Bonds & Interest Rates

Between 2006 and 2016, Canadian household debt grew by $932 billion (or 85 per cent); governments by $755 billion (or 83 per cent); non-financial corporations by $713 billion (or 98 per cent); and financial corporations by $778 billion (or 93 per cent)… CLICK HERE for the complete article

Bread, it is said, is the staff of life. Or at least it was, before beating up on gluten became all the rage. But whatever your dietary choices, if you’d been investing in bread — or, more precisely, the stuff that goes into it — over the past few weeks, you’d be feasting on a pretty satisfying repast right now.

Prices for wheat futures have been soaring. In little more than a week after June 27, July futures at the Chicago Board of Trade (the most liquid wheat derivatives market in the world) rose about… CLICK HERE for the complete article

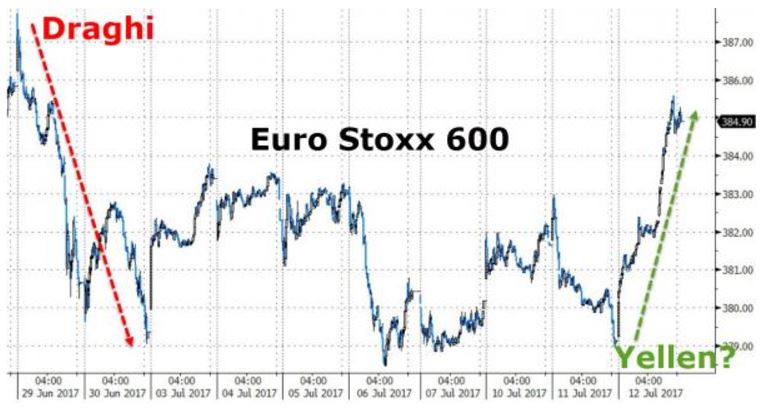

Aside from the post-Macron first-round-win in April, stocks across Europe surged to their best day since last September today, surging higher after Yellen’s dovish comments, presumably due to the market’s belief that as goes The Fed, so goes the rest of the hawkish hangers-on… CLICK HERE

The Bank of Canada is hiking its key interest rate for the first time in seven years, joining the U.S. Federal Reserve in starting the process of undoing nearly a decade of easy money.

The bank raised its overnight lending rate to 0.75 per cent from 0.5 per cent Wednesday, citing “bolstered” confidence that the Canadian economy has finally turned the corner after years of sputtering growth… CLICK HERE for the full article