Currency

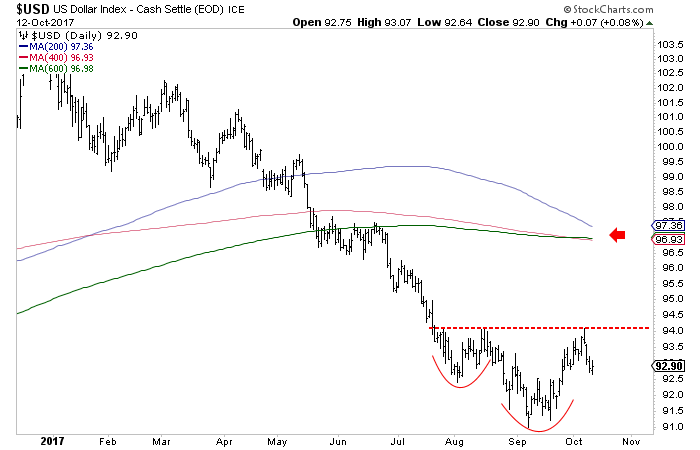

The US Dollar Index (USDI) bottomed in September a hair below 91.00 and has recently rallied up to 94. We were skeptical Gold would break its 2016 highs as it failed to show strong performance in the wake of the USDI’s decline to new lows. The market was discounting a coming rebound in the USDI and/or future weakness in Gold. In any event, although the USDI broke key levels which leave its bull market in question, it became quite oversold and was due for a sustained rebound.

First let’s look at the big picture with a monthly bar chart and the 40-month moving average. As you can see, the 40-month moving average has been an excellent trend indicator and especially since the mid 1990s. The USDI lost that support in July and in addition, made a lower low. Neither happened during the previous two bull markets.

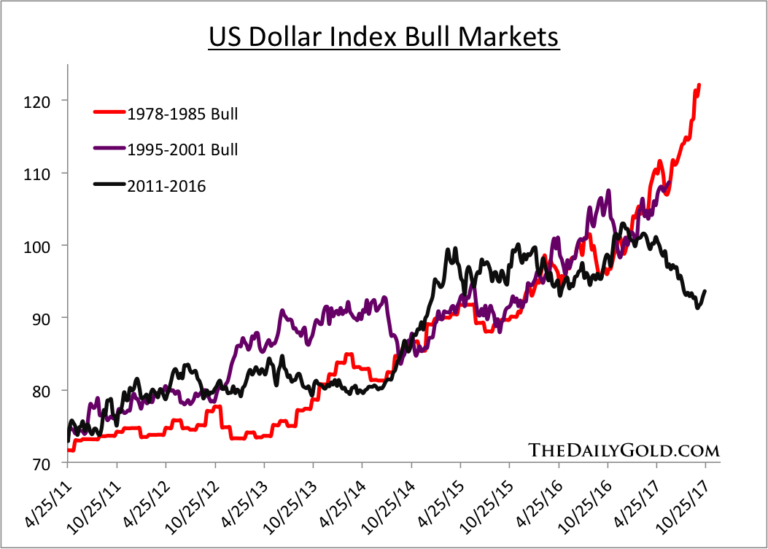

When comparing the bull market to the recent two bull markets we find that the recent correction began at the point at which the other two bull markets advanced toward their inevitable peaks.

While the longer term trend may have turned bearish, the short-term trend may have turned bullish. The USDI could be forming a reverse head and shoulders bottom. On a close above resistance at 94, the USDI has a measured upside target of 97. That target fits very well with the long-term moving averages which are coalescing around 97. (The aforementioned 40-month moving average should reach +96 in the months ahead).

We remain cautious on Gold in the near term as Gold’s correction would continue if the US Dollar Index breaks above 94. With that said, if the USDI’s primary trend has turned bearish then that certainly bodes well for precious metals and precious metals shares in 2018. If the greenback does break above 94 then we will be looking at 96 and 97 as potential levels where the rebound could reverse course. Our goal is to buy value with a catalyst or buy very oversold conditions within the junior space. This action has served us well since last December and should the USDI reach 96-97 then it could lead to low risk buying opportunities in juniors by year end. To find out the best buys right now and our favorite juniors for 2018, consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

While OPEC mulls over further steps to once again support falling oil prices, tech startups are quietly ushering in a new era in oil and gas: the era of the digital oil field.

While OPEC mulls over further steps to once again support falling oil prices, tech startups are quietly ushering in a new era in oil and gas: the era of the digital oil field.

Much talk has revolved around how software can completely transform the energy industry, but until recently, it was just talk. Now, things are beginning to change, and some observers, such as Cottonwood Venture Partners’ Mark P. Mills, believe we are on the verge of an oil industry transformation of proportions identical to the transformation that Amazon prompted in retail.

According to Mills, the three technological factors that actualized what he calls “the Amazon effect”, which changed the face of retail forever, are evidenced in oil and gas right now. These are cheap computing with industrial-application capabilities; ubiquitous communication networks; and, of course, cloud tech.

The Internet of Things is entering oil and gas, and so are analytics and artificial intelligence. These, Mills believes, will be among the main drivers of a second shale revolution, reinforcing the efficiency push prompted by the latest oil price crisis.

It seems that shale operators have been paying attention to what growing choirs of voices, including Oilprice, have been saying: they are talking more and more about the benefits that software solutions can bring to their business, potentially leveling the playing field for independents, a field that has been tipped in favor of Big Oil for decades.

Long-standing mistrust of technology is now dwindling as the benefits—including streamlining operations, maximizing the success rate of exploration, and optimizing production—make themselves increasingly evident, not least thanks to a trove of tech startups specifically targeting the oil and gas industry.

In a story for Forbes, Mills notes several examples of such startups that are already disrupting the industry with cognitive software for horizontal drilling, an on-demand contractor network, and an AI-driven software platform for well planning, among many others. The common feature among them all is they are narrowly specializing in various segments of the oil industry to deliver solutions that promise to substantially reduce times, labor, and costs, while improving outcomes. What’s not to like?

Tech investments among oil independents are still much below the level already characteristic of other industries such as healthcare or financial services, to mention just a couple. Yet this will also change. In the not-too-distant future we may see a flurry of M&A in oil and gas software development.

Related: Higher Oil Prices Could Threaten Saudi Vision 2030

The reason for this future consolidation is already evident: there are many oil and gas independents in the shale patch. Technology improvements will soon separate the winners from the losers, so it’s a pretty certain bet that more M&A—a lot more—will likely happen over the next few years.

But independents in the shale patch are already burdened with debts that they took on in order to expand their production, and not all will survive the digital disruption. And they don’t just have Big Oil to contend with; oil and gas independents also have renewable energy solution providers breathing down their necks every time oil prices rise—renewable energy that’s already married to software.

That should be strong enough motivation for shale boomers to make sure they catch up, and catch up fast.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- 5 Big Gainers In Oil & Gas This Week

- Oil Giants At Odds As Saudi, Russian Ties Improve

- Has The Bear Market In Oil Finally Ended?

My approach to the gold market involves fundamentals, sentiment and technicals in that order, except when sentiment is extreme in which case it takes priority. To give non-TSI subscribers an idea of what I do, here’s a brief excerpt from the TSI commentary that was published on 8th October:

Today’s bullish surge was strongly impulsive on the hourly chart (see inset), surpassing no fewer than four prior peaks, three of them ‘external’. From a technical standpoint it transformed a bearish head-and-shoulders formation that has been taking shape since May into something else — presumably a consolidation pattern with enough energy to push the stock above the all-time high at 1083.31 recorded in late July. We shall soon see.

Of course, if the bull market in AMZN is about to get second wind, it holds bullish implications for the stock market as a whole, since the company is the most important retailer in the world. Concerning AMZN’s chart, from a trading perspective the rally from the September low at 931.75 was as appealing a ‘counterintuitive’ set-up as we could have imagined, since the low was just inches from June’s watershed bottom at 927.00. I

f you don’t subscribe, click here for a free two-week trial