without a compensating reduction of the quantity of marks in circulation. Until very recently, most of the world was America’s monetary colony, and in that context, she is losing Asia, the Middle East and some countries in Africa as well. The territory that offers fealty to the dollar is definitely contracting, just as it did for the German mark after 1918, and as it did for the Austro-Hungarians, whose Austrian crown suffered a similar fate.

The relative slowness of the dollar’s decline so far should not fool us. The factors that led to the collapse of the German mark in 1923 are with us in our fiat currencies today. As von Mises put it,

“If the practice persists of covering government deficits with the issue of notes, then the day will come without fail, sooner or later, when the monetary systems of those nations pursuing this course will break down completely.”[iii]

Updated for today’s monetary system, this is precisely how the American government finances itself. Instead of printing notes, it is the expansion of bank credit, issued by banks licenced by the government with this purpose in mind, that ends up being subscribed for government bonds. The same methods are employed by all advanced nations, giving us a worrying global dimension to the ultimate failure of fiat currencies, whose only backing is confidence in the issuers.

Now that America is being forced back from the post-war, post-Nixon-shock strategy of making the dollar indispensable for global trade, the underlying monetary inflation of decades will almost certainly begin to be reflected in the foreign and commodity exchanges. There is little to stand in the way of the global fiat monetary system, led by the dollar, to begin a breakdown in its purchasing power, as prophesied by von Mises nearly a century ago. Whether other currencies follow the dollar down the rabbit hole of diminishing purchasing power will to a large extent depend on the management of the currencies concerned.

How a fiat currency dies

The last thing anyone owning units of a state-issued currency will admit to is that they may be valueless. Only long after it has become clear to an educated impartial monetary observer that this is the case, will they abandon the currency and get rid of it for anything while someone else will still take it in exchange for goods. In the case of the German hyperinflation, it was probably only in the last six months or so that the general public finally abandoned the mark, despite its legal status as money.

Von Mises reported that throughout the monetary collapse, until only the final months, there persists a general belief that the collapse in the currency would soon end, there always being a shortage of it. The change in this attitude was marked by the moment people no longer just bought what they needed ahead of actually needing it. Instead, they began to buy anything, just to get rid of the currency. This final phase is what von Mises called the crack-up boom, though some far-sighted individuals had already acted well ahead of the crowd. Both these phases are still ahead for the American citizen. However, we can now anticipate how the first is likely to start, and that will be through dollars in foreign hands being replaced for trade purposes with the yuan, and then sold into the foreign exchanges.

Once the process starts, triggered perhaps by the petrodollar’s loss of its trade settlement monopoly, it is not beyond the bounds of possibility for the dollar to initially lose between a third and a half of its purchasing power against a basket of commodities, and a similar amount against the yuan, which is likely to be managed by the Chinese to retain its purchasing power. It will be in the interests of the Chinese authorities to promote the yuan as a sounder currency than the dollar to further encourage foreign traders to abandon the dollar. From China’s point of view, a stronger yuan would also help ensure price stability in her domestic markets, at a time when countries choosing to remain on a dollar-linked monetary policy will be struggling with rising price inflation.

There then emerges a secondary problem for the dollar. A fiat currency depends in large measure for its value on the credibility of the issuer. A weakening dollar, and the bear market in bonds that accompanies it, will undermine the US Government’s finances, in turn further eroding the government’s financial credibility. This will be happening after an extended period of the US Government being able to finance its deficits at artificially low interest rates, and is therefore unprepared for this radical change in circumstances.

As the dollar’s purchasing power comes under attack, lenders, whether they be those with surplus funds, or their banks acting as their agents, will increasingly take into account the declining purchasing power of the dollar in setting a loan rate. In other words, time-preference will again begin to dominate forward rates, and not central bank interest rate policy. This will be reflected in a significantly steeper yield curve in the bond market, forcing borrowers into very short-term financing or using other, more stable monetary media to obtain capital for longer-term projects. This, again, plays into the yuan becoming the preferred currency, possibly with a rapidity that will be unexpected.

The US Government is obviously ill-equipped for this drastic change in its circumstances. The correct response is to eliminate its budget deficit entirely, and refuse to bail out failing banks and businesses. Bankruptcies will be required to send surplus dollars to money heaven and therefore stabilise the dollar’s purchasing power. A change in the Fed’s attitude towards its banks and currency is, however, as unlikely as that of the Reichsbank subsequent to the Versailles Treaty.

Therefore, it follows that capital markets in dollars will inevitably be severely disrupted, and market participants will seek alternatives. Remember that the dollar’s strength has been based on its function in trade settlement and its subsequent deployment as the international monetary capital of choice. Both these functions can be expected to go into reverse as the trade settlement function is undermined.

Whether China will be tempted to employ the same methods in future to support the yuan as the Americans have during the last forty-three years for the dollar, remains to be seen. It may not be a trick that can be repeated. There is a great danger that a significant fall in the dollar will lead to global economic stagnation, coupled with escalating price inflation, affecting many of China’s trading partners. China will want to insulate herself from these dangers without adding to them by going for full-blown hegemony.

We are beginning, perhaps, to see this reflected in rising prices for gold and silver. China has effectively cornered the market for physical gold, the only sound money of the market that over millennia has survived all attempts by governments to replace it. Her central planners appear to have long been aware of the West’s Achilles’ heel in its monetary affairs, and have merely been playing along to China’s own advantage. As the dollar weakens in the coming years, her wisdom in securing for herself and her citizens the one form of money that’s no one else’s liability will ensure her survival in increasingly turbulent times.

Now that’s strategic thinking.

[i]Stabilisation of the Monetary Unit – from the Viewpoint of Theory ( January, 1923)

[ii] See https://www.bloomberg.com/news/articles/2018-01-01/how-china-will-shake-up-the-oil-futures-market-quicktake-q-a

[iii] Ibid. Opening sentence.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.

Enjoy the good times while you can because when the economy BLOWS UP this next time, there is no plan B. Sure, we could see massive monetary printing by Central Banks to continue the madness a bit longer after the market crashes, but this won’t be a long-term solution. Rather, the U.S. and global economies will contract to a level we have never experienced before. We are most certainly in unchartered territory.

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

While some of my family members know about my work, I don’t really discuss it with them. If they ever have a question, I will try to answer it, but I found out years ago that it was a waste of time to try and impose my knowledge upon them. Which is the very reason I started my SRSrocco Report website… LOL. So, now I have a venue to get my analysis out to the public. I don’t care about reaching everyone, but rather to provide important information to those who are OPEN to it.

As I have stated before, I receive communications from individuals all across the world and from all different occupations. The common theme I receive from these individuals, who stumbled upon my website, is that they say, “IT’S MUCH WORSE THAN YOU REALIZE.” Unfortunately, I cannot share publically the information that they have provided, but I can tell you that the GRAND FACADE will come crashing down to the shock and surprise by the masses.

However, I can tell you one individual has contacted me with data suggesting that one of the largest shale oil companies in the United States has been fudging its numbers for the past several years. I have had nearly a half a dozen phone conversations with this individual and the evidence points to serious fraudulent activity. And let me tell you this individual is no conspiracy nut, he was a Senior-Level person in the company. When this information becomes public, it could be the next ENRON. If so, that will destroy the investor trust in the U.S. Shale Energy Industry. Virtually overnight, we could see a collapse of capital investment in an industry that hasn’t really made any profits since it started producing shale oil and gas nearly a decade ago.

Unfortunately, I continue to read articles and receive emails from individuals who believe that the vast U.S. shale energy resources will make the U.S. energy independent. I am completely surprised by the lack of wisdom of supposedly highly intelligent individuals who should know better. Furthermore, it seems to be that the debate is not about discussing facts and reason, but rather between the TRUTH & LIES.

Thus, there is a big disconnect between individuals with CHARACTER, INTEGRITY, and TRUTH versus those who don’t care about increasing the debt to produce shale energy. According to these individuals, they don’t care if someone gets stuck with the debt if it allowed them to make money or for Americans to enjoy low-priced gasoline. This is exactly what is wrong with the world today. The world has become so big; we don’t care about screwing someone else in order to make a buck. If it isn’t our money, then the hell with them.

So, to debate someone with that sort of mentality, it’s a total waste of time. You cannot debate an individual based on facts and truth if they come from a position of fraudulent activity and lies. Just like oil and water, they don’t mix. I can tell you; I see this all over the internet… even in the alternative media community. Of course, these individuals will reply that they are correct. However, their position is flawed because their ideology is also flawed.

Here is a piece of advice. Don’t waste time debating individuals who don’t base their ideas on truth and sound data. The only reason I do it via my articles is to prove why their analysis is flawed because people are still making up their minds. I don’t do it to change the mind of the analysts, (example, CPM Group’s Jeff Christian), but to provide information that helps individuals understand the reality of dire energy predicament we are facing because it all comes down to the energy.

That being said, I haven’t received a reply from Jeff Christian in regards to my article, CPM Group’s Jeff Christian Responds “NEGATIVELY” To The SRSrocco Report On Silver Investment Demand. After my first article, Jeff left some choice words in a comment, which motivated me to reply. Of course, Jeff didn’t reply to the second article because I gather he realizes that the FACTS & DATA prove their gold and silver price analysis has been flawed for 40 years. So, it’s better for Jeff Christian and the CPM Group to keep quiet as they want to continue selling their Gold and Silver Yearbooks to the industry.

The Fundamentals Point To The GREAT DELEVERAGING Of The Economy… Dead Ahead

While the mainstream media and financial networks suggest that THIS TIME IS DIFFERENT for the markets…. it isn’t. The fundamentals of the markets are so out-of-whack, I am amazed people can’t see it. This is also true for the Bitcoin and cryptocurrency market. While a small group of crypto-investors have made a killing, it’s mostly digital wealth. While I don’t have a problem with someone making profits investing in cryptocurrencies, I do have a problem when they believe this technology is the wave of the future. For some strange reason, they must believe in the ENERGY TOOTH FAIRY.

While some of these cryptocurrency analysts (or supposed analysts) believe that we are heading into a new high-tech world where we no longer have to work, just live phat on our Billions in Bitcoin profits, the Falling EROI – Energy Returned On Investment never sleeps. That’s correct; it continues to erode our modern way of living each passing day. Unfortunately, adding more technology does not solve our energy predicament, it just makes it worse.

Also, individuals who believe in FREE ENERGY technology or supposed advanced ALIEN ENERGY technology hand-me-downs, to save the day… you are grasping at straws. Now, I am not trying to change anyone’s mind who believes in free energy or alien technology, but all I ask is that you stay alive for another 5-10 years to see the mistake of your ways. Yes, that may sound a bit confident or arrogant, but empires have come and gone in the past. The current one is no different.

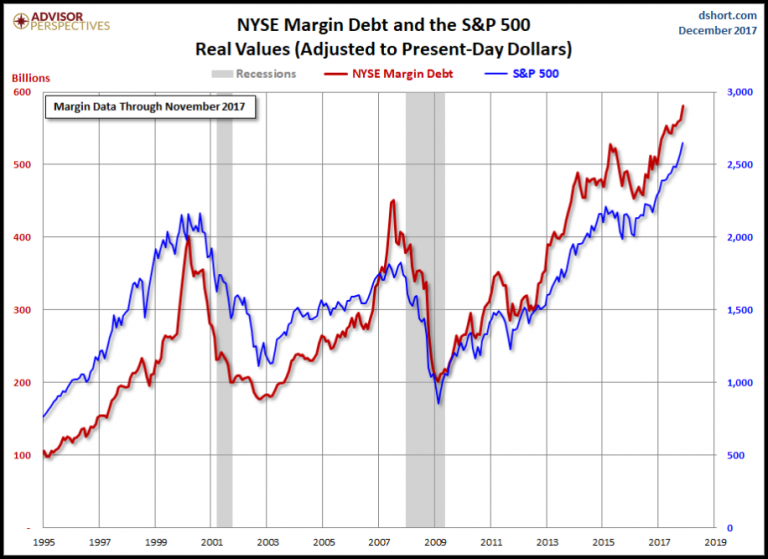

Let’s first look at the NYSE margin debt. According to the chart by the Advisor Perspectives, the New York Stock Exchange margin debt is at new record high:

As we can see, the NYSE margin debt (by traders) is nearly $600 billion versus $400 billion in 1999 and $450 billion in 2007. Which means the NYSE margin debt is 33% higher than the level it was right before the 2008 U.S. Housing and Banking collapse. If we look at the 1999 and 2007 NYSE margin debt graph lines (RED), we can spot a huge spike right before they both peaked. If this is the way it will happen in the current trend, then we will likely see a huge spike and stock market MELT-UP before it peaks and collapses.

You know…. the last chance for the really stupid traders to get SUCKED in.

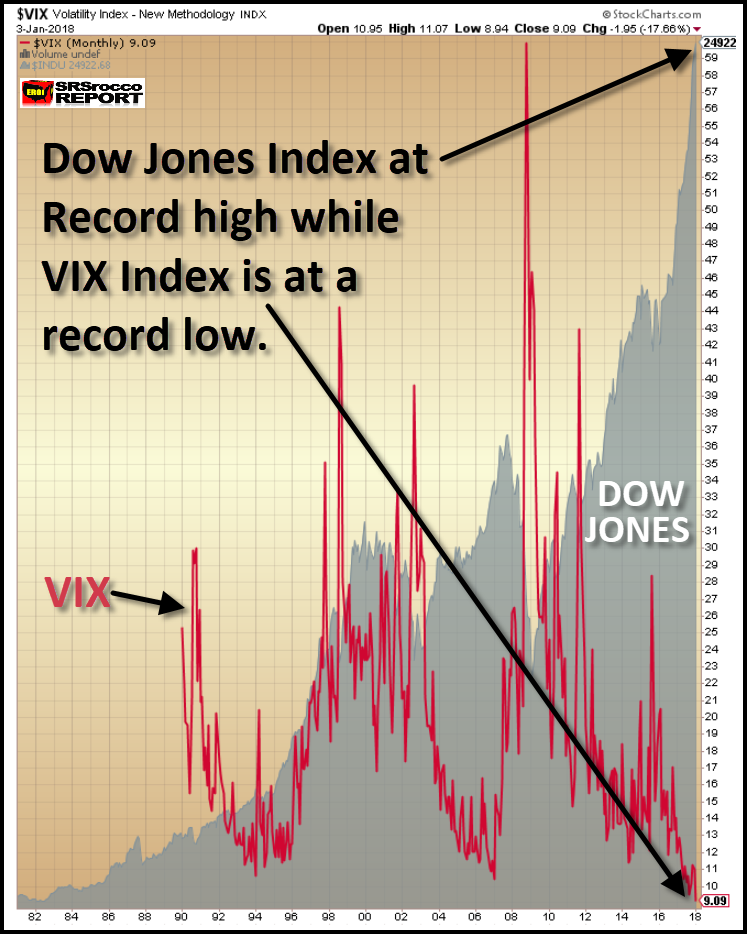

So, as the NYSE margin debt reaches new record territory, so has the VIX Index and the stock market. Yesterday, the VIX Index (measures volatility in the markets) closed at a new record low of “9”, while the Dow Jones Index ended the day at a record high of 24,922 points:

Today, the Dow Jones Index has reached another record at 25,100. Just like the cryptocurrency market, the only direction is HIGHER. Who knows how low the VIX Index will go and how high the Dow Jones will reach, but my gut tells me that this will be the year that the fun finally ends.

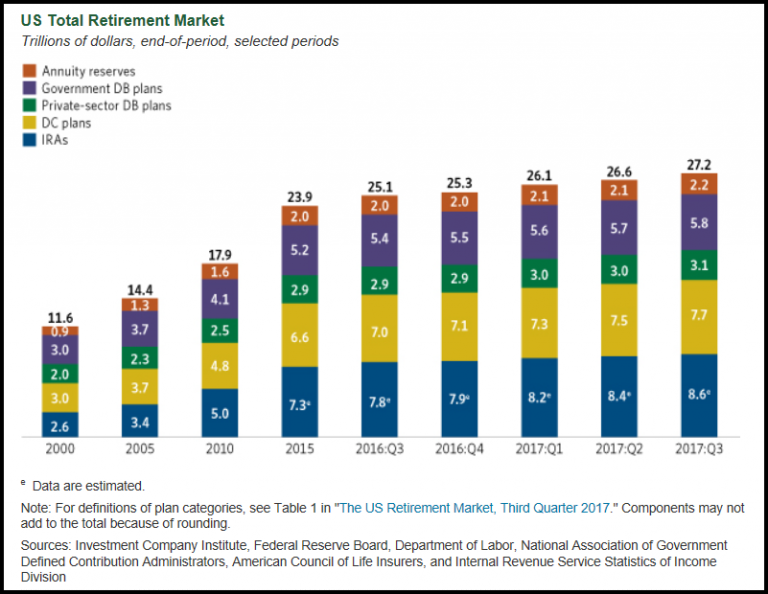

Of course, if we have new record highs in the stock markets, we should see the same with the U.S. Retirement Market:

According to the ICI – Investment Company Institute, the U.S. Retirement Market hit a new record at $27.2 trillion in the third quarter of 2017. I would imagine the U.S. Retirement Market will surpass the $28 trillion mark in 2018. When Americans feel rich via their investments, it makes them also feel good about buying more crap they don’t really need or can afford.

You see, frugality has been totally erased from Americans’ mindset. By being frugal, I am talking about being extremely wise and cautious about spending ones fiat currency. Being frugal is one of the most important aspects of a successful household. However, if frugality were reintroduced to Americans, then the entire economy would collapse overnight. Why? Because, the U.S. economic model is based on buying as much as we can on debt and credit. If we moved back to being frugal or buying only with cash, then 95-98% of the U.S. economy would disintegrate.

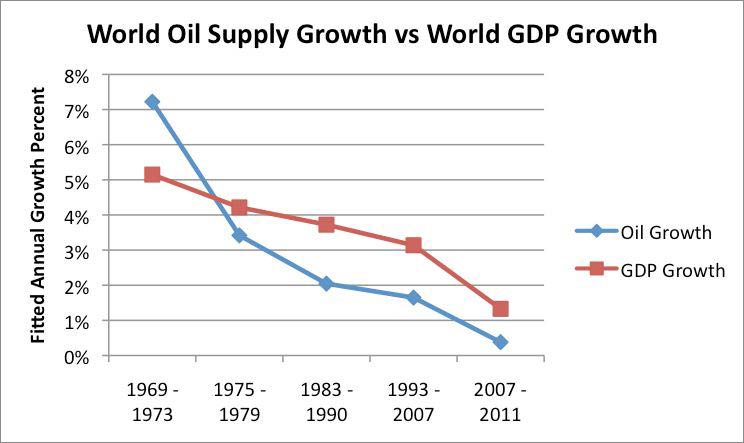

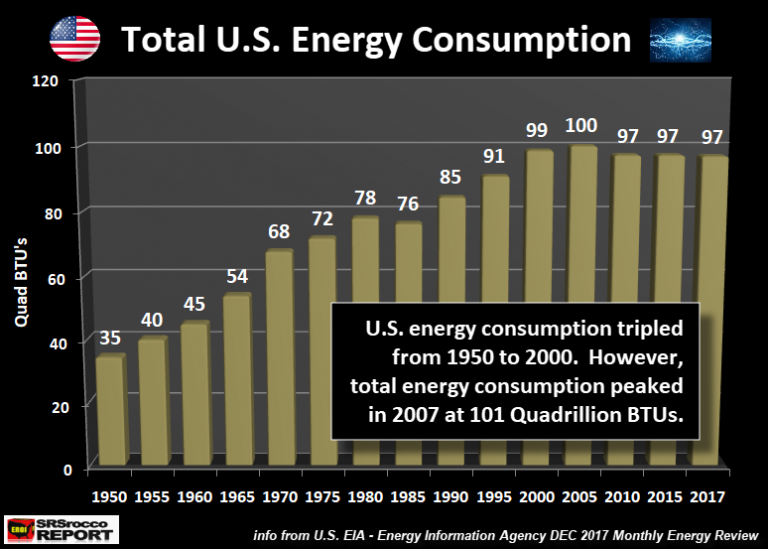

What is quite interesting about the U.S. stock and retirement market is that their values have skyrocketed while our energy consumption has remained flat since 2000. This wasn’t the case from the 1950-2000 period. As U.S. energy consumption increased, so did the value of the stock market. This was also true for world GDP:

Global GDP growth increased in percentage in line with world oil production growth. However, it was different for the United States. While total U.S. energy consumption remained flat since 2000, the value of stock and retirement markets skyrocketed higher:

This chart shows total U.S. energy consumption in Quadrillion BTUs. As we can see, total U.S. energy consumption tripled from 35 Quad BTUs in 1950 to 99 Quad BTUs in 2000. However, total energy consumption has been virtually flat ever since 2000 while the value of the U.S. Retirement Market has increased from $11.6 trillion to $27.2 trillion and the Dow Jones Index has surged from 11,000 to 25,000 points currently. Both markets are up approximately 130% since 2000 while energy consumption is flat.

That is most certainly a neat trick by the Fed and Wall Street Banks. Of course, there will be individuals who say the value of STOCKS, BONDS, and REAL ESTATE can rise on flat energy consumption. They can say that because they are completely FOS… FULL OF SHITE. Pardon my French.

When we look at the world in digital values instead of energy data, we can come up with virtually anything. The value of stocks, bonds, and real estate have been wildly inflated due to Central Bank money printing and the tremendous increase in debt. If an individual stayed awake during their economic classes in high school or college, NET WORTH comes from subtracting DEBTS from ASSETS. However, today… we don’t worry about the debts. We only look at the assets. This is like eating all the junk food during the holidays and not worrying about the way it comes out the other end.

Americans have deluded themselves into believing that crap that is put on our dinner plate is good for us. So, why should we blame them if they forget about debts and only look at assets? It makes perfect sense when LIES and FRAUDULENT activity are the predominant ideology in society.

When The Markets Crack, So Will The Price Of Oil… and with it, The Economy

If you have been reading my analysis on energy, you would understand that oil is the KEY FACTOR to the health of our economy. It doesn’t matter if we were to come up with some new energy technology like cold fusion or thorium energy reactors, they don’t solve our LIQUID ENERGY PREDICAMENT. The world doesn’t run on electricity; it runs on liquid oil. If you remember anything, that is one not to forget.

Regardless, I have looked over cold fusion and thorium reactors (along with many other “silver-bullet” energy-saving technologies), and they just don’t work. Yes, I would imagine some individuals will send me information to the contrary, but the fact remains… our retail markets are based on the just-in-time inventory system. That system needs liquid fuels to function, not electricity. So, when liquid energy runs into trouble, the world economy runs into trouble.

While I have presented a lot of articles and analysis on the Great U.S. Shale Energy Ponzi Scheme, I am not going to focus on that today. Rather, let’s look at the oil price and its dynamics going forward. As I have mentioned, I believe the price of oil will trend lower even though we may experience price spikes. My realization of the continued falling oil price came from the Thermodynamic work of Bedford Hill (TheHillsGroup.org) and Louis Arnoux. While some do not agree with the findings of The Hill’s Group or Louis Arnoux, the only error I can see in their work is the timing of the Thermodynamic Oil Collapse. And that is really not an error as they stated their calculations are based on the “Average Barrel of oil.” Thus, there is room for improvement of their model as well as a degree of accuracy… but not much.

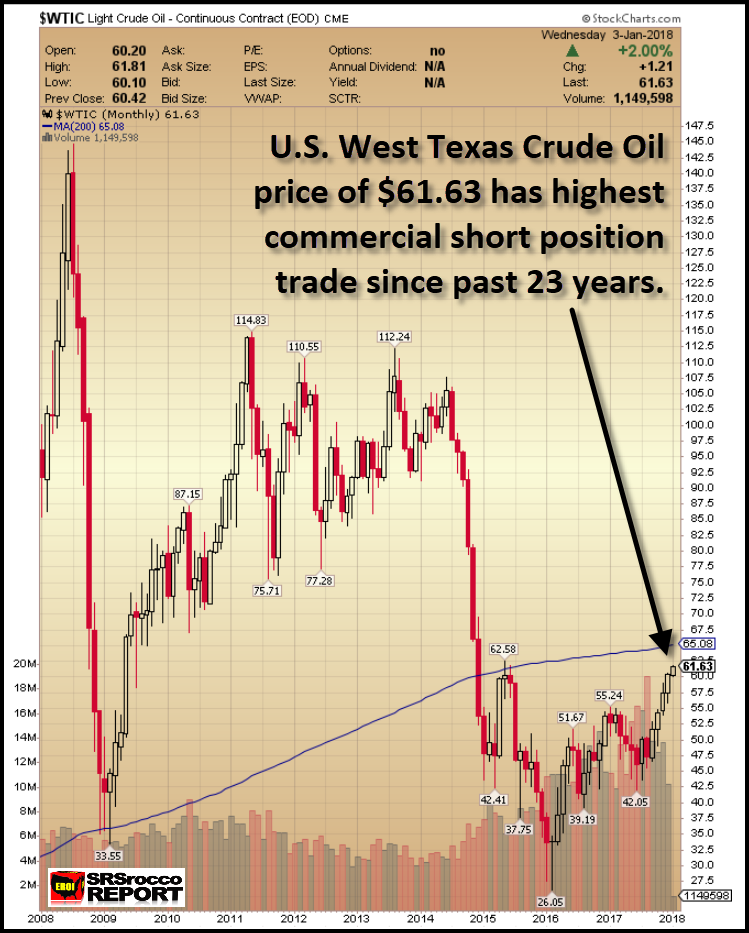

If we look at the current oil price chart, it seems as if it is heading back towards $65 (200-month moving average-BLUE LINE) and then up to $100:

However, the COT Report (Commitment of Traders) shows a much different setup. The amount of commercial short positions in the oil market is the highest going back 23 years. Furthermore, the current 644,000 commercial short positions are even higher right before the price fell from $105 in 2014:

You will notice when the price of oil was at $105 in 2014, the commercial shorts (hedgers positions) were approximately 500,000 contracts. Today at $62, the current commercial short positions are 644,000 (the chart above is two weeks old). Furthermore, when the price of oil fell from $105 down to a low of $26 at the beginning of 2016, the commercial short positions fell to a low of 180,000 contacts. So, it looks like the oil price is being set up for one hell of a fall.

Now, the interesting part of the equation is this… will the oil price fall when the markets crack, or before? Regardless, if we look at all the indicators (VIX Index record low, Stock Market Record High, NYSE margin debt record high or commercial short positions on oil at a record high), we can plainly see that the LEVERAGE is getting out of hand.

These indicators and others give me the impression that the economy and markets are going to BLOW UP in 2018.

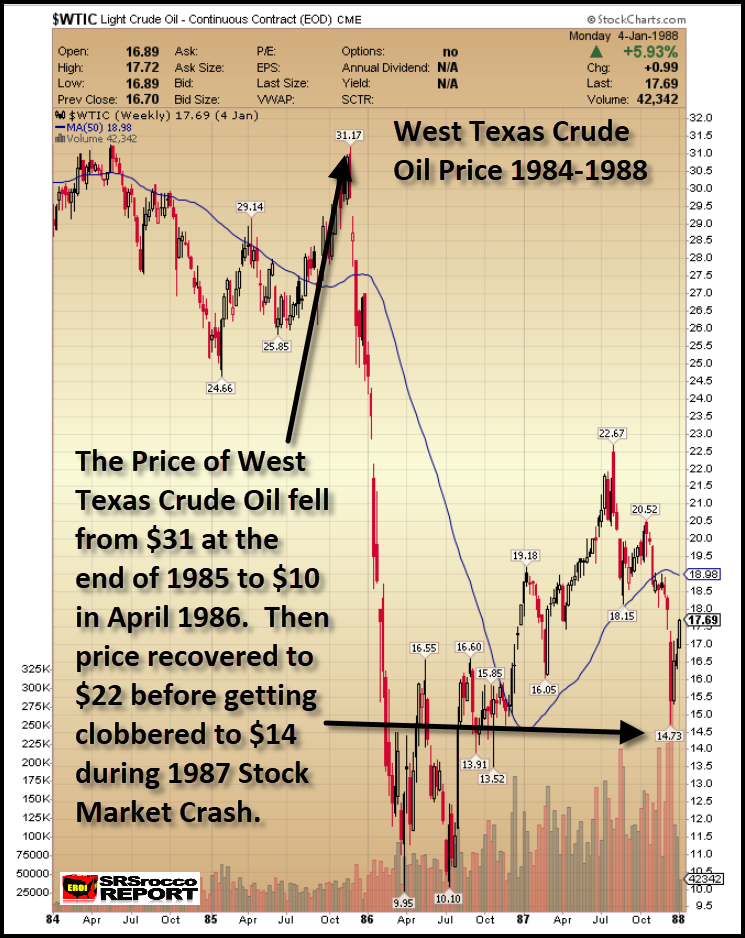

Moreover, this setup already took place in the market back in 1987. While I have written about this in a previous article, I wanted to show it using the oil price from 1984-1988. Very few people knew that the oil price dropped like a rock from $31 in 1985 to a low of $10 in 1986:

The decline in the price of oil from $31 to $10 was quite similar to what happened in 2014 when the price fell from $105 to a low of $26 in 2016. Also, the oil price recovery in both periods was quite similar as well. From July 1986 to August 1987 and from January 2016 to January 2018, the oil price (and economy) recovered. The oil price more than doubled from its low in 1986 ($10-$22) and 2016 ($26 to $62).

However, a few months before the infamous BLACK MONDAY Stock Market Crash on Oct 19, 1987, the oil price peaked and declined by nearly 20% ($22 down to $18). So, are we going to see a similar pattern this time around? Will the warning shot be the peak and decline of the oil price as it’s currently being set up by the record amount of commercial short positions? These are all very good questions in which I have no answer, but clearly, history does repeat itself.

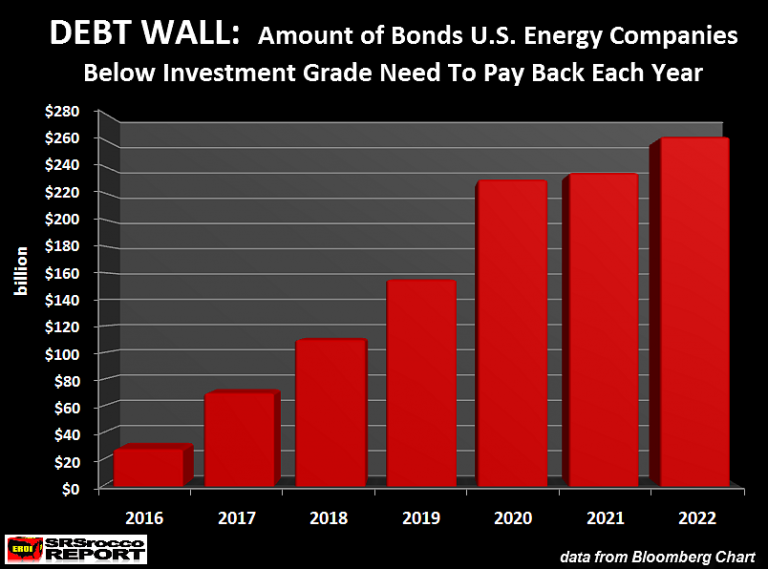

Either way, the indicators are pointing to one hell of a deleveraging of the markets. Investors need to understand when the oil price heads south once again; it will likely be the death-knell for the already weak U.S. Shale Oil Industry. We must remember, when the markets were collapsing in 2008, the U.S. oil industry was still in relatively good shape. Today, most of the shale companies have debt up to their eyeballs. Once again, here is the chart of the coming ENERGY DEBT WALL:

The tactic used by the Shale Energy Industry was to take investor money and push back the PAYBACK as far as possible. The intent was to BAMBOOZLE as many SUCKERS as possible before anyone realized just how unprofitable it was to produce shale oil and gas. A perfect example of this is the poster child of what’s wrong with the shale oil industry… Continental Resources.

Before Continental Resources embarked on the Great U.S. Shale Ponzi Scheme, the company only had $165 million in debt (2007) and was paying an annual interest payment (on their debt) of $13 million. Fast forward to today, Continental now has over $6.6 billion in long-term debt and will likely pay over $300 million in their interest expense this year.

This is precisely why Continental Resources announced the issuance of $1 billion in new Bonds so they could pay off existing ones that were coming due. And get this. The SUCKERS who purchased the $1 billion of new bonds, will not be paid back until 2028… LOL.

The POOR SLOBS that purchased those Continental bonds need to read about the Fiasco that happened to BHP Billiton when they blew over $50 billion in their investment in the wonderful U.S. Shale Ponzi Scheme.

I would like to remind investors that the definition of a PONZI SCHEME is to use new investor money to pay off existing ones. This is exactly what is taking place in the U.S. Shale Energy Industry. Because Continental has pushed back the payback period for ten years, they have received additional funds to continue the facade a bit longer. It is quite likely that Continental Resources will no longer be around in ten years to pay back that debt.

But why should that matter? Why should the CEO care about the debt if he made $millions and was able to sell most of his stock before the public realized what a worthless PIECE OF GARBAGE shale oil and gas have been?? Again, this is the fabric of our society. As long as some other SMUCK get’s stuck with the bill…… who gives a RATS AZZ??

To tell you the truth, when the markets finally crack, and the real carnage rips through the U.S. economy, we only have ourselves to blame. There are no pointing fingers when we are all involved. Especially the Bitcoin and cryptocurrency fanatics. I hate to say it, but those who believe they are going to get rich on CRYPTOS so they don’t have to work anymore…… let me provide you with my famous saying.

GOD HATH A SENSE OF HUMOR…..

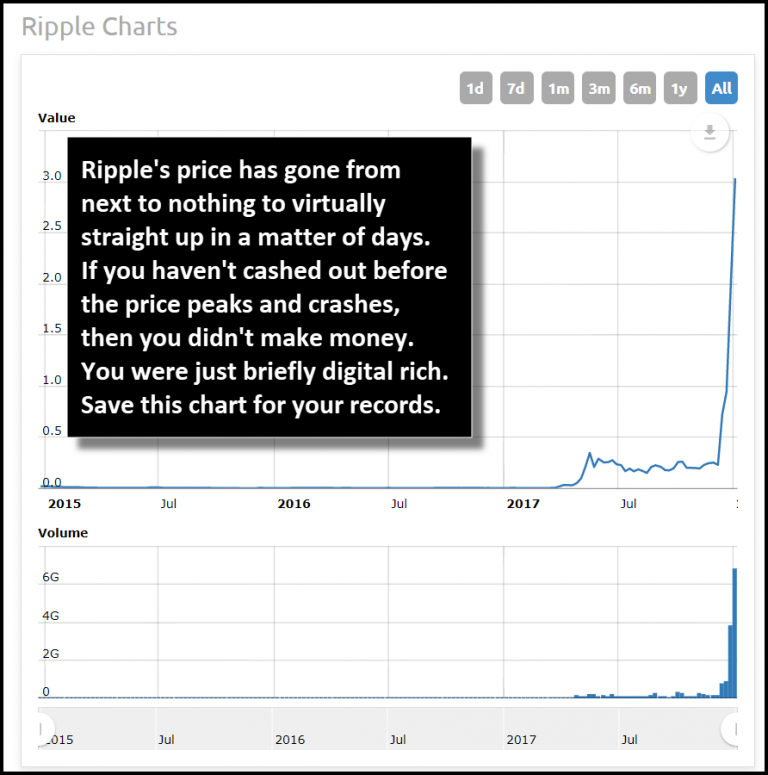

Currently, the cryptocurrency that is now stealing the show is Ripple. Anyone who bought Ripple a year ago for $0.005 a piece is salivating on the profits they have in their account. I would imagine the BOOZE and MONEY SPENDING are really flowing. However, if you look at Ripple’s chart and you don’t see a problem…. you might want to check yourself in and get an MRI brain scan:

There’s a lot more that I can say about Ripple and the other cryptocurrencies, but either you get it, or you don’t. Those that don’t get it now… will likely get it shortly. Unfortunately, the cryptos won’t be the new technology that will change our world for the better. Rather, they will be another Tulip Mania that we can add to the growing list.

In conclusion, the U.S. and world economies are heading towards one heck of a crash. What happens when this occurs, it’s anyone’s guess. Likely, the Central Banks will step in with their magic and print money like crazy. However, this is not a long-term solution. If you haven’t bought some physical gold and silver insurance yet and are waiting to time the markets, GOOD LUCK WITH THAT.

Lastly, I wanted to personally thank all those who have supported and continue to support the SRSrocco Report site. Your generous support allows me the opportunity to continue putting out the analysis and articles. As I have mentioned, I will be soon putting out new Youtube Videos that I believe will help explain some of these concepts better.

Check back for new articles and updates at the SRSrocco Report.