Timing & trends

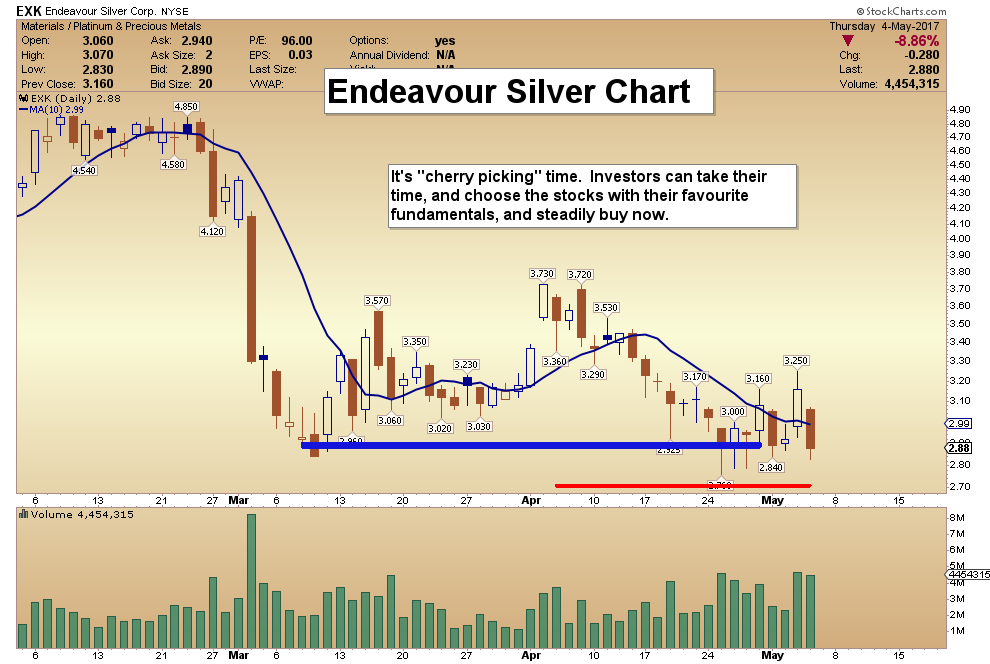

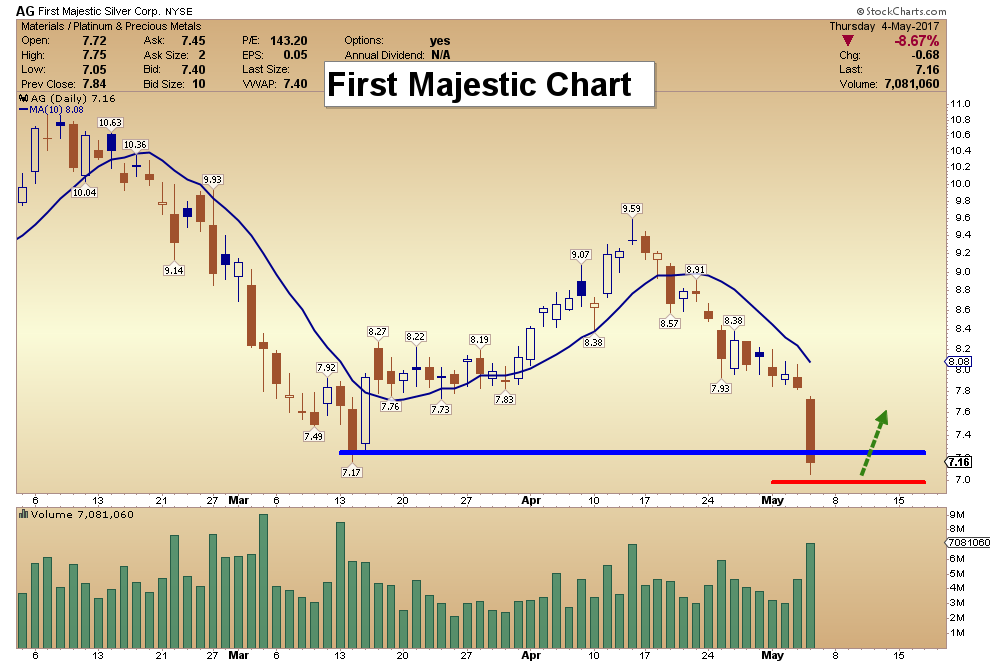

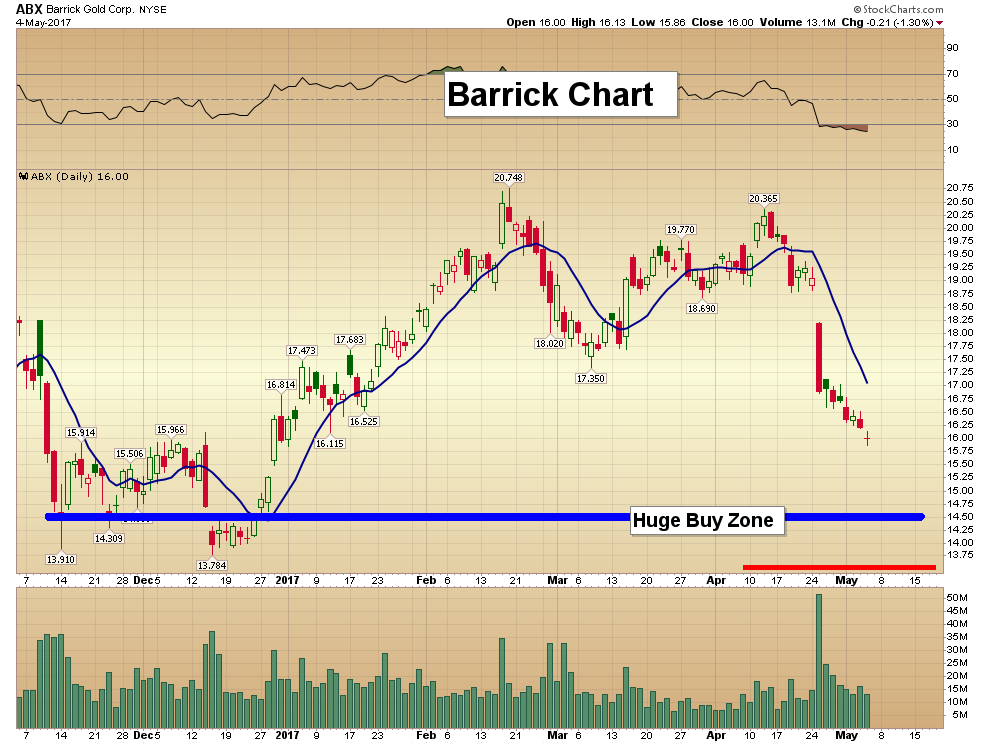

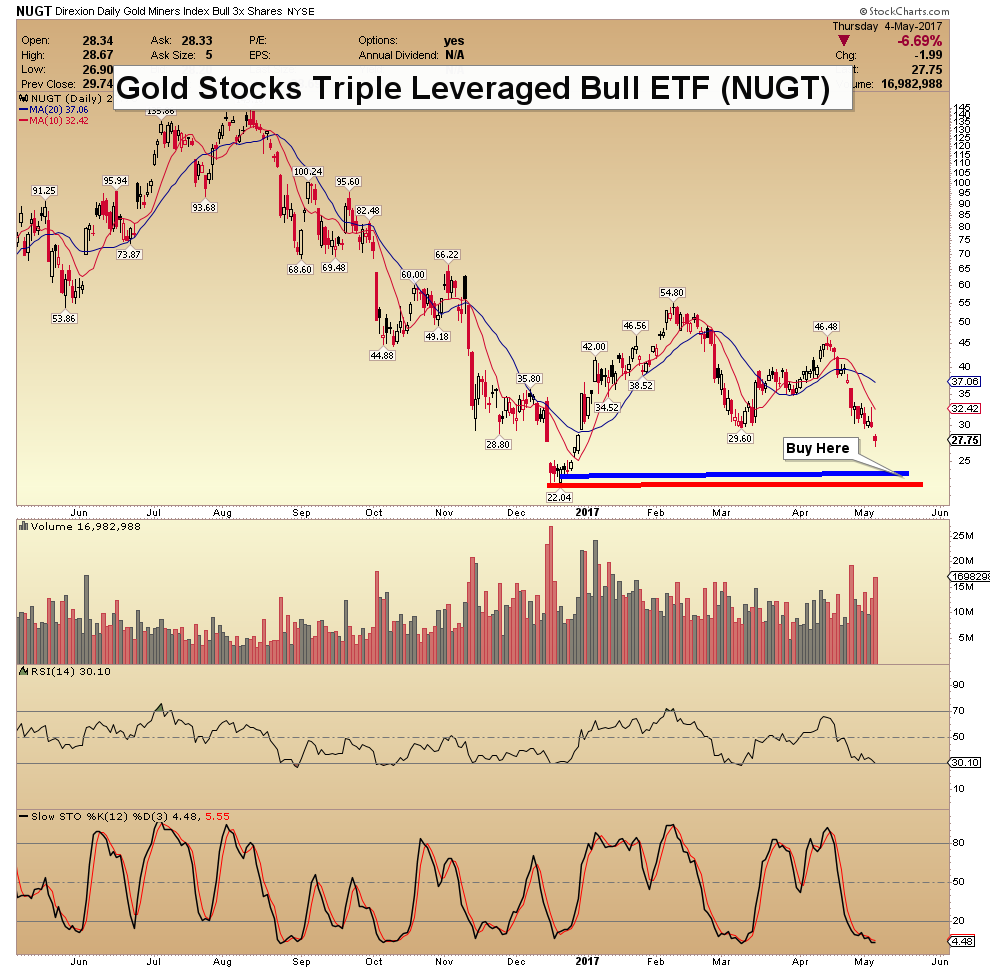

The past few weeks have been rough for precious metals. Gold had climbed all the way to $1297/oz but the other parts of the sector (Silver and the gold stocks) failed to confirm the move. They have since fallen off a cliff. Over the past 14 days, GDX has lost 15% while GDXJ has declined 20%. Silver during that span has declined every day. Yes, Silver has declined 14 consecutive days. Gold still has some “catching down” to do (with the rest of the sector) but the gold stocks and Silver are oversold and nearing a bounce.

We plot the daily bar charts of our in-house junior gold index and GDXJ below along with GDX. The junior sector has been hit especially hard partly due to news that GDXJ, because of massive inflows will be cutting its stake in various juniors and investing in larger companies. Regardless of the why, the charts are the charts and much damage has been done. However, both junior indices have a bit more downside potential before testing strong support. GDX has good support roughly 4% below Thursday’s close.

Silver, as we noted, is down 14 consecutive trading days and nearly 13% over that period. This week Silver has lost 5.6% and sliced below key long-term averages. While the broader trend is lower, Silver is very close to testing strong short-term support from $15.90 to $16.13. That is another 1%-2% lower for Silver, which could then face resistance from $16.90 to $17.20.

Overall, both the gold stocks and Silver are oversold and nearing a bounce. We say nearing because another day or two of selling is possible before a bounce. Gold meanwhile, has key support at $1220/oz but the gold stocks have already priced in sub $1200/oz Gold. Although the gold stocks are setup to bounce this month and we see a few opportunities, we expect another opportunity and a better one in the middle of summer.

If you don’t think the transformation we’re embarked upon is a profound one, consider this: Within two decades, half the jobs in this country may be performed by robots. What then of our unemployment rate and social safety net? Opinion is divided: Will the next technological wave further skew the wealth distribution toward the uber-rich, or will it ultimately create more entrepreneurial and job opportunities than it destroys?

If you don’t think the transformation we’re embarked upon is a profound one, consider this: Within two decades, half the jobs in this country may be performed by robots. What then of our unemployment rate and social safety net? Opinion is divided: Will the next technological wave further skew the wealth distribution toward the uber-rich, or will it ultimately create more entrepreneurial and job opportunities than it destroys?

There is an interesting historical precedent for our situation, an era during which the technological firmament shifted just as abruptly as it is here and now. In the United Kingdom in the year 1800, the textile industry dominated economic life, particularly in Northern England and Scotland. Cotton-spinners, weavers (mostly of stockings), and croppers (who trimmed large sheets of woven wool) worked from home, were well compensated, and enjoyed ample leisure time.

Ten years later, that had all changed. Clive Thompson, the author of today’s Outside the Box,tells us what happened:

(I)n the first decade of the 1800s, the textile economy went into a tailspin. A decade of war with Napoleon had halted trade and driven up the cost of food and everyday goods. Fashions changed, too: Men began wearing “trowsers,” so the demand for stockings plummeted. The merchant class—the overlords who paid hosiers and croppers and weavers for the work—began looking for ways to shrink their costs.

That meant reducing wages—and bringing in more technology to improve efficiency. A new form of shearer and “gig mill” let one person crop wool much more quickly. An innovative, “wide” stocking frame allowed weavers to produce stockings six times faster than before: Instead of weaving the entire stocking around, they’d produce a big sheet of hosiery and cut it up into several stockings. “Cut-ups” were shoddy and fell apart quickly, and could be made by untrained workers who hadn’t done apprenticeships, but the merchants didn’t care. They also began to build huge factories where coal-burning engines would propel dozens of automated cotton-weaving machines….

The workers were livid. Factory work was miserable, with brutal 14-hour days that left workers – as one doctor noted – “stunted, enfeebled, and depraved.”… Poverty rose as wages plummeted.

Enter the notorious Luddites. Angry workers began to fight back, destroying the hated wide stocking frames and cotton-spinning machinery and even killing factory owners. Soon they were breaking at least 175 machines per month, and within months they had destroyed some 800, worth £25,000—the equivalent of nearly $2 million today.

As we know, the owners retaliated, the English government intervened decisively, and the Luddite rebellion was crushed. However, says Thompson,

At heart, the fight was not really about technology. The Luddites were happy to use machinery – indeed, weavers had used smaller frames for decades. What galled them was the new logic of industrial capitalism, where the productivity gains from new technology enriched only the machines’ owners and weren’t shared with the workers.

The owners had taken to heart Adam Smith’s The Wealth of Nations, published a few decades earlier, in which Smith makes the case for a laissez-faire, free-market economy. In the ensuing centuries we have seen a seesaw battle between labor and capital, and it certainly appears that capital now has the upper hand; but clearly, the Industrial Revolution did lift all boats: It is inconceivable that we could support our present global population without our machines.

But will the Information Revolution that gave us computers, the internet, and social media – and the AI Revolution that is about to give us self-driving taxis and trucks and robot baristas – continue to lift our lower and middle classes, or further disempower and impoverish them?

Big, hard questions, and in today’s OTB, Clive Thompson gives us plenty of food for thought. (Warning: I can detect a slight tilt to the political left here that may annoy some of you; but the author’s facts are solid, and the reality is that we’re going have to deal with these issues as a society.)

John Mauldin, Editor

Outside the Box

When Robots Take All of Our Jobs, Remember the Luddites

By Clive Thompson

Originally published in Smithsonian magazine, January 2017

What a 19th-century rebellion against automation can teach us about the coming war in the job market

Is a robot coming for your job?

The odds are high, according to recent economic analyses. Indeed, fully 47 percent of all U.S. jobs will be automated “in a decade or two,” as the tech-employment scholars Carl Frey and Michael Osborne have predicted. That’s because artificial intelligence and robotics are becoming so good that nearly any routine task could soon be automated. Robots and AI are already whisking products around Amazon’s huge shipping centers, diagnosing lung cancer more accurately than humans and writing sports stories for newspapers.

They’re even replacing cabdrivers. Last year in Pittsburgh, Uber put its first-ever self-driving cars into its fleet: Order an Uber and the one that rolls up might have no human hands on the wheel at all. Meanwhile, Uber’s “Otto” program is installing AI in 16-wheeler trucks—a trend that could eventually replace most or all 1.7 million drivers, an enormous employment category. Those jobless truckers will be joined by millions more telemarketers, insurance underwriters, tax preparers and library technicians—all jobs that Frey and Osborne predicted have a 99 percent chance of vanishing in a decade or two.

What happens then? If this vision is even halfway correct, it’ll be a vertiginous pace of change, upending work as we know it. As the last election amply illustrated, a big chunk of Americans already hotly blame foreigners and immigrants for taking their jobs. How will Americans react to robots and computers taking even more?

One clue might lie in the early 19th century. That’s when the first generation of workers had the experience of being suddenly thrown out of their jobs by automation. But rather than accept it, they fought back—calling themselves the “Luddites,” and staging an audacious attack against the machines.

**********

At the turn of 1800, the textile industry in the United Kingdom was an economic juggernaut that employed the vast majority of workers in the North. Working from home, weavers produced stockings using frames, while cotton-spinners created yarn. “Croppers” would take large sheets of woven wool fabric and trim the rough surface off, making it smooth to the touch.

These workers had great control over when and how they worked—and plenty of leisure. “The year was chequered with holidays, wakes, and fairs; it was not one dull round of labor,” as the stocking-maker William Gardiner noted gaily at the time. Indeed, some “seldom worked more than three days a week.” Not only was the weekend a holiday, but they took Monday off too, celebrating it as a drunken “St. Monday.”

Croppers in particular were a force to be reckoned with. They were well-off—their pay was three times that of stocking-makers—and their work required them to pass heavy cropping tools across the wool, making them muscular, brawny men who were fiercely independent. In the textile world, the croppers were, as one observer noted at the time, “notoriously the least manageable of any persons employed.”

But in the first decade of the 1800s, the textile economy went into a tailspin. A decade of war with Napoleon had halted trade and driven up the cost of food and everyday goods. Fashions changed, too: Men began wearing “trowsers,” so the demand for stockings plummeted. The merchant class—the overlords who paid hosiers and croppers and weavers for the work—began looking for ways to shrink their costs.

That meant reducing wages—and bringing in more technology to improve efficiency. A new form of shearer and “gig mill” let one person crop wool much more quickly. An innovative, “wide” stocking frame allowed weavers to produce stockings six times faster than before: Instead of weaving the entire stocking around, they’d produce a big sheet of hosiery and cut it up into several stockings. “Cut-ups” were shoddy and fell apart quickly, and could be made by untrained workers who hadn’t done apprenticeships, but the merchants didn’t care. They also began to build huge factories where coal-burning engines would propel dozens of automated cotton-weaving machines.

“They were obsessed with keeping their factories going, so they were introducing machines wherever they might help,” says Jenny Uglow, a historian and author of In These Times: Living in Britain Through Napoleon’s Wars, 1793-1815.

The workers were livid. Factory work was miserable, with brutal 14-hour days that left workers—as one doctor noted—“stunted, enfeebled, and depraved.” Stocking-weavers were particularly incensed at the move toward cut-ups. It produced stockings of such low quality that they were “pregnant with the seeds of its own destruction,” as one hosier put it: Pretty soon people wouldn’t buy any stockings if they were this shoddy. Poverty rose as wages plummeted.

The workers tried bargaining. They weren’t opposed to machinery, they said, if the profits from increased productivity were shared. The croppers suggested taxing cloth to make a fund for those unemployed by machines. Others argued that industrialists should introduce machinery more gradually, to allow workers more time to adapt to new trades.

The plight of the unemployed workers even attracted the attention of Charlotte Brontë, who wrote them into her novel Shirley. “The throes of a sort of moral earthquake,” she noted, “were felt heaving under the hills of the northern counties.”

**********

In mid-November 1811, that earthquake began to rumble. That evening, according to a report at the time, half a dozen men—with faces blackened to obscure their identities, and carrying “swords, firelocks, and other offensive weapons”—marched into the house of master-weaver Edward Hollingsworth, in the village of Bulwell. They destroyed six of his frames for making cut-ups. A week later, more men came back and this time they burned Hollingsworth’s house to the ground. Within weeks, attacks spread to other towns. When panicked industrialists tried moving their frames to a new location to hide them, the attackers would find the carts and destroy them en route.

A modus operandi emerged: The machine-breakers would usually disguise their identities and attack the machines with massive metal sledgehammers. The hammers were made by Enoch Taylor, a local blacksmith; since Taylor himself was also famous for making the cropping and weaving machines, the breakers noted the poetic irony with a chant: “Enoch made them, Enoch shall break them!”

Most notably, the attackers gave themselves a name: the Luddites.

Before an attack, they’d send a letter to manufacturers, warning them to stop using their “obnoxious frames” or face destruction. The letters were signed by “General Ludd,” “King Ludd” or perhaps by someone writing “from Ludd Hall”—an acerbic joke, pretending the Luddites had an actual organization.

Despite their violence, “they had a sense of humor” about their own image, notes Steven Jones, author of Against Technology and a professor of English and digital humanities at the University of South Florida. An actual person Ludd did not exist; probably the name was inspired by the mythic tale of “Ned Ludd,” an apprentice who was beaten by his master and retaliated by destroying his frame.

Ludd was, in essence, a useful meme—one the Luddites carefully cultivated, like modern activists posting images to Twitter and Tumblr. They wrote songs about Ludd, styling him as a Robin Hood-like figure: “No General But Ludd / Means the Poor Any Good,” as one rhyme went. In one attack, two men dressed as women, calling themselves “General Ludd’s wives.” “They were engaged in a kind of semiotics,” Jones notes. “They took a lot of time with the costumes, with the songs.”

And “Ludd” itself! “It’s a catchy name,” says Kevin Binfield, author of Writings of the Luddites. “The phonic register, the phonic impact.”

As a form of economic protest, machine-breaking wasn’t new. There were probably 35 examples of it in the previous 100 years, as the author Kirkpatrick Sale found in his seminal history Rebels Against the Future. But the Luddites, well-organized and tactical, brought a ruthless efficiency to the technique: Barely a few days went by without another attack, and they were soon breaking at least 175 machines per month. Within months they had destroyed probably 800, worth £25,000—the equivalent of $1.97 million, today.

“It seemed to many people in the South like the whole of the North was sort of going up in flames,” Uglow notes. “In terms of industrial history, it was a small industrial civil war.”

Factory owners began to fight back. In April 1812, 120 Luddites descended upon Rawfolds Mill just after midnight, smashing down the doors “with a fearful crash” that was “like the felling of great trees.” But the mill owner was prepared: His men threw huge stones off the roof, and shot and killed four Luddites. The government tried to infiltrate Luddite groups to figure out the identities of these mysterious men, but to little avail. Much as in today’s fractured political climate, the poor despised the elites—and favored the Luddites. “Almost every creature of the lower order both in town & country are on their side,” as one local official noted morosely.

An 1812 handbill sought information about the armed men who destroyed five machines.

(The National Archives, UK)

**********

At heart, the fight was not really about technology. The Luddites were happy to use machinery—indeed, weavers had used smaller frames for decades. What galled them was the new logic of industrial capitalism, where the productivity gains from new technology enriched only the machines’ owners and weren’t shared with the workers.

The Luddites were often careful to spare employers who they felt dealt fairly. During one attack, Luddites broke into a house and destroyed four frames—but left two intact after determining that their owner hadn’t lowered wages for his weavers. (Some masters began posting signs on their machines, hoping to avoid destruction: “This Frame Is Making Full Fashioned Work, at the Full Price.”)

For the Luddites, “there was the concept of a ‘fair profit,’” says Adrian Randall, the author of Before the Luddites. In the past, the master would take a fair profit, but now he adds, “the industrial capitalist is someone who is seeking more and more of their share of the profit that they’re making.” Workers thought wages should be protected with minimum-wage laws. Industrialists didn’t: They’d been reading up on laissez-faire economic theory in Adam Smith’s The Wealth of Nations, published a few decades earlier.

“The writings of Dr. Adam Smith have altered the opinion, of the polished part of society,” as the author of a minimum wage proposal at the time noted. Now, the wealthy believed that attempting to regulate wages “would be as absurd as an attempt to regulate the winds.”

Six months after it began, though, Luddism became increasingly violent. In broad daylight, Luddites assassinated William Horsfall, a factory owner, and attempted to assassinate another. They also began to raid the houses of everyday citizens, taking every weapon they could find.

Parliament was now fully awakened, and began a ferocious crackdown. In March 1812, politicians passed a law that handed out the death penalty for anyone “destroying or injuring any Stocking or Lace Frames, or other Machines or Engines used in the Framework knitted Manufactory.” Meanwhile, London flooded the Luddite counties with 14,000 soldiers.

By winter of 1812, the government was winning. Informants and sleuthing finally tracked down the identities of a few dozen Luddites. Over a span of 15 months, 24 Luddites were hanged publicly, often after hasty trials, including a 16-year-old who cried out to his mother on the gallows, “thinking that she had the power to save him.” Another two dozen were sent to prison and 51 were sentenced to be shipped off to Australia.

“They were show trials,” says Katrina Navickas, a history professor at the University of Hertfordshire. “They were put on to show that [the government] took it seriously.” The hangings had the intended effect: Luddite activity more or less died out immediately.

It was a defeat not just of the Luddite movement, but in a grander sense, of the idea of “fair profit”—that the productivity gains from machinery should be shared widely. “By the 1830s, people had largely accepted that the free-market economy was here to stay,” Navickas notes.

A few years later, the once-mighty croppers were broken. Their trade destroyed, most eked out a living by carrying water, scavenging, or selling bits of lace or cakes on the streets.

“This was a sad end,” one observer noted, “to an honourable craft.”

**********

These days, Adrian Randall thinks technology is making cab-driving worse. Cabdrivers in London used to train for years to amass “the Knowledge,” a mental map of the city’s twisty streets. Now GPS has made it so that anyone can drive an Uber—so the job has become deskilled. Worse, he argues, the GPS doesn’t plot out the fiendishly clever routes that drivers used to. “It doesn’t know what the shortcuts are,” he complains. We are living, he says, through a shift in labor that’s precisely like that of the Luddites.

Economists are divided as to how profound the disemployment will be. In his recent book Average Is Over, Tyler Cowen, an economist at George Mason University, argued that automation could produce profound inequality. A majority of people will find their jobs taken by robots and will be forced into low-paying service work; only a minority—those highly skilled, creative and lucky—will have lucrative jobs, which will be wildly better paid than the rest. Adaptation is possible, though, Cowen says, if society creates cheaper ways of living—“denser cities, more trailer parks.”

Erik Brynjolfsson is less pessimistic. An MIT economist who co-authored The Second Machine Age, he thinks automation won’t necessarily be so bad. The Luddites thought machines destroyed jobs, but they were only half right: They can also, eventually, create new ones. “A lot of skilled artisans did lose their jobs,” Brynjolfsson says, but several decades later demand for labor rose as new job categories emerged, like office work. “Average wages have been increasing for the past 200 years,” he notes. “The machines were creating wealth!”

The problem is that transition is rocky. In the short run, automation can destroy jobs more rapidly than it creates them—sure, things might be fine in a few decades, but that’s cold comfort to someone in, say, their 30s. Brynjolfsson thinks politicians should be adopting policies that ease the transition—much as in the past, when public education and progressive taxation and antitrust law helped prevent the 1 percent from hogging all the profits. “There’s a long list of ways we’ve tinkered with the economy to try and ensure shared prosperity,” he notes.

Will there be another Luddite uprising? Few of the historians thought that was likely. Still, they thought one could spy glimpses of Luddite-style analysis—questioning of whether the economy is fair—in the Occupy Wall Street protests, or even in the environmental movement. Others point to online activism, where hackers protest a company by hitting it with “denial of service” attacks by flooding it with so much traffic that it gets knocked offline.

Perhaps one day, when Uber starts rolling out its robot fleet in earnest, angry out-of-work cabdrivers will go online—and try to jam up Uber’s services in the digital world.

“As work becomes more automated, I think that’s the obvious direction,” as Uglow notes. “In the West, there’s no point in trying to shut down a factory.”

The Canadian dollar dropped against the U.S. dollar to a 14-month low on Tuesday as the lower oil prices earlier this week added to the downside for the currency of Canada, whose key export commodity is oil.

Oil prices fell on Monday and Tuesday as hedge funds and money managers started to cut bullish positions in a reaction to quickly growing supply. At 3:40pm EST on Tuesday, WTI was trading down over 2 percent on the day, well below the US$50 mark at US$47.59. Brent Crude was trading at US$50.38. Brent Crude hit a low early on Tuesday of US$50.14—the lowest point this year.

Brent prices have now erased all the price gains since OPEC agreed at end-November to a collective production cut in an effort to help draw down bloated global inventories and prop up the price of oil.

According to Reuters data, at 4:00pm EST on Tuesday, the Canadian dollar was trading at US$0.7291, down from the US$0.7309 at close on Monday.

On Tuesday, the American Petroleum Institute (API) reported a healthy draw of 4.2 million barrels in United States crude oil inventories for the week ending April 28, compared to analyst expectations that markets would see a bit of relief with a crude oil draw of 2.2 million barrels.

Early on Wednesday, oil prices were ticking higher, with the EIA inventory report expected later in the day.

While the inventory reports are expected to influence the oil prices, the biggest currency market mover this week will be the Fed interest rate decision on Wednesday. The Fed is expected to hold, but may point to future policies, or a possible increase in June, in its statement, analysts reckon.

For the loonie, apart from oil prices, the currency movers are the future of the North American Free Trade Agreement (NAFTA), concerns over the Canadian mortgage market, and expectations that the Bank of Canada will likely not raise interest rates this year.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- EIA Steals Bulls’ Thunder By Reporting Minor Inventory Draw

- All Eyes On Saudi Arabia As OPEC Begins To Unravel

- Are Gasoline Prices About To Crash? Glut Moves Downstream

Examine the picture below. The global economy thrives on debt and credit. We purchase essential products using debt/credit. The U.S. dollar bill is a debt of the Federal Reserve. All debt based assets have counter-party risk.

The St. Louis Federal Reserve publishes data on “Total Debt Securities” in $ millions. Note the rapid rise since 1971 after President Nixon encouraged rapid devaluation of the dollar.

Yes, the total U.S. increases debt rapidly – about 9% per year on average since 1971. A graph of U.S. national debt looks similar and shows about the same rate of increase.

Gold bullion and coins are NOT debt and have no counter-party risk, in contrast to debt based assets. But who cares about gold?

- Central banks profess little interest in gold, although they own a substantial quantity.

- Wall Street makes little profit from gold – no interest there.

- The middle class struggles to pay debts and shows little awareness of gold. (A change in attitude is coming!)

How does increasing debt affect us?

- Rapidly increasing total debt means more dollars in circulation and higher consumer prices.

- Increasing debt service for the masses. How much do you owe for mortgage debt, auto loan debt, student loan debt, credit card debt? How much interest do you pay each year?

- More profits for Wall Street.

- Debt increases every day – globally.

- Zimbabwe, Venezuela, Greece, and many more in the near future.

From 1934 Montgomery Ward Catalog:

Debt and Gold:

On the log scale you can see:

- Total debt increased rapidly until about 2008, but the rate of increase has slowed since then. Regardless, debt is growing more rapidly than the economy which forces prices higher.

- How much debt can the economy carry? Is “peak debt” or “debt saturation” the reason why central banks in the EU, Japan and the US have pushed interest rates to near and below zero? Can this end well?

- Gold rose more rapidly than debt until 1980, fell for 20 years, and has increased since 2001.

- On average gold increases along with debt.

- Expect much higher prices for gold as the dollar and all fiat currencies are devalued.

Thought Experiment:

- Which government expects to spend less and reduce debt each year?

- Will military and Medicare expenditures decrease in the next 10 years?

- Name the congressmen who want to spend less and balance the budget each year?

- Does Wall Street support a reduction in spending, debt, and their profits?

- Does the Federal Reserve want to reduce the profits of big banks?

- Do Social Security recipients want their benefits reduced?

- Do “Big Pharma” and the “Health Care Cartel” want their revenue and profits reduced?

- Will the multi-decade trend of increasing debt and increasing prices reverse except as a consequence of a disastrous collapse?

Do you expect total debt to decrease in the next decade?

CONCLUSIONS:

Option A: More debt, more expenses, higher prices. Expect the same failed fiscal and monetary policies, more wars, increasingly fragile economies, accelerating consumer price inflation and an excess of “happy talk” from leaders. Gold and silver prices will rise.

Option B: Catastrophic collapse possible, global depression, nuclear war or expanded conventional war and much trauma for most people of the western world. In this hopefully unlikely collapse scenario, should you own gold and silver with no counter-party risk, or debt based paper that might be worth much less in purchasing power, or could become utterly worthless?

Given the debt policies of the western financial world, the following makes far more sense!

Gary Christenson

The Deviant Investor