Currency

Strengths

- The best performing precious metal for the week was silver, climbing 2.36 percent and just beating out gold’s price performance as softer economic data emerged.

- Gold traders and analysts are split on their outlook for gold, reports Bloomberg, with 12 bearish, three bullish and four neutral this week. On May 16 the yellow metal advanced for a fourth day, with Kotak Commodities Services saying gold is supported by “mixed U.S. economic data, weakness in the U.S. dollar, geopolitical tensions and uncertainty about Trump’s policy actions.” On the prior Friday, consumer prices (excluding food and energy) rose 1.9 percent year-over-year for April, the least since 2015, while retail sales were also weaker, reports Bloomberg.

- Eldorado Gold will “gain an operating foothold in its own country with a deal to take full control of Integra Gold Corp,” reports Bloomberg, offering the equivalent of C$1.2125 for each Integra share. That is a 52 percent premium to Integra’s closing price on May 12, according to a statement on Monday from Eldorado. The proposed acquisition provides Eldorado with its first operating mine in Canada, offering G&A and income tax benefits, along with exposure to a lower political risk project, notes a Viii Capital report.

Weaknesses

- The worst performing metal for the week was palladium, down 5.87 percent. UBS noted that electric cars will be brought to the market sooner than consensus expectations and that platinum group metals are expected to lose market demand on this technology adoption.

- Barrick Gold reached an agreement with the Dominican Republic government (where it operates its Pueblo Viejo mine), outlining new financial terms and tax rates, reports Bloomberg. The new terms show the government is projected to receive an additional $181 million from Barrick between 2017 and 2019, according to a statement from the Dominican President’s office. The new terms are based on a gold price of $1,275 per ounce.

- Sibanye Gold Ltd. announced it will sell around $1 billion of shares at a 60-percent discount to partly fund its purchase of Stillwater Mining. The statement soon sent the stock plummeting the most in five months before rebounding after, reports Bloomberg. “The South African miner dropped as much as 11 percent in Johannesburg, the most since December 9, before paring losses to trade 2.4 percent lower,” the article continues.

- Frankfurt-based Commerzbank AG is exiting its physical precious-metals trading and services business, reports Bloomberg. The bank’s physical services include trading of physical precious metals, refining services, vaulting and transportation. Commerzbank does plan to continue its other bullion banking operations.

Opportunities

- Author and investor Mark Faber says that for the first time in a long time he is more heavily weighted in Europe than in the U.S. Faber cites “good opportunities in European stocks” at the present time along with his belief that the euro will continue to strengthen against the dollar. In a Bloomberg phone interview, he continues by stating, “In my opinion in the U.S. they will launch QE4 at the end of the year. The economy in the U.S. is weakening.” He also noted that gold mining shares are “inexpensive” and Amazon is “expensive.”

- Since President Trump’s comments about the dollar being “too strong” back in April, the greenback has since dropped – the Bloomberg Dollar Spot Index has fallen 3.1 percent, reports Bloomberg. Citigroup, the world’s biggest currency trading firm, believes continued erosions for policy changes in D.C. will only lead to further weakening of the currency, the article continues. Even Westpac Banking Corp., the second most-accurate currency forecaster in Bloomberg’s recent rankings, is advising clients to sell the dollar, with Macquarie Bank expecting the greenback to decline as well. Gold traded near a two-week high this week, with equities in retreat “and in

- Bullion markets are staging a tentative recovery, reports Bloomberg, with the number of holes drilled at gold deposits steadily rising for more than a year, according to S&P Global Market Intelligence. For example, exploration has jumped around 50 percent in parts of Argentina for lithium mainly, but also for gold. “When prices fell, exploration budgets were slashed, which means the industry had limited scope to grow,” said Goldcorp CEO David Garofalo. In a similar note from Bloomberg, mining companies lured back to Ecuador after a ban on large projects was overturned, “will welcome news that the incumbent mining minister is set to continue in the role under President-elect Lenin Moreno.”

Threats

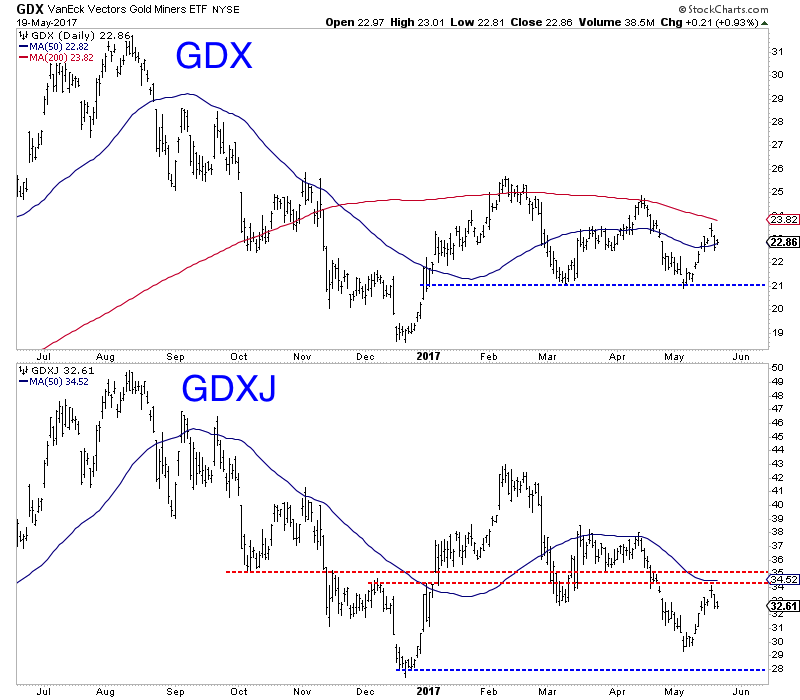

- Despite the world’s largest gold-mining companies posting their best profit margins in four years, the biggest ETF linked to producers (the VanEck Vectors Gold Miners ETF) has seen net withdrawals this month of $617 million, reports Bloomberg. During 2016, investors poured record amounts into the ETF, but now it seems the gold rally has faded, with prices lower by 10 percent from 2016 highs. “Some companies are finding it more difficult to tighten their belts further, diminishing prospects for increased cash flow,” the article continues.

- Staff was evacuated and production was suspended at one of the two Banro Corp. gold mines in eastern Democratic Republic of Congo on Thursday, reports Bloomberg. A gunman left three people dead, making this the fourth assault on the company’s operations in eight months. Namoya is the company’s second mine in eastern Congo, beginning production back in January of 2016.

- Acacia Mining will start its three-year process of closing down its Buzwagi mine in Tanzania, reports Bloomberg. According to an emailed statement from the company’s communication manager, the mine will be shut down by 2020, leading to as many as 100 job cuts. At current gold prices, Acacia is not able to increase the life of the mine past the year 2020. Back in March, the Tanzanian government issued a ban on concentrate exports that Acacia said cost the company over $1M a day.

Everyone loves to talk about gasoline prices, usually incorrectly assumng that the biggest gasoline cost factor is the price of oil. That’s why when oil prices fall they demand to know why gas prices didn’t fall proportionately. The go to answer is to blame greedy businesses, but the truth is that taxation is the biggest gasoline cost factor in most markets.

Both provincial and federal taxes on gasoline make-up about 36% of the at the pump cost. One of my favorite add-ons is paying GST on top of the other gasoline taxes. According to an illuminating new study by the Canadian Taxpayer Federation, the federal and provincial tax-on gas tax adds an extra 3 cents per litre on average. All told governments take in an extra $1.4 billion in revenue thanks to paying GST on the taxes.

Okay, maybe that’s not my favourite – as the Taxpayer’s Federation reminds us we still pay the temporary 15 cent per litre deficit reduction levy that was implemented in 1995. Temporary my ass, so far that little beauty has brought in $13.3 billion since inception. This year alone it will bring in $638 million.

The grand total of fuel taxes is a whopping $23.5 billion in 2017.

If you are wondering how much you pay in gas taxes check out the table below compiled by the Canadian Taxpayers Federation:

source: The Canadian Taxpyer’s Federation’s 19th Annual Gas Tax Honesty Report May 18th, 2017

Michael Campbell

1. Crude Awakening: The Global Black Market for Oil

1. Crude Awakening: The Global Black Market for Oil

The value of the crude oil production alone is worth a staggering $1.7 trillion each year. Eventually, everybody wants a piece of the pie, includng politicians, military personnel, and police who are complicit in the outright theft of oil. Tapping pipelines….

2. An Impending Economic And Financial Disaster

An extremely low VIX level, like the current one, is signaling an eventual sell-off that I believe will be quite extreme.This event always generates a lot of press, and this year’s event was no exception. Here are a few of what I think are the most-interesting takeaways from Berkshire meeting.

3. An Unexpected Change In Gold’s Seasonal Trading Pattern

One of the interesting things about the Great Recession was how Canada’s financial system sailed through it largely unscathed. Its banks were regulated wisely and behaved prudently, its citizens avoided the extreme stupidity of their credit-addicted neighbors to the south, and its government refrained from doubling its debt every eight years.

But instead of Americans learning from Canada, Canadians appear to have concluded that we had it right after all.