Stocks & Equities

One year on from Donald Trump’s election victory and U.S. equity markets are on course to open near record highs once again, having made stunning gains over the last 12 months – more than 30% in the case of the Dow and Nasdaq.

While many may claim that Trump’s achievements to date equate to very little given his difficulties repealing and replacing Obamacare, slower than expected progress on tax reform and minimal detail on fiscal stimulus, investors have clearly not been deterred as is evident by staggering gains in U.S. stocks. Of course, much of this may still be conditional on the President delivering on the latter two in particular and some is also attributable to the rally in global equity markets over the same period, but the Trump trade is clearly still alive and well.

This is despite the fact that the Fed has raised interest rates three times since the election and is likely to do so again next month, which many will have believed could have threatened the economic recovery and with that, the stock market rally. That is clearly not the case and with the economy having now come off two quarters of around 3% annualized growth, one may wonder whether there is any need for the spending element of the President’s plan to revive the economy. There certainly doesn’t appear to be the desire for it that we’ve seen for tax reform over the course of the year.

While political and geopolitical events have caused minor problems along the way, the rally has been very gradual and consistent with few hiccups along the way. In the absence of any major U.S. economic events this week, Trump’s tour of Asia will continue to attract the bulk of the attention, although I imagine the rhetoric coming from the meetings and press conferences will be broadly in line with what we’ve heard already. Assuming no slip ups along the way and no unexpected back and forth with North Korea – which is possible given the country is one of the main topics of conversation – there’s little reason to believe we won’t see more of the same in the markets.

USD consolidating but further gains may lie ahead

The U.S. dollar has consolidated over the last couple of weeks since rebounding off its lows on the prospect of more rate hikes and tax reform progressing more smoothly than thought – albeit not as quickly as one would hope. The greenback is still looking bullish into the end of the year though and the appointment of Jerome Powell as Janet Yellen’s replacement as Chair should support this, particularly if he is accompanied by other hawkish appointments on the board.

GBP under pressure as May’s problems mount

It’s been a relatively slow week for the markets so far, despite there being a number of concerning political stories that have the potential to cause further disruption down the line. The UK, as ever, is right at the top of this list, with Prime Minister Theresa May in the uncomfortable position of potentially being forced to sack another member of her cabinet at a time when her position is already seen by many as untenable in the aftermath of her disastrous election campaign.

Still, the softness we’re seeing in the pound today is likely more a reflection of the Bank of England’s decision to raise interest rates last week while adopting a dovish stance on future hikes. While much of the move was priced in on Thursday, we have seen a minor pullback since and I think today’s drop is simply a continuation of Thursday’s initial decline. The pound will face a big test around 1.30-1.3050 against the dollar should we reach those levels and a break of this could trigger a move back towards 1.28.

Oil inventories eyed as oil rally continues

The one notable release today will be crude inventory numbers from EIA, which come after API reported another small drawdown on Tuesday and as the political situation in Saudi Arabia – OPEC’s largest producer – becomes a growing concern. I don’t think this has been a big factor in oil’s recent rise given the talk of an output cut extension next year, growing demand forecasts and the stabilization in U.S. output. With momentum not slowing though there does appear to be more upside potential and the situation in Saudi Arabia may be supportive of this the longer is goes on.

About the Author

Craig Erlam is senior market analyst at OANDA who also writes for OANDA’s Market Pulse site, Marketpulse.com.

Segwit2x cancelled due to lack of “sufficient consensus”

The Segwit2x development team has called off any plans for the Segwit2x hard fork, previously set for mid-November. The report published only an hour ago was co-signed by the Segwit2x figureheads, including Erik Voorhees of Shapeshift fame and Jeff Garzik, the lead developer on the BTC1 repo. Jihan Wu of Bitmain, Wences Casares of Xapo and investment banker Peter Smith are also co-signatories. Mike Belshe, CEO of BitGo, sent out the email.

The report states that their goal “has always been a smooth upgrade for Bitcoin”. For anyone who has been active on social media, github repos, or even just chatting to Bitcoin evangelists, it would have been clear that the Segwit2x change was anything but a smooth “upgrade”. In a sudden turn of events, the Segwit2x figureheads stated that their dedication to keeping the Bitcoin community together trumped their beliefs over on-chain scaling and big blocks:

“… It is clear that we have not built sufficient consensus for

a clean blocksize upgrade at this time. Continuing on the current path

could divide the community and be a setback to Bitcoin’s growth. This was

never the goal of Segwit2x.”

All plans for the “upcoming” 2MB upgrade have been suspended until clear and present consensus can be achieved. The use of the term “upcoming” in the report show clear intentions to continue pushing the rhetoric of on-chain scaling and big blocks, despite the majority of the community’s focus being on scaling through off-chain solutions such as the Lightning Network.

Bitcoin price skyrockets

At the time of publishing, Bitcoin is rocketing past $7700 USD. In stark contrast, Segwit2x futures have crashed from $1.2k USD to $300 USD in under the span of an hour. This free-fall ought to continue to $0 USD, as the chainsplit tokens only have value in the event of a hard fork.

Screenshot captured 18h10 GMT

[UPDATE: Segwit2x futures noting a short-term recovery to $450 USD in the interim. The only explainable cause is unsubstantiated speculation]

While the report had intentions of mitigating potential damages to the Bitcoin community, it’s clear that many people who bought into the Segwit2x hard fork are paying the price in cold hard crypto.

In line with Bitfinex’s Chainsplit T&C, all split BT2 tokens (representing Segwit2x) will be worthless:

In the case of BT2, Segwit2x shall be deemed to exist only if a blockchain has diverged incompatibly from the Incumbent Blockchain. Any settlements of BT2 shall be to B2X. If no Segwit2x blockchain exists pursuant to these T+Cs, BT2 tokens shall be deemed to have a value equal to zero and shall be removed from the platform.

Bitcoin veterans who saw uncertainty in the Segwit2x hard fork made sure to steer clear – but newbies, enthusiastic traders hoping to make a quick buck, and those who genuinely believed in figureheads like Mike Belshe and Jeff Garzik are now suffering. It’s a tough lesson learnt in trying to circumvent decentralized governance.

“We want to thank everyone that contributed constructively to Segwit2x,

whether you were in favor or against. Your efforts are what makes Bitcoin

great. Bitcoin remains the greatest form of money mankind has ever seen,

and we remain dedicated to protecting and fostering its growth worldwide.”Mike Belshe, Wences Casares, Jihan Wu, Jeff Garzik, Peter Smith and Erik

Voorhees

These words are sure to leave a bitter taste in the mouths of those affected.

Stick to this space for further updates.

Featured image from Pexels

By Daniel Dalton via Crypto Insider

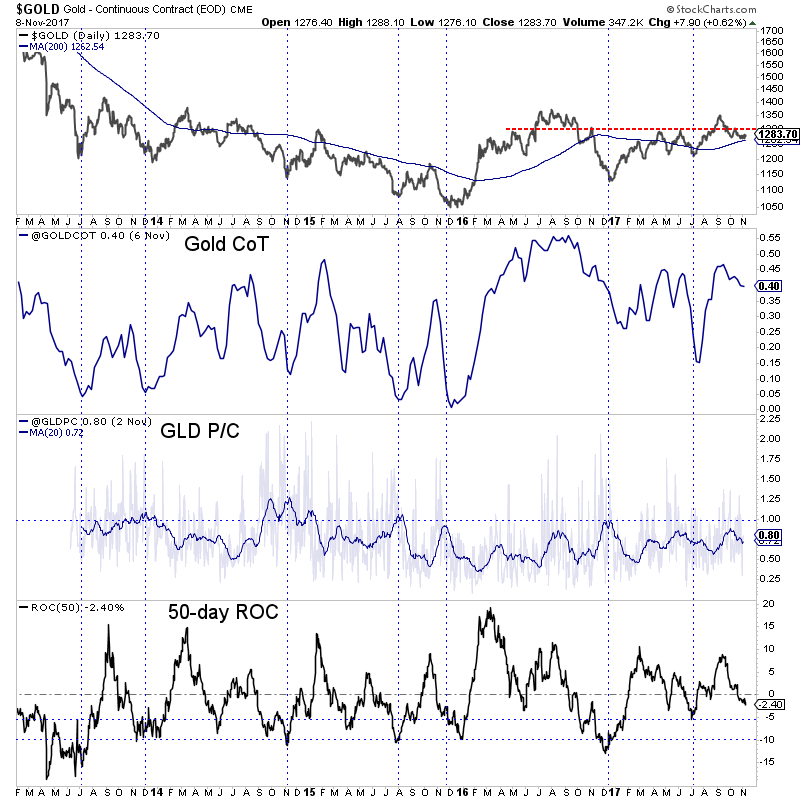

After a severe selloff, precious metals have enjoyed a bit of a respite. Corrections are a function of time and/or price. The correction to the recent selloff has been more in time than price. Metals and miners have stabilized over the past nine trading days but have not rebounded much in price terms. Gold has barely rallied $20/oz while GDX and GDXJ have rebounded less than 4% and 5% respectively. In addition to the weakness of this rally, the gold stocks are sporting a negative divergence and that does not bode well for an end of the year rally.

The negative divergence is visible in the daily bar charts below. We plot Gold along with the gold stock ETF’s and are own “mini” GDXJ index. The price action in Gold since October looks constructive. The market has held its October low and the 200-day moving average. It could have a chance to reach $1300-$1310. However, the miners are saying no to that possibility. Everything from large miners to small juniors made a new low while Gold did not. The second negative divergence is in regards to the 200-day moving average.

Gold has corrected $100/oz over the past seven weeks but the relevant sentiment indicators do not indicate much of a shift in sentiment. In the chart below we plot the net speculative position in Gold as a percentage of open interest (Gold CoT) and the GLD put-call ratio. The CoT remains elevated at 40%. The two important lows of the past 12 months occurred at 16% and 26%. The put-call ratio (which is smoothed by a 20-day moving average) has some work to do before it reaches a level associated with market lows. Finally, Gold is not oversold based on a simple 50-day ROC.

The relative weakness and negative divergence in the gold stocks coupled could portend to lower Gold prices by the end of 2017. Gold has important support at $1260 and if it loses that it threatens a decline to $1200-$1220. The gold stocks are lagging Gold across the board with the worst performers being the smaller juniors. Given the weak technicals and questionable fundamentals for Gold, we will continue to wait for lower prices, worse sentiment and a low-risk buying opportunity in the coming months. The good news is those who buy weakness in the months ahead can position themselves for strong profits in 2018. In the meantime, find the best companies and evaluate their potential value and catalysts that will drive buying.

During a quiet like this one, traders may begin to experience déjà vu, that is, each day seems like a carbon copy of the last. Such has been the case for the US Dollar, as it remains within the two-week range carved out since the end of October. The range, between 94.29 and 95.17, has little reason to break one way or the other, given the lack of drivers on the immediate horizon.

Chart 1: DXY Index Daily Timeframe (July to November 2017)

For now, particularly in the run up to the Thanksgiving holiday in the United States in two weeks time, the prospect of tax reform legislation will be the key source of influence for the US Dollar. Speculation around the Fed is lower down the totem pole as a major influence; markets have been pricing in a 100% of a 25-bps rate hike in December for the past two weeks.

As it were, the DXY Index remains between two key levels, 94.29 (the neckline of the inverse head & shoulders pattern, as well as the July 26 bearish outside engulfing bar high) and 95.17 (the July 20 bearish outside engulfing bar high). Given price action today across individual USD-pairs, in particular EUR/USD, USD/CAD, and USD/JPY, it seems the most likely outcome in the near-term would be for a test of the 94.29 range low in DXY.

See the full DailyFX economic calendar here.

In March 2017 the Monthly Absorption Rate based on total inventory and total residential sales hit 154% in Toronto vs Vancouver at 47%. Vancouver may have led the FOMO crowd up the ladder, but Toronto is sending them down the snake.

|

|

This chart shows the relative values of STRATA units as a percentage of average single family dwellings in the 3 hot markets of Vancouver, Calgary and Toronto.

Calgarians are willing to trade 1 house for only 1.3 townhouses. Torontonians will settle for 1.6 townhouses and Vancouverites demand 2.

If the numbers don’t make sense you can always rent. When MOI is low & MAR is high, developers and vendors have the edge.

One year on and the Trump rally is very much alive and well; U.S. dollar consolidating but further gains may lie ahead; GBP under pressure as May’s problems mount; Oil inventories eyed as oil rally continues.

One year on and the Trump rally is very much alive and well; U.S. dollar consolidating but further gains may lie ahead; GBP under pressure as May’s problems mount; Oil inventories eyed as oil rally continues.