Timing & trends

Kitty Hawk is the “flying car” company that’s financially backed by Google founder Larry Page, and today it has published the first video of its prototype aircraft. The company describes the Kitty Hawk Flyer as an “all-electric aircraft” that is designed to operate over water and doesn’t require a pilot’s license to fly. Kitty Hawk promises people will be able to learn to fly the Flyer “in minutes.” A consumer version will be available by the end of this year, the company says.

1. Artificial Intelligence Confounds Its Creators

1. Artificial Intelligence Confounds Its Creators

Advanced artificial intelligence is far from that. Algorithms are constantly learning, often in unusual ways, and at an exponential rate. It’s one of the cornerstones of the New Gilded Age.

Unfortunately, nobody really knows how they learn. And that should scare you, a lot.

2. Canada’s 6-City Housing Prices & the Plunge-O-Meter

In March 2017 Canada’s big city metro SFD prices coiled about or slid off their near term highs except in Toronto where detached houses, town houses and condos fetched new peak prices; Vancouver strata prices also hit new highs as well. Strata is the new Canadian “can-do” “must-do” “will-do” affordability metric.

2. “The Donald” at Bat

Once again, the big man steps up to the plate.

Once again, he points his bat at the far bleachers.

This is going to be “bigger, I believe, than any tax cut in history.”

And once again, the fans go wild.

Wow… if he can pull this off

Todd Market Forecast for Thursday April 27, 2017 Available Mon- Friday after 6:00 P.M. Eastern, 3:00 Pacific.

DOW + 6 on flat breadth

NASDAQ COMP + 24 on 250 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS: The stock market keeps inching higher mainly on better than expected profits, but we didn’t like the internals. The NASDAQ was up nicely, but breadth was lacking.

Also, the S&P 500 is in a resistance zone. Let’s see how this pans out.

GOLD: Gold was flat. Not much to report here.

CHART The S&P 500 is hesitating near all time highs. I see no reason to issue a short term sell, but I really don’t want to recommend a trading position.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash stay on the sidelines for now.

System 8 We are in cash. Stay there.

System 9 We are in cash. Stay there.

NEWS AND FUNDAMENTALS: Not available

INTERESTING STUFF I can’t change the direction of the wind, but I can adjust my sails to always reach my destination. —–Jimmy Dean

TORONTO EXCHANGE: Toronto was down 143.

BONDS: Bonds were flat.

THE REST: The dollar almost unchanged. Silver was lower. Crude oil had a small bounce.

Bonds –Bullish as of April 3.

U.S. dollar -Change to bearish as of today April 25.

Euro — Change to bullish as of today April 25.

Gold —-Bearish as of April 19.

Silver—- Bearish as of April 19.

Crude oil —- Bearish as of April 18.

Toronto Stock Exchange—- Bullish from January 22, 2016

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

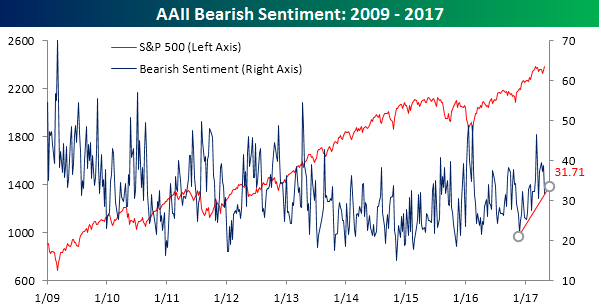

After dropping to its lowest level since the election, bullish sentiment on the part of individual investors surged by the most this week since the week after the election. According to the weekly survey from the American Association of Individual Investors (AAII), after just one-quarter of individual investors considered themselves bullish last week, more than 38% now put themselves in the bullish camp. So was it the French election that individual investors were so worried about (kidding)? Even with this week’s increase, a little perspective for this poll is in order, as it has now been 121 straight weeks since bulls were in the majority.

What we will be watching in this poll next week is what happens with bearish sentiment. In this week’s survey, bears decline from 38.7% down to 31.71%. Even after this week’s decline, the uptrend in bearish sentiment that has been in place since late last year remains in place (chart below). If that uptrend breaks, it could be a precursor for a move to a majority in the bullish camp.