Energy & Commodities

Despite concerns around refinery closures and inventory builds post Hurricanes Harvey and Irma, WTI Oil has traded constructively and, in our view, has the potential to reach $60+ as we head into the end of the year…

Despite concerns around refinery closures and inventory builds post Hurricanes Harvey and Irma, WTI Oil has traded constructively and, in our view, has the potential to reach $60+ as we head into the end of the year…

WTI Crude has broken through the trend line across the 2017 highs and this overall setup can be viewed as a triangle consolidation before the prevailing trend higher resumes. In fact, the break higher suggests just that (see chart below).

also:

DANGER: Major Warning Indicator Hits All-Time High While A 2nd Plunges To All-Time Record Low!

If you’re not just a little bit nervous before a match, you probably don’t have the expectations of yourself that you should have. Hale Irwin

This is a topic that financial writers should cover in more depth, but it also needs to be covered accurately. From the very beginning individuals have been trained to view crashes as disasters, and in doing so, they miss an opportunity of a lifetime. One has to wonder why so many experts almost purposely go out of their way to proclaim the next crash will mark the end of everything. History is not on their side and the average person having failed to examine history is none the wiser. When experts start to make a lot of noise one has to understand that it is being done to redirect one’s attention; the masses always fall for this ploy. Stock market crashes are perfect examples of misdirection; the crowd is directed to fixate on the fear factor and not the opportunity factor. The dumb money always buys close to the top and sells close to the bottom, and the smart money always does the opposite.

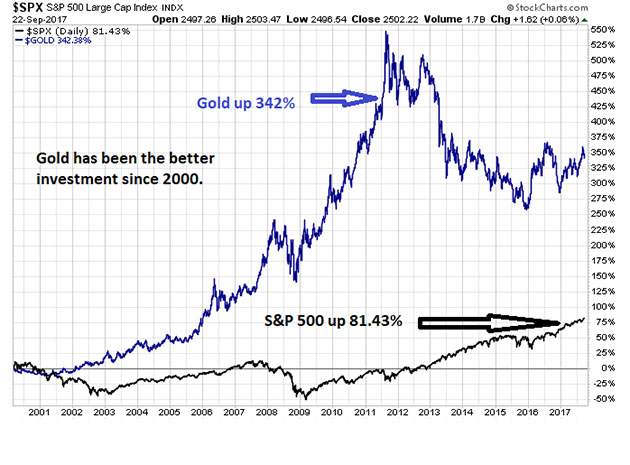

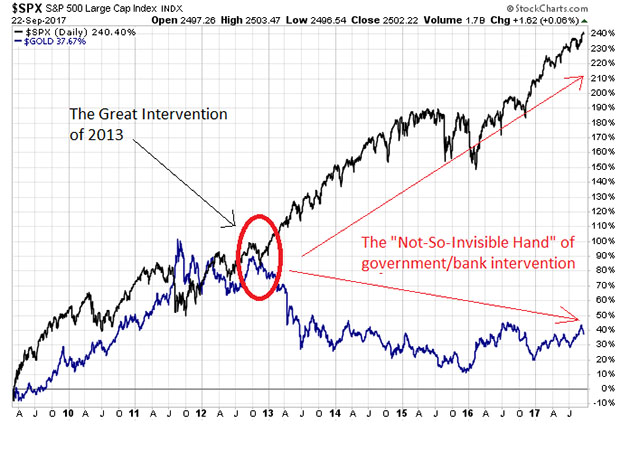

Click Chart For larger version Chart provided courtesy of http://www.macrotrends.net

One of the best ways to determine optimal entry and exit points is to pay close attention to the mass sentiment. When the masses are joyous, then it is usually time to exit the markets and vice versa.

A very strong correction is going to hit this market sooner or later, and our goal is to use the trend indicator to get out close to the top. We are not going bother trying to get out at the exact top; the goal is to get out when the trend indicator starts to flash warning signals, and sentiment levels start to rise. The best lesson you could impart to your kids and grandkids is to teach them view stock market crashes through a bullish lens. This lesson is probably more valuable than anything they could ever hope to gain from the public education system.

Conclusion

Before we got off the Gold Standard, it would have been quite risky to view back breaking corrections as buying opportunities. If you look at the chart above and you take a long-term view, you can see that every back-breaking correction turned out to be a mouth-watering opportunity; this argument will hold true for the foreseeable future.

The crowd, however, will forget the opportunity factor the moment the markets start to crash They will utter these words “it’s different this time”. It is always different because fear has a way of making something look worse than it is.

In reality, nothing has changed; the crowd always reacts in the same manner. Instead of seeing opportunity, they will see disaster. Their response (as always) will be to throw the baby out with the bath water. The smart money waits for them to stampede, and when they have sold everything, they swoop in and purchase top companies for next to nothing. The masses, in turn, remain shell-shocked for years as the markets trend higher, then all of a sudden the memory of the last beating fades away and the process repeats itself again and again. This is what’s taking place now, and that is why this stock market Bull continues to trend higher than even the most ardent of bulls could have ever envisioned.

The masses have still not embraced it, but they are slowly warming up to it. Instead of a crash, the markets are more likely to experience a strong correction, as they are trading in the extremely overbought ranges. Until the crowd embraces this market with the same intensity that has gripped bitcoin, this market is unlikely to crash.

A long dispute means that both parties are wrong

Voltaire

By Sol

The BBC has come out and reported that three million savers in Britain in what is known as final-salary pension schemes only have a 50/50 chance of receiving the payouts they were promised, a study has concluded. We issued a special report on the rising Pension Crisis and it has been unfolding on schedule. The odds of those in government receiving what they were promised is probably less than 50/50 worldwide with few exceptions.

This year’s WEC we will look at how to survive this crisis now that the Year from Political Hell is coming to an eventful end as Spain sends in 16,500 troops to invade Barcelona and subjugate Catalonia proving that it is still a fascist state. The last on the list will be the Italian election and the way Germany has gone, expect more of the same.

We will address this issue in a special report for many people asking how to survive this crisis when what you thought your future would be comes crashing down. This is the crisis we face in Democracy. Government will become more Draconian as we see in Spain to retain power. To hell with human rights or even what is moral. Government will only act in its own self-interest.

Norway – The Largest Sovereign Wealth Fund in the World

Norway – The Largest Sovereign Wealth Fund in the World

QUESTION: Martin,

There are several news stories this past week reporting that Norway’s pension fund has reached $1 trillion dollars, or $190,000 per citizen. Are there some countries like Norway that will survive the coming pension crisis?

Thank You,

Alex

ANSWER: Not many. They are far and few between because Europe, Asia, and North America (USA/Canada) as a whole have only made promises rather than funding. Norway is the largest Sovereign Wealth Fund in the world. Norway has gotten where it is because they do NOT follow the brain-dead crowd of government debt is safe. Norway’s sovereign wealth fund has been one of the earliest to shift investment from public sector bonds to equities. They have risen to the largest fund in the world for recognizing the shift from public to private sector investments. Norway is the exception to the pension crisis.

….also from Martin:

Politicians Start to Run Away from Global Warming

The price of oil is finally back above $50 and Dan Steffens, President of the Energy Prospectus Group, believes the remainder of the year will be quite bullish for the energy sector.

The price of oil is finally back above $50 and Dan Steffens, President of the Energy Prospectus Group, believes the remainder of the year will be quite bullish for the energy sector.

Market Direction Is Up

With demand projected to continue growing this year into next, inventories tightening and continuing to fall, and rig counts decreasing, we can expect oil prices to go up into year-end, said Steffens.

It’s interesting to note that in the first quarter, S&P 500 profits largely came from the energy sector. Yet, energy stocks have been decimated since then.

Steffens follows about 50 publicly traded companies, and almost all are down year-to-date even though they’re having a better year financially.

There’s “this fear that there’s going to be a big collapse in oil and gas prices,” he said. “I don’t see it happening. I don’t see any way sub-$50 oil can be maintained and meet future demand for refined products.”

While Steffens doesn’t think we’re going to see $100 anytime soon, he believes we will hit around $65 oil in 3 or 4 months.

Energy Stocks Unloved

Also Consider: Dan Steffens: Energy Sector Massively Undervalued (Podcast)