Stocks & Equities

Cobalt prices continue to rise on increasing demand for electric vehicles. Tesla (NADASQ:TSLA) remains a hot topic, and many investors are closely watching for the company’s next move — most recently, CEO Elon Musk confirmed that production of Model 3 cars will start on Friday (July 7), and should reach 20,000 units per month by December.

Cobalt prices continue to rise on increasing demand for electric vehicles. Tesla (NADASQ:TSLA) remains a hot topic, and many investors are closely watching for the company’s next move — most recently, CEO Elon Musk confirmed that production of Model 3 cars will start on Friday (July 7), and should reach 20,000 units per month by December.

Mass production of lithium-ion batteries will be needed to power these electric cars, which are forecast to number 3.1 million in 2021, according to UBS (NYSE:UBS). And as demand for batteries surges, prices for metals such as cobalt are also expected to soar. In fact, Benchmark Mineral Intelligence analyst Caspar Rawlessaid recently that by 2020 cobalt demand will increase to 76,000 tonnes from 46,000 tonnes in 2016.

In light of those developments, investors interested in the cobalt space are growing more and more interested in cobalt stocks. To help provide a picture of which cobalt-focused companies are making progress this year, we’ve put together a brief overview of the three cobalt stocks on the TSX that have seen the largest share price gains year-to-date. Read on to learn what they’ve been up to in 2017.

1. Katanga Mining (TSX:KAT)

Current price: $0.58; year-to-date gain: 314.29 percent

Major miner Glencore (LSE:GLEN) increased its interest in Katanga Mining to about 86.33 percent earlier this year. The company operates a large-scale copper-cobalt mine complex in the Democratic Republic of Congo through two joint ventures; the joint ventures are called Kamoto Copper Company and DRC Copper and Cobalt Project.

In 2015, the company announced the decision to suspend the processing of copper and cobalt during the construction phase of its whole ore leach project. The suspension continued through the first two quarters of 2017, and production is not expected to resume until the project is commissioned; that process is expected to commence in Q4 2017.

2. eCobalt Solutions (TSX:ECS)

Current price: $1.17; year-to-date gain: 116.67 percent

eCobalt Solutions is focused on providing battery-grade cobalt salts that are ethically sourced, environmentally sound and produced safely and responsibly in the US. eCobalt’s primary asset is its Idaho cobalt project located in Lemhi County, Idaho.

In the second quarter of 2017, the company continued working on the feasibility study for its Idaho project. In June, eCobalt provided an operational update to its shareholders, noting that it has made progress in several areas.

3. Fortune Minerals (TSX:FT)

Current price: $0.20; year-to-date gain: 60 percent

Fortune Minerals expects to benefit from the development of its NICO cobalt-gold-bismuth-copper project, located in Canada’s Northwest Territories. The plan is for bulk concentrates from NICO to be shipped to a planned metals processing plant in Saskatchewan. The company is positioned to become a Canadian producer of battery-grade cobalt chemicals with gold and bismuth co-products.

In March, the company closed a bought-deal financing for $6,450,000, and said it expects to use the proceeds for NICO. In April, the company provided an update on its feasibility study for the project.

The data for this article was retrieved on July 5, 2017 using The Globe and Mail’s market data filter. Only TSX-listed cobalt companies with market capitalizations greater than $50 million are included.

The past decade’s historically low interest rates convinced millions of Americans to buy cars they could only afford with hyper-cheap credit. This made auto sales one of the drivers of the recovery, but it also left far too many people with underwater “car mortgages” that will limit their spending on other things and prevent them from buying their next car until sometime in the 2020s.

Like all artificial (that is, credit-driven) booms, this had to end eventually, and it’s looking like now is the time:

U.S. Auto Makers Post Sharp Sales Decline in June

(Wall Street Journal) – Detroit’s car companies reported steep sales declines in June, capping a bumpy first half of the year for the U.S. auto industry and setting a bleak tone for the summer selling season.

The reports, released Monday, come as analysts expect overall auto sales to have fallen more than 2% in June compared with the prior year, according to JD Power. The firm said the industry’s selling pace hit its lowest point since 2014 over the first six months of 2017, and traffic at dealerships—measured by retail sales—fell to a five-year nadir in June.

Edmunds.com, a consumer-research company, said buyers are stretching more than ever to afford cars and trucks that are growing increasingly more expensive due to a barrage of safety gear and connectivity options. The firm estimates the average auto-loan length reached a high of 69.3 months in June, with the average amount of financing reaching $30,945, up $631 from May.

General Motors Co. GM +2.91% said U.S. sales fell 5% to 243,155 vehicles, while Ford Motor Co. F +4.07% said sales totaled 227,979 vehicles, down 5.1% from a year earlier, and Fiat Chrysler Automobiles N.V. posted a 7% decline to 187,348 vehicles.

The following charts show a steady rise in car sales and inventories from their 2009 low to a 2015-2016 peak. If they’ve shifted into a cyclical decline the bottom, based on history, is a long way down.

Meanwhile, the cheap lease deals of the past few years are starting to run off, producing a tidal wave of nearly-new used cars to compete with much more expensive new ones. The result: falling used car prices that will, over time, cut demand for new cars even further.

Used cars are getting cheaper: CarMax

(Fox News) – CarMax (KMX), the nation’s largest used-car retailer, reported a decline in selling prices during its fiscal first quarter.

Used-car prices are expected to decline this year, as vehicles leased during the U.S. auto sales boom in recent years begin to hit the market. Manufacturers and dealers are closely watching price trends because cheaper used cars could soften demand for new vehicles .

CarMax CEO Bill Nash said Wednesday the Richmond, Virginia-based dealership chain has already seen an influx of off-lease vehicles, which is driving prices lower.

“As more of them come in, prices will continue to drop,” Nash told analysts during a conference call.

The trend put downward pressure on CarMax’s average selling prices for the first quarter, offsetting a high mix of more expensive pickup trucks and SUVs. CarMax sold used vehicles for $19,478 on average, a 1.9% drop from the year-ago quarter’s average selling price of $19,858. Prices for wholesale vehicles also fell 2.9% to $5,113.

This is obviously bad news for an economy dependent on people buying stuff they don’t need with money they don’t have. So other things being equal, expect disappointing numbers for GDP, inflation, wages, etc., going forward as this major industry morphs from tailwind to headwind.

And expect the process of interest rate normalization to become an even harder sell for the Fed, which needs a boom to justify making loans more expensive for tomorrow’s car and house buyers. As the saying goes, it’s inflate or die.

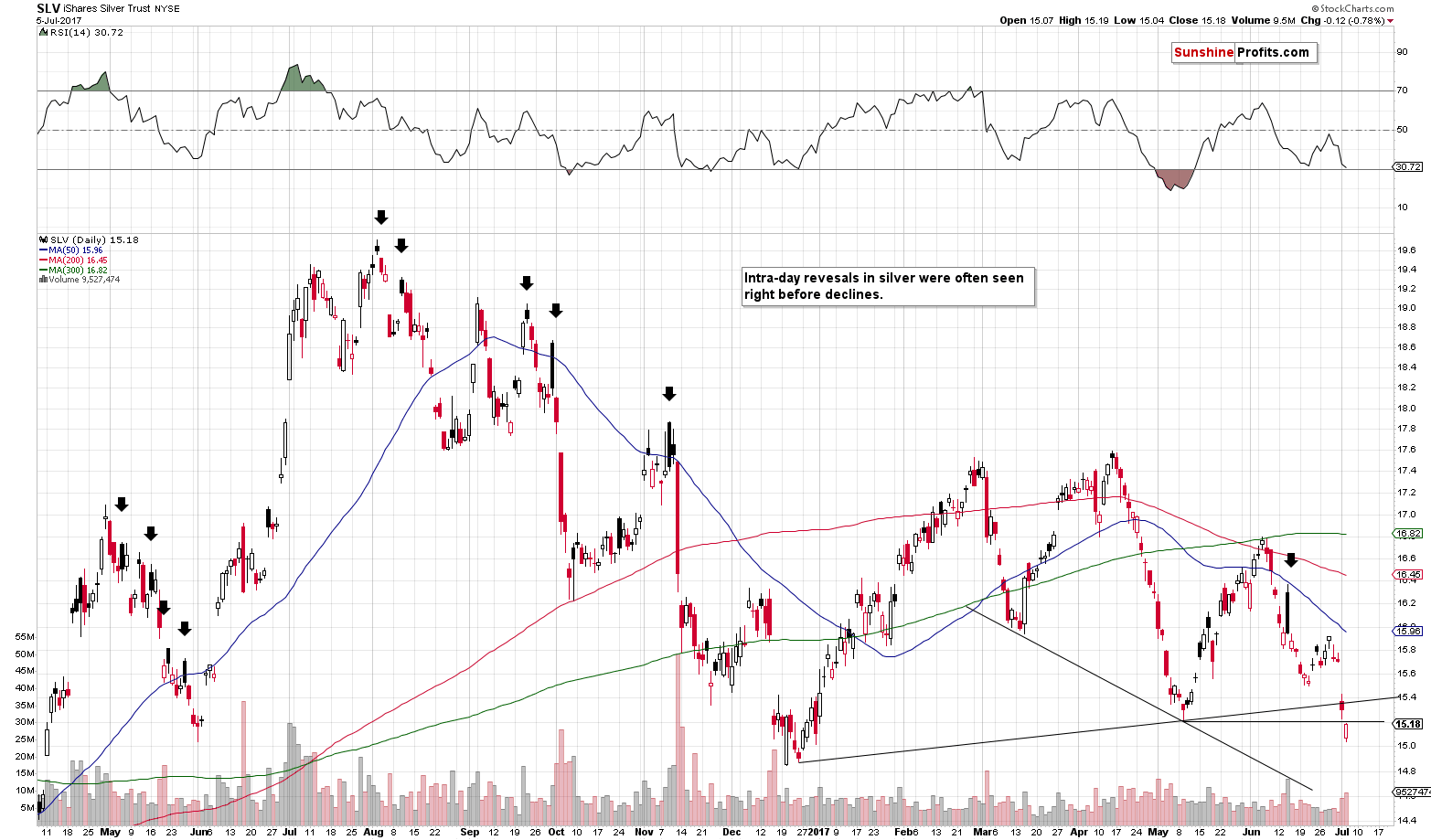

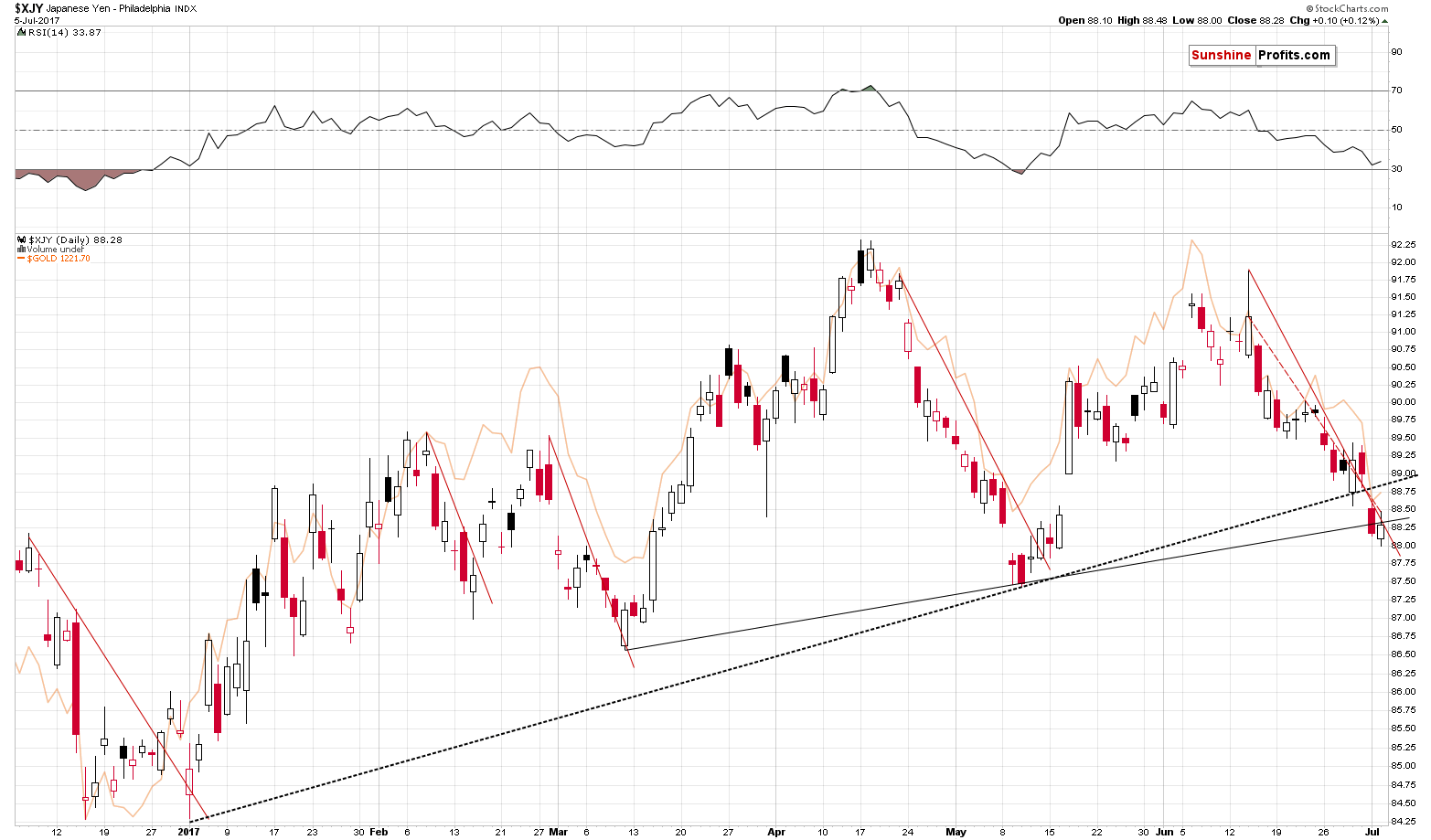

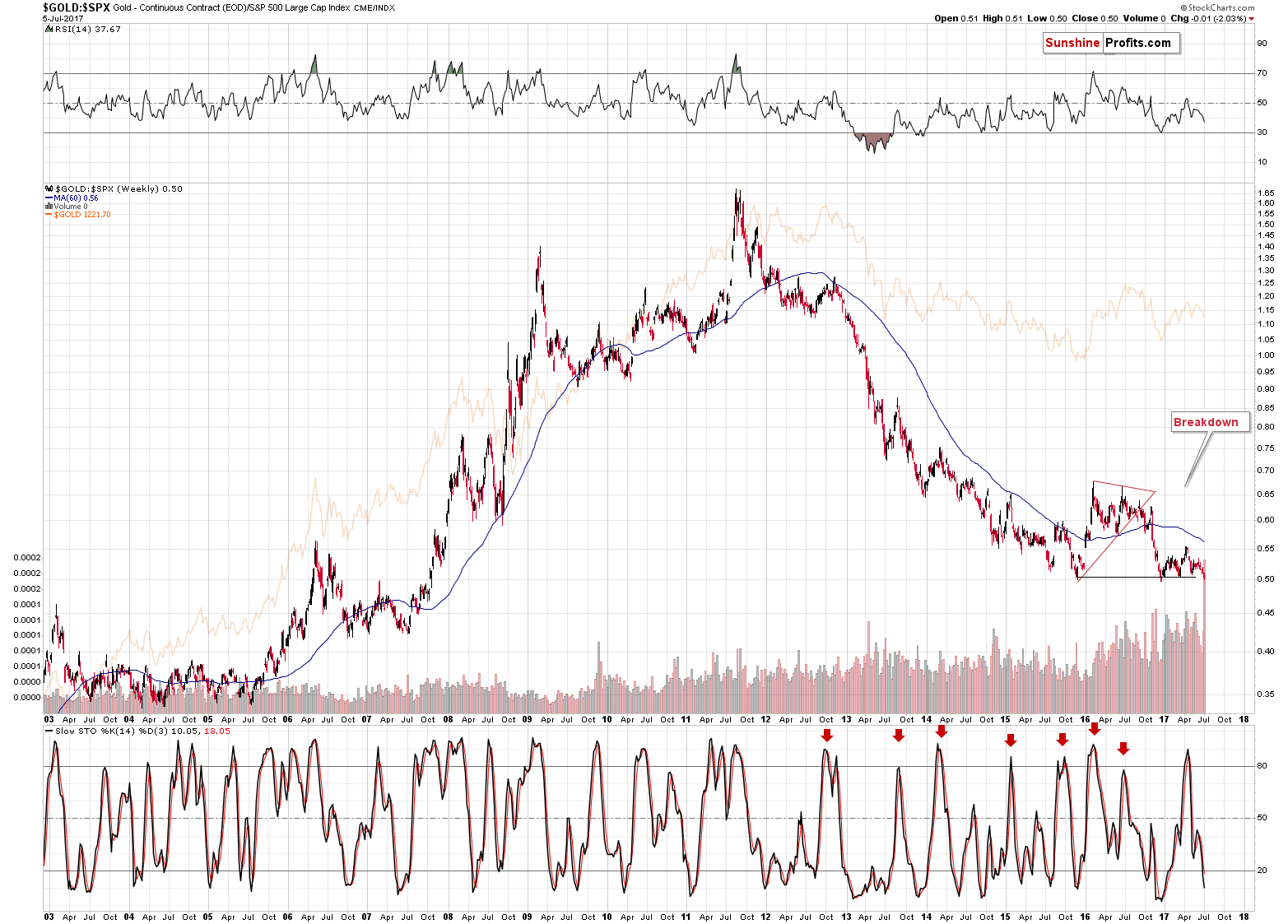

It appears the US Dollar has bottomed following an intermediate degree correction. This suggests that the dollar will rally for 6-8 weeks while gold heads lower. Gold has decisively broken down through its 200 dma. Traders are in a bull market mentality and will try to buy gold’s dips until sentiment becomes bearish. Expect gold to continue lower over the next 4- 8 weeks.

What we have is a totally propped-up market based upon debt. Energy isn’t producing positive growth, really. So instead of having real economic growth, we have inflated economic growth and inflated asset values.

What we have is a totally propped-up market based upon debt. Energy isn’t producing positive growth, really. So instead of having real economic growth, we have inflated economic growth and inflated asset values.

When growth starts to decline, I think we’re going to see the valuations of assets decline considerably. It’s anyone’s guess how quickly they can fall, but according to what I have been looking at, I think we are going to see a 50% decrease in real estate values right off the bat. I am not saying this will happen in a day, but the first wave will be a 30-50% decrease in real estate values when the markets really start to crack. They are already at the edge of the cliff — and I see prices falling down the cliff, struggling to recover, and then falling even further. Actually, I predict within the next 5-10 years, we can easily see a 75% or more reduction in real estate values.

This was part of my interview with Chris Martenson at Peak Prosperity. During the interview Chris and I discussed how the disintegrating energy industry would negatively impact the value of most assets…. Stocks, Bonds and Real Estate, while the precious metals would ultimately be the higher quality safe haven and store of value.

Out of all the analysts in the alternative media, I find that Chris Martenson’s work at Peak Prosperity gets closer to the root of the problem as it pertains to the future of our financial system and economic markets. This is due to the fact that Chris focuses on energy and the Falling EROI – Energy Returned On Investment.

Unfortunately, most precious metals and resource analysts overlook energy. Thus, their analysis is likely flawed because they view the future as a continuation of “business as usual”, once the debts and leverage are taken out of the system. This is an incorrect assumption, because the debt and leverage actually have allowed our financial system and markets to continue to function well beyond its expiration date. Getting rid of the debt and leverage would cause a collapse of the system… one that we will be unable to grow back out of.

Lastly, I believe it is important to continue focusing on the information and data as it changes. This will provide the investor-public with a guideline as to the timing of the upcoming disintegration of our highly leveraged debt based financial market.

You can also access my interview with Chris here: Steve St. Angelo: Prepare For Asset Price Declines Of 50-75%

Also, if you have not watched Chris Martenson’s CRASH COARSE, I would highly recommend it.