Energy & Commodities

On Friday, crude oil moved sharply lower and lost over 3% after investors digested the EIA report and reacted to the increase in crude oil inventories. Thanks to these circumstances, light crude invalidated the earlier breakout above the resistance area and slipped well below $48. What does it mean for the commodity?

Crude Oil’s Technical Picture

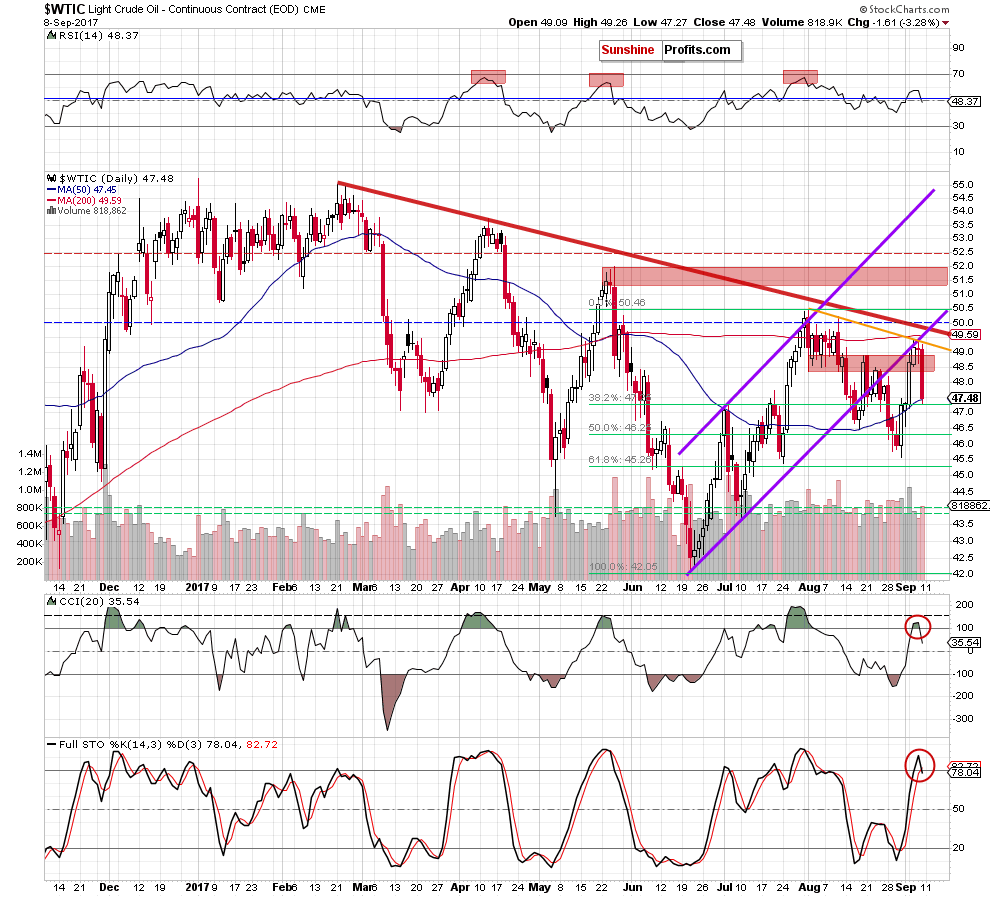

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

On Thursday, we wrote the following:

Yesterday, crude oil extended gains, but did this increase change anything? In our opinion, it didn’t. Why? As you see on the weekly chart, despite Wednesday’s move, the black gold is still trading under the purple declining resistance line based on the previous highs and the 50-week moving average, which together were strong enough to stop oil bulls in the previous months.

Additionally, the commodity increased to two important lines: the orange resistance line based on the August highs and the previously-broken lower border of the purple rising trend channel, which increases the probability of reversal – especially when we factor in the size of yesterday’s volume. (…) Wednesday’s move materialized on visibly lower volume than Tuesday’s increase, which raises some doubts about oil bulls’ strength (similarly to what we saw in mid-August).

What’s next for light crude?

(…) if the commodity increases to the lower border of the purple rising trend channel and then reverses and declines, we will see another verification of the earlier breakdown under this short-term resistance, which will give oil bears a very important reason to act in the following days.

From today’s point of view, we see that the situation developed in line with the above scenario as crude oil reversed and declined sharply on Friday. Thanks to this drop light crude created a bearish candle on the weekly chart (visibly longer upper shadow suggests a turning point), which verified the earlier breakdown below the long-term purple declining resistance line (based on the February and April highs) and the 50-week moving average once again. Taking this bearish development into account and combining it with the sell signal generated by the weekly Stochastic Oscillator, we think that further deterioration is more likely than not.

When we take a closer look at the daily chart, we can easily notice more bearish factors. As we assumed in our Thursday’s alert, crude oil reversed and declined after an increase to the lower border of the purple rising trend channel, which resulted in another verification of the earlier breakdown under this short-term resistance. Additionally, the commodity invalidated the earlier breakout above the red resistance zone and closed the day below it. On top of that, CCI and the Stochastic Oscillator generated the sell signals, supporting oil bears and further deterioration.

How low could the commodity go in the coming days?

In our opinion, if light crude declines under the Friday low of $47.27, the next downside target will the August low (around $45.58) or even the 61.8% Fibonacci retracement and the late July low (around $45.26-$45.40).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil moved sharply lower after another verification of the breakdown below the medium-term purple declining resistance line based on the February and April highs, the 50-week moving average and the lower border of the purple rising trend channel. Additionally, the weekly Stochastic Oscillator and both daily indictors generated the sell signals, supporting further deterioration in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

The USD/CAD fell close to 1400 pips from the May 2017 highs into the July lows. In August the currency pair retraced over 350 pips topping out at 1.2777. Since the high that was struck on August 15, the USD/CAD has once again moved back under the July lows and is now trading more than 500 pips below that August 15 high.

The USD/CAD fell close to 1400 pips from the May 2017 highs into the July lows. In August the currency pair retraced over 350 pips topping out at 1.2777. Since the high that was struck on August 15, the USD/CAD has once again moved back under the July lows and is now trading more than 500 pips below that August 15 high.

On Wednesday, September 6, the Bank of Canada increased its benchmark interest rate to 1%. Following the announcement of this news, the USD/CAD moved lower, breaking down under a key support level at 1.2330, signaling that further follow through to the downside was likely.

Now along with the move lower in the USD/CAD, the U.S. Dollar Index (DXY) has also continued to move lower. The U.S. Dollar Index is already deep into its support zone for its potential wave 4. The USD/CAD, on the other hand, is still about 300 pips over the longer-term target zone, which comes in at the 1.1754-1.0986 area.

So, whether the USD/CAD and DXY Index will find a bottom simultaneously is still somewhat uncertain. What is more certain is that neither the DXY nor the USD/CAD have shown any signal of having formed a bottom just yet.

I have been looking for these lower levels on the USD/CAD for quite some time. In fact, ever since the pair made a large degree 5 wave move down into the May 2016 lows, I was expecting to see another large swing lower. I will note, however, that the correction from the May 2016 low into the May 2017 high took much longer than I had expected. From a price perspective, however, it has followed the pattern almost perfectly.

As noted above, the 1.2330 was a key short-term support level that I had been keeping a close eye on this week. Once that level broke to the downside, it gave us confirmation that the move down off of the August 15 high was likely to follow through down towards at least the 1.2162 level and potentially as low as the 1.1699 level.

Now that the 1.2162 support has broken, the door is open for the pair to see a fairly clear path directly down towards the 1.1699 level. We do, however, need to hold under the 1.2374-1.2238 resistance zone if we are going to see direct follow through down towards those levels. A break back above the 1.2374 level would be the initial signal that we may have formed at least a local bottom in the USD/CAD.

Although the USD/CAD has yet to reach its target zone, I am certainly becoming much more cautious to the short side continue to extend lower. With that being said, as long as the pair holds the 1.2374 level that zone is still well within reach.

See charts illustrating the wave counts on the DXY and USD/CAD.

Mike Golembesky is a widely followed Elliott Wave technical analyst, covering U.S. Indices, Volatility Instruments, and Forex on ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

Let’s take a closer look at recent activity in US Treasuries. The yield on the 10-year note ended the day at 2.06% and the 30-year bond closed at 2.67%, some of the lowest levels since November of 2016.

Here is a table showing the yields highs and lows and the FFR since 2007 as of today’s close.

The 2-10 yield spread is now at 0.79%.

The chart below shows the daily performance of several Treasuries and the Fed Funds Rate (FFR) since the pre-recession days of equity market peaks in 2007.

Briefly:

Intraday trade: Our Friday’s neutral intraday outlook has proved accurate. The S&P 500 index continued to fluctuate within its week-long trading range. The broad stock market is likely to open much higher today following futures contract rally after an overnight gap-up opening. We can see some short-term technical overbought conditions. Therefore, intraday short position is favored. Stop-loss is at the level of 2,490, close to early August record high. Potential profit target is at 2,455 (S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish, as we expect downward correction. Our medium-term outlook remains bearish:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): bearish

The main U.S. stock market indexes were mixed between -0.6% and +0.1% on Friday, extending their short-term fluctuations, as investors reacted to economic data announcements, news concerning hurricane ‘Irma’, among others. The S&P 500 index continues to trade around 1% below the August 8 all-time high of 2,490.87. The Dow Jones Industrial Average extended its fluctuations along the level of 21,800, and the technology Nasdaq Composite index lost 0.6%, as it fell below the level of 6,400. The nearest important level of resistance of the S&P 500 index remains at around 2,470-2,475, marked by last Tuesday’s daily gap down of 2,471.97-2,473.85. The next resistance level is at 2,480-2,490, marked by recent local high and the above-mentioned August record high. On the other hand, support level is at around 2,445, marked by last Tuesday’s daily low. The next level of support is at around 2.430-2,435, marked by the daily gap up of 2,430.58-2,433.67 and previous local low. The broad stock market continues to trade within an over-month-long consolidation following November-July uptrend. Will it continue higher? Or is this some medium-term topping pattern before downward reversal?

Very Positive Expectations

Expectations before the opening of today’s trading session are very positive, with index futures currently up between 0.6% and 0.8% vs. their Friday’s closing prices. The European stock market indexes have gained 0.5-1.2% so far. There will be no new important economic data announcements today. The S&P 500 futures contract trades within an intraday uptrend, following much higher opening of the trading session. The nearest important level of support is at around 2,465-2,470, marked by today’s daily gap up, among others. The next support level remains at 2,455-2,460, marked by short-term local lows. On the other hand, resistance level is at 2,480-2,490, marked by some local highs and the early August all-time high. The market broke above its short-term consolidation this morning. Will it continue its uptrend? There have been no confirmed negative signals so far. However, we can see some short-term technical overbought conditions:

Nasdaq Relatively Stronger

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday uptrend. It retraces its Friday’s move down. The nearest important level of resistance is at around 5,980, marked by recent local high. The next level of resistance is at 6,000-6,020, marked by record high, among others. Will the Nasdaq resume its uptrend and break above 6,000 mark again?

Concluding, the S&P 500 index extended its short-term consolidation on Friday, as it lost 0.2%. The broad stock market will likely break above its recent trading range today following an overnight futures contract rally. Will the uptrend continue towards the level of 2,500? There have been no confirmed short-term negative signals so far. However, we still can see some medium-term overbought conditions along with negative technical divergences.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Paul Rejczak

Stock Trading Strategist