Energy & Commodities

QUESTION: First question: Disappointed I have not heard an opinion concerning OPEC’s continuation of reducing oil out put. Can the US shale drillers fill the void and or can the Canadian and Mexican producers ramp up any shortfall into the US

Second Question: What is your opinion on the Chinese Yuan being pegged to the US dollar. In the past you have always stated that “pegs can’t survive” i.e Swiss Franc to the Euro.

ANSWER: Supply really has little to do with the price. The real issue is demand. Electric cars are coming rapidly. I have a BMW hybrid I8 sports car and it is fantastic. It is the fastest sports car I have ever owned off the line. It has two engines a gas and electric and this technology is being expanded to all models. My neighbor has a Tesla and that is fine for local use. Tesla vehicles are currently the only battery electric cars you can buy in the that have an official range of more than 200 miles per charge. When I went to Amsterdam, the taxis are Teslas. Europe is moving toward electric cars faster than the States.

Most major automakers, including GM and Volkswagen, have vowed to roll out more than one fully electric car by 2020. In Europe, the average emissions level of a new car 2015 was 130 g of CO2 per kilometre (g CO2/km) and those sold in 2016 was down to 118.1 grams. By 2021, this has to be down to 95 grams of CO2 per kilometre.

Sales of electric cars totaled over 315,000 units in 2014, up 48% from 2013 reaching 565,00 units in 2015. In the U.S. alone, 542,000 electric cars have been sold to date. Granted, that is still small in comparison to the overall number estimated to be 263.6 million cars registered in the United States in 2015. Nevertheless, the trend is in motion. Does it by itself kill oil? Not yet! This is why oil did not elect any yearly long-term bearish signals on our model.

Keep in mind there are a lot of new discoveries also in gas. Cars make up 51.4% of oil consumption and jet fuel is 12.3%. Historically, demand drops with the economy as people drive and travel less. That is clearly the trend we see ahead.

With regard to pegs, none will stand and that includes China, Hong Kong and Middle East. What will break the peg is the dollar rally for that will import deflation to those nations with dollar pegs.

…also from Martin:

If You Want To Know Why Civil War Is Possible Just Look At This

How Does Gold Respond With War – For Real & Why It Should be Part of a Portfolio

Volatility has gone brain-dead, as today’s chart makes clear. What this implies is that ‘everyone’ has bet the opposite or is hedged up the wazoo with puts, calls or straddles against a stock market melt-up or -down. Such an event is inevitable, but not on any time schedule that traders have been able to predict with any particular success. We’ve got a small bet down ourselves, having hit .666 in our last three at-bats. Two of the trades precisely caught trampoline lows in VXX within hours, allowing subscribers who followed my explicit guidance to easily quadruple their money. Some who held onto a portion of their initial position reported doing far better than quadrupling their stake. Past performance is of course no guarantee of future success, but the current bet, notwithstanding VXX’s relentless sinking spell, is one I can surely live with. See my tout below for explicit details.

If you don’t subscribe, click here for a free two-week trial that will allow you not only to view the tout, but to enter the Rick’s Picks chat room, where great traders from around the world gather 24/7.

It was a whirlwind week. After attending two big conferences, I landed in Vancouver Friday where I presented at the International Metal Writers Conference. Markets continued to close at record highs, even as political uncertainty remained and the threat of terrorism loomed large over Western nations. Last Monday, gold flashed a bullish signal we haven’t seen in over a year.

There’s much to talk about! Below are five things you need to know from the week now behind us.

1. Quants Now Control Wall Street

A special report by the Wall Street Journal last week confirmed what I’ve been saying for a while: Wall Street is now run by the quantitative analysts, or quants. Numbered are the days when traders and fund managers picked stocks on gut instinct. Today, a decision is made only after whole oceans of data have been processed using sophisticated algorithms.

And yet quants’ role has even further room to expand. As the WSJ reports, quant hedge funds now represent 27 percent of all U.S. stock trades by investors, up from 14 percent in 2013.

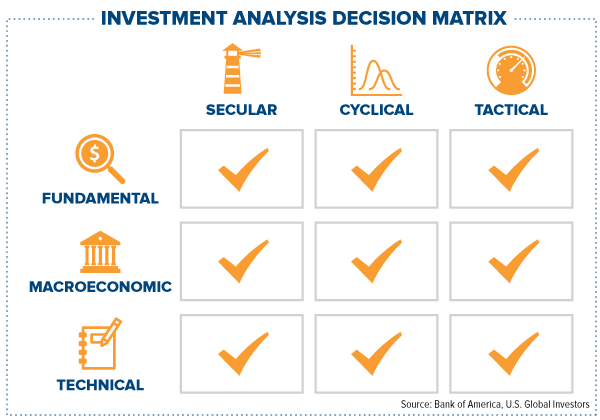

To get some idea of the type of analysis quants conduct, take a look at the matrix below. Of course, their methods are far more sophisticated, their data crunched in a matter of nanoseconds, but it’s helpful to see how they might codify many points of data.

We aspire to conduct the same sort of analysis, from technical to tactical, to make better, more strategic investment decisions.

2. Paul Singer Says It’s Time to Build Up Some Dry Powder

|

Last week at a Chief Executives Organization (CEO) event, I had the privilege of hearing billionaire hedge fund manager Paul Singer speak. His firm, Elliott Management, has one of the most impressive long-term track records, generating a compound annual growth rate (CAGR) of 13.5 percent since its inception in 1977, with only two down years.

Elliott Management currently manages close to $33 billion—not including the $5 billion it raised this month in as little as 24 hours. Yes, billion with a b. Singer, suggesting a potential investment opportunity in distressed stocks could soon open up, recently called on investors to commit a fresh infusion of cash. The resultant $5 billion in dry powder, the most ever raised in the firm’s history, is expected to be deployed at some later date.

Singer continues to be a huge advocate for gold. At the event, he mentioned that he still holds the yellow metal, noting its attractive diversification benefits. This is in line with what I frequently say: You’re unlikely to get rich investing in gold, but as a diversifier it helps to reduce some of the volatility in your portfolio. I like to recommend a 10 percent weighting in gold—5 percent in bars and coins, the other 5 percent in gold stocks—with annual rebalances.

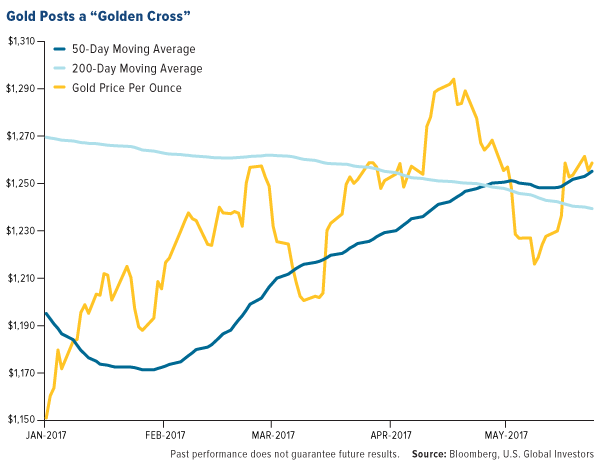

Gold posted a “golden cross” last week, which is what happens when the 50-day moving average climbs above the 200-day moving average, often seen as a bullish move.

The metal is up about 10 percent year-to-date on a weaker U.S. dollar, which has declined more than 5.5 percent over the same period.

3. BBH: Just Say No to Overdiversification

Diversification can sometimes help minimize volatility, but too much of it can lead to mediocre returns. That was the main theme of another speaker at the CEO event, this one from Brown Brothers Harriman (BBH), one of the largest private banks in the U.S. BBH research shows that, if your investment goal is to get rich, a highly-concentrated portfolio is the surest way to achieve it. An S&P 500 Index fund, while possibly delivering positive returns, is unlikely to make anyone a millionaire.

This is good to know, but the problem is that most investors can’t stomach the volatility inherent in a portfolio that holds only a few assets. With minimal diversification, daily swings can be dizzying. Professional money managers and investment banks such as BBH know how to use this volatility to their advantage, but for everyone else, it’s prudent to be diversified in gold, municipal bonds and other assets often seen as havens.

For more on how to deal with market volatility, download my whitepaper, “Managing Expectations.”

4. Want Volatility? Look No Further Than Bitcoin

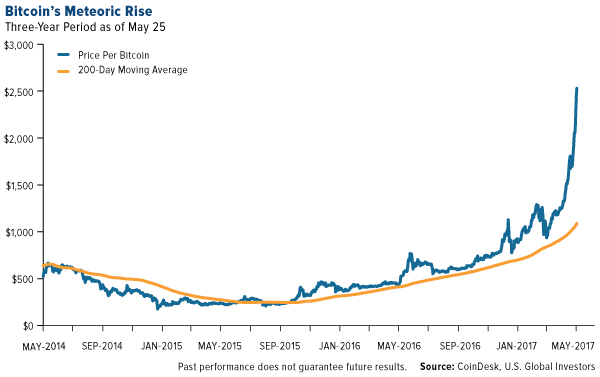

Markets watched in amazement last week as bitcoin, the online-only currency, soared to a fresh high of $2,740, more than twice the value of an ounce of gold. On Thursday alone, it traded within a $510 range, underscoring the nearly 10-year-old cryptocurrency’s high levels of volatility and speculation.

Some bitcoin analysts forecast even higher gains, while others see the formation of a bubble they liken to the dotcom crash of the late 1990s and early 2000s. Since only March, when it surpassed gold, the digital currency has doubled in value.

These were among some of the discussions at Consensus, a bitcoin technology conference, which I also attended last week in New York. One of the highlights of the conference was hearing from Fidelity CEO Abigail Johnson, who surprised many attendees by embracing the digital currency and supporting its growth. I admire Johnson, head of a traditional financial firm, for recognizing the fact that bitcoin is already disrupting our industry and will likely continue to do so for some time. Not only does Fidelity now allow its workers to buy their lunches using bitcoin, but there are also plans to make it possible for clients to see and manage their bitcoin assets.

|

Fidelity isn’t the only firm trying to position itself as a bitcoin pioneer. Both Nasdaq and the Chicago Mercantile Exchange (CME) were sponsors of the conference, indicating cryptocurrencies’ gradual shift from fringe curiosity to legitimate speculative asset.

I was shocked to learn that there are now somewhere in the neighborhood of 700 cryptocurrencies, all of them locked in a race to see which ones will come out on top. They’re collectively up more than 400 percent so far this year, the market having risen from $17.6 million in January to $88 million today, according to cryptocurrency and blockchain technology news site CoinDesk.

To “mint” a new cryptocurrency, I learned, speculators raise capital not through conventional means but through crowdfunding, like a 21st century Gold Rush. All regulatory oversight and governance is therefore bypassed. The currency is then issued in an initial coin offering (ICO), after which it can be “mined” using powerful, energy-hogging computers. Naturally, the cheaper the electricity, the better. The hunt for the world’s cheapest kilowatt hour has taken “miners” all over the globe, from parts of Russia to Iceland to Finland to rural China.

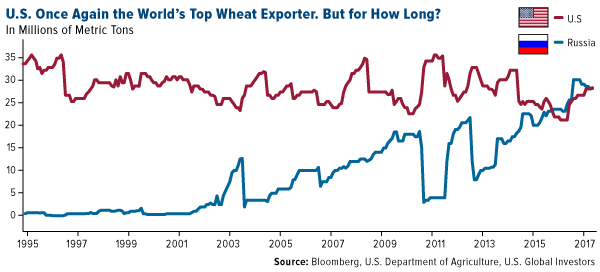

5. Make American Wheat Great Again

It looks as if wheat exporters are great again. After being displaced by Russia in August 2016, the U.S. has regained its title as the world’s top exporter of the grain—for now. Interestingly enough, the investigation into possible collusion between Donald Trump’s campaign and Russia has driven the U.S. dollar’s devaluation since the start of the year, which in turn has made U.S. exports cheaper for overseas buyers. Egypt, Algeria, Mexico and Japan all reportedly increased their purchase amounts of American wheat.

Two years ago, it was the Russian ruble’s weakness—prompted by the dramatic decline in oil prices and international sanctions following Russia’s occupation of Ukraine—that gave Russian exporters an edge. Coupled with a bumper crop, the country outpaced both the U.S. and European Union, then the leader.

As I said earlier, the dollar has declined 5.5 percent year-to-date, helping to give American exporters an edge. According to Bloomberg, the U.S. is expected to ship more than 28 million metric tons of wheat this season, an increase of 34 percent compared to the same time last year.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Diversification does not protect an investor from market risks and does not assure a profit.

What types of jobs will be lost to automation?

Today’s data visualization applies probabilities from a well-cited study to current U.S. job numbers.

The end result: the most common jobs of today will not likely be the most common jobs of tomorrow.

View Larger Version “Visualizing the Jobs Lost to Automation“

But in my opinion, all things in nature occur mathematically.” ― René Descartes

When I am assessing a business or leader of that business, I listen carefully during the first few minutes of the conversation for the sign of a number, any number! If I hear it, I draw a sigh of relief, knowing that I am talking to someone who is serious about the business. If I don’t hear a number early on, I start to worry and ask a series of close ended questions to tease out some hope, such as: “What was your sales growth last year?”, “What are your gross margins, or any margins for that matter?”, “Can you tell me one or two key ratios?”. This line of questioning invariably separates the wheat from the chaff and the truly exceptional business owners begin to emerge.

When I am assessing a business or leader of that business, I listen carefully during the first few minutes of the conversation for the sign of a number, any number! If I hear it, I draw a sigh of relief, knowing that I am talking to someone who is serious about the business. If I don’t hear a number early on, I start to worry and ask a series of close ended questions to tease out some hope, such as: “What was your sales growth last year?”, “What are your gross margins, or any margins for that matter?”, “Can you tell me one or two key ratios?”. This line of questioning invariably separates the wheat from the chaff and the truly exceptional business owners begin to emerge.

In my experience, knowing how to describe your business numerically is one of the top, tell-tale traits of exceptional entrepreneurs, business owners, CEOs, executives and managers. Why? Because good numbers are objective, not a figment of someone’s imagination, dreams, hopes, wishes and desires. Good numbers show how the money flowsthrough a business, which helps clarify the business systems and obstacles. Good numbers show trends which can moderate or accelerate executive actions through enlightenment. Good numbers are acommon language and give common comparisonsacross sectors and the globe.

Here is how I recommend business owners get into the habit of developing financial numeracy skills.

Focus on a critical few, not the trivial many: Identify a small number of key financial indicators, no more than 6. This should include measures of revenue, margins, working capital and cash flow. Don’t try to boil the ocean.

Make it relevant: Pick financial measures that are relevant for your industry sector and stage of growth. This will keep you focused on what truly matters and will give you real and valuable tools to manage and grow the business.

Improve your financial literacy: If you lack a business degree from Wharton, don’t panic. Take some extra education in the form of seminars, webinars, continuing education or what ever works for you. Treat it seriously and you will learn quickly.

Add financial capability to your exceptional team:A top notch CFO, Controller or Accountant is imperative for the success of your business. Hire one and get someone good, really good! Ask them to explain everything to you in detail and make them full partners in managing the entreprise. They must keep their finger on the financial pulse of the business.

Pick good financial indicators: While these may vary by sector and stage, here are a few financial indicators that I look at and are applicable across many situations:

- Revenue (most recent period and change from previous period)

- CAGR (Compound Annual Growth Rate) for a key metric

- Gross Margin % (Revenue – COGS / Revenue)

- Acid Test Ratio (Cash+A/R+S/T Investments / Current Liabilities)

- Current Ratio (Current Assets / Current Liabilities)

- Net Profit Margin (% of Revenues remaining after operating expenses, interest and taxes)

- Cash and Working Capital Measures (i.e. A/R, A/P and Operating Cash Flow Ratio)

Additional important metrics include customer retention rates, cost of customer acquisition, customer lifetime value and a measure of productivity.

Becoming well versed in a few key metrics will give you more clarity in the operations and prospects of your business, while giving your investors, employees and partners more confidence that the business is in good hand. Take the time to learn and do it right!I write, speak and advise on the topics of accelerating business growth and leadership, based on my 25 years of real-life experiences of leading, managing and growing companies.