Word is that Hurricane Harvey will end up being the most expensive natural disaster in U.S. history. According to AccuWeather, the estimate for the full cost of the storm will approach $160 billion. To put this number in perspective, Harvey is expected to cost about the same as the combined costs of Hurricanes Katrina and Sandy.

Timing & trends

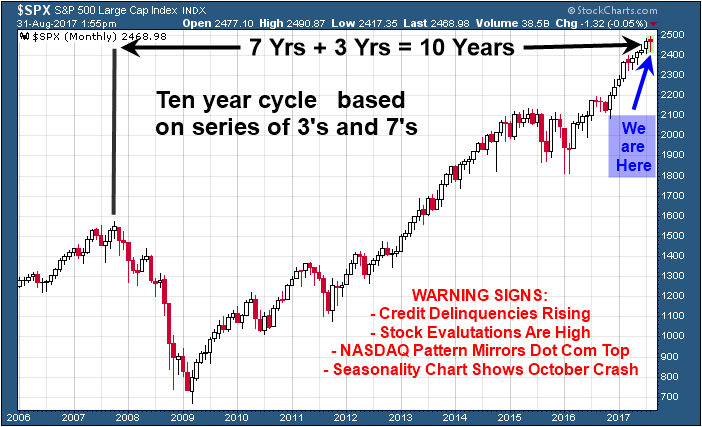

It has been proven repeatedly by various market experts that stock market cycles exist. Whether you believe in them or not that is up to you, but as a technical trader myself I see price action repeat on virtually all time frames from the intraday charts, to daily, weekly, monthly, quarterly, yearly, and beyond.

In fact, cycles tend to move in series of 3’s, 7’s and 10’s, and multiples of these as well. So, 3 bars, 7 bars, 10 bars no matter the time frame, though I find the 10min, daily, weekly, and monthly charts work best.

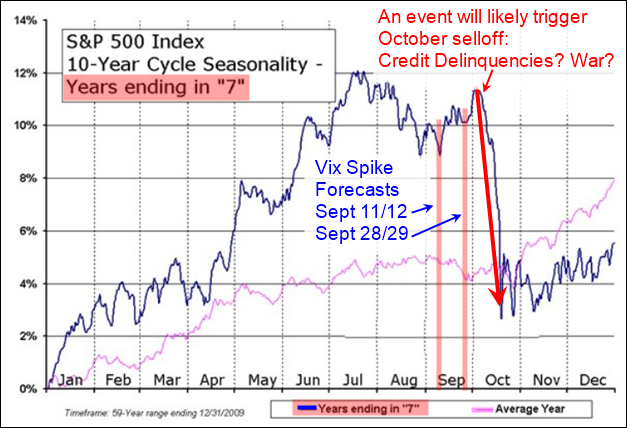

Knowing these cycles lengths, let’s review briefly where the markets are situated in terms of a seasonality, volatility, and the 3, 7 and 10 cycle periods. What I am about to show you is very intriguing.

I will let the charts do all the talking as they show the picture clearly.

Example of Last 7 Year Stock Market Cycle

Potential 10 Year Cycle Top Forming

Seasonality of Monthly Price Action for Years Ending in 7

Concluding Thoughts:

In short, this is just a quick snap shot of some angles in which I look at the stock market. There are a lot different things happening (cycles, technical analysis patterns, and fundamentals) which have been painting a bearish picture for the stock market.

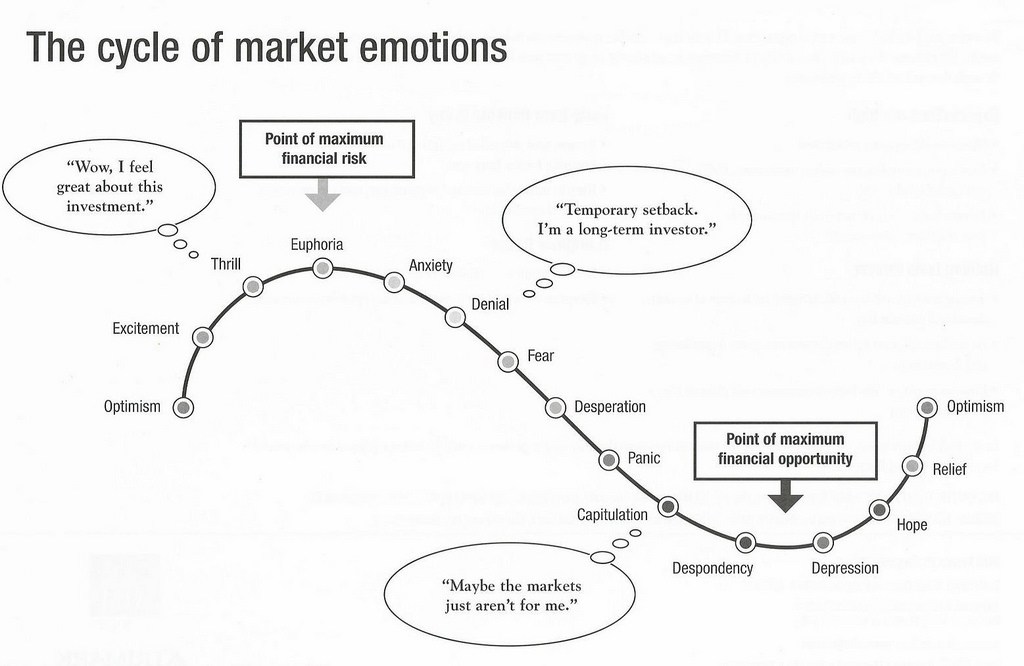

In fact, last year the US equities market were only a couple down days way from trigging a full-blown bear market. But Trump was elected and that triggered a massive rally which I see as being a final exhaustion move (euphoria) just before a major market top.

I have been watching and waiting for what I feel will be the next major market top for just over a year now. Why? Because once a market top looks to be in place we must adjust all our long-term portfolio holdings into different asset classes with CASH being a huge portion of it.

Stock prices typically fall 7 times faster than they rise so just imagine being properly positioned for a bear market with a portion of your position knowing you could make 7 years of slow painful growth in only 8-12 months when the bear market starts. I recently did a seminar talking about his and how one can use inverse ETF’s and short selling to profit from the next financial down turn which will eventually happen.

If you want to stay in the loop and be positioned for this massive move over the next two years Bear Market, then back into a Bull Market be sure to join my 2 Year Trading & Investing newsletter plan at http://www.thegoldandoilguy.com/etf-trading-newsletter/

Chris Vermeulen

Summary

Summary

The sample size for major hurricanes hitting the U.S. is relatively small.

We review the five big storms and their impact on the stock market.

The bottom line is…

A few years ago, TINA was everywhere … she was the life of the party. Whenever people wondered why stocks kept rising, she’d show up and people would scream, TINA!

But I haven’t heard anyone mention her recently … did she take off? Or did she drink so much from the punch bowl that she’s passed out, sleeping somewhere?

Of course, I’m talking about TINA the acronym, not Tina your old drinking buddy. As in, There Is No Alternative … to stocks.

Let’s be clear. Choosing your investments by process of elimination is not the best way to approach things. After all, you shouldn’t invest in something just because everything else looks worse. That investment could also have little intrinsic value and a poor risk to reward ratio.

But TINA is not a way of investing, it’s a narrative … one that’s been with us for years and may be here for a while longer. So far, this narrative has helped investors achieve substantial returns. Will it continue to do so moving forward?

For most investors, the highest level asset allocation decision typically involves deciding between stocks, bonds, and cash. Let’s begin with these three and then we’ll expand our discussion to encompass alternative asset classes such as precious metals, real estate, and currencies.

Since stocks are the shoe-in here, let’s take a look at cash and bonds to see what type of case can be made for investments there. First cash.

As you well know, the returns on cash have dropped to zero over the past couple of decades. The chart below exemplifies this, showing how the return on savings accounts has dwindled since the early 90’s.

Here’s a news flash for you: Donald Trump is controversial and caustic. He says exactly what’s on his mind, no matter how incendiary, and he’s not afraid to make enemies, even with members of his party. “Bully” is a word many people use to describe the 45th U.S. president.

Here’s a news flash for you: Donald Trump is controversial and caustic. He says exactly what’s on his mind, no matter how incendiary, and he’s not afraid to make enemies, even with members of his party. “Bully” is a word many people use to describe the 45th U.S. president.

The thing is, no one who voted for Trump—I think it’s safe to say—didn’t already know this about him. His being a bully is baked right into his DNA, and he expertly honed this persona during his stint as the tough-as-nails host of NBC’s The Apprentice.

Remember when Trump received flak a few weeks back for retweeting a gif of himself

body-slamming “CNN”? The clip actually came from WrestleMania 23 in 2007, when the future president defeated World Wrestling Entertainment (WWE) CEO Vince McMahon—and consequently got to shave his head—in a fight billed as the “Battle of the Billionaires.” Trump’s bombastic style and rough edges were so aligned with the smack-talking world of professional wrestling that he was inducted into the WWE Hall of Fame in 2013.

That’s who Trump is. He’s a bully. But I’m convinced that’s why he was elected—to stand up to even bigger bullies.

Standing Up to the Beltway Party

Right now those bullies include members of the beltway party, sometimes referred to as “the deep state”—career bureaucrats, lobbyists, regulators and other officials who make it their mission to oppose any Washington outsider who threatens to shake up the status quo.

The beltway party isn’t a new phenomenon, of course. For the past 50 years, the number of government workers relative to the entire U.S. workforce has remained virtually the same. Meanwhile, the percentage of Americans employed in manufacturing has steadily plummeted.

Think about it: We have fewer people in this country who innovate and build things than people who enforce the laws that often prevent manufacturers from innovating and building at their fullest potential. What hope do they have?

When you have a bully problem, you don’t send in a Boy Scout. That’s what we learned with Jimmy Carter, whose presidency Trump’s administration so far resembles in an interesting way, according to former Federal Reserve chair Ben Bernanke. Carter and Trump, both outsiders, were sent to Washington to “drain the swamp” of the beltway party. We all know unsuccessful Carter was, but that’s likely because he was simply too nice and “decent” for the White House.

I don’t think anyone would ever accuse President Trump of being too nice and decent, but I also don’t think decency is what we need right now. Decency won’t motivate Congress to pass tax reform. Decency won’t roll back strangulating regulations.

Unlike Carter, Trump is a disruptor. He’s disrupting government just as Sam Walton, Jeff Bezos and Elon Musk disrupted the marketplace with Walmart, Amazon and Tesla. These entrepreneurs and businesses were initially criticized for shaking up the status quo and setting new precedents. Similarly, Trump gets harshly maligned, and for the very same reasons.

A Battle Brewing over Financial Regulations

Most everyone is aware of the fight that took place this past weekend between now-retired Floyd Mayweather and UFC Lightweight Champion Conor McGregor. Although official pay-per-view data hasn’t been released yet, the number of people who paid the $100 to tune in is expected to exceed the roughly 4.6 million who bought access to watch the Mayweather-Manny Pacquiao fight in 2015. This year, Mayweather’s purse was a guaranteed $100 million but will likely be northwards of $200 million. When all is said and done, McGregor’s payday is estimated to be about half that, according to ESPN.

It wasn’t called “the Money Fight” for nothing.

But over the weekend, a “money fight” of a different kind took place, with the first volley fired in Jackson Hole, Wyoming, where the annual economic symposium of central bankers was held. In what could be her last speech as chair of the Federal Reserve, Janet Yellen defended the efficacy of financial regulations that were enacted following the subprime mortgage crisis nearly 10 years ago.

Because of the reforms, Yellen said, “credit is available on goods terms, and lending has advanced broadly in line with economic activity in recent years, contributing to today’s strong economy.” Banks are “safer” today, she insisted.

Never mind that her conclusions here are questionable at best. Post-crisis reforms such as 2010’s Dodd-Frank Act have actually led to a large number of community banks drying up,giving borrowers, especially in rural areas, fewer options. Because of added compliance costs, many banks have done away with free checking, which disproportionately affects lower-income customers.

Leaving all that aside for now, Yellen’s intent was crystal clear. She made it known to President Trump that, should he re-nominate her to head the Fed when her term ends in February, she will do what she can to protect post-crisis regulations.

Trump, of course, has another point of view. He’s promised to do a “big number” on Dodd-Frank, which he claims has prevented “business friends” from getting loans.

So far he’s been true to his word. In April, he signed an executive order issuing a review of Dodd-Frank. Many of his top-level appointments to the Federal Deposit Insurance Corporation (FDIC), the U.S. Securities and Exchange Commission (SEC) and other such federal agencies have come from a pool of people the big banks feel comfortable with. And his Cabinet is well-stocked with former investment bankers, most notably Steven Mnuchin, who heads the Treasury Department.

In June, the Treasury Department released its recommendations for regulatory reform.Among them are a wholesale reduction in financial regulations, a decrease in their complexity and greater coordination among regulators.

But there’s only so much the executive branch can do alone. A bill designed to repeal key provisions in Dodd-Frank easily passed the House in June and is now in the Senate’s hands. Because it will need to clear a 60-vote threshold, a clean repeal bill looks unlikely, but relief of any kind is better than none.

Abrasive as his style may be, Trump is our greatest hope right now in bringing sensible reform to our complex tax code and regulatory infrastructure.

Looking Ahead to 2020

The Democrats might very well take a page out of the Republicans’ handbook and put up a similarly confrontational, in-your-face candidate in 2020. Right now I can think of no one more fitting of that description than Massachusetts senator Elizabeth Warren. A Democratic Socialist cut from the same cloth as Bernie Sanders, Sen. Warren can be every bit as much a bully as Trump. If you’ve seen her grill someone during a Congressional hearing, you’ll know what I’m talking about.

The Democrats might very well take a page out of the Republicans’ handbook and put up a similarly confrontational, in-your-face candidate in 2020. Right now I can think of no one more fitting of that description than Massachusetts senator Elizabeth Warren. A Democratic Socialist cut from the same cloth as Bernie Sanders, Sen. Warren can be every bit as much a bully as Trump. If you’ve seen her grill someone during a Congressional hearing, you’ll know what I’m talking about.

But whereas Trump supports free markets and business-friendly policies, I believe a President Warren would usher in a new age of punitive taxes and regulations on steroids.

As I’ve often said, it not the politics that matter so much as the policies. I support the candidate who makes it easier for Americans to conduct business and create capital. Sen. Warren has many admirable qualities, I’m sure, but her socialist, far-left ideology would be devastating to businesses and investors alike.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2017.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

On August 21st many Americans witnessed the moon cast a historic but short-lived shadow across the United States. One day later, President Trump reversed his previously stated position on the 16 year old Afghan War, thereby eclipsing the possibility that the United States would finally come to its senses and rethink a failed strategy that is likely to fail for years, perhaps decades, to come. The abrupt change, in what had been a central plank in candidate Trump’s appeal to voters thirsting for change in American foreign policy, came hard after the departure of Steve Bannon from the White House. As a self-avowed nationalist, Bannon had represented a true break in interventionist Republican thinking that had entangled the United States in intractable conflicts around the globe. To put an exclamation point, Sebastian Gorka, the last remaining proponent of the Bannon perspective, was forced out of the White House. The counter-revolution appears to be complete.

On August 21st many Americans witnessed the moon cast a historic but short-lived shadow across the United States. One day later, President Trump reversed his previously stated position on the 16 year old Afghan War, thereby eclipsing the possibility that the United States would finally come to its senses and rethink a failed strategy that is likely to fail for years, perhaps decades, to come. The abrupt change, in what had been a central plank in candidate Trump’s appeal to voters thirsting for change in American foreign policy, came hard after the departure of Steve Bannon from the White House. As a self-avowed nationalist, Bannon had represented a true break in interventionist Republican thinking that had entangled the United States in intractable conflicts around the globe. To put an exclamation point, Sebastian Gorka, the last remaining proponent of the Bannon perspective, was forced out of the White House. The counter-revolution appears to be complete.

In his widely-followed speech regarding Afghan policy, Trump now appears to favor a widening of the military effort to insure that the United States continues to exert an influence on a remote central Asian region, where it is often said that empires go to die.

A big part of Trump’s “drain the swamp” appeal, lay in his promise to change the politics of Washington. To many voters, such a shift would include a break from America’s “Neo-Con” agenda of foreign intervention, which has deeply enmeshed the country in foreign politics and has enriched the defense industry and its lobbyists. However, given the Administration’s failure to break the Congressional inertia with respect to healthcare and now its reversal on Afghanistan, it appears as if the swamp refuses to be drained.

Recent elections in the U.S. and Europe have exposed deep-seated public distrust, suspicion and anger at the political establishment. Most had expected that the 2016 Presidential election would be a test of established figures, but populist elements in both parties soon took center stage. Against almost all political calculations, Trump ousted Jeb Bush as the establishment Republican candidate and went on to win the Presidency. The political establishment was stunned, and has yet to come to terms with the people’s choice. Now it appears that the entire establishment is united in a common aim to destroy the duly elected President.

The fact that business as usual now appears to be remaining so is manifesting itself with growing popular frustration. The past few days have seen an increase in politically motivated street violence in America. Meanwhile, the grass roots supporters of Sanders and Trump fight in the streets and on university campuses.

It appears that Bannon was squeezed out of the White House by establishment Republicans. In other words, the swamp swamped him, and America is just as stuck in Afghanistan as she ever was. While Trump may have insisted on better tactics, including increased aggression and more realistic rules of engagement, our servicemen and women will continue fighting a sixteen-year war on ground chosen by and favoring the enemy. Normally, history illustrates that given a determined enemy, and particularly one with sanctuary neighbors like Pakistan, even the largest armies lose. Such was the case in Vietnam.

The likelihood for real change in foreign policy has been mirrored by equal despair in the realm of healthcare. Based on the intransigence and hypocrisy of Congressional Republicans, and the failure of the Trump Administration to honestly and meaningfully grasp the policy details of healthcare, it appears as if the promise to repeal and replace Obamacare is now on life support, if not already dead on the table. It is starting to dawn on many Trump voters that effective deregulation and meaningful tax reform may vanish down the same rabbit hole.

It is become ever more probable that the United States will be left with increased government spending, ever greater public debts, and an expansion of identity politics and the welfare state. A stalling of enterprise, recession, and a fall in tax revenues may follow. America may resume the downward path carved by past Republican and Democrat politicians most markedly over the past half century.

If Government debt explodes, confidence in the U.S. economy and its dollar could fall, likely forcing interest rates to rise, possibly in the face of a recession. As hope for an enterprise revival fades, stock markets could stall and then fall dramatically.

But, currently, stock markets are heading for new highs, supported by oversize gains in biotech, transports and financials. Most likely these gains are based still on the blind hope that Republican and Democrat establishments will not succeed in sabotaging Trump’s goals, including the repatriation of up to $5 trillion of U.S. corporate earnings marooned overseas, and cuts to the U.S. corporate income tax rates that would make U.S. corporations more competitive globally. If those initiatives disappear into the swamp, look for U.S. stocks to come under selling pressure.

Investors should concentrate hard on determining whether current ascendency of the establishment represents a skirmishing success or a major trendsetting victory. Regardless, Trump will continue to face resistance from Republican establishment leaders until he shows more determination to root out swamp personnel from the White House and from within his Administration.

Should Trump fail, Americans in his power base will feel betrayed, seriously disappointed and may take matters increasingly into their own hands on the streets. People from all sides, including those of allied nations, should fear such an outcome that now is poised menacingly to cast a dark and lasting shadow over America.

History shows that when the people hold their established politicians in open contempt and fight each other not with words in parliaments but with fists and weapons on the streets, as they did in the French and Russian Revolutions and in Weimar Germany, the results threaten democracy. Amazing as it may seem, this worrying specter now faces the United States.

For many Americans, Trump’s election offered hope – that government would concentrate on defending the country, protecting citizens under the law, bringing immigration within the law, rebalancing trade deals and removing ensnaring regulations and crippling taxation. In the months following the election, the optimism fed into the markets and helped push stock prices up to record levels. As a Member of the English Parliament under Margaret Thatcher, I witnessed almost all these results at first hand. In particular, deregulation and lower tax rates triggered an economic renaissance and higher total tax revenues from increased earnings.

There can be little doubt that the American economy has declined markedly in recent years. But the truth has been kept from ordinary people by the surreptitious manipulation of key statistics such as inflation and employment figures and the massive deployment of fake money.

Ordinary Americans suffer falling living standards as the income gap continues to widen. They sense this as grossly unfair and blame correctly their establishment politicians who have feathered their own nests unashamedly. They are demanding change, and if it can’t come through the democratic process, the results could be ugly.

Read the original article at Euro Pacific Capital