Stocks & Equities

Sent to subscribers on April 24, 2017, 6:57 AM.

Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,410, and profit target at 2,200, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

The main U.S. stock market indexes were mixed between -0.3% and 0.0% on Friday, extending their short-term consolidation, as investors awaited quarterly corporate earnings, economic data releases, French presidential election outcome, among others. The S&P 500 index remained within its week-long consolidation along the level of 2,350, around 2% below the March 1 all-time high of 2,400.98. The Dow Jones Industrial Average closed below the level of 20,600 again, and relatively stronger technology Nasdaq Composite index remained above 5,900 mark, as it continued to trade close to its early April record high. The nearest important level of support of the S&P 500 index is now at around 2,350, marked by previous resistance level. The next support level is at 2,320-2,330, marked by previous short-term consolidation. The support level is also at around 2,270-2,280. On the other hand, the nearest important level of resistance is at 2,365-2,370, marked by some previous local highs. The next resistance level is at 2,380-2,400, marked by record high, among others. We can see some short-term volatility following five-month-long rally off last year’s November low at around 2,100. Is this a topping pattern before medium-term downward reversal? The uptrend accelerated on March 1 and it looked like a blow-off top pattern accompanied by some buying frenzy. The S&P 500 index is trading below its medium-term upward trend line, as we can see on the daily chart:

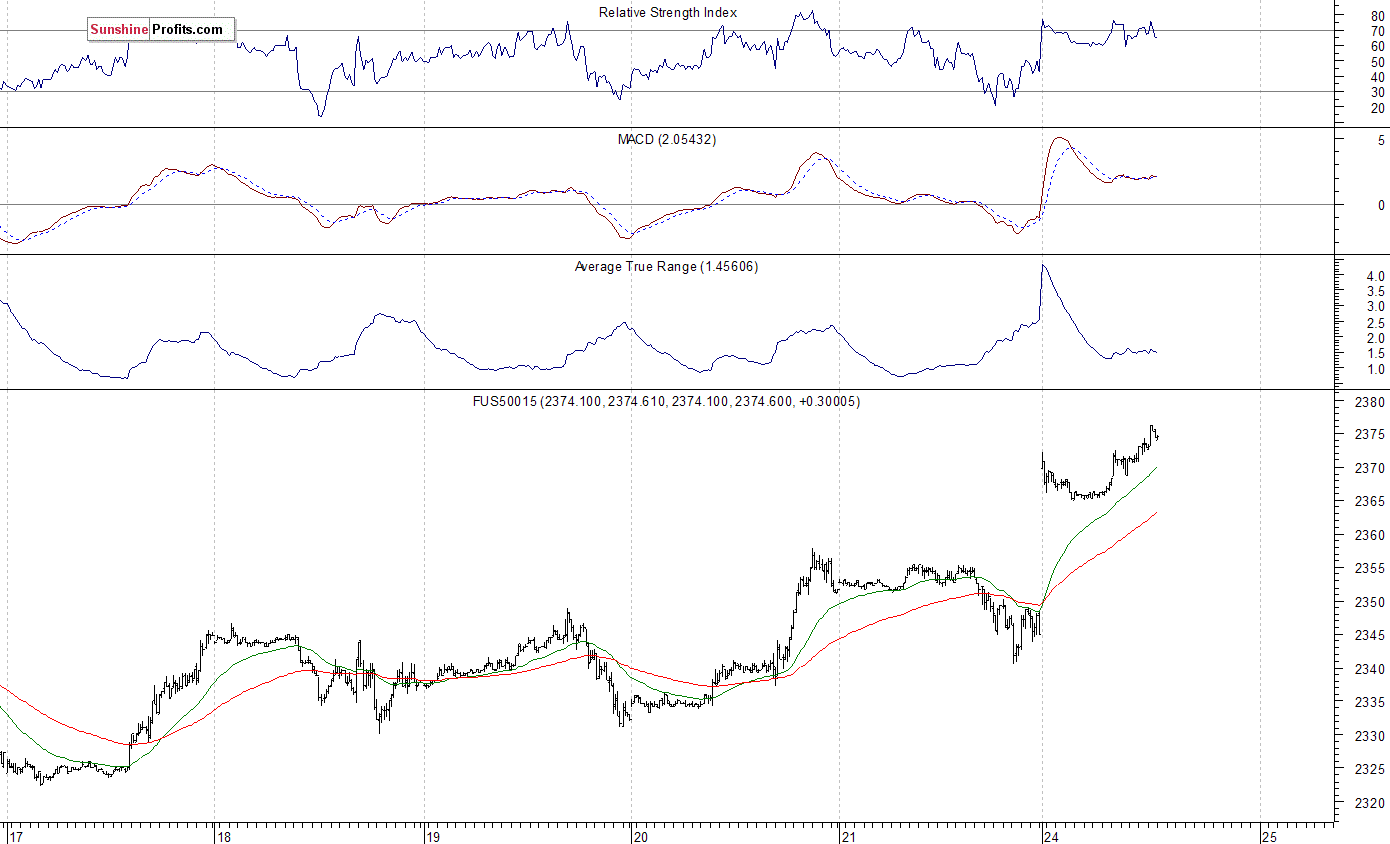

Expectations before the opening of today’s trading session are very positive, with index futures currently up 1.0-1.2%. The European stock markets have gained 1.8-4.5% so far. Investors will now wait for more quarterly corporate earnings releases. The S&P 500 futures contract trades within an intraday uptrend following an overnight gap-up opening. The nearest important level of support is at around 2,365, marked by local low. The next support level is at 2,350-2,355, marked by recent consolidation. On the other hand, the nearest important level of resistance is at around 2,375, marked by recent local high. The next resistance level remains at 2,380-2,400, marked by March topping consolidation, and an all-time high slightly above 2,400 mark. Will the market break above almost two-month long consolidation? Or is this just another upward correction? We can see some medium-term negative technical divergences, but will they lead to a downward correction?

The technology Nasdaq 100 futures contract remains relatively stronger than the broad stock market, as it currently trades at new record high, along the level of 5,500. The nearest important support level is at around 5,480, marked previous level of resistance and intraday local lows. The next level of support remains at 5,450, marked by short-term consolidation. There have been no confirmed negative signals so far. However, we can see some short-term overbought conditions:

Concluding, the S&P 500 index extended its short-term consolidation on Friday, as investors awaited French presidential election outcome, among others. Expectations before the opening of today’s trading session are very bullish. The broad stock market index may get close to its early March record high. Will it break higher? Or is this just an upward move within almost two-month-long consolidation? The index is currently trading below five-month-long medium-term upward trend line. There have been no confirmed negative signals so far. However, we still can see medium-term negative technical divergences. Therefore, we continue to maintain our speculative short position (opened on February 15 at 2,335.58 – opening price of the S&P 500 index). Stop-loss level is at 2,410 and potential profit target is at 2,200 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract – SP, E-mini S&P 500 futures contract – ES) or an ETF like the SPDR S&P 500 ETF – SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

To summarize: short position in S&P 500 index is justified from the risk/reward perspective with the following entry prices, stop-loss orders and profit target price levels:

S&P 500 index – short position: profit target level: 2,200; stop-loss level: 2,410

S&P 500 futures contract (June) – short position: profit target level: 2,197; stop-loss level: 2,407

SPY ETF (SPDR S&P 500, not leveraged) – short position: profit target level: $220; stop-loss level: $241

SDS ETF (ProShares UltraShort S&P500, leveraged: -2x) – long position: profit target level: $15.47; stop-loss level: $12.98

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts

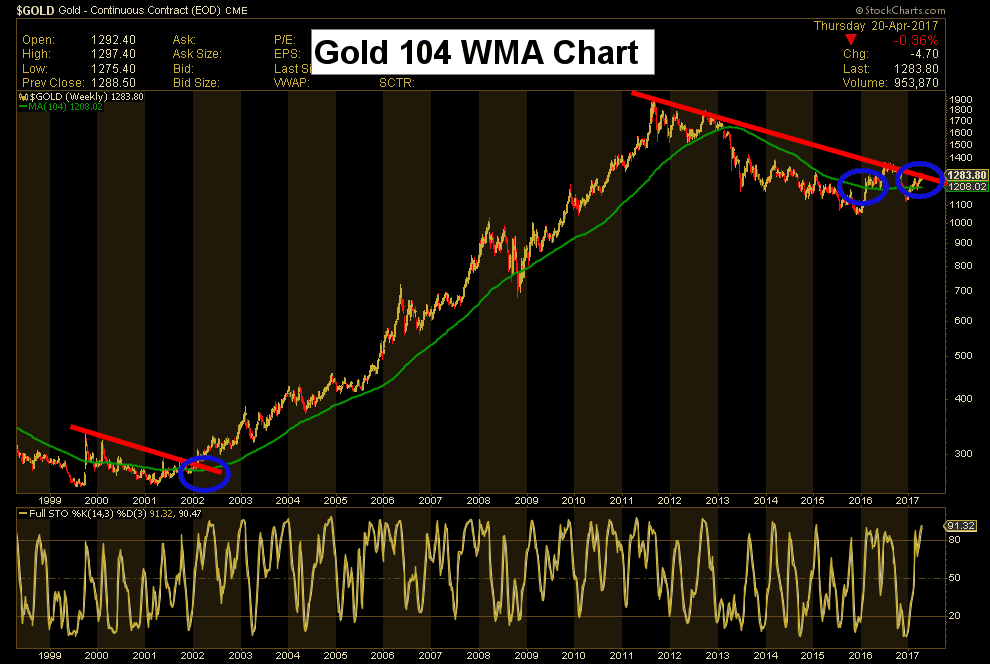

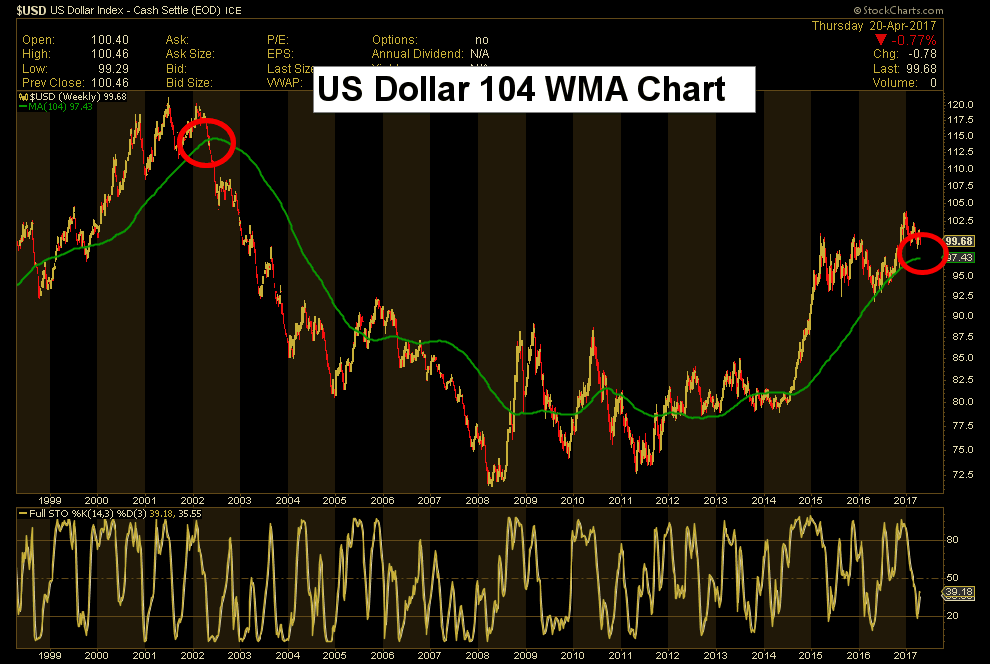

1. Gold, Dow, & Dollar: The Big Picture

1. Gold, Dow, & Dollar: The Big Picture

by Morris Hubbart

Big Picture (104 WMA) Charts & Video Analysis, Juniors Key Charts & Video Analysis, Key Charts & Tactics Video Analysis, Trader Time Key Charts Video Analysis

2. Extreme Pessimism indicates market is near inflection point!

by Chris Vermuelan

Big Picture (104 WMA) Charts & Video Analysis, Juniors Key Charts & Video Analysis, Key Charts & Tactics Video Analysis, Trader Time Key Charts Video Analysis

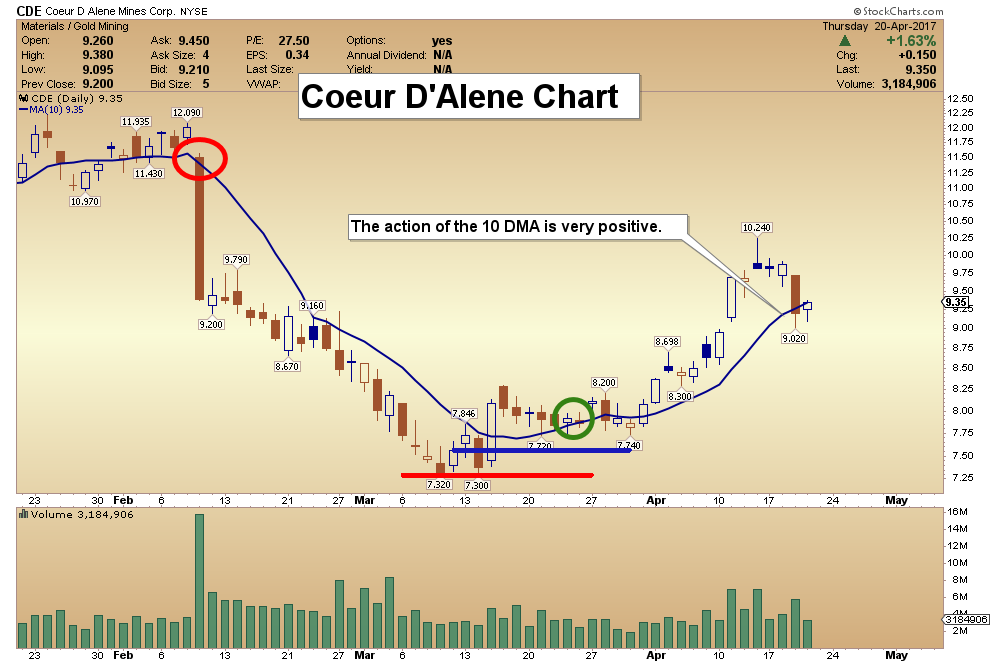

2. An In Depth Look at the Precious Metals Complex

by Rambus Chartology

There is a potential new pattern forming on some of the precious metals stock indexes which is only coming to light today. Before today’s price action there was only a guess of what may be forming with no confirmation. After today’s big gap breakout another piece of the puzzle is falling into place.

Today’s videos and charts (double click to enlarge):

Big Picture (104 WMA) Charts & Video Analysis

SF Juniors Key Charts & Video Analysis

SF60 Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

When a resistance zone gets tested multiple times it usually breaks. It shouldn’t be long before the Nasdaq breaks through this resistance. After it does it will pull the rest of the market up with it.

https://blog.smartmoneytrackerpremium.com/

…related:

What Just Took Place In Stocks Has Rarely Happened In The Past 117 Years