Timing & trends

1. The War Against Jobs

1. The War Against Jobs

So many politicians arguing for higher taxes, more regulations, the opposition to Free Trade, the whole anti-resource push and the moves to cool the real estate markets are all job killers.

2. The Six Groups of Investors and Traders

by Martin Armstrong

The recent report by the Commodity Futures Trading Commission (CFTC), shows that the professional investors have continued to bet on falling Dow Jones “short” as private investors are starting to bet heavily on rising prices ( “Long”).

3. Don’t Leave Me This Way

For those wondering “how long” the US equity run can continue – this is a very insightful piece of analysis from our in-house team. ~ Brent Woya

Nothing To See Here

October 26 (King World News) – While the government says there is little to no inflation, take a look at the price of skyrocketing lumber:

And here is a look at skyrocketing asset prices from Peter Boockvar.…continue reading HERE

….also from KingWorldNews:

This week’s census data revealed Canadians’ changing living habits – and the trickle-down effect that’s affecting the rental market and its existing stock in Toronto.

This week’s census data revealed Canadians’ changing living habits – and the trickle-down effect that’s affecting the rental market and its existing stock in Toronto.

Only 50.2% of Millenials own their own homes, compared with 56% of boomers who owned when they were that age, according to the Census. However, Phil Soper, president and CEO of Royal LePage referred CREW to a summer study the organization commissioned on peak Millenials (aged 25 to 30) that found 87% believed homeownership was a positive thing and intended to someday own a home, and in which 69% said they intended to buy a home within five years.

“If you compare that to Stats Can data, it shows people are leaving their parents’ homes later, staying in school later, and essentially growing up at a slower rate than their parents, which makes perfect sense,” said Soper. “With technology and increasing lifespans, the old standard of when we got married and left the house got stretched, so it makes perfect sense to me.”

Housing affordability has also contributed to more millennial-aged Torontonians renting than their parents did at their ages. The city is experiencing inventory shortages on the ownership and rental fronts, and Soper says condo rentals will likely comprise a large part of the incoming supply.

“I think one of the things we’re going to continue to see is the trend that’s been obvious to us for some time, and it’s that purpose-built rentals will not keep up with the demand for rental accommodation,” he said. “So we’re going to see more and more property that is developed for ownership, but that is owned with the intent of renting it.”

Soper added that the reintroduction of rent control in Ontario will dissuade developers from building purpose-built rental buildings, further constricting rental supply.

“Particularly in Ontario with the reintroduction of rent control, this will become the case,” he said. “Some of the big projects intended for the rental market will now move back to condominium-based ownership. It’s too bad, but it is what it is. The good news is that those who buy individual condo units for the rental market will fill in the gap.

“If you’re renting in contemporary Canada, you’re likely renting from an entrepreneur who has purchased a home, a condo.”

Of the 14.1 million households in the Census, 9.5 million owned their homes in 2016, for a rate of 67.8%, which is down 1.2% from the 2011 census.

The Census revealed the number of renters in the country rose commensurately with the cost of ownership, however, that is out of step with a decades-long trend of dwindling rental supply. Forty percent of renters spent more than 30% of their monthly income on house, which hasn’t changed since 2011.

Financial experts love to spin lovely yarns

In fact, most of them appear to have chosen the wrong field; writing fables would have probably been a better choice.

The real phase of a bull market starts after it has taken out its old highs. Until this moment occurs, it’s not a real bull market The Nasdaq recently achieved this milestone; this was not an easy feat as it took the Nasdaq 15 years to break through the strong zone of resistance illustrated In the chart below. A market normally doubles after breaking out to new highs, especially if it has been struggling to achieve this for 15 years. Roughly it should trade to the 9800-10,500 ranges before putting in a long term. Therefore until this occurs the most likely outcome is that it will experience corrections ranging from Mild to strong along the way up.

An expert who has stated the same thing over and over again hoping for a new outcome

Experts like the masses are always on the wrong side of the market

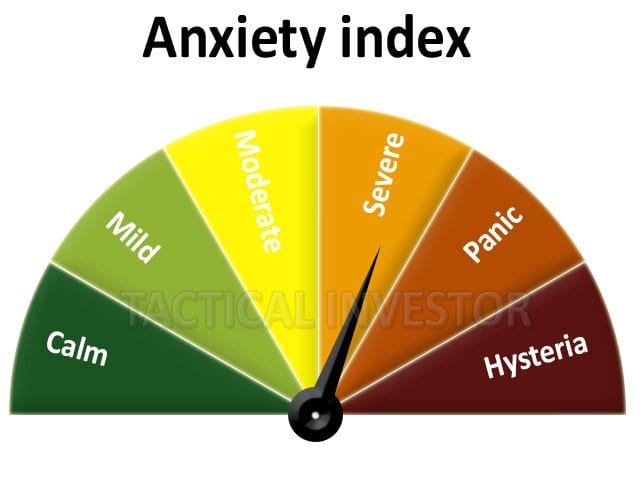

Experts felt the same way when we stated in Aug of 2016 that the Dow was gearing up for a move to 21K. However, these targets were hit at the beginning of this year. Since then we issued higher targets the second of which was 22k and that was also breached recently. The main reason for this stance boils down to market sentiment, the masses have not embraced this bull market, and therefore it is destined to trend higher. We dedicate an inordinate amount of time to mass sentiment analysis and to studying the mindset of the masses. Mass Psychology is very clear on this subject; the masses need to embrace this market with gusto; until they do, the market is destined to trend higher.

Experts would have felt the same way if someone told them that the Dow would be trading past 21K after it dropped below 7,000 in 2009.

Conclusion

We don’t expect the upward journey to be smooth; along the way up we expect the market to experience corrections ranging from mild to wild. As long as the primary trend is up, all corrections have to be viewed through a bullish lens.

The NASDAQ has just validated the statement which we first put out in 2014:

This Bull Market will trend to levels that will shock the most ardent of bulls.

This has proved to be true every year since and this stance will remain valid until the trend changes. Buy when the masses panic and flee when they are joyous.