Real Estate

Click chart for Larger Version

In December 2017 Toronto metro SFD prices, 8 months since the March 2017 spike and peak price, continued slipping and to date have lost $207,895 or 18%. Vancouver prices are still defying gravity; FOMO and speculative pricing is still on.

Anyone owning a detached house in the scorching hot Vancouver market is sitting on an unredeemed lottery ticket with time running out as buyers hibernate into the seasonal decline. The Bank of Canada interest rate up-moves is thinning the crowd even more.

It remains interesting to note that the combined average sum price of a Vancouver, Calgary & Toronto condo is currently 49% more expensive than a median priced Montreal SFD; last month it was 52% (no typo). It was 51% in APR 2017, 49% in FEB 2017 and 41% in July 2016 at the Vancouver peak. Montreal has more listing inventory available for sale than any of the other 5 biggest metros in Canada and the lowest monthly absorption rate based on total listings and sales.

In case you have forgotten the depth and velocity of the previous market reversal when Canadian real estate prices plunged in 2007-2008 (chart); householder equity vanished as follows:

- ’07-’08 Average Vancouver SFD lost $122,900, or 15.9% in 8 months (2%/mo drop)

- ’07-’08 Average Calgary SFD lost $92,499, or 18.3% in 18 months (1%/mo drop)

- ’07-’08 Average Edmonton SFD lost $78,719, or 18.5% in 21 months (0.9%/mo drop)

- ’07-’08 Average Toronto SFD lost $63,867, or 13% in 13 months (1%/mo drop)

- ’07-’08 Average Ottawa Residence lost $25,664, or 8.6% in 6 months (1.4%/mo drop)

- ’07-’08 Median Montreal SFD lost $6,000, down 2.6% in 6 months (0.4%/mo drop)

This past weekend, I discussed the current extension of the market. To wit:

“In the short-term, the market trends are CLEARLY bullish, very overbought, but nonetheless bullish.”

“As such, our portfolios remain ‘long’ on the equity side of the ledger…for now. “

The current momentum behind the market advance is clearly bullish, and with the “smell of tax reform” in the air, there is little to derail the bulls before year-end.

As I previously wrote, I am still somewhat suspicious of the markets going into 2018. As I laid out over the last couple of weeks, I believe the risk of “tax-related” selling is a strong possibility at the beginning of the year as portfolios lock in gains without having to pay taxes until 2019. While the risk to the overall market trend remains small, a correction of 3-5% is possible. I am still looking for the right “setup” by the end of the month to add a small “short S&P 500” position to portfolios and increase longer-duration bond exposure to hedge off some of the potential risks.

I will keep you apprised, of course.

However, in the meantime, there seems to be nothing stopping the market from going higher. As stated in the title, the current push higher puts 2700 in sight by the time Santa fills the “stockings hung by the chimney with care.”

As shown below, price momentum triggered a short-term “buy” signal following Thanksgiving, and after the brief “AMT Tax Debacle” in the Senate Tax Bill, momentum again has turned up as prices continue to press higher.

As noted above, this “momentum” keeps portfolios allocated towards equity risk, but we continue to be prudent about the risk we are taking and continue to hedge risk as necessary.

It’s All About Liquidity

As I have discussed previously, what fundamental strength there is in the market currently was long-ago priced in. The reality is this continues to be a liquidity driven market through Central Bank interventions. The correlation between the NYSE Advance/Decline line and the Japanese Yen shows the “carry trade” that arises from these monetary interventions.

Following the early 2016 correction, the “carry trade” has picked up steam and has continued to force asset prices higher as liquidity seeks opportunity. With the “carry trade” now extremely extended currently, which is also highly leveraged, watch for a triggering of a “sell signal” as a sign to temporarily reduce equity-related risk.

But wait, the Fed is reducing their liquidity flows into the financial system, right?

Not so much.

As shown in the first chart below, the Fed’s balance sheet continues to remain stable even as asset prices surge.

With global Central Banks still flooding the system with liquidity, the Fed has yet to begin rolling off their reinvestments as expected. In fact, the Fed made a timely reinvestment during the “Senate Tax Bill” debacle earlier this month.

Of course, that bump of liquidity sent asset prices rocketing higher.

The question becomes just what will happen to the markets when the Fed actually does begin to aggressively decrease their “reinvestments” in the coming year. The projected decline in the balance sheet looks like the following:

One can only imagine how market which has been repeatedly driven higher on a “feast of liquidity,” either from the Fed or other Central Banks, will react to being put on a diet.

The consequences for investors is likely not optimal particularly given, as discussed this past weekend, the degree of extensions in the market from both long and short-term moving averages. As shown, there are only a few occasions in history where the market has gotten extremely deviated from it 6-year moving average as it is now.

Such deviations do not necessarily mean a crash is coming tomorrow, as shown, irrational exuberance can last much longer than logic would otherwise dictate. However, with the economy running at substantially weaker levels of growth, the ability to leverage debt limited, and valuations already grossly extended, a repeat of the late-90’s is much less likely currently.

The current environment, while bullish, is much more fragile than what was witnessed at the end of the last century hence the need for ongoing “emergency measures” from global Central Banks. This is due to:

- Weakness in revenue and profit growth rates

- Stagnating economic data

- Deflationary pressures

- Excessive bullish sentiment

- Rising levels of margin debt

- Expansion of P/E’s (5-year CAPE)

(For visual aids on these points read: 4 Warnings)

But, for now, the bull charges on.

2700 by Christmas? It’s likely as asset managers try to make up ground, performance wise, before year-end reporting.

How To Play It

With the markets currently in extreme intermediate-term overbought territory, it is likely that the current “hope driven” rally is likely near a short-term top.

For individuals with a short-term investment focus, pullbacks in the market can be used to selectively add exposure for trading opportunities. However, such opportunities should be done with a very strict buy/sell discipline just in case things go wrong. (See last week’s post for guidelines)

However, for longer-term investors, and particularly those with a relatively short window to retirement, the downside risk far outweighs the potential upside in the market currently. Therefore, using the seasonally strong period to reduce portfolio risk and adjust underlying allocations makes more sense currently. When a more constructive backdrop emerges, portfolio risk can be increased to garner actual returns rather than using the ensuing rally to make up previous losses.

For More Read: “You Can’t Time The Market?”

With our portfolios invested at the current time, it makes little sense to focus on what could go “right.” You can readily find that case in the mainstream media which is biased by its needs for advertisers and ratings. However, by understanding the impact to portfolios when something goes “wrong” is inherently more important. If the market rises, terrific. It is when markets decline that we truly understand the “risk” that we take. A missed opportunity is easily replaced. However, a willful disregard of “risk” will inherently lead to the destruction of the two most precious and finite assets that all investors possess – capital and time.

Just something to consider when the media tells you to ignore history and suggests “this time may be different.”

That is usually just about the time when it isn’t.

One month ago, a chart from Convoy Investments went viral for showing that among all of the world’s most famous asset bubbles, bitcoin was only lagging the infamous 17th century “Tulip Mania.”

One month later, the price of bitcoin has exploded even higher, and so it is time to refresh where in the global bubble race bitcoin now stands….

….also from ZeroHedge:

Deutsche: “We Are Almost At The Point Beyond Which There Will Be No More Bubbles”

“spiraling leverage cannot continue indefinitely. At some point, the bubble becomes too big and cannot be subsumed by a bigger bubble – the damage of its burst would become irreparable. Therefore, when that moment comes — and we believe that moment is now – the market is facing a following dilemma.”

- Permanent state of exception: We continue to operate in a regulated environment. Leverage is limited, but care is taken not to overconfine the system so we avoid the Japanese scenario. While this appears as a prudent approach to reality, it implies giving up all the ideas of unlimited growth, something that made US economy look better than the rest of the world. Compared to what we have seen before, this means settling for much less than this country is used to aspiring. Although a reasonable proposition, it is emotionally a difficult choice that is and will remain subject to substantial political manipulation. It is unlikely that populist narrative will not continue to challenge this choice [ZH: hey, one can just blame the Russians, right?]

- Flirting with high tail risk : Deregulation and deficit spending could result exactly due to abandoning the first path, as its direct challenge, under political pressure that American economy can restore its old status and resume its pace of the previous decades. This is a serious tail risk as it is playing against the backdrop of considerable overhang of the post-2008 one-side positioning. Central banks are massively short convexity in this scenario. Any inflationary maneuver, or anything that would be a bear steepener of the curve, could force disorderly unwind of the bond trade and reinforce the trend thus creating another crisis from which there could be no way out.

- Forced deleveraging: An overly hawkish Fed forces rates higher and triggers a disorderly unwind of the bond trade, thus forcing the system to deleverage. This is the policy mistake.

The Deutsche Banker’s conclusion was stark and certainly dramatic:

…..read the conclusion & the rest of the article HERE

QUESTION: You have said that coins were still fiat and not tangible hard money. Nobody else has said that. Can you support that statement?

DS

ANSWER: Of course. During the American Colonial period, there was a shortage of silver in particular in Britain. The British imposed restrictions on what coins could be used to pay Americans for anything. That restriction was imposed on silver and gold. Therefore, payment to Americans from Britain was always in copper coins. If Americans wanted to buy something from Britain, it was typically demanded in silver or gold. This was one of the reasons for the American Revolution.

Because of these restrictions, the monetary value of copper coins was twice its actual metal content. All governments produced coins ONLY at a profit, which is called the seignorage..……

….also from Martin:

EU Commission v Eurogroup

Most people do not understand that there is the Eurogroup, which is an informal body of finance ministers from the Eurozone member states that are intended to discuss matters relating to their countries’ common responsibilities related to the Euro. They do not keep any minutes so nothing emerges with respect to policy. There is now a clash building between this Eurogroup and that of the European Commission….

Writing about blockchain and bitcoin right now is a little like buying a new computer in the 1990s. The tech was advancing so fast in those days that as soon as you brought the thing home, it was sorely outdated. Similarly, the cryptocurrency world is changing so rapidly at the moment that even before “the ink dries” on one of my posts, some important new development has already surfaced.

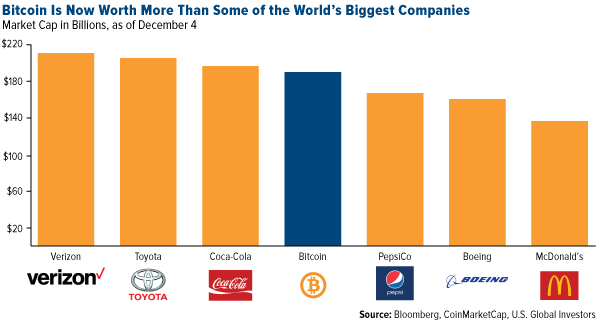

Case in point: When Bloomberg ran a particular story last Monday—“Bitcoin Is Now Bigger Than Buffett, Boeing and New Zealand”—bitcoin’s market cap hovered just above $185 billion, making it worth more than the likes of PepsiCo, Boeing and McDonald’s.

Well, here it is a week later, and this chart is already outdated. As of Monday morning, bitcoin’s market cap topped $275 billion, bringing its total value comfortably above Coca-Cola, Toyota and Verizon (and now Bank of America, Walmart, Procter & Gamble, Pfizer, AT&T and Chevron). Next stop is Alphabet, which had a market cap of $288 billion at the end of the third quarter.

Or consider this: In May 2011, an early bitcoin investor named Greg Schoen tweeted his regret that he sold at $0.30, as the currency had then risen to $8.00 apiece.

Obviously we’ve seen earth-shattering appreciation since then. As of my writing this, bitcoin has breached the $17,000 level, up nearly 5.6 million percent—yes, you read that right, 5,600,000 percent—from our friend Greg’s exit point in 2011.

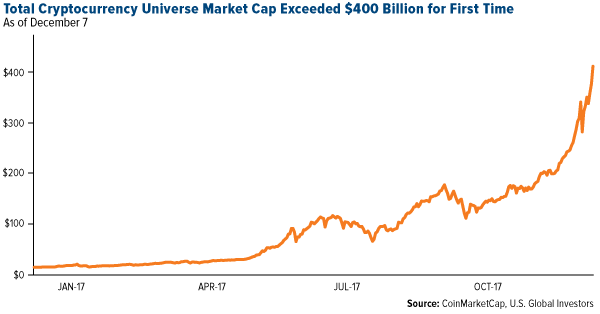

Bitcoin, of course, is just the largest fish in the entire universe of cryptocurrencies, which now number somewhere in the vicinity of 1,340, according to CoinMarketCap. If we combine the total market cap of all “altcoins” Monday morning, the amount exceeded $440 billion. That’s larger than the economies of Thailand, Nigeria and Austria. As of my writing this, as many as 15 coins had market caps over $2 billion.

Coinbase Now Has More Accounts Than Charles Schwab

|

This meteoric growth has attracted not just retail investors but also, inevitably, regulators. San Francisco-based Coinbase, which allows users to trade digital currencies, now boasts more active users than fellow San Francisco-based Charles Schwab, the second biggest brokerage firm following Fidelity. As of December 1, Coinbase had 13 million accounts, Schwab 10.6 million.

Contributing to Coinbase’s attractiveness is the ease with which someone can join. Whereas it can take up to two weeks to create a Schwab account, a Coinbase account can be opened in mere minutes, and as effortlessly as a Tinder account. This is one of the many reasons why both the popular online trading platform and dating service appeal to millennials.

According to Coinbase, as much as $50 billion have been traded on its platform since its inception, but as the number of accounts grows, we’ll likely see this dollar figure surge exponentially. This is the effect of Metcalf’s law, which I featured in an earlier post and discussed with SmallCapPower during the Mines and Money conference in London last month.

The Rule of Unintended Consequences

If you recall, President Reagan once said: “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops, subsidize it.” Surprising no one, then, Coinbase’s success has raised alarm bells for regulators and other government officials.

Ironically, it’s regulators that have unintentionally created the current environment in which cryptocurrencies now thrive. Back in May, I shared with you the fact that the number of listed companies here in the U.S. fell by more than half between 1996 and 2016. The addition of new financial rules and regulations, from Sarbanes-Oxley to Dodd-Frank, has encouraged more and more startups to avoid going public altogether, which is why we’re seeing an explosion right now in both stock prices—fewer listed companies means greater consolidation of fund flows into select stocks—and nontraditional methods of fundraising, from initial coin offerings (ICOs) to angel investing.

|

Consider the unintended consequences of Prohibition. Thanks to the 18th Amendment, the U.S. saw a sharp rise in organized crime and the emergence of notorious figures such as Al Capone.

By invoking “Scarface,” I’m not suggesting that all activities involving cryptocurrencies are illegal or malicious. I’m only saying that when rules and regulations become too restrictive, it invites new opportunities in unexpected ways.

And the beat goes on. After a months-long pushback, Coinbase agreed at the end of November to turn over the identities of 14,000 of its users to the Internal Revenue Service (IRS), which asserted that only 800 to 900 taxpayers reported bitcoin earnings between 2013 and 2015.

The tax agency initially requested access to all 13 million of Coinbase’s users, so I would call this an overall win for the exchange.

Bad News Is Good News

You might presume the IRS’ crackdown on Coinbase would discourage some potential bitcoin investors from participating. I would argue that the IRS incident is actually constructive for bitcoin because there’s very recent precedent of similar setbacks being turned into a windfall for digital currencies.

In mid-September, we saw the price of bitcoin dip sharply after China restricted new ICOs and JPMorgan Chase CEO Jamie Dimon knocked the digital currency as a “fraud,”comparing it to the Dutch tulip bubble in the 17th century. The one-two punch purged the market of weak-stomached investors, resulting in an intraday loss of $711 per coin.

Since mid-September, though, bitcoin has rallied close to 380 percent, even after the IRS came for its pound of flesh. On November 29, bitcoin swung wildly from as high as $11,427 to as low as $9,001, a difference of $2,426.

Those who managed to tolerate these swings in the past will likely continue to stay aboard the S.S. Bitcoin—after all, the big banks and IRS’ opposition to digital currencies is precisely why they’re in the game in the first place. Bitcoin enthusiasts value the currency because it’s decentralized, anonymous, finite and cannot be manipulated by “the powers that be,” unlike fiat money.

Put another way, that some world governments, big banks and the IRS seek to quash bitcoin is unequivocal confirmation of its value.

If You Can’t Beat Them, Join Them

That brings us to Venezuela’s recent announcement that it plans to launch its own cryptocurrency, dubbed the “petro,” which will reportedly be backed by oil, gold and diamond reserves.

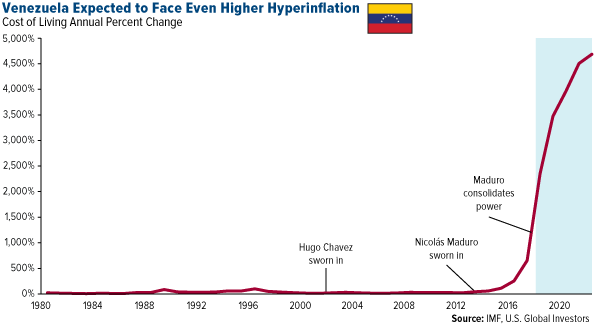

The revelation comes as the beleaguered South American country’s economy continues to deteriorate since Nicolás Maduro took office in 2013. The country owes around $60 billion to bondholders yet has only $9.6 billion sitting in the bank. An estimated 80 percent of Venezuelans currently live in poverty. Food, medicine and other necessities are dangerously scarce, and inflation right now is among the worst the world has ever seen, comparable to Germany in the 1920s and Zimbabwe in the 80s.

This is inexcusable for such a resource-rich country. Venezuela, which depends on oil for around 95 percent of its export revenues, sits atop the world’s largest known oilfield. Amazingly, though, its output has been declining for several straight months. In September, production fell below 2 million barrels a day, a three-decade low, according to the Organization of Petroleum Exporting Countries (OPEC).

Conditions aren’t likely to improve for the country since Maduro consolidated power in July,effectively making himself absolute dictator and inviting harsh economic sanctions from the U.S. government.

This is precisely what drives Maduro’s interest in establishing a cryptocurrency—to circumvent U.S.-led sanctions. The petro will serve as a “buffer” between transactions, encrypting all incoming and outgoing money to free up the country’s monetary system from controls imposed by the U.S.

As explained by Bloomberg’s Leonid Bershidsky, foreign investors “will be able to lend money to Venezuela and get repaid in cryptocurrency, which Maduro wants them to spend on oil and other Venezuelan commodities” that are tied up by the U.S.

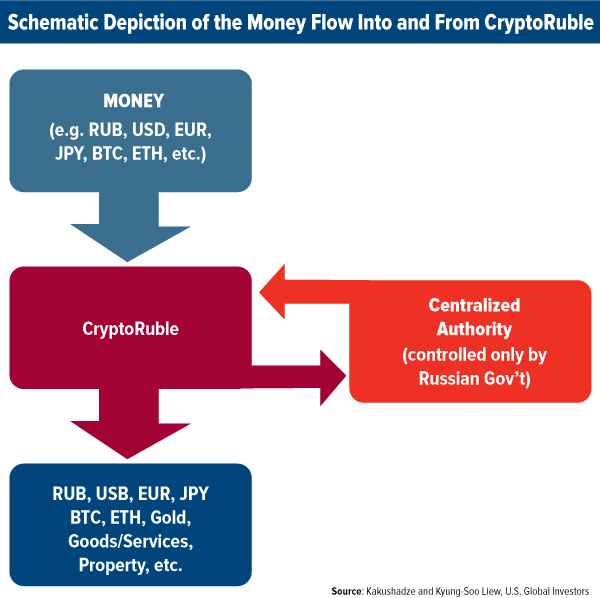

Russia has similar ambitions with its “CryptoRuble,” unveiled in October. Like Venezuela, Russia grapples with steep U.S. and international sanctions following its annexation of Crimea in 2014 and meddling in the 2016 U.S. election. Below is a flowchart— courtesy of Zura Kakushadze, professor of quantitative finance at Free University of Tbilisi, and Jim Kyung-Soo Liew, assistant professor of finance at John Hopkins University—illustrating how the CryptoRuble is designed to allow the Russian government to maintain full control of money flow into and out of the country’s coffers.

According to Kakushadze and Kyung-Soo Liew:

With government-issued cryptocurrencies, central banks and sovereign governments will gain even more control, not less, than with the current banking system… This is any government’s dream come true!

To be clear, the way in which Venezuela and Russia plan to use cryptocurrencies is antithetical to their appeal in the eyes of many investors. Unlike bitcoin, Ethereum, Litecoin and other popular digital currencies, the petro and CryptoRuble are centralized—they are conceived and will be controlled exclusively by the Venezuelan and Russian governments.

And unlike bitcoin, they will not be mined, as gold is, but issued by governments, as fiat money is.

Again, Kakushadze and Kyung-Soo Liew:

The world order as we know it is changing, right before our eyes. This disruptive technology—cryptocurrencies—will indeed end up disrupting the status quo. However, at least in the mid-term, forward-thinking sovereign states that embrace and adapt it to their advantage will end up being the disruptors as opposed to disrupted. The U.S. is the sovereign state with the most to lose in their process, with a clear policy implication: adapt to the changing reality, issue CryptoDollars now, or risk being marginalized.

This assessment dovetails perfectly into a November report from Deutsche Bank strategists Jim Reid and Craig Nicol, who reflect on what they see as the end of traditional fiat money within the coming decades. Because fiat currencies are “inherently unstable and prone to high inflation,” Reid and Nicol write, “We may need to find an alternative.” Among other solutions, the two suggest cryptocurrencies, which “are as much about blockchain as anything else.”

Speaking of blockchain, Australia’s main stock market, the Australian Securities Exchange (ASX), is soon poised to become the first in the world to use blockchain’s superior ledger technology to process transactions, according to Bloomberg. It wouldn’t surprise me if other global stock markets, including the New York Stock Exchange (NYSE), quickly embraced this exciting new technology.

How to Gain Exposure to Bitcoin Without Owning Any

And finally, both the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) have set the table to offer bitcoin futures contracts for the first time ever this month—the CBOE this past Sunday, the CME a few days later. This will give investors a new way to participate in bitcoin and, in many skeptics’ minds, help “legitimize” the currency as a serious asset.

There are other ways to participate without actually owning bitcoin. In a recent Bloomberg story, Tom Lee of market research firm Fundstrat lists several companies and funds with exposure to the digital currency. Among his favorites is HIVE Blockchain Technologies, a blockchain infrastructure company involved in the mining of fresh new coins, never before traded. The first company of its kind to sell shares to the public, HIVE began trading on the TSX Venture Exchange on September 18.

I’m sure I’ll have more to say on these topics at a later time. In the meantime, I invite you to watch this short, 16-minute film titled “Cryptocurrency Revolution: On the Frontlines of the World’s Hottest Tech Opportunity.” It features myself, Frank Giustra and Marco Streng, co-founder and CEO of Genesis Mining, the world’s largest cloud bitcoin mining company.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2017): The Boeing Co., Chevron Corp.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly.