Stocks & Equities

So, we are now in the ebullient month of December and as often stated, “It is tough to put stocks away to the downside in December. It can happen, but it’s pretty rare.” In fact, there were only two years that saw negative returns for the S&P 500 (SPX/2642.22) in December. They were 1936 and 1955, but even then the declines were small.

To be sure, over the last 100 years the average December gain has been 1.55% with a “win rate” of 74% of the time (Chart 1).

Moreover, ten of the S&P’s macro sectors have experienced positive returns in December. As Bespoke Investment Group notes, “Surprisingly, it has been the high yielding dividend paying sectors that have seen the largest gains with Real Estate, Telecom Services, and Utilities all posting gains of more than 2%.” Worth mention is that last December ALL the macro sectors rallied! Parsing a list of some of the historically best performing stocks in the S&P 500 during the month of December we find the following names from the Raymond James research universe. Each stock screens well on our models and carries a favorable rating from our fundamental analysts: Broadcom (AVGO/$271.56/Strong Buy), Oracle (ORCL/$49.61/Outperform), Valero (VLO/$84.17/Outperform), Red Hat (RHT/$125.26/Outperform), Nvidia (NVDA/$197.68/Outperform), and Mohawk (MHK/$284.82/Strong Buy).

It seems like investors were writing off the real estate sector entirely.

With the rise of technology used to shop online, work from home and even go to school, real estate has been a hated sector.

But it’s a sector I have been a fan of this year, triggering gains of 15% and 17% in my Pure Income service.

That’s because even though I know the landscape for real estate is changing, I still see the crowds at the malls, the wait times at restaurants and the continued need for hospitals and health care facilities.

So the decline in values recently has looked like an opportunity to me.

But my personal experience or viewpoint doesn’t have anything to do with my recommendation today.

Instead, three separate computer-based buy signals are flashing bullish signals on the real estate sector, and I have a possible triple-digit opportunity for you.

Let me explain.

Three Buy Signals for the Real Estate Sector

Let’s start with the three buy signals on the sector before I give you the opportunity.

The first is the most basic, a price chart of the SPDR Real Estate Select Sector ETF (NYSE: XLRE).

This is showing a possible breakout of a long trend channel.

It may have just had a false breakout, since the price jumped above the trendline, then fell back below it. But this can also hold as a new, steeper uptrend for the exchange-traded fund (ETF). As long as it can hold above its previous peak, around $33.50, prices should continue to climb.

The second is a seasonality chart.

Right now, it is a great time to enter the real estate sector based on a 10-year seasonal analysis of the Vanguard REIT ETF (NYSE: VNQ). I used this ETF because it has data going farther back than the newly listed XLRE in the price chart.

December is clearly the strongest month to be in real estate, and we just bought a real estate investment trust (REIT) in my seasonal service, Automatic Profits Alert, a couple of weeks ago that is already benefiting from this trend.

The third chart is something you may not be too familiar with, but it is a concept I have discussed before called a Relative Rotation Graph™.

If you want to learn more about the concept, you can click here to read more about it.

Basically, it’s the idea that stocks rotate in and out of leading and lagging the market. And there are key turning points, where a sector will shift from lagging, to improving and eventually leading the market.

The real estate sector is at such a point. Take a look:

If you can read the text, you’ll notice it is in the lagging section of the chart. But when an ETF is in that section and turns sharply higher, like XLRE did, that is a sign momentum is shifting and the sector is turning around — which is the exact time we want to jump in.

A Unique Way to Profit

All told, the real estate sector is a solid buy right now.

In my service, I handpick certain stocks to benefit from these trends. For today, I’m going to recommend a unique way to profit, and that’s to buy a call option on the XLRE real estate ETF.

The option we are going to buy is the February 16, 2018, $34 call option.

With this option, we are expecting the ETF to rise as predicted by the three charts above. However, whenever you buy an option, it’s important to remember you can lose everything you paid to buy the option. Even though we have three buy signals, there’s always a chance the trade doesn’t work out, so just keep that in mind.

This option costs roughly $0.55, depending on when you purchase it. Since one contract covers 100 shares, one contract will cost about $55.

Now, I want to highlight that this is not a position that I will be tracking or updating you on, so it will be up to you to pull the trigger to take profits or cut losses.

A good rule of thumb for a trade like this is to sell half of your position at a 50% gain, and manage the second half to either take profits if it begins to fall by about 30% in value, or start to sell the second half once it is above 100%.

For a loss, you can cut it if it falls to a 50% loss.

For the ETF, all we need is it to rise about 4.2% over the next three months to hand us a 100% gain.

Regards,

Chad Shoop, CMT,

Editor, Automatic Profits Alert

In the year 301 AD, the Roman unit of barter was the denarius, which had originally been 95% pure silver when introduced by Augustus at the end of the first century BC but by the time of Diocletian’s rule, it had moved to 50,000 denarii to a pound of gold. Ten year later, it took 120,000 denarii to buy a pound of gold and by 337, that figure was 20,000,000. What had occurred in a mere 400 years was that a slow and agonizing erosion in the purchasing power of the Roman currency accelerated to full fiat disintegration and that complete and total disregard for the denarius was attributed as one of the underlying causes of the Fall of the Roman Empire. Nothing was more evident in the underlying rot permeating Roman society, economics and national security than the refusal by the Barbarian armies to accept anything but gold as payment for their leaving the Roman legions alone. Rejection of the currency of the Roman Empire was complete and irreversible.

One of the omens of impending inflationary spirals is the tendency of those individuals controlling large swaths of wealth to reject any form of “savings” in the form of bank deposits or interest-bearing certificates. They choose instead to jettison cash or cash-equivalent instruments because of a loss of faith in the ability of local currencies to retain purchasing power. We have seen this over the ages from Weimar Germany to Zimbabwe and now Venezuela, and where gold and land were generally the tried-and-true assets of choice for those wishing to protect their wealth from the insanity and irresponsibility of governments, today in 2017 with the advent of technology and its attendant curses and wonders, the wunderkind of today have actually created their own receptacle for frightened wealth and that is the true meaning of Bitcoin and its incredible “success.”

When the chief technology engineers sat down ten years ago after watching the global bankers vaporize the financial system and then turn right around and “save” it through a massive and globally coordinated counterfeiting racket, they determined that anywhere government has control over money (as in the banking system), there could be no certainty of anything responsible or prudent whereas there was absolute certainty that corruption would exist at a systemic level. Therein lies the reason for the invention of blockchain technologies and the best-performing “asset” of 2017, Bitcoin, which is ahead an astonishing 1,000% year-to-date spurring the creation of hundreds and hundreds of “wannabes” being trotted out as heir apparents.

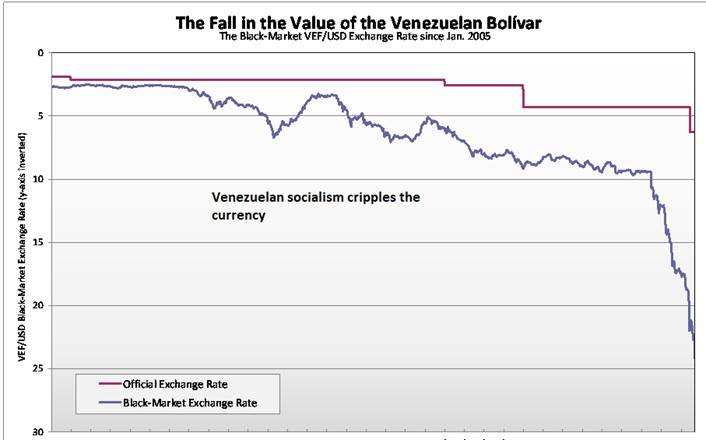

Traditionally, investors moved to the old saws, gold and silver, as safe havens for decomposing currencies and as recently as this year, we have witnessed the efficacy of wealth preservation as Venezuelan citizens that moved their savings to U.S. dollars from the bolivar avoided the most hideous of outcomes as the bolivar collapsed. This is precisely what occurs when confidence sinks to zero and hoarding of staples escalates.

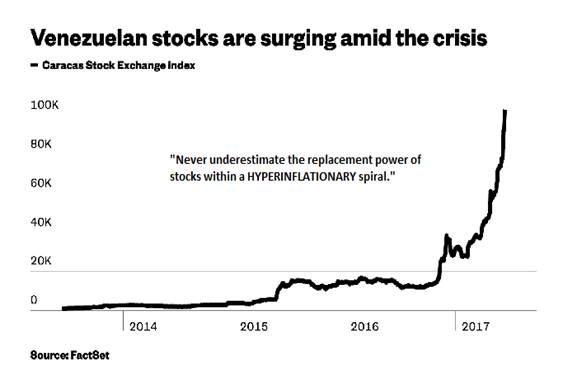

If they further diversified by converting bolivar to gold, the outcome was predictably preferable to holding cash in mattresses or term deposits in a Caracas banking institution. However, it was the early escalation in stock prices that became the harbinger of collapse in the bolivar’s purchasing power. “Never underestimate the replacement power of stocks within an inflationary spiral” the saying goes and no more relevant than when “inflation” metamorphoses into “hyperinflation” as seen recently in Venezuela.

Now, in the Western world and specifically the U.S, it is apparent that very large holders of American dollar wealth have decided that they want to have control of the currencies to which they transfer wealth, keeping it away from the interference and meddling of politicians and the global banking cartel. Whereas gold and silver, by way of physical possession were once the stores of value within which wealth sought sanctuary, government intervention and manipulation by way of the derivative exchanges sent the members of this elite class of billionaires scurrying for the ultimate alternative to the precious metals and herein lies the genesis of Bitcoin.

In my opinion, BTC represents the final chapter of the repudiation of fiat currencies by those of the Super-Wealth fraternity. They own all of the prime real estate around the world; they own all of the publicly traded behemoths listed on global stock exchanges; and they own every politician and every court of law in existence. Ergo, there was only one glaring vulnerability to which the elite class were exposed—currency risk. Now, with Bitcoin, they have removed accessibility of this product to the Rothschild-ian Mantra of “controlling a nation by controlling its currency,” which was and is the modus operandi of the banker class. The maniacal move of BTC in 2017 represents total disdain, not for Zimbabwe dollars or Venezuelan bolivars, but for U.S. dollars, euros, and yen.

Now you may have noticed that I have purposely refrained from offering predictions on the outlook for BTC and the myriad of blockchain “wannabe’s” that are being marketed like pretzels at a ball game. My inbox this week is stuffed with dozens and dozens of these deals and the more difficult to assess and analyze, the more the demand swells. It seems that scarcity outweighs logic in handicapping this type of mania to the extent that when I see junior exploration companies announcing plans to restructure into blockchain business ventures by way of a twenty-something engineering graduate two years out of school, it is eerily reminiscent of the DotCom mania of the late 90s which, by the way, marked the bottom of the gold markets and the top in the tech bubble.

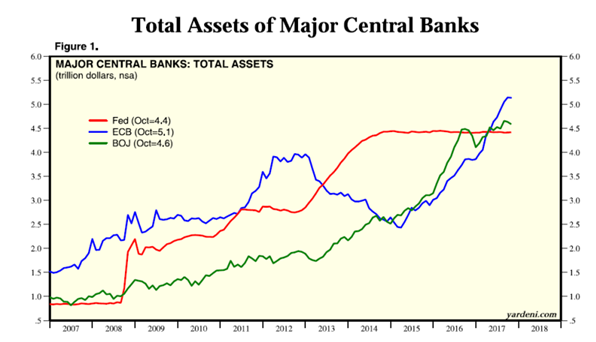

With central bank balance sheets engaged in an unrelenting escalation of credit creation, one needs look no further than the chart shown below in order to rationalize the increases being seen not just in the U.S. but around the world. All major stock markets are dancing with all-time highs as the impact of serial money-printing impacts prices. The Achilles Heel of the banker class—real estate, the ultimate collateral upon which banks are grounded—has rebounded with a vengeance in the U.S. and Europe with housing bubbles now in Canada, Australia and Sweden. That collateral so terminally impaired in 2008 is now the Mother’s Milk of the Banker Class with prices in many locations eclipsing the highs of 2005–2007. After all, that was the sole intent of Paulsen-Bernanke bailout at the bottom of the markets in 2009. A scant ten years later from a time when bankers were being hunted down in places like Iceland and Ireland, the American bankers have soared unimpeded to even greater riches than they enjoyed blowing up the sub-prime bubble.

I offer this commentary neither as a bull or a bear on BTC or this new industry called “blockchain” but rather as a 40-year observer and interpreter of market events. I am adamant in my conviction the just as central bank largesse is responsible for the asset bubbles popping up around the world, it is also the impetus for Bitcoin. More importantly, just as the turning of the leaves and the southern flight of flocks of geese are harbingers of fall and winter in the northern hemisphere, the emergence of alternative currencies replacing gold and silver as monetary sanctuaries is an underscored harbinger of the acceleration of the decomposition of the modern fiat currency regime. For traditionalists such as I (meaning “old and stubborn”), I shall opt for the certainty of possession as it pertains to physical gold and silver and the preservation of wealth. I leave this infatuation with digital havens to the younger and more daring but young or old, the message contained in the Bitcoin phenomenon is far more important than directional accuracy or investment merit. It is an omen of change in a manner far more important than the arrival of the internet or putting a man on the moon.

Think “Venezuela”. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

One of the most compelling and engaging presenters at the Precious Metals Summit in London last month was Ronald-Peter Stöferle, a managing partner at Liechtenstein-based asset management company Incrementum. Incrementum, as you may know, is responsible for publishing the annually-updated, widely-read “In Gold We Trust” report,which I’ve cited a number of times before.

During his presentation, Stöferle shared the fact that his wife prefers to do her Christmas decoration shopping in January. When he asked her why she did this—Christmas should be the last thing on anyone’s mind in January—she explained that everything is half-off. A bargain’s a bargain, after all.

This is very smart. Here we are several days before Christmas, and demand for ornaments, lights and other decorations is red-hot, so be prepared to pay premium prices if you’re doing your shopping now. But mere hours after the Christmas presents have been unwrapped and Uncle Hank has fallen asleep on the couch with a glass of boozy eggnog, stores will begin slashing prices to get rid of inventory.

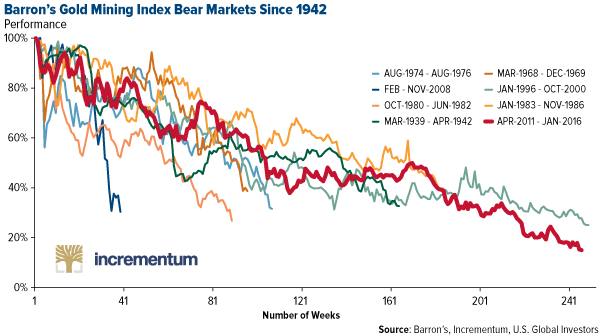

Gold bullion and mining stocks are currently in the “January” phase, so to speak, according to Stöferle. The Barron’s Gold Mining Index, which goes all the way back to 1938, recently underwent its longest bear market ever, between April 2011 and January 2016. And as I already shared with you, the World Gold Council (WGC) reported last month that gold demand fell to an eight-year low in the third quarter.

“Most people get interested in stocks when everyone else is,” Warren Buffett famously said. “The time to get interested is when no one else is.”

The same logic applies to Christmas decorations, gold and mining stocks.

Gold on Track for Its Best Year Since 2010

As of my writing this, gold is trading around $1,280, up 11 percent in 2017. That’s off 5 percent from its 52-week high of $1,351 set in September. If it stays at its present level until the end of the year, the metal will end up logging its best year since 2010, when it returned 30 percent.

|

Gold traded up on Friday as the U.S. dollar weakened following news that former National Security Advisor Mike Flynn pleaded guilty to lying to the FBI about conversations he had with Russian officials last December during the presidential transition. It’s possible that the details Flynn might provide as part of a plea bargain could help special prosecutor Robert Mueller advance his investigation into Russia’s meddling in the 2016 election.

But back to gold. Considering it’s faced a number of strong headwinds this year—a phenomenal equities bull run that’s drawn investors’ attention away from “safe haven” assets, lukewarm inflation and anticipation of additional rate hikes, among others—I would describe its performance in 2017 as highly respectable.

And yet if you listen to the mainstream financial news media, gold is “boring” and “flat.” Speaking to CNBC last week, Vertical Research partner Michael Dudas called the gold market “eerily quiet.”

|

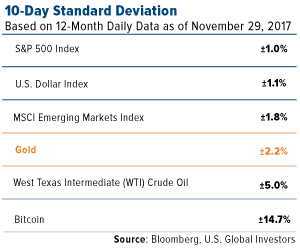

Dudas was specifically describing gold’s volatility, but even here the facts tell a slightly different story. In the table to the right, you can see the 10-day standard deviation for a variety of assets, using data from the past 12 months. Gold traded with higher volatility than domestic equities, the U.S. dollar and global emerging markets. Of those measured, only oil and bitcoin showed higher volatility.

Based on volatility alone, it’s stocks that look pretty “boring” and “quiet” this year, but you’re not likely to hear a pundit or analyst describe them that way.

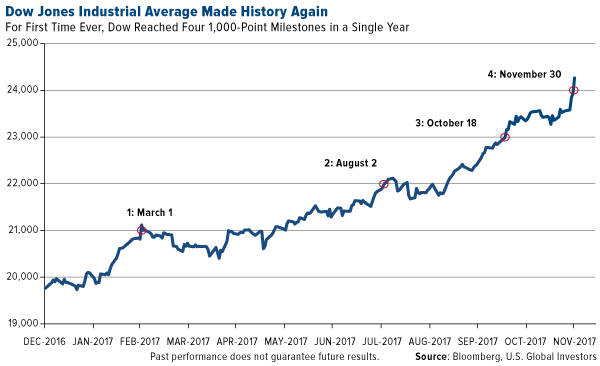

And with good reason. The S&P 500 hasn’t fallen more than 3 percent from a previous high for more than 388 days now, the longest stretch ever for the index. And for the first time in its 120-year history, the Dow Jones Industrial Average has reached four 1,000-point milestones in a single year—with a whole month left to go. It’s possible that excitement over the Senate’s tax bill will be enough to push the Dow above 25,000 sometime before the ball drops in Times Square. The drama involving Flynn, however, could threaten to derail those chances.

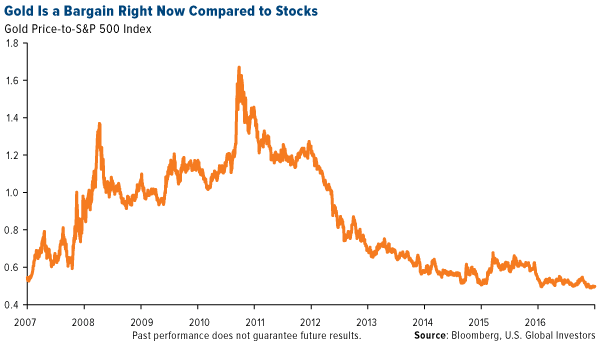

What this means is that, compared to domestic equities, gold is highly undervalued right now. The gold-to-S&P 500 ratio, a time-tested trading indicator, is near 50-year lows. I see this as a strong buy signal, especially now as we await the Federal Reserve’s decision to lift rates this month. If you recall, gold broke out strongly following the December rate hikes in 2015 and 2016.

In his December outlook on precious metals, Bloomberg Intelligence commodity strategist Mike McGlone writes that “gold is ripe to escape its cage soon,” adding that “prices just don’t get as compressed as they did for gold in November, indicating a breakout soon.”

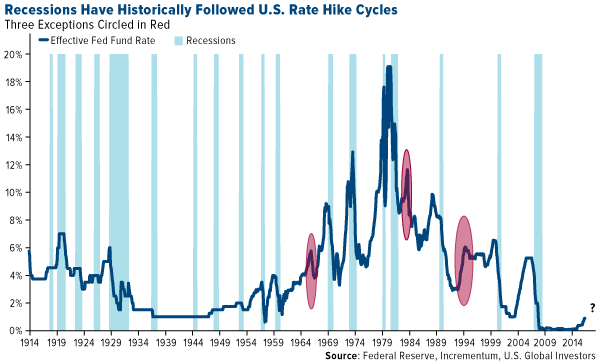

Is a Recession Brewing? History Says Maybe

So what are the catalysts that could trigger a breakout? Stöferle mentions two: a possible recession and stronger inflation.

“I think the odds are pretty high that a recession might be upon us sooner or later because we’re in this rate hike cycle, and as always the central banks are way behind the curve,” he said.

What Stöferle is referring to is the strong historical correlation between new U.S. rate hike cycles and recessions. Going back more than 100 years, 15 of the last 18 recessions were directly preceded by monetary tightening.

The Federal Reserve isn’t just raising rates, remember. It’s also begun to unwind its $4.5 trillion balance sheet, which was built in the years following the financial crisis. This carries historical risk. The central bank has embarked on similar reductions six times in the past—in 1921-1922, 1928-1930, 1937, 1941, 1948-1950 and 2000—and all but one episode ended in recession.

“Quantitative tightening will fail,” Stöferle predicted.

Obviously, there’s no guarantee that this particular round will have the same outcome as past cycles, but if you agree with Stöferle, it might be prudent to have as much as 10 percent of your wealth in gold bullion and gold stocks.

The Risks Surrounding Tax Reform

Inflation is a trickier thing to forecast. A lot of people, myself included, had expected the cost of living to show signs of life this year in response to some of President Trump’s more protectionist and policies. But nearly 10 months into his term, no major legislation has been passed or signed.

That might be about to change with the highly anticipated tax reform bill, which the Senate passed late Friday night. If the bill reaches Trump’s desk, it will be the first time in a generation that the U.S. has amended its tax code.

But will the $1.5 trillion bill, as it’s currently written, lead to stronger economic growth and pay for itself, as its most vehement supports insist? My hope is that it will. As I’ve been saying for a while now, it’s time we begin relying more on fiscal policies to drive growth, especially now that the Fed is beginning to tighten policy.

In the spirit of staying balanced, though, there are troubling signs and forecasts that the bill could actually end up being a disappointment. After reviewing the bill, the Joint Committee on Taxation (JCT) estimates that its enactment could lead to a whopping $1.4 trillion increase in the deficit between now and 2027. Even if we factor in economic growth that might come as a result of reforms, the JCT says, we’d still be looking at a $1 trillion shortfall.

Many economists are also skeptical. A recent University of Chicago Booth School of Business survey of economists from Yale, MIT, Princeton, Harvard and other Ivy League schools found that over half did not believe the current tax bill will “substantially” grow GDP. Only 2 percent thought it would, and more than a third were uncertain. Additionally, nearly 90 percent believed that if the bill is enacted, the U.S. debt-to-GDP ratio will be “substantially” higher a decade from now.

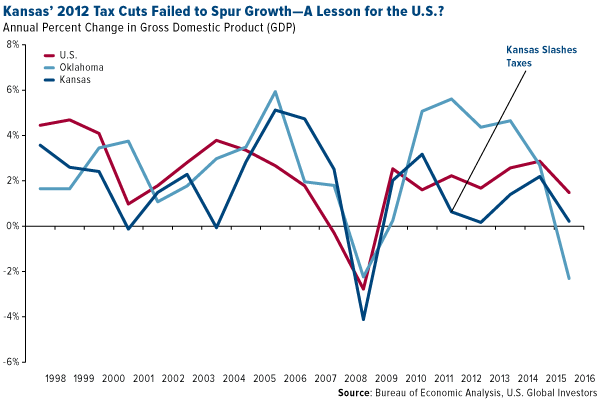

And then there’s the Kansas experiment from five years ago. In May 2012, Governor Sam Brownback signed a sweeping state tax reform bill that in many ways resembles the Senate’s current tax bill. It slashed personal and business income taxes, consolidated the state’s three tax brackets into two and eliminated a number of credits and exemptions. Hopes were high that the reforms would kickstart economic expansion, help taxpayers and attract new business to the state.

Instead, none of that happened. Following the bill’s enactment, Kansas GDP growth remained stagnant, trailing the national growth rate as well as that of neighboring states and even its own rate from years past. This year, the nonprofit financial watchdog group Truth in Accounting gave Kansas a failing financial grade of D, citing its inability to pay its debts or balance its budget.

In June of this year, Kansas’ Republican-controlled state legislature voted to raise taxes for the first time since reforms were enacted and eventually had to override Governor Brownback’s veto. Many of those state legislators who initially supported the Kansas tax cuts are now warning federal lawmakers that similar outcomes could occur on a nationwide scale.

I’m not sharing this to discredit tax reform—in fact, I’m strongly in favor of it. However, I believe it’s important to highlight the fact that nothing in life is guaranteed. Hope for the best, prepare for the worst. What steps can you take now in the event the tax reform bill doesn’t accomplish what it’s designed to do—or worse? This type of uncertainly has historically made gold shine the brightest.

Think Gold Has Fallen Short of Expectations this Year? Don’t Blame Bitcoin

At conferences I’ve attended and spoken at recently—the Silver & Gold Summit in San Francisco and Mines and Money in London among them—the suggestion has been made by a few big-name investors and money managers that bitcoin’s meteoric rise is to blame for the market’s apparent disregard for gold and gold stocks right now. With bitcoin up more than 1,050 percent since the beginning of the year, even after a 21 percent dip last Wednesday, many market-watchers might simply be too star-struck by the newness of bitcoin to be bothered by the “barbarous relic.”

I happen to think this is a mistake. As much as I believe in the value of bitcoin, gold and gold stocks still play a crucial role in the modern portfolio.

As I told Kitco News’ Daniela Cambone at the Silver & Gold Summit, bitcoin isn’t responsible for dismantling gold. Although both assets are currencies, I don’t see them at odds because they serve very different functions. For one, gold is more than money—it’s worn as jewelry, widely used in dentistry and can be found in art and even some high-end foods. It’s been traded around the world for millennia and, unlike bitcoin, does not require electricity. Indeed, it conducts electricity, which is why you can find it in your iPhone and GoPro camera’s circuitry.

|

Bitcoin is more than money as well. It’s the most influential spokesperson, if you will, of blockchain technology, upon which the currency is built. Speaking with SmallCapPower’s Angela Harmantas at the Mines and Money conference in London, I made the comparison that bitcoin is to email as blockchain is to the internet. In the earliest days of the internet, few people truly understood what it was or could predict the implications of this new technology—but email they understood. It’s what woke people up to the idea of using the internet. Bitcoin is doing just that for blockchain.

But blockchain’s utility goes far beyond finance. As a decentralized, highly encrypted ledger, it has untold potential to change the way we run our lives, businesses and governments. Among other tasks, the technology can help manage digital rights to intellectual property, bring transparency to supply chains and reliably track the spending of public funds. It can even be used as a tamper-proof voting system, whether you’re voting for a new chairman of the board or president of the United States. One day soon, we might all be e-voting from our smartphones and tablets, reassured that our vote cannot be compromised.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

The Standard & Poor’s 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices. The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The DJIA was invented by Charles Dow back in 1896. The MSCI Emerging Markets Index is an index created by Morgan Stanley Capital International (MSCI) designed to measure equity market performance in global emerging markets. The U.S. Dollar Index (USDX, DXY) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S.trade partners’ currencies. The Barron’s Gold Mining Index (BGMI) consists of publicly traded companies involved primarily in the mining for gold

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly.

click to enlarge

click to enlarge click to enlarge

click to enlarge