Currency

Several weeks after Goldman’s chief technician started covering bitcoin, overnight Bank of America has released what some may call an “initiating coverage” report on bitcoin which notes that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA’s commodity strategist Francisco Blanch writes that bitcoin is uncorrelated to any financial asset, “so there is no way to explain let alone predict returns.”

Several weeks after Goldman’s chief technician started covering bitcoin, overnight Bank of America has released what some may call an “initiating coverage” report on bitcoin which notes that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA’s commodity strategist Francisco Blanch writes that bitcoin is uncorrelated to any financial asset, “so there is no way to explain let alone predict returns.”

While we will present some of the more notable findings from the report shortly, one observation caught our attention, namely that in at least one regard, bitcoin has already surpassed gold: the total daily trading bolume for bitcoin has now surpassed that of the biggest gold ETF, the GLD.

“The trend in housing starts for Canada reached its highest level in almost five years”, said Bob Dugan, CMHC’s chief economist. “So far this year, all regions are on pace to surpass construction levels from 2016 except for British Columbia, where starts have declined year-to-date after reaching near-record levels last summer.” CMHC News Room

NOTE: The chart below shows the actual annual totals count from 1956 through 2016.

The 2017 data points on the chart are derived from the “annualized” provincial data set in the charts above and are therefor a projection of what year end 2017 might look like.

|

|

Projected Year End 2017 Totals

Canada = 190,424 (-4% Y/Y) ON = 74,310 (-1% Y/Y) QC = 35,100 (-9% Y/Y) BC = 39,131 (-7% Y/Y) AB = 25,423 (-4% Y/Y) |

Last week, the S&P 500 price/revenue ratio reached the highest level in history, outside of the single week of March 24, 2000 that represented the peak of the tech bubble. Meanwhile, the 30-day CBOE volatility index (largely reflecting the level of fear or complacency among option traders) dropped to a record low, as bullish sentiment surged to 57.8% bulls versus 16.7% bears (Investors Intelligence), and the S&P 500 pushed to its upper Bollinger bands (two standard deviations above a 20-period moving average) on daily, weekly, and monthly resolutions.

Last week, the S&P 500 price/revenue ratio reached the highest level in history, outside of the single week of March 24, 2000 that represented the peak of the tech bubble. Meanwhile, the 30-day CBOE volatility index (largely reflecting the level of fear or complacency among option traders) dropped to a record low, as bullish sentiment surged to 57.8% bulls versus 16.7% bears (Investors Intelligence), and the S&P 500 pushed to its upper Bollinger bands (two standard deviations above a 20-period moving average) on daily, weekly, and monthly resolutions.

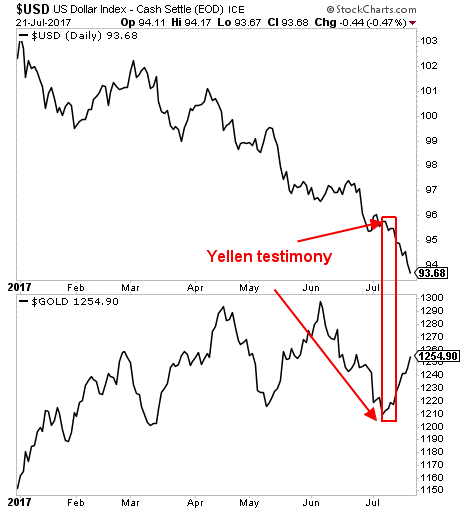

Janet Yellen has confirmed that the US Dollar is going to collapse.

I don’t mean a systemic, going to zero, collapse (though one day the $USD, like all fiat currencies will fail). I mean that the $USD is going to drop hard in the coming 18+ months.

How hard?

I believe we’ll see the $USD in the 80s sometime in 2018. That’s a full 11% lower from where the $USD is today. Put simply, the entire move in the greenback that was driven by the Fed ending QE will be unwound.

How do we know this?

Janet Yellen’s testimony to Congress earlier this month was a clear signal.

First, a little context…

For months now, numerous Fed officials have been publicly stating that the Fed was embarking on a significant tightening schedule.

This has been one of the most coordinated and clear Fed PR campaigns in recent history with numerous Fed officials calling for 3-4 rate hikes in 2017 as well as Fed balance sheet shrinking.

Then on Tuesday and Wednesday July 11th and 12th respectively, Fed Chair Janet Yellen testified in front of Congress that the Fed is just about done with tightening. Moreover, she stated that the Fed WOULDN’T use its balance sheet normalization as a monetary policy (indicating that it won’t use it to drain liquidity from the system).

The $USD, which was already trending downward in spite of the Fed’s previous hawkishness, promptly collapsed. And Gold erupted higher.

It’s time to get moving into inflation plays.

If you’re not taking steps to actively prepare your portfolio for this, you need to so now.

Graham Summers

Chief Market Strategist