Timing & trends

1. Gold Price Rally: Enjoy The Ride

1. Gold Price Rally: Enjoy The Ride

There’s no question that gold can pull back at any time now, given the extent of the rally, but even a decline to $1225 would only add to the positive look of the chart.

2. Marc Faber: Central Bankers Desperate to Keep Colossal Global Debt Bubble Inflated

Marc thinks the Fed will only raise rates once more in 2017 before the next global financial crisis. He thinks the Federal Reserve will reverse course, start lowering interest rates again and do a large QE program. Central bankers are routinely coordinating monetary and interest rate policy as well as exchange rates with each other to prevent a “colossal debt bubble” from bursting.

3. Sentiment: Market is Waiting On The Catalyst to Go Higher

April marks the end of what is historically the best six months for DJIA and the S&P 500. Since 2006, April has been up eleven years in a row with an average gain of 2.6% to reclaim its position as the best DJIA month since 1950.And there’s no end in sight.

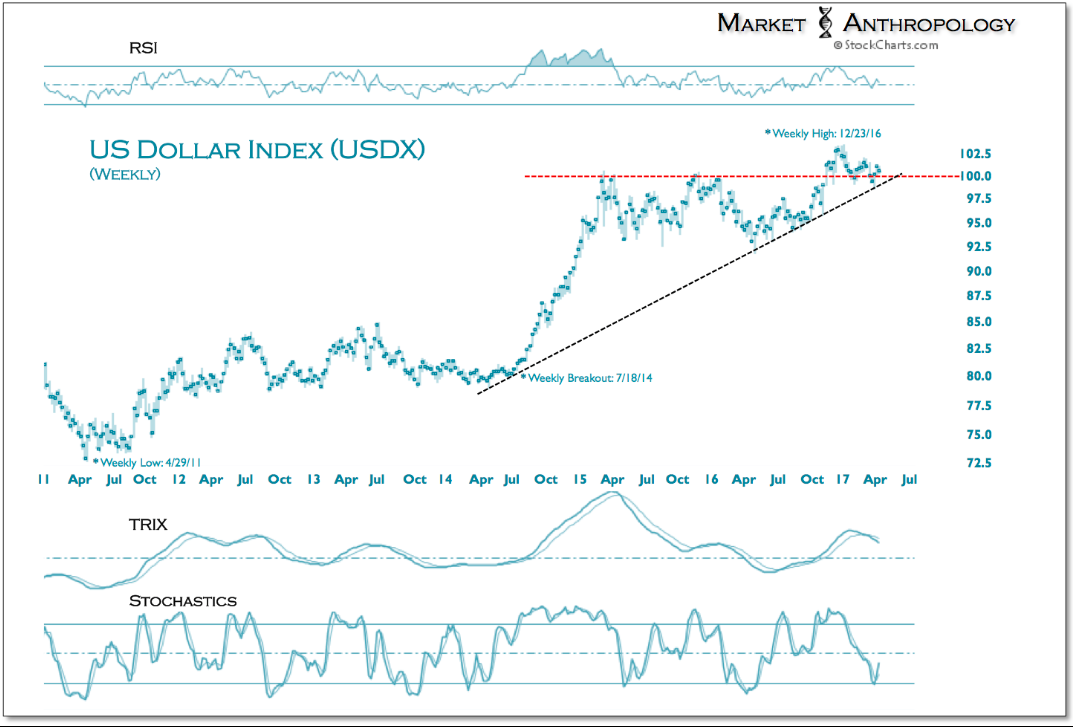

Headed into what we anticipate will bring some fireworks to the currency markets this month, the US dollar index has again turned down modestly in the front half of this week.

Currently trading behind a series of lower highs and lows from this past December’s cycle peak, our expectations remain for a breakdown below the index’s long-term uptrend extending from the July 2014 breakout.

Over the past few months…

….contiinue reading and viewing 10 more large charts HERE

With the Fed having hiked thrice and calling for three more hikes still, the 2017 Hoisington First Quarter Review contains a call that will have many if not most analysts shaking their heads: “The secular low in bond yields remains in the future, not the past,” says Lacy Hunt.

The United States is the world’s largest and most diversified economy! It is currently suffering through a protracted period of slow growth which has held down job creation and labor market participation. The Pew Research Center reported, in late 2015, that a mere 19% of Americans trust the government either always or most of the time.

The FED must print more money in order to keep the party going forward.

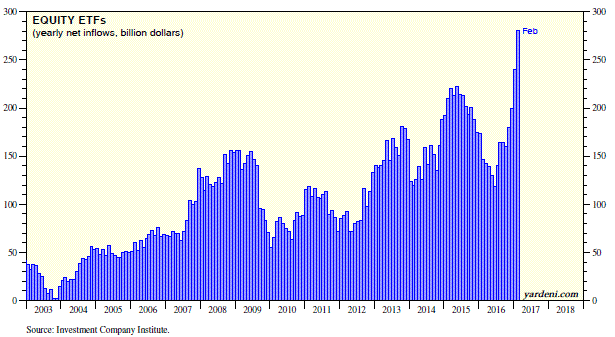

The bottom line is that this current bull market has been driven mostly by corporations which are buying back their shares, over the years. Individual investors have increasingly been moving out of equity mutual funds and into equity ETF’s.

The Congressional Budget Office (CBO) reported that in fiscal year 2016, the federal budget deficit increased in relation to the GDP, for the first time since 2009. The CBO projects that over the next decade, budget deficits will follow an upward trajectory. The spending costs for retirement and health care programs targeted towards senior citizens, and rising interest payments on the government’s debt will be the root drivers. There will be only a modest growth in revenue collections. This will drive up public debt to its’ highest level of gross domestic product (GDP) since shortly after World War II ended.

The Congressional Budget Office stated that the nation’s public debt will reach 145 percent of gross domestic product by 2047

Conclusion:

The BULLISH Trend in the stock markets is not reversing in the near future.

The stock market is on an upward trajectory. Are you wondering what you should do next?

Do you want to gain the edge that you need in order to beat the markets an profit during both rising and falling prices?

Take advantage of my insight and expertise as I can help you to grow your trading account. Tune in every morning for my video analysis and market forecasts at TheGoldAndOilGuy.com on all ‘asset classes’ and new ETF trade opportunities.

I always take half off of the table, on all positions, to lock in quick solid gains and then ride out the other half for much higher returns! I manage my risk while keeping profits!