Currency

Picture a life where you do most of your shopping through Amazon.com and the local farmers’ market, most of your communicating through Facebook and Instagram, much of your travel via Uber, and much of your saving and transacting with bitcoin, gold and silver.

Do you really need an immense, distant, and rapacious central government? Maybe not. Perhaps your region or ethnic group would be better off forming its own independent country.

This question is being asked — and answered — in a growing number of places where distinct cultures and ethnic groups within larger nations now see their government as more burden than benefit. The result: Secession movements are moving from the fringe to mainstream.

This question is being asked — and answered — in a growing number of places where distinct cultures and ethnic groups within larger nations now see their government as more burden than benefit. The result: Secession movements are moving from the fringe to mainstream.

In just the past couple of weeks, Iraqi Kurdistan and Spain’s Catalonia declared their independence. Neither succeeded, but the fact that they felt free to try illustrates how times have changed.

This is fascinating on a lot of levels, but why discuss it on a gloom-and-doom finance blog? Because secession is about the messiest event a country can experience short of civil war. And few things are more financially disruptive for an already over-leveraged society than potential dissolution.

Today’s fiat currencies depend for their value on the belief that the governments managing them are coherent and competent. Let a major region break away and plunge a debtor country into political/civil chaos and the markets will abandon its currency in a heartbeat. Note the sense of panic in the following article:

EU TURMOIL: Finland preparing to go against Spain and RECOGNISE Catalonia’s independence

(Express) – FINLAND could be the first country to officially recognise Catalonia as a republic state, in a move that would put the Scandinavian country in direct opposition to the European Union (EU).

The country’s MP for Lapland Mikko Karna has said that he intends to submit a motion to the Finnish parliament recognising the new fledgling country.

Mr Karna, who is part of the ruling Centre Party, led by Prime Minister Juha Sipila, also sent his congratulations to Catalonia after the regional parliament voted earlier today on breaking away from the rest of Spain.

Should Finland officially recognise the new state of Catalonia this will be yet another body blow to the the EU which has firmly backed the continuation of a unified Spain under the control of Madrid.

European Commission President Jean-Claude Juncker warned today that “cracks” were appearing in the bloc due to the seismic events in Catalonia that were causing ruptures through the bloc.

Mr Juncker spoke in favour of unity. He said: “I do not want a situation where, tomorrow, the European Union is made up of 95 different states. We need to avoid splits, because we already have enough splits and fractures and we do not need any more.”

The Scottish Government has also sent a message of support, saying that Catalonia “must have” the ability to determine their own future.

Scotland, of course, is itself considering secession from the UK, which recently voted to leave the European Union.

The political class, meanwhile, is trying to figure out where it went wrong. See the New York Times’ recent What Is a Nation in the 21st Century?

If the combination of long-term financial mismanagement and sudden technological change really has made large, multi-cultural nations dispensable, then some of them are going to fragment. This in turn will contribute to the failure of the fiat currency/fractional reserve banking system that’s ruining global finance. Poetic justice for sure, but of an extremely messy kind.

I know I am not the traditional author you come across on most financial sites. Most others will provide you with traditional notions of the stock market based upon rationalities. So, many authors will suggest that we “cannot separate public policy and geopolitics from the markets,” they will focus on “market valuations,” they will claim that “fundamentals do not support this rally,” and will provide you with many, many other reasons as to why they have continually believed that this rally would never happen.

I know I am not the traditional author you come across on most financial sites. Most others will provide you with traditional notions of the stock market based upon rationalities. So, many authors will suggest that we “cannot separate public policy and geopolitics from the markets,” they will focus on “market valuations,” they will claim that “fundamentals do not support this rally,” and will provide you with many, many other reasons as to why they have continually believed that this rally would never happen.

Yet, they have been left on the sidelines, scratching their heads for the last year and a half, as the US equity markets have rallied over 45% since February 2016.

I mean, think about all the reasons they have put before you over the last year and a half regarding the imminent risks facing the stock market, which they have lead you to believe will stop the market in its tracks. I have listed them before, and I think it is worthwhile listing them again:

Brexit – NOPE

Frexit – NOPE

Grexit – NOPE

Italian referendum – NOPE

Rise in interest rates – NOPE

Cessation of QE – NOPE

Terrorist attacks – NOPE

Crimea – NOPE

Trump – NOPE

Market not trading on fundamentals – NOPE

Low volatility – NOPE

Record high margin debt – NOPE

Hindenburg omens – NOPE

Syrian missile attack – NOPE

North Korea – NOPE

Record hurricane damage in Houston, Florida, and Puerto Rico – NOPE

Spanish referendum – NOPE

Las Vegas attack – NOPE

And, each month, the list continues to grow.

Yet, the same authors you have read for years just continue to repeat their mantras that we “cannot separate public policy and geopolitics from the markets,” they continue to focus on “market valuations,” and they continue to claim that “fundamentals do not support this rally.”

Einstein was purported to suggest that insanity is doing the same thing over and over while expecting a different result. But, you see, in the stock market, there is a bit of a difference. Just as trees do not grow to the sky, the stock market will not rally indefinitely. So, we will eventually see a bear market. Then, the broken clock syndrome will prove these authors to be “right,” rather than simply insane, and we will hear it from them incessantly about how they tried to warn us. Yes, warn us indeed.

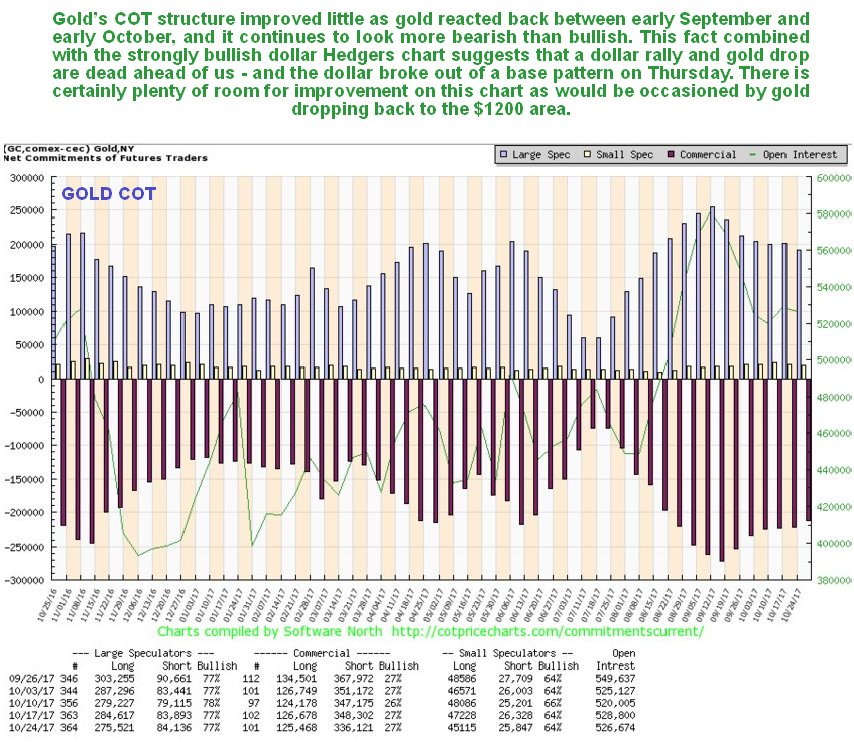

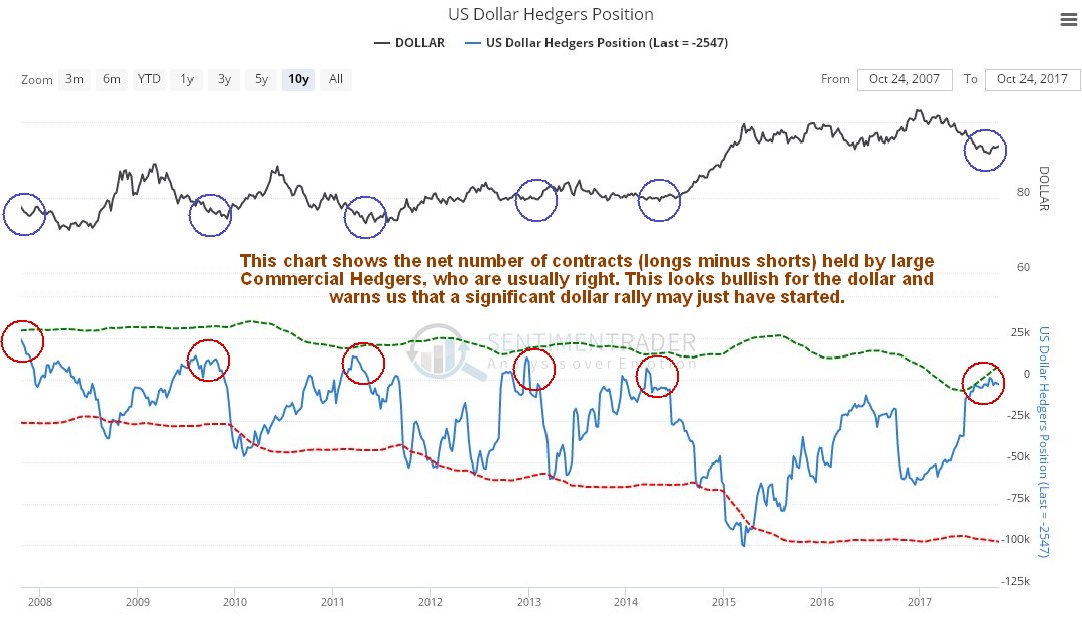

Now, that does not mean we should expect analysts to be right all the time. Clearly, I was expecting the set ups we have seen in the metals market to spark a big rally in 2017, but when we broke upper support back in September, it caused me to turn quite cautious until 2018. But, the difference is that I use an objective methodology that listens to what the market is saying rather than trying to force a predetermined linear perspective on the market.

And, that is the issue with most of the bearish presentations you have read for the last year and half about the stock market, while they claim they are simply “opening your eyes to the inherent risks in the stock market.” Let me ask you a question: Is there anyone reading this article that believes the stock market does not have risk at all times? I will not belabor this point, but, needless to say, these bearish presentations couched as “risk awareness” is not based upon objective perspectives on the stock market.

My friends, look at the events I have listed above yet again. None of them (nor ALL of them cumulatively) have been able to put a dent in this market advance over the last year and a half. So, rather than view the market from a perspective of insanity, maybe one should come to the conclusion that public policy, geopolitics, market valuations, or fundamentals are really not what drive the stock market. Clearly, we have seen that none of this has mattered one iota. So, maybe we need to consider that there is a stronger force at work which overrides any of the traditional perspectives you were lead to believe drives the market?

Bernard Baruch, an exceptionally successful American financier and stock market speculator who lived from 1870– 1965, identified the following long ago:

All economic movements, by their very nature, are motivated by crowd psychology. Without due recognition of crowd-thinking … our theories of economics leave much to be desired. … It has always seemed to me that the periodic madness which afflicts mankind must reflect some deeply rooted trait in human nature — a trait akin to the force that motivates the migration of birds or the rush of lemmings to the sea … It is a force wholly impalpable … yet, knowledge of it is necessary to right judgments on passing events.

Price pattern sentiment indications and upcoming expectations

The upcoming week is rather simple, and centered around the 2572SPX region. As long we hold over the 2572SPX early in the coming week, we are on our way to the 2611SPX region.

However, if we break down below 2572SPX early in the coming week, it opens the market up to another decline which will revisit the 2520-2550SPX support region before we finally rally to the 2611SPX region.

See charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

SP 500 Total Earnings Same as 2013 and Index Up 40% Since

Earnings per share for S&P 500 are up 6.6% since the end of 2013, all the gain is due to share buyback, while the total reported earnings are the same (see Fig. 1).

If the total earnings are the same as 3 years and 10 months ago without a recession we can say that we are operating in an essentially flat earnings environment. During the same period the index is up 40%. The only reason that earnings are up for the past 12 months is that earnings per share went down almost 20% since the end of 2014 to August 2016.

A much worse picture of market valuation emerges if we look at the Market Cap to GDP Ratio. Fig. 2 shows the ratio of total market cap of S&P 500 companies to the GDP. If we include all the public companies the ratio is between 140-150%. The only period when the market valuation was more extreme than today was during 1999-2000.

The sentiment with Bulls at 62.3 and Bears at 15.1 and VIX below 10 is at an all-time extreme in terms of bullishness. Fig. 3 shows the Complacency Index at a new high. All this doesn’t mean that the market will go down tomorrow or in a near future, but all it says is that risk has risen to a historically high level.

Larger Image

The following is an excerpt from Pivotal Events published for our subscribers October 19, 2017.

Perspective

The headline about the cost of not being fully invested was from the manager at JP Morgan Asset Management who added “I’ve never been so optimistic about the global economy.”

We are still disturbed by last week’s observation from a very big money manager that the main risk is “policy error” by the Fed. This could be based upon 2007, when there was adamant conviction that the Fed, in making the perfectly-timed “cut” in the administered rate, could keep the mania going. One conclusion could be that the Fed’s timing was not perfect and was an “error”. The more practical observation is that the T-bill rate always plunges during a post-bubble collapse and the Fed rate follows the market rate of interest. Down.

T-bill rates, or equivalent increase in a boom and decrease in the consequent contraction.

And then there is the comment about creating new kinds of financial instruments. Which is a sign of speculation, but we do not know of any “alarm bells” at the Fed. Wild, but ephemeral financial instruments have been created with every great bubble since the first one in 1720.

Stock Markets

A year ago, going into the US election financial markets were unsettled. Part of the decline was political and the other was seasonal. Pressures in the stock market were sufficient to prompt a ChartWorks “Springboard Buy” on November 3rd. The market was poised for a rebound and the prospect of a pro-business administration launched the rally on November 7th.

In December, we began calling it “Rational Exuberance”. With the momentum readings in June we called it just “Exuberance”. As outlined below, this could get into “Irrational Exuberance”.

We see big names out there, such as Stockman, offering many alarms based upon government financial excesses. But the stock market is its own master. And then there is Krugman, for whom the most reckless central banking in history is not enough to fit his Keynesian concerns. For some weird reason the concern is that the rate of CPI inflation must be kept above 2 percent. There are many perma-bulls who consider that “Rosy Scenario”, “Lady Bountiful” and Janet Yellen are there personally to look after their portfolios.

Let’s review how we got this far and just how this speculation could end.

The most recent in the series of Sequential Buys, which is our “Buy-the-Dip” model, was on the Nasdaq on the slump into August at 6177. The rally has made it to 6633 and we are now wondering, in the absence of credit adversity, how far this strength can run.

This week’s action in the DJIA as well as the S&P has generated Upside Exhaustions on the Daily and Weekly readings. Previous such examples occurred somewhat before the peaks in 2000 and in 1987. Of course, the lead time on this set can’t be known. Hot action in stocks and industrial commodities likely into September has continued into October. In so many words, our September target got us this far.

The flattening yield curve, which is supportive to the boom, is now out to the time window when it can reverse. And as noted last week this could be in or around November. The second attempt, as we have been noting, to reverse spreads to widening stalled out.

It is one thing to have a sudden “outlier” appear in the markets when the action is oversold, as with last November’s election. It is something else when the “outlier” that tax reform could advance when the stock market is cyclically expensive. The “outlier” could be the Republicans taking a significant step in reducing tax rates.

Independent of this is that the DJIA looks as if it wants to go into the bubble-climax mode. In which case when will its elastic limits be reached?

Ross has a chart overlaying the action in the DJIA, now, with the dramatic conclusion to the Nasdaq’s Dot.Com Bubble in March 2000. The record shows a series of Upside Exhaustions. As with grand events, the phenomenon is recognizable, but the height and duration of the concluding spike can’t be determined ahead of time. It is, however, satisfying to identify it as it brews up. One timing model comes to mind.

Some great speculations have completed at the end of the year or into January.

These include the S&P on January 11, 1973. Gold on January 21, 1980 and the Nikkei right at the end of 1989.

These dates provide a probable target for the peak, which is more than two months away. In the meantime, anything can happen, but any shocking “news” could be led by changes in the credit markets.

Listen to the Bob Hoye Podcast every Friday afternoon at TalkDigitalNetwork.com