Real Estate

In its November report, mortgage security firm Freddie Mac called 2017 the “best year in a decade” for the housing market by a variety of measures. These include low inflation, strong job growth and historically-low mortgage rates. This assessment is very encouraging, not just for homebuyers and builders and the U.S. economy in general, but also for commodities, resources and raw materials as we head into 2018.

Although past performance is no guarantee of future results, it’s still instructive to look back at how materials performed the last time the U.S. was ramping up housing starts and mortgages. The last housing boom, which peaked in 2006, was accompanied by elevated commodity prices. We could see a return to these valuations over the next couple of years on higher demand, a stronger macroeconomic backdrop and cyclical fundamentals, as shown in the following chart courtesy of DoubleLine Capital:

Speaking on CNBC’s “Halftime Report” last week, DoubleLine founder Jeffrey Gundlach said he thought “investors should add commodities to their portfolios” for 2018, pointing out that they are just as cheap relative to stocks as they were at historical turning points.

“We’re at that level where in the past you would have wanted commodities” in your portfolio, Gundlach said. “The repetition of this is almost eerie. And so if you look at that chart, the value in commodities is, historically, exactly where you want it to be a buy.”

A Wealth of Positive Housing Data

There’s more to support the commodities narrative than cyclicality.

For one, home builders right now are more confident of the future than they’ve been in over 18 years. December’s National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) soared to 74, eight points up from the November reading and its highest report since July 1999.

NAHB Chairman Granger MacDonald chalks up the incredible improvement in optimism to “new policies aimed at providing regulatory relief to the business community.” Other contributing factors include low unemployment rates, favorable demographics and a tight supply of existing home inventory.

In addition, new housing starts in November rose to a seasonally adjusted annual rate of 1.3 million, up 3.3 percent from October and a strong 12.9 percent from a year ago.

This is all very constructive (no pun intended), as the market is still trying to recover nearly a decade following the subprime mortgage crisis.

Millennials, the Largest U.S. Generation, Finally Entering the Market

We’ve seen booms and busts in new housing starts over the past several decades, but homeownership rates in the U.S. took a huge blow as a result of the Great Recession. The rate dipped to a 51-year low of 62.9 percent in the second quarter of 2016, indicating buyers, especially first-time millennial buyers, are still struggling to save up for down payments.

Economists with the National Association of Realtors (NAR) note that student debt has played a massive role in delaying homeownership for young people, by as many as seven years on average. When asked how student loan debt has impacted their life decisions, more than seven in 10 millennials (those born roughly between 1980 and 1998) ranked “purchasing a home” as the most affected decision, followed by “taking a vacation.”

Since reaching its low last year, however, the homeownership rate has steadily improved, ending at 63.9 percent in the second quarter of 2017, a three-year high. This leads me to believe that the worst is behind us and that as the economy and labor market continue to improve, so too will demand for new homes. I also have high hopes that the tax cuts President Donald Trump signed into law today will encourage even more millennials, who have until now been sidelined, to join their older cohorts in owning a home.

Time to Add Commodities?

Indeed, all of the conditions appear ripe for another housing boom. Economic growth is on the upswing. The country is at near-full employment. Inflation and 30-year mortgage rates are also historically low.

When we factor in residential fixed investment and housing services, housing as a whole contributes between 15 and 18 percent to national gross domestic product (GDP). That’s a huge slice of the pie. And as I’ve pointed out before, housing has an extremely high multiplier effect. For every home that’s built, 2.97 full-time jobs and $162,080 in wages and salaries are created, according to a 2014 estimate by the NAHB.

Beyond that, increased home demand is good news for resources and raw materials. According to home-construction services firm Happho, for every 1,000 square feet of new housing, nearly 8,820 pounds of steel are required, as well as 400 bags of cement, 1,800 cubic feet of sand and 1,350 cubic feet of gravel and other aggregate. This doesn’t begin to touch on finishers such as brick, paint and tiles, or fittings such as windows, doors, plumbing and electrical. You can see the full infographic by clicking here.

Interested in learning how you can participate in the growing housing market? Unsure how to gain exposure to raw materials and commodities?

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P GSCI (formerly the Goldman Sachs Commodity Index) serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. It is a tradable index that is readily available to market participants of the Chicago Mercantile Exchange.

The Standard & Poor’s 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices.

The NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Listen – HERE Mp3 download.

Highlights

- Brimming with holiday cheer, Bob Hoye of Institutional Advisors rejoins the show with comments on the global financial bubble.

- The Dow could be approaching an ultimate peak – current valuations are stretched beyond those of the last equities market top of 2000.

- Bitcoin recently eclipsed the total value of Wal-mart, which should make for enlightening discussion around the holiday dinner table.

- As relatives learn that their disenfranchised Junior, Grandma Kettle and Uncle Fester, who have long shared the privilege of residing in the palatial household basement, suddenly hold enough BTC to pay off the mortgages of the entire neighborhood, a big spike in popularity is anticipated.

- One compelling BTC price estimate is $180,000.

- Gold hedge funds are turning away from PMs to Bitcoin to boost profits. Since the institutional money is finally pouring into the BTC realm.

- Bitcoin / altcoin miners are literally printing money, with the expressed blessings of the Fed / Treasury, as hubris filled authorities consider cryptos merely a commodity.

- Both the guest / host concur that the PMs offer solid relative values, with silver the more enticing of the two.

- The TEZOS ICO** with a minimum investment of $250 recently launched in pre-ICO skyrocketed to $12 (Figure 1.1.).

- Investors could reap a 20 fold increase in the $250 investment.

- Futures are trading on BitMEX for pennies using 100x’s leverage or no leverage at all, plus BitHTC.

- Berkshire Hathaway Shares trade for $300,000 – where is the Bitcoin Bubble when Bitcoin is 20 times cheaper?

- The much anticipated B2X fork will take place around December 28th!

$4,000 * 450M / 10M = $180,000

Now that gold hedge funds are turning to Bitcoin to boost profits, will the new institutional interest transfer to the herd as usual, resulting in a feeding frenzy, catapulting price into the vicinity of $100k? Berkshire Hathaway Shares trade for $300,000 – where is the Bitcoin Bubble when Bitcoin is 20 times cheaper? Bitcoin / altcoin miners are literally printing money with the expressed blessing of the Fed / Treasury, as authorities in their hubris consider cryptos only a commodity, not real money. Both the guest / host concur that the PMs offer solid relative values, with silver the more enticing of the two – both anticipate a new bull market rally in the sector.

Figure 1.1. TEZOS pre-ICO futures on HitBTC

Note: Graph prepared by Chris G. Waltzek – courtesy of HitBTC.

US treasuries are seeing action we have not seen for a while: Strong sharp steepening of the yield curve.

The yield curve is said to steepen when the spreads between short-term and long-term rates increases. The yield curve flattens when spreads shrink.

- A bearish steepener occurs when rates are rising and long-term yields are rising more than short-term rates. Spreads widen.

- A bullish steepener occurs when rates are falling and short-term rates are falling faster than long-term rates. Spreads widen.

- A bullish flattener occurs when rates are falling and long-term rates are falling faster than short-term rates. Spreads narrow.

- A bearish flattener occurs when rates are rising and short-term rates are rising faster than long-term rates. Spreads narrow.

The terms bearish and bullish refer to capital gains (bullish) or losses (bearish) if one is invested in government bonds.

Bearish Steepener Meaning

A bearish steepener is generally a sign that market participants believe the economy is getting stronger and the Fed (Central Bank), will be hiking rates faster than previously anticipated or more than anticipated.

What Happened Today?

- The housing market was stronger than expected: Housing Starts Jump More Than Expected: Economy Overheating?

- The current account deficit shrank more than expected: Current Account Deficit Shrinks Due to Hurricanes

June Rate Hike Odds

Synopsis

- The Fed Funds rate is currently 1.25% to 1.50%

- The odds of two quarter point hikes through the June meeting increased from 32.5% yesterday to 38.1% today. This is consistent with the bearish steepening of the yield curve.

I did not believe the Fed would hike as much as expected in 2018, and today does not change my mind.

By Mike “Mish” Shedlock

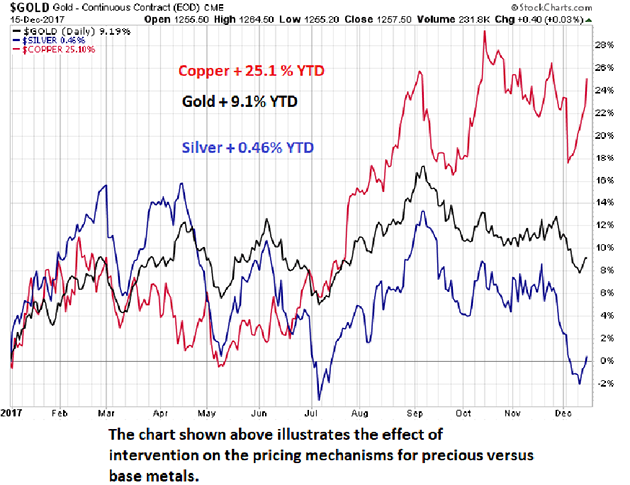

A break of this trend line will confirm that the Euro has entered a bull market and the dollar has entered a bear market. Gold is expected to finally be released from its year-long basing pattern.