Real Estate

In October 2017 Toronto metro SFD prices hung on to their recent correction high but after 7 months since the March 2017 spike and peak price, they have lost $206,215 or 17%

(Plunge-O-Meter). Vancouver prices are still defying gravity; FOMO and speculative pricing is still on.

Anyone owning a detached house in the scorching hot Vancouver market is sitting on an unredeemed lottery ticket with time running out as buyers hibernate into the seasonal decline. The Bank of Canada interest rate up-moves is thinning the crowd even more.

….read more about Calgary & the CMHC

….also the plunge-0-meter:

*The Price Support target represents prices at March 2005; the start of a 40 month period of ardent speculation in all commodities; then a full blown crash into the pit of gloom (March 2009); and then another 39 month rocket ship to the moon but then the crowd suddenly thinned out in April 2012. The revival of spirits erupted in 2013 as global money went short cash and long real estate on an inflation bet. Now we have a major sense of doubt about value in Toronto.

Plunge-O-Nomics

The Pit of Gloom

- ’07-’08 Average Vancouver SFD lost $122,900, or 15.9% in 8 months (2%/mo drop)

- ’07-’08 Average Calgary SFD lost $92,499, or 18.3% in 18 months (1%/mo drop)

- ’07-’08 Average Edmonton SFD lost $78,719, or 18.5% in 21 months (0.9%/mo drop)

- ’07-’08 Average Toronto SFD lost $63,867, or 13% in 13 months (1%/mo drop)

- ’07-’08 Average Ottawa Residence lost $25,664, or 8.6% in 6 months (1.4%/mo drop)

- ’07-’08 Median Montreal SFD lost $6,000, down 2.6% in 6 months (0.4%/mo drop)

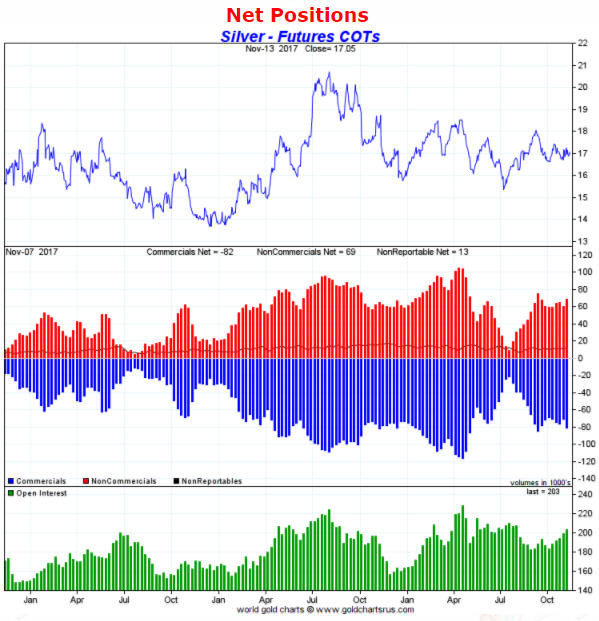

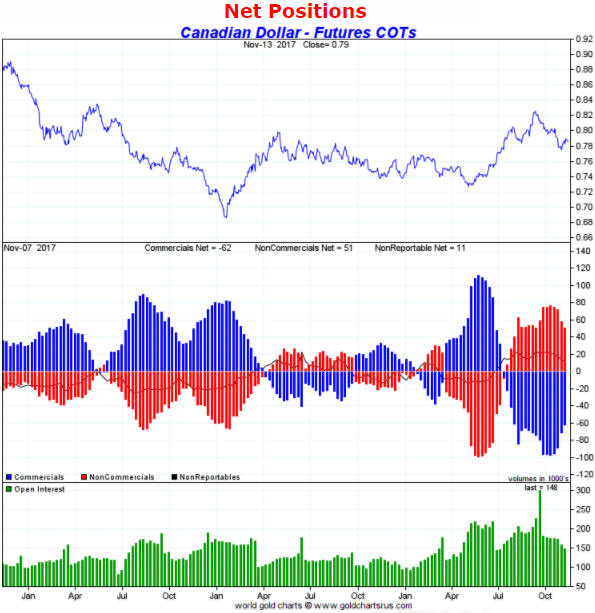

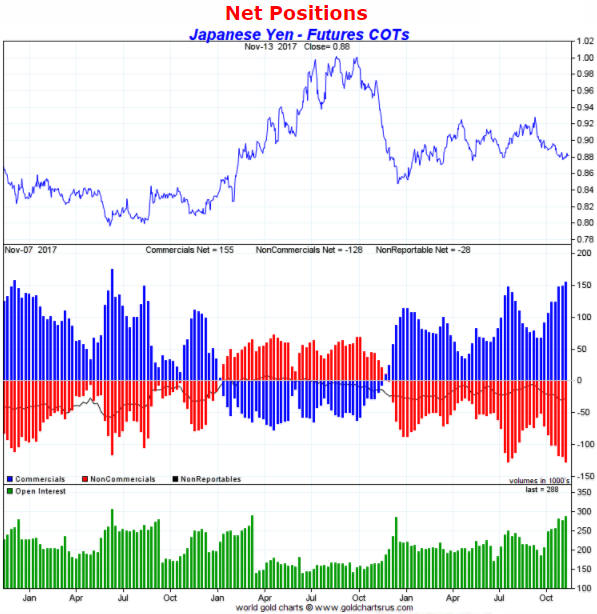

The Commitments of Traders (COT) reports are nothing other than sentiment indicators, but as far as sentiment indicators go they are among the most useful. In fact, for some markets, including gold, silver, copper and the major currencies, the COT reports are by far the best indicators of sentiment. This is because they reflect how the broad category known as speculators is betting. Sentiment surveys, on the other hand, usually focus on a relatively small sample and are, by definition, based on what people say rather than on what they are doing with their money. That’s why for some markets, including the ones mentioned above, I put far more emphasis on the COT data than on sentiment surveys.

In this post I’m going to summarise the COT situations for four markets with the help of charts from an excellent resource called “Gold Charts ‘R’ Us“. I’ll be zooming in on the net positions of speculators in the futures markets, although useful information can also be gleaned from gross positions and the open interest.

Note that what I refer to as the total speculative net position takes into account the net positions of large speculators (non-commercials) and small traders (the ‘non-reportables’) and is the inverse of the commercial net position. The blue bars in the middle sections of the charts that follow indicate the commercial net position, so the inverse of each of these bars is considered to be the total speculative net position.

Let’s begin with the market that most professional traders and investors either love or hate: gold.

The following weekly chart shows that the total speculative net-long position in Comex gold futures hit an all-time high in July of 2016 (the chart only covers the past three years, but I can assure you that it was an all-time high). In July of last year the stage was therefore set for a sizable multi-month price decline, which unfolded in fits and starts over the reminder of the year. More recently, the relatively small size of the speculative net-long position in early-July of this year paved the way for a tradable rebound in the price, but by early-September the speculative net-long position had again risen to a relatively high level. Not as high as it was in July of 2016, but high enough that it was correct to view sentiment as a headwind.

There has been a roughly $100 pullback in the price from its early-September peak, but notice that there has been a relatively minor reduction in the total speculative net-long position. This suggests that speculators have been stubbornly optimistic in the face of a falling price, which is far from the ideal situation for anyone hoping for a gold rally. A good set-up for a rally would stem from the flushing-out of leveraged speculators.

The current COT situation doesn’t preclude a gold rally, but it suggests that a rally that began immediately would be limited in size to $50-$100 and limited in duration to 1-2 months.

It’s a similar story with silver, in that the price decline of the past two months has been accompanied by almost no reduction in the total speculative net-long position in Comex silver futures. In other words, silver speculators are tenaciously clinging to their bullish positions in the face of price weakness. This suggests a short-term risk/reward that is neutral at best.

In May of this year the total speculative net-short position in Canadian dollar (C$) futures hit an all-time high, meaning that the C$’s sentiment situation was more bullish than it had ever been. This paved the way for a strong multi-month rally, but by early-September the situation was almost the exact opposite. After having their largest net-short position on record in May, by late-September speculators had built-up their largest net-long position in four years. The scene was therefore set for C$ weakness.

The speculative net-long position in C$ futures has shrunk since its September peak but not by enough to suggest that the C$’s downward correction is complete.

For the Yen, the sentiment backdrop is almost as supportive as it gets. This is because the speculative net-short position in Yen futures is not far from an all-time high. There are reasons outside the sentiment sphere to suspect that the Yen won’t be able to manage anything more than a minor rebound over the coming 1-2 months, but due to the supportive sentiment situation the Yen’s short-term downside potential appears to be small.

Needless to say (but I’ll say it anyway), sentiment is just one piece of a big puzzle.

![]()

In this week’s issue:

Stockscores Free Webinars

What are the Economics of Stock Trading?

Nov 15, 2017 6:00 PM PST

Whether you are a long term investor or a short term active trader, it is essential to understand the economics of trading. How should you measure your returns? What are the risks? How much capital does it take to trade? What are the potential gains? These questions and more will be addressed during this webinar. I will show performance data for my day, swing and position trading over the last few months.

Stockscores Market Minutes – Expect Failure

Whether it is the development of a new trading strategy or just the trades you make day to day, expect to fail often. Trading is simple, but it is not easy. Learn from your mistakes and don’t let failure stop you from achieving success. That plus this week’s Market Analysis and the trade of the week on RLOG.

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – The Importance of Trading Less

It’s better to miss a good trade than to take a bad one. Missing a good trade doesn’t deplete your capital-it only fails to add to it. A bad trade will not only reduce the size of your trading account, it will eat up emotional capital and your confidence.

A losing trade is not a bad trade. Bad trades are simply taking the trade that doesn’t meet your requirements. Bad trades come from working hard to see something that’s not there, guided by your need to trade rather than the market offering a good opportunity.

I have read very few books about the stock market, but one that I’ve read more than once and that I think is a must-read for every investor is Reminiscences of a Stock Operator by Edwin Lefevre. Here is a wonderful quote from that book that captures the essence of what this chapter is about:

“What beat me was not having brains enough to stick to my own game-that is, to play the market only when I was satisfied that precedents favored my play. There is the plain fool, who does the wrong thing at all times everywhere, but there is also the Wall Street fool, who thinks he must trade all the time. No man can have adequate reasons for buying or selling stocks daily-or sufficient knowledge to make his play an intelligent play.”

-Reminiscences of a Stock Operator

I advise all my students that they will make more money by trading less, at least so long as trading less is the result of having a high standard for what they trade. If you tell yourself you’re limited to only making 20 trades a year, you’re probably going to be very fussy about what trades you take. With less than two trades to be made each month, only the very best opportunities will pass your analysis. All of the “maybes” or “pretty goods” will get thrown out.

We take the pretty good trades because we’re afraid of missing out. It’s painful to watch a stock you considered buying but passed on go up. You remember this pain and the next time you see something that looks pretty good, you take it with little regard for the expected value of trading pretty good opportunities.

Pretty good means the trade will make money some of the time and lose some of the time, and the average over a large number of trades may be close to breaking even. The fact that one pretty good trade did well is reasonable and expected. In the context of expected value, taking those pretty good trades many times will lead to less than stellar results when the losers offset the winners.

You shouldn’t judge your trading success one trade at a time. You must look at your results over a large number of trades. To maximize overall profitability requires you to have a high standard for what trades you make. Maintaining that standard will be easier if you take the trades that stand out as an ideal fit to your strategy, not by taking those that are marginal and require a lot of hard work to uncover.

Ran the Abnormal Breaks Market Scans for the US and Canada today, did not find too much I like but there is one stand out, listed on both the TSX and Nasdaq.

1. APTO

Three months of sideways trading on T.APS and APTO with a break to new highs today on strong volume. Support at $1.60 on the US listing and $2 on the Canadian.

If you wish to unsubscribe from the Stockscores Foundation newsletter or change the format of email you are receiving please login to your Stockscores account. Copyright Stockscores Analytics Corp.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Foundation is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of this newsletter may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

A funny thing happened to commodities in October. They went up. All of ’em. Or nearly all. Enough that the CRB Index busted out like an escaped felon with nothing to lose.

This index tracks a basket of 19 commodities. It’s energy-heavy – 33% by weight. But it is stuffed with everything from cocoa to copper, hogs to gold.

And as a group, these things are headed higher. And higher.

That tells us a lot about the global economy. And if you listen closely, the CRB’s price action will even tell you where to invest. To make handsome profits.

I’m talking about things that do well in global reflation.

What is global reflation, anyway? It’s when economic growth picks up all at the same time. Along with that, we see prices start to climb up.

That price climb is delayed a bit – for now. But economic activity is definitely accelerating.

How do we know that? Well, here in the U.S., GDP is expanding at about 3%. That’s after expanding at 3.1% in the second quarter. That’s better than the listless growth we saw during the Obama years.

And around the world, the IMF is boosting GDP forecasts for almost every advanced economy.

And here’s more proof: The number of countries in recession around the world has fallen to its lowest level ever. Ever!

So, what should you invest in for the global reflation trade? There are a BUNCH of things that do very well. But let me give you one group to buy … and one to SELL!

Buy: Metals

Let’s start with copper. It’s the most industrial metal on Earth. It’s used for everything from buildings to electronics.

And copper is also vital to the electric vehicle megatrend. Copper is NOT in electric-vehicle batteries. But it’s in everything else in an EV. On average, an EV has three to four times the amount of copper wiring that an internal combustion engine car contains.

This means a huge amount of copper is going to be in demand in the future. I talk about copper a lot in this space and in my trading services because its potential is so enormous.

Nickel is another industrial metal I pounded the table about. It’s used to make everything shiny, from silverware to steel. AND nickel is an important part of EV batteries. So, it’s going to ride the EV megatrend, too.

I told you about the industrial metals rally in August. I showed you a chart of …

- The PowerShares DB Base Metals Fund (DBB), which tracks a basket of aluminum, copper and zinc.

- The iPath Bloomberg Copper Subindex Total Return ETN (JJC), which focuses on copper.

- And the iPath Bloomberg Nickel Subindex Total Return ETN (JJN), which targets nickel.

Let’s see how you would have done if you’d bought ANY of my picks then.

Both copper and base metals have outperformed the S&P 500 since that issue ran. The real winner is nickel. A 28% gain. Wow!

I haven’t talked about gold or silver. Yet. Don’t worry, their day is coming. Especially as we start to see prices go higher.

Speaking of inflation, let’s get to my “sell” pick …

Sell: Bonds

There is already inflation in China and other “factory” economies. Stateside, we’re saved from that by technological innovation. But inflation will start to pass through.

Rising inflation tends to mean higher interest rates set by central banks. And that means Treasury yields will trend higher. And as yields go higher, prices go lower. That’s the simple fact.

To dig a bit deeper, negative interest rate policies have reached their limit in Europe and Japan. That means the deflation trade has run its course. The pendulum is going to swing in the other direction.

So, think about selling bonds. You can even short bonds through inverse funds. An example would be buying the ProShares Short 20+ Year Treasury ETF (NYSE: TBF). Speculators could consider buying the Direxion Daily 20-Year Treasury Bear 3X (NYSE: TMV).

The global reflation trade is here. It’s one of those megatrends I plan to keep talking about, because you should be aware of it. You can ride it to potential profits, or ignore it at your peril. Whatever you buy, do your own due diligence.

All the best,

Sean Brodrick