Timing & trends

Marc Faber reveals his asset allocation strategy to tide over the risks posed by the US equity markets.

Marc Faber reveals his asset allocation strategy to tide over the risks posed by the US equity markets.

Marc Faber’s disenchantment with equity shares, especially US stocks, is well-known. However, it is not very often that the 80-year old veteran gives others an insight into his portfolio. Often referred to as Dr Doom, renowned investor Marc Faber — the author of Gloom, Boom & Doom report — said this week that he has allocated only a quarter of his portfolio to equities, and that too, mainly in Asia. The remaining three-fourths of Marc Faber’s money is mainly divided between real estate, precious metal and gold shares.

The reason is simple: Marc Faber is not a believer in the rally in the US stock markets, and seems to be openly opposed to the US President Donald Trump’s ideas!

Venezuela is sliding closer and closer toward the brink, and things look as if they’ll get worse, unfortunately, before they improve.

Venezuela is sliding closer and closer toward the brink, and things look as if they’ll get worse, unfortunately, before they improve.

A country that boasts the largest proven oilfield in the world should not be facing such dire food and medicine shortages, not to mention rampant protests and violence in the streets. But that’s what happens when far-left, authoritarian socialist regimes threaten to dissolve economic freedom, the rule of law and democracy itself.

As you might have heard, a vote passed in Venezuela on Sunday that could permanently amend the country’s constitution for the worse. President Nicolas Maduro is now poised to become the world’s next absolute dictator.

As you might have heard, a vote passed in Venezuela on Sunday that could permanently amend the country’s constitution for the worse. President Nicolas Maduro is now poised to become the world’s next absolute dictator.

Last Wednesday, the U.S. Treasury Department issued economic sanctions on 13 current and former Venezuela government officials in an effort to encourage Maduro to drop the election, which—let’s be honest—was likely rigged in his favor. According to Transparency International, Venezuela is among the most corrupt countries on the planet, ranking 166 out of 176 in 2016.

“We will continue to take strong and swift actions against the architects of authoritarianism in Venezuela, including those who participate in the National Constituent Assembly as a result of today’s flawed election,” the U.S. State Department said in a statement issued Sunday.

So why am I telling you this? Again, Venezuela sits atop the world’s largest proven oil patch. Crude accounts for roughly 95 percent of its export earnings. If Maduro does not relent, the U.S. could very possibly target the country’s oil industry next.

As Evercore ISI put it last week, the Treasury Department’s decision is “the first step toward comprehensive sectoral sanctions, including crude oil imports into the U.S.”

This would be phenomenally disruptive to Venezuela’s already fragile economy. Right now, the U.S. is the country’s top cash-generating market. Unlike most other markets, the U.S. pays its oil import invoices in full and on time. Venezuela could always boost exports to other existing clients, but the cash would dry up.

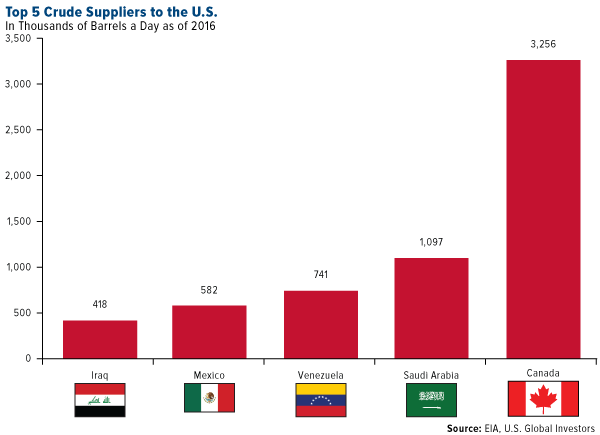

To be fair, such a move wouldn’t be exactly painless for the U.S. either. Venezuela is currently its third-largest supplier of crude, following Canada and Saudi Arabia. Several large American producers, including Chevron, Halliburton and Schlumberger, have joint-venture contracts with Petroleos de Venezuela (PDVSA), the South American country’s state-run oil company. And a number of oil refineries in the U.S. are equipped specifically to handle Venezuela’s notoriously extra-heavy crude.

Speaking to MarketWatch last week, Oil Price Information Service energy analyst Tom Kloza said the “possibility of chaos” in Venezuela could adequately spur an oil rally that the most recent global production cuts have failed to achieve. Despite the Organization of Petroleum Exporting Countries’ (OPEC) December agreement to trim output in an effort lift prices, crude fell more than 14 percent in the first six months of 2017 and is currently underperforming its price action of the past four years.

Venezuela’s vote this past weekend, followed closely by fresh U.S. Treasury Department sanctions, could be the “only true element that would change the dynamic for crude,” Kloza says.

Crude Gains on Inventory Draw

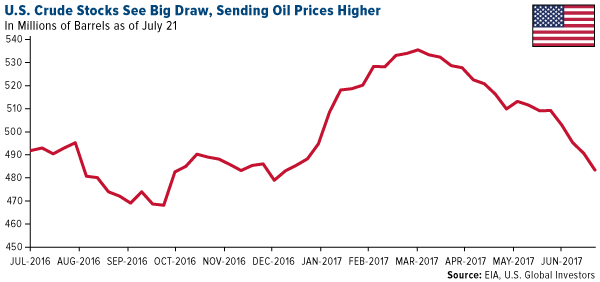

West Texas Intermediate (WTI) crude climbed to a nearly two-month high last week—but not entirely in response to the upcoming Venezuela vote. The U.S. Energy Information Administration (EIA) reported that crude oil inventories, not including those in the Strategic Petroleum Reserve (SPR), sharply fell 7.2 million barrels in the week ended July 21. Stocks now stand at slightly more than 483 million barrels. Although still historically high, inventories have now decreased for four straight weeks.

Last Tuesday, oil jumped 3.34 percent, its biggest one-day gain since November 2016. The commodity is on track to have its first positive month since February.

Also supporting oil right now is speculation that domestic producers could soon start slashing capital budgets after months of depressed prices. Anadarko Petroleum made headlines last week after becoming the first major U.S. producer to announce cuts. The Texas-based company plans to trim $300 million from its 2017 budget.

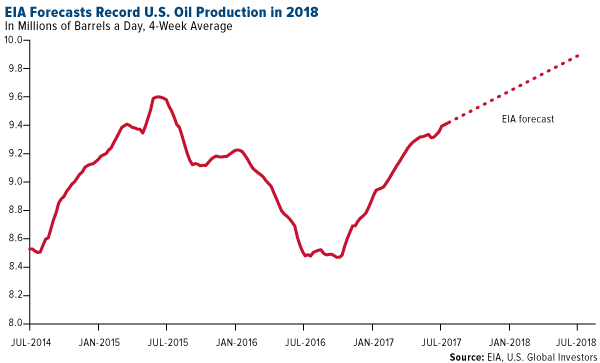

But don’t expect domestic output to slacken anytime soon. In its Short-Term Energy Outlook, released last week, the EIA forecasts crude production to reach a record high of 9.9 million barrels a day on average in 2018. That would push it over the previous record of 9.6 million barrels a day, set way back in 1970.

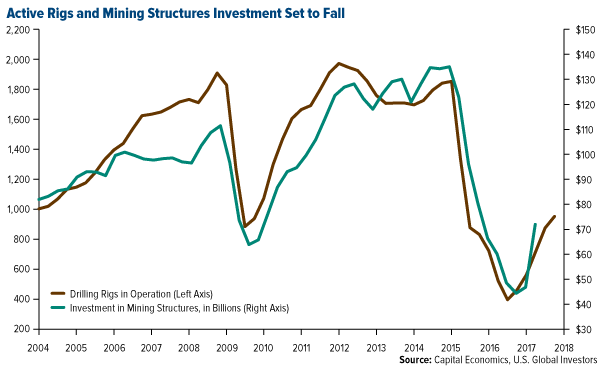

Not everyone agrees with this assessment. In a report last week, Capital Economics writes that “after more than a year of steady gains, the number of active drilling rigs will decline in the second half of the year. Accordingly, while mining structures investment probably posted another rise in the second quarter, these gains won’t be repeated in the second half of the year.”

It’s important to remember, though, that a common theme among American frackers is that operations have become exceedingly more efficient than ever before. When oil prices collapsed more than two years ago and rigs were mothballed, output remained strong. So it’s possible that even with fewer rigs actively pumping crude, and less capital going into mining structures, we could still see domestic production reach 10 million barrels a day by next year.

OPEC Compliance at Six-Month Low

Obstructing price appreciation right now is news that a number of OPEC countries are not complying with production guidance laid out earlier in the year. The compliance rate fell from 95 percent in May to a six-month low of 78 percent in June, with monthly output from Algeria, Ecuador, Gabon, Iraq, the United Arab Emirates and Venezuela totaling more than what should be allowed.

Meanwhile, Libya and Nigeria—which are exempt from the OPEC agreement because recent political instability in those countries knocked out months’ worth of production—dramatically increased output that reportedly has Saudi Arabia worried.

Peak Oil Demand in 10 Years?

Looking ahead on the demand side, we could see global oil consumption peak as soon as the late 2020s or early 2030s.

|

|

That’s according to Ben van Beurden, CEO of Royal Dutch Shell. Speaking to CNBC last Thursday, van Beurden cited growth in electric vehicle sales as well as countries switching from fossil fuels to renewables as major catalysts that would trigger peak demand much sooner than previous estimates. Back in November, the International Energy Agency (IEA) said it didn’t expect demand to peak before 2040.

But things are changing more rapidly every day. In June, Volkswagen—the world’s number one manufacturer by sales—announced it would cease selling fossil fuel-burning automobiles by 2020. Both France and the United Kingdom recently said gas and diesel cars would be banned by 2040. India, the fastest growing automobile market, set a similar target for 2030.

Even when oil demand peaks—whether in 2030 or 2040—it won’t “go out of fashion overnight,” van Beurden said. Planes, ships and heavy trucks will continue using fossil fuels all around the globe, and smaller emerging markets will not be able to make the transition to renewables so easily as larger economies such as Western Europe, China and India.

“Supply will shrink faster than demand can shrink,” he explained, “and therefore, working on oil and gas projects will remain relevant for many decades to come.”

Shell reported knockout second-quarter earnings as cash generation rose sharply. The Anglo-Dutch producer’s earnings attributable to shareholders rose to $1.9 billion in the June quarter, a whopping 703 percent increase over the same period last year. Free cash flow stood at an incredible $12.1 billion, up from negative $3.1 billion during the same quarter in 2016.

With the price of oil having averaged $45 a barrel for the past two years, Shell will remain “very disciplined” going forward, van Beurden said.

In a better world we might expect:

- Individuals, corporations, and governments spend no more than their income.

- “Honest” money is used by all, has intrinsic value, retains its purchasing power and is not counterfeited by individuals or bankers.

- Governments and bankers support and encourage “honest” money.

Alas, we live in this world and must realize that:

- Debt has increased rapidly for the past century. Example: U.S. national debt has expanded from roughly $3 billion to $20 trillion.

- Currencies are IOU’s issued by central banks who promote ever-increasing currency in circulation, expanding debt, and continual devaluations in purchasing power.

- The “fiat-currency-game” will continue until it implodes.

THE PROBLEM SHOWN IN ONE GRAPH:

Another Perspective on Official National Debt Increases Since 1913:

The economic world runs on debt and credit. Dollars are created as debt, so expect more debt, lots more debt. From the St. Louis Federal Reserve:

However, gold and silver protect purchasing power.

The stock market is another way to protect purchasing power.

Central banks and commercial banks create more dollars, yen, euros, and pounds, thereby diluting the value of all existing fiat currencies. Consequently consumers must protect their purchasing power.

The government and central banking “borrow and spend” business supports and benefits the financial and political elite, so it will continue. For perspective on central bank “printing,” of their currencies from “thin air” consider this graph:

How do you protect your purchasing power? Stocks, bonds, real estate, silver, gold, and many others.

The problem with stocks – they are dangerously high.

From SovereignMan: “It’s Better to Turn Cautious Too Soon”

The problem with bonds: Bonds yield next to nothing and pay in currencies guaranteed to depreciate in value. Waiting for a friendly central banker to bail out your investment works for the elite, but not for most individuals.

The problems with gold and silver: They are mostly anonymous, safe, retain their value over centuries, are not simultaneously another party’s liability, and cannot be counterfeited by central banks or governments.

Some might see these characteristics as benefits, not problems!

Western central bankers believe gold and silver are threats to their fiat currencies. They want everyone locked into their unbacked debt based fiat currency schemes that benefit the financial and political elite. Tough luck for the rest of us.

The rise of cryptocurrencies indicates, among other things, dissatisfaction with fiat currencies.

In summary, the global financial system, based on “dishonest” fiat currencies is dangerous and unstable. Potential wars with North Korea, Russia and China will aggravate an already dangerous economic structure. Existing wars in Syria, Iraq, Afghanistan and elsewhere have been costly in terms of soldier deaths, excessive expenses, and unpayable debt. Central banks and governments want more debt, more currency in circulation, and higher prices, so … expect more wars.

The consequence of massive and unpayable debt, out of control spending, and central bank “printing” of currencies is inevitable destruction of the currencies.

The western central bank answer: Levitate stocks, boost bonds, near zero interest rates, “war on cash,” and more debt. Note the current parallels with crashes in 2000 and 2007.

The Asian answer involves acquisition of gold, lots of gold. Why have western vaults shipped another 1,000 metric tons of gold bullion to Asia in 2015?

We have been warned!

Gary Christenson

The Deviant Investor

The dramatic failure of the U.S. Senate’s last-ditch Obamacare repeal effort leaves Republicans so far without a major legislative win since Donald Trump took office. No healthcare reform. No tax reform. No monetary reform. No budgetary reform.

The dramatic failure of the U.S. Senate’s last-ditch Obamacare repeal effort leaves Republicans so far without a major legislative win since Donald Trump took office. No healthcare reform. No tax reform. No monetary reform. No budgetary reform.

The more things change in Washington… the more they stay the same.

Despite an unconventional outsider in the White House, it’s business as usual for entrenched incumbents of both parties. The next major order of business for the bipartisan establishment is to raise the debt ceiling above $20 trillion.

Since March, the Treasury Department has been relying on “extraordinary measures” to pay the government’s bills without breaching the statutory debt limit.

By October, according to Treasury officials, the government could begin defaulting on debt if Congress doesn’t approve additional borrowing authority.

Treasury Secretary Steven Mnuchin wants Congress to pass a “clean” debt limit increase. That would entail just signing off on more debt without putting any restraints whatsoever on government spending.

Fiscal conservatives hope to tie the debt ceiling hike to at least some budgetary reforms. But even relatively minor spending concessions will be difficult to obtain from the bipartisan establishment.

Democrats and a few left-leaning Republicans together have an effective majority in the U.S. Senate. They wielded their legislative might by defeating the GOP’s watered down Obamacare repeal bill, with the decisive “no” vote cast by ailing Republican John McCain.

It was exactly the sort of media spotlight moment Senator McCain has craved throughout his long political career.

The narcissistic Senator’s shtick is to posture as a selfless crusader for noble causes that his fellow Republicans just aren’t high-minded enough to get behind.

Yet for all his sanctimony, McCain is just as politically opportunistic and just as hypocritical as many of his Senate colleagues. The Senator from Arizona ran for re-election last time around on repealiång Obamacare. Yet when given the opportunity, he voted to keep it in place.

He campaigns as a conservative when it suits his political needs and portrays himself as a maverick when he wants media accolades. He legislates as neither a conservative nor a maverick but as an entrenched establishment incumbent. That can also be said of other big-name Republicans.

Trump’s Budget Cut Proposals Declared “Dead on Arrival” by Spending-Drunk Congress

When President Trump’s Budget Director Mick Mulvaney unveiled a proposed budget that, for the first time in decades, asked Congress to make tough cuts to an array of spending programs, establishment Republicans joined Democrats in branding it “dead on arrival.”

Congress didn’t even consider the idea of spending cuts to be on the table for negotiation. That’s how entrenched deep state loyalties are in Congress.

Instead of working with Trump’s budget, the Republican-controlled Congress promptly began hammering out a spending bill that added billions to what the administration requested – $4.6 billion more for agriculture, $4.3 billion more for interior and environmental programs, $8.6 billion more for the departments of Transportation and Housing and Urban Development.

No cuts to refugee and foreign aid programs. Even the much-maligned National Endowment for the Arts made it through the House Appropriations Committee unscathed.

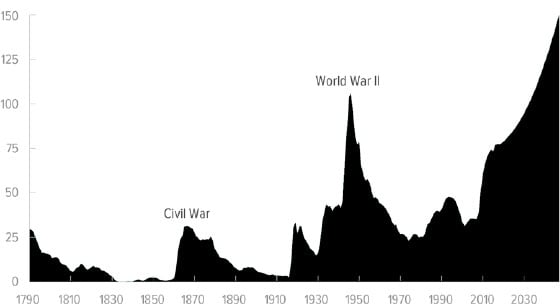

The bottom line is that there will be no spending restraint in Washington, and therefore no way out of the coming debt crisis. The Congressional Budget Office projects that publicly held federal debt as a percentage of the economy will soon surge past all previous wartime spikes.

National Debt (Publicly Held) as a Percentage of GDP

Source: Congressional Budget Office

The official national debt of nearly $20 trillion is just the tip of the iceberg. It represents a small proportion of the total unfunded liabilities the political class has racked up over the past few decades (pointedly, after President Richard Nixon repealed the last remnants of gold redeemability for the U.S. dollar and replaced it with pure fiat).

Taxpayers are on the hook for perhaps $100 trillion more in unfunded entitlement and pension IOUs.

Plus, state and local government pensions are underfunded by several trillion dollars. They haven’t blown up yet because the rising stock market and steady bond market seen over the past several years has enabled pension fund administrators to kick the can further down the road. They are projecting unrealistically high market returns into the future – and still coming up short.

Federal Reserve Makes It All Possible

Trillions upon trillions of dollars have been promised that simply won’t exist… unless the Federal Reserve creates them out of nothing. The Fed’s unlimited power to expand the currency supply enables politicians to commit acts of fiscal malfeasance with political impunity.

A legislator might get voted out of office for raising taxes, but probably not for adding to the budget deficit. Most voters don’t perceive any immediate consequences to a rising national debt or the expansion of the currency supply. That’s why “borrow and print” is a politically convenient way for lawmakers to stealthily raise taxes.

Government spending extracts resources from the economy regardless of whether that spending is paid for through taxes or through the deceit of borrow and print.

What excessive borrowing today does is set up political demand for massive inflation of the currency supply down the road. The inflation tax can be just as devastating to a person’s wealth as any tax collected by the IRS.

Trump & Chaos

Trump & Chaos

US President Donald Trump may be a good businessman, but in politics, he just does not get it. Politics is all about ego and back-stabbing. It is not about logic and the art of the deal. After just ten days in the office, Trump’s communications chief, Anthony Scaramucci has been forced to resign. The Chief of Staff John Kelly demanded a clean new start and and that meant the dismissal of Scaramucci. This last week had caused a lot of trouble, when Scaramucci attacked the now dismissed Reince Priebus and Trump’s chief Steve Bannon with vulgar words. Trump is under pressure, because he has not implemented many announced projects so far. He is kept spinning around in circles fighting things like gays in the military creating so many new wars and hatred alienating support for projects he promised like tax reform.

So far, Trump is a man who does listen, but he is also a man who is very much his own. He is out of his league in politics. This is not about the best deal for the country. This is indeed more than a swamp – it is an entire ocean of corruption and self-interest. Negotiating a business deal is a one on one arrangement with each having a self-interest. This is a multi headed beast with no possible way of confronting on so many levels simultaneously for every politicians has his own self-interest, which has nothing to do with the good of the nation. Trump has to STOP creating so many new wars and stop the personal tweeting to get even. Just get on with the tax reform before it is too late or he will find himself losing support from the people in 2018.

It has been this downturn in Trump’s administration that feeds the weakness of the dollar.

….also from Martin:

Our European Tour – Part II – Seizing All Bank Accounts Throughout EU