Stocks & Equities

Briefly:

Intraday trade: Our yesterday’s neutral intraday outlook has proved accurate. The S&P 500 index fluctuated within a relatively narrow trading range of 10 points. The broad stock market index may extend its short-term consolidation today. Therefore, we prefer to be out of the market, avoiding low risk/reward ratio trades.

Our intraday outlook is neutral, and our short-term outlook is bearish, as we expect downward correction. Our medium-term outlook remains bearish:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): bearish

The main U.S. stock market indexes gained 0.3% on Wednesday, extending their short-term fluctuations following last week’s move up, as investors reacted to economic data announcements, among others. The S&P 500 index extends its over-month-long consolidation along the level of 2,450. It currently trades around 1% below the August 8 all-time high of 2,490.87. The Dow Jones Industrial Average trades along the level of 21,800, and the technology Nasdaq Composite index remains close to record high, as it trades along 6,400 mark. The nearest important level of resistance of the S&P 500 index is at around 2,470-2,475, marked by Tuesday’s daily gap down of 2,471.97-2,473.85. The next resistance level is at 2,480-2,490, marked by recent local high and the above-mentioned August’s record high. On the other hand, support level is at around 2,445, marked by Tuesday’s daily low. The next level of support is at around 2.430-2,435, marked by previous daily gap up of 2,430.58-2,433.67 and last week’s Wednesday’s daily low. The broad stock market continues to trade within an over-month-long consolidation following November-July uptrend. Will it continue higher? Or is this some medium-term topping pattern before downward reversal?

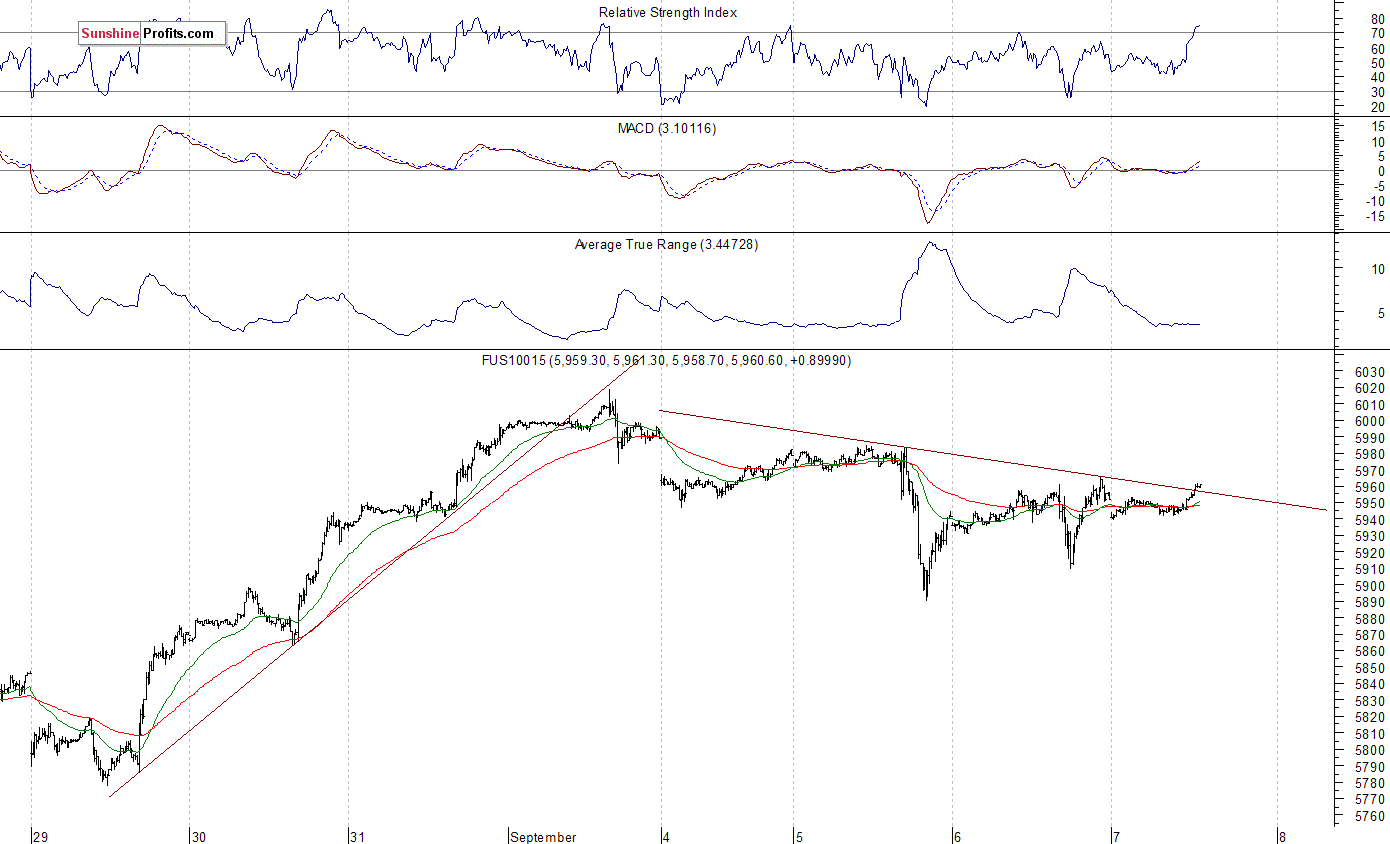

Short-Term Uncertainty

Expectations before the opening of today’s trading session are virtually flat, with index futures currently between -0.05% and +0.05% vs. their yesterday’s closing prices. The European stock market indexes have gained 0.5-1.0% so far. Investors will now wait for some economic data announcements: Initial Claims, Productivity number at 8:30 a.m. The market expects that Productivity grew 1.3% in Q2, and Initial Claims were at 241,000 last week. The S&P 500 futures contract trades within an intraday consolidation, as it extends Wednesday’s fluctuations following a rebound off support level at around 2,445-2,450. On the other hand, level of resistance is at 2,465-2,470, marked by some short-term local highs. The next resistance level is at 2,475-2,480. The futures contract trades within a short-term consolidation, as we can see on the 15-minute chart:

Nasdaq Close To Record High

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. It fluctuates following Tuesday’s sell-off and a rebound off support level. The nearest important level of resistance is at around 5,970-5,990, marked by recent consolidation. The next resistance level is at 6,000-6,020, marked by new record high. Will the tech stocks’ market continue higher? Or is this some topping pattern before downward reversal?

Concluding, the S&P 500 index extended its short-term fluctuations on Wednesday, as it traded along the level of 2,460. Will the uptrend continue following last week’s rebound off support level? There have been no confirmed short-term negative signals so far. However, we still can see some medium-term overbought conditions along with negative technical divergences.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Paul Rejczak

An idealist is one who, on noticing that a rose smells better than a cabbage, concludes that it is also more nourishing.

- L. Mencken

Many pundits associate higher copper prices with inflation. While this is true to a degree, that is the wrong metric to focus on. Higher copper prices are usually associated with an improving economy. For the past few years, Copper which is a leading indicator did not trend in sync with the markets. It was marching to a different drum beat, but a new trend could be in the works.

Copper has traded past a key resistance point ($3.00), and it has managed to close above this important level on a monthly basis. The long term outlook for copper is now bullish and will remain so as long as it does not close below $2.80 on a monthly basis. Copper is facing resistance in the 3.20-3.25 ranges and as it is now trading in the extremely overbought ranges. As copper is now trading in the extremely overbought ranges, it is more likely to let out some steam before trading past this zone. A healthy consolidation should provide copper with the force needed to challenge the $3.20 ranges and trade as high as $3.80 with a possible overshoot to $4.00, provided it does not close below $2.80 on a monthly basis.

Now that copper has traded past $3.00 on a monthly basis, the Fed deserves another pat on the back for they have managed to further cement the illusion that this economic recovery is real. Copper is seen as a barometer for economic growth, so pulling off a Houdini is probably going to propel a lot of former naysayers to embrace this economic recovery.

Mass Sentiment is still Negative so Stock Market likely to Correct only

Combining this data with the action in the Copper markets leads us to believe that the stock market is more likely to experience a correction than an outright crash. Higher copper prices are usually indicative of higher stock market prices. Therefore, the copper markets are confirming that the long term trend is still intact.

What about the Inflation issue?

Should we start to worry about inflation, now that copper prices are trending higher? We would prefer to look at it from a different angle; higher copper prices in the past were associated with an improving economy. For a long time, this indicator like the Baltic dry index diverged, but now it appears copper is dancing to the same tune as the Stock Market

Don’t focus on the inflationary factor, as we are not operating in normal times. The Fed opened Pandora’s box so expect the unexpected.

Greenspan raised rates from 1% in 2004 to 5.25% in 2006 and long term rates hardly budged. The Fed today is in no position to act as aggressively and on a worldwide basis, central bankers are preparing for deflation as opposed to inflation.

Long term rates are trending upwards, but the Fed has already changed its tune and appears to be taking a more dovish stance.

“Because the neutral rate is currently quite low by historical standards, the federal fund’s rate would not have to rise all that much further to get to a neutral policy stance,” Yellen will tell Congress.

In a twist, the bond market did not trade to new lows after the last rate hike. In fact, it put in a higher low and has been trending upwards. The bond market has completely shrugged off the effects of the last rate hike.

Bonds bottomed out in March, and since then they have been trending upwards. A monthly close above 158 should lead to a test of the 164 ranges.

Last but not least, the velocity of M2 money stock continues to trend downwards. Inflation will remain a non-issue until it starts to trend upwards. We also have a plethora of deflationary factors to consider, grocery wars that will escalate now with Amazon’s purchase of Whole Foods, automation and AI, etc.

Irony is the form of paradox. Paradox is what is good and great at the same time.

Friedrich Schlegel

By Sol Pahla

The South China Post reported that Chinese scientists fear that a mountain in North Korea under which the last five bombs detonated as tests, may collapse crumbling into a crater. They fear that the radiation underground would then leak across region.

The South China Post reported that Chinese scientists fear that a mountain in North Korea under which the last five bombs detonated as tests, may collapse crumbling into a crater. They fear that the radiation underground would then leak across region.

Russian President Vladimir Putin has warned that the escalating crisis concerning North Korea’s weapons program is placing the world at risk of developing into a “global catastrophe” with massive casualties. Putin has UNREALISTICALLY said that the only way to resolve the crisis was through diplomacy. For that to be even a possibility, it requires talking. Kim Jong Un has not even met with the leader of China – its once closet Allies.

Let’s put this is perspective. Why is Kim pushing the world to the brink? Kim Jong Un looks at this differently He believes that the survival of his regime depends on possessing nuclear weapons. He is most likely NOT interested in starting a nuclear war for he cannot be so stupid to believe he would win. Yet, Kim also realizes that the prospect of the USA sending a nuke to North Korea is also not likely for that would antagonize China and risk pollution drifting to South Korea and Japan, not to mention China. So with all the saber rattling, Kim is not stupid and realizes that the USA cannot launch a first strike.

Now, why is the goal of Kim? To be honest, Kim Jong Un does not trust the USA for from the outsider perspective, he has watched how American intervention in Iraq ended in the overthrow of Saddam Hussein, his execution as well as family members, and left the country ravaged by war and a puppet of Washington. Obviously, Kim has made the determination that had Saddam truly possessed nuclear power then the USA would never have intervened. This logic is understandable for it creates the stalemate between USA, China, and Russia. The USA invading Iraq, Afghanistan, and Syria with the objective of regime change creates the image that one must protect themselves and this is Kim’s perspective.

Sanctions will never work because Kim would starve his people before giving up his power. Also, as long as he appears to be strong, then there is little risk of an internal coup. If he backs down and appears weak, the prospect of being overthrown becomes probable from within.

…also from Martin: Market Talk- September 5th, 2017

On September 5th, the members of both houses of Congress of the United States will clean the beach sand from between their toes and return to work. Our public servants who occupy The House of Representatives have been working on their respective tans since July 29th. The Senate has had a little less time in the sun; they held their final vote on August 3rd despite their pledge to stay until August 11th.

Hopefully, they got a lot of rest, because they have a lot to do upon their return. By the end of September Congress will need to pass a budget bill to avoid a government shutdown. Expect Tea Party Republicans to hold their ground on spending cuts while Trump petitions for his wall. According to recent tweets, Trump is pushing for this fight and welcomes a government shutdown. Get out the popcorn this could get interesting.

Washington also need to increase the debt ceiling, to avoid a debt default that could trigger a global financial crisis. Treasury Secretary Steven Mnuchin can pay the bills in full and on time through September 29th – after that, he will need an increase in the country’s $19.81 trillion-dollar credit limit. Republicans are promising that a default is impossible, but Congress also promised a repeal and replacement of Obamacare within the first 100 days of the Trump Presidency, and Trump himself guaranteed to kill the ACA on day one–so I wouldn’t hold my breath that increasing the nation’s credit limit will go any smoother.

Congress also needs to reauthorize the insurance of 9 million children through the Children’s Health Insurance Program (CHIP) and pass the National Flood Insurance Program (NFIP)—Hurricane Harvey has put extra importance on this provision, as well as aid for the storm itself.

After they take care of those urgent matters they plan to segue back to tax reform, infrastructure and to take yet another crack at making some needed modifications to Obamacare; before the premiums rise to 100% of disposable income.

And they will have to juggle this full legislative agenda while dealing with North Korea, Russia-gate and Confederate Statue-gate.

For a body of elected officials who have built their careers on doing nothing they have an enormous amount of legislation to sift through in an incredibly short amount of time.

And all this dysfunction in DC is having an adverse effect on the dollar, which is already down over 9% this year. A strong dollar is emblematic of a vibrant economy. Whereas, the opposite displays faltering GDP growth and a distressed middle class.

This recent retreat in the dollar is also due to Mario Draghi’s hint that he may pull back QE in the Eurozone. In their June meeting, The European Central Bank (ECB) failed to announce a policy change, but they did make some small changes to forward guidance, which has investors bracing for such an announcement at the September 7th meeting. Mr. Draghi has recently expressed more confidence in the Eurozone economy. The expectation of ECB tapering has put downward pressure on our dollar.

This is why the lynchpin for the global economy now rests on the shoulders of Mario Draghi and Janet Yellen—both of whom foolishly believe that their massive counterfeiting sprees have put the global economy in a viable and stable condition. I intentionally left out Haruhiko Kuroda of the BOJ; even though he is the worst of the money printing bunch, at least he knows—along with everyone else–that he will never be able to stop counterfeiting yen. If the ECB begins the taper in January of next year, QE would be wound down to zero by June. And, of course, the Fed has made it clear that it will begin reverse QE around the end of this year. This will result in the selling of $50 billion worth of MBS and Treasuries at the same time the ECB is out of the additional bond-buying business.

The memories of central bankers are extremely limited. In particular, Draghi forgets that before his pledge to do “whatever it takes” to push European bond yields lower during 2012, the German 10 year bund was 4%. And periphery yields such as; the Italian 10 year was close to 8%, Portugal 14%, and in Greece the yield was 40%. That is how high yields were before ECB purchases began. However, these intractable yields were extant before the gargantuan increase in nominal aggregate debt levels incurred since the global financial crisis, which was abetted by the central bank’s offering of negative borrowing rates.

The central banks’ prescription for boosting the economy out of the Great Recession has been: print $15 trillion worth of fiat credit to purchase distressed bank assets, dramatically reduce debt service costs for both the public and private sectors, and to vastly inflate asset prices so as to create a trickle down wealth effect. But now, central banks are in the process of reversing that very same wealth effect that temporarily and artificially boosted global GDP.

Therefore, by the middle of next year–at the very latest—we should experience unprecedented currency, equity and bond market chaos, which will be a trenchant change from today’s era of absent volatility. The vast majority of investors have fully embraced the passive buy and hold strategy due to confidence in governments and central banks. That misplaced confidence is the biggest bubble of all.

By Michael Pento